Solv Protocol Dominates Bitcoin Finance on Soneium

Solv Protocol Dominates Bitcoin Finance on Soneium

🚀 Velodrome's Bitcoin King

Solv Protocol continues to strengthen its position in Bitcoin Finance on Soneium's Superchain. Recent data shows SolvBTC dominating DEX volume on Velodrome, capturing 9x more volume than all other DEXs combined on the network.

Key developments:

- SolvBTC is the leading Bitcoin token on Soneium

- Velodrome emerges as the primary liquidity hub

- Platform continues building infrastructure for Bitcoin scaling on Superchain

This follows Solv's expansion across multiple chains including Core DAO, Solana, and Berachain, where they've established significant presence in Bitcoin-based DeFi services.

Solv Protocol is now powering BTC yield for @binance Earn. Our institutional-grade BTCFi strategies are live in Binance’s On-Chain Yield suite, right after our first Shariah-compliant BTC product. Here’s how Solv’s integration with Binance Earn helps unlock for institutional

New to BTC Staking? Earn on-chain yields of up to 1.1% - 3.8% APR* with your idle BTC — no bridges, no wallets, no gas. Earn SOLV rewards seamlessly via @SolvProtocol, all within Binance. Stake now 👇

Solv Shines at TOKEN2049 Dubai! 🌍 We upgraded SolvBTC's institutional infrastructure, scaled yields to Telegram's 950M users, and unlocked new capital markets this week. A recap 🧵👇

Weekly Digest: Solv Unlocks $5T with Institutionalized Bitcoin Product This week, Solv achieved the first-ever Shariah-compliant Bitcoin yield product. Certified halal yields. Institution-ready, with potential for $5T+ in untapped sovereign wealth funds. A recap for the week

Solv Weekly Digest: Bitcoin Pizza Day Special! 🍕 15 years after 10,000 BTC bought two pizzas, Solv continues to cook up the best Bitcoin yields in the space. What went down this week 👇

We're on a mission to bring institutional BTC yield to @solana, at scale. Now, we become an Institutional Guardian on @ZeusNetworkHQ, securing the permissionless bridge alongside @MechanismCap, @animocabrands & @anagramxyz. Here’s what 1% of Bitcoin liquidity on Solana means

Solv has integrated Chainlink Proof of Reserve (PoR) for real-time transparency. This secures over $2B+ in tokenized BTC and RWA yield products, including SolvBTC, xSolvBTC, and Solv Protocol itself. A new standard for institutional-grade Tokenized Bitcoin Finance 👇

Solv deepens its strategic alignment with @Coredao_Org as Bitcoin Finance gains momentum. SolvBTC.CORE is now the largest asset on @colend_xyz, Core’s leading lending protocol. Solv is the composable Bitcoin Finance protocol that allows BTC holders to earn yield through Core's

State of @Coredao_Org Q1 Key Update: Core’s DeFi TVL rose 40% QoQ to 1.1 billion CORE. Leaders: @colend_xyz (266.5M CORE), @Pell_Network (248.4M CORE), @BitFluxFi (183.1M CORE). Q1 Highlights: - Core and @maplefinance announced lstBTC for liquid BTC staking with top-tier

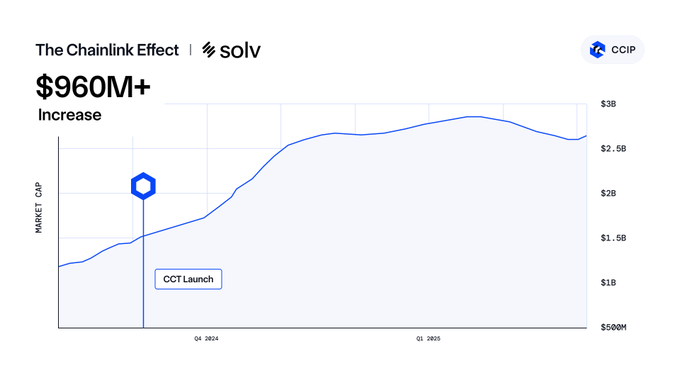

With @chainlink's CCT standard, Solv achieves composable liquidity and programmable yield. unlocking seamless BTC asset mobility across chains. Solv is accelerating Bitcoin.

After @SolvProtocol adopted the Cross-Chain Token (CCT) standard, the Bitcoin staking protocol surged to $2.5B+ TVL—with $1.16B+ in cross-chain transfers via CCIP. Cross-chain by Chainlink → a catalyst for growth uniquely enabled by CCIP and a thriving community.

Solv is institutionalizing Bitcoin by bringing RWA-backed yields to Wall Street. This week: 🔹 BlackRock BUIDL & Hamilton Lane SCOPE back the first RWA BTC yield. 🔹 Solv is Binance Earn’s exclusive BTC fund manager. More on how Solv brings institutional BTC and RWA to you👇

SolvBTC continues to lead Bitcoin Finance on @soneium. Solv is building the foundation to scale Bitcoin on Superchain.

Leading BTC on Soneium 💿 In the last 24 hours, Velodrome has captured 9x the volume of all other DEXs on @soneium combined for the leading BTC token, $SolvBTC. Velodrome––the liquidity hub of the Superchain

Even as Boyco sunsets, Solv continues to deliver the highest Bitcoin yields on ₿erachain. SolvBTC.BERA on @berachain targets 8% real-time APR through a combination of BGT emissions, Solv S2 points, and team-based community boosts. Introducing our new 🐻⛓ journey on Berachain:

Solv acc(SOL)erates Bitcoin Finance with @chainlink. Solv + Chainlink CCIP = Institutional-Grade Interoperability With Chainlink CCIP now deployed on @solana mainnet, Solv’s strategy to expand Bitcoin use cases across the cross-chain ecosystem is scaling fast. This unlocks

Chainlink CCIP is officially live on @solana mainnet, supercharging the growth of Solana DeFi by unlocking access to $18B+ of Assets. prnewswire.com/news-releases/… Solana devs now have access to the standard for cross-chain interoperability, joining Data Feeds and Data Streams

Solv Protocol lands on @solana via @InterportFi Powered by @chainlink‘s CCIP, SolvBTC, xSolvBTC, and SolvBTC.JUP are now live, bringing 1% of BTC liquidity to the fastest L1.

SolvBTC is now live on @solana — bridge it via @InterportFi A new chapter for BTC-backed assets. SolvBTC, xSolvBTC, and SolvBTC.JUP now seamlessly move to Solana. 🚀 Powered by @chainlink #CCIP & @SolvProtocol

Solv’s Vision for Bitcoin Finance at TOKEN2049 Dubai! @RyanChow_DeFi discussed with @bitcoinnews on how Solv is laying the groundwork for Bitcoin Finance—from native BTC to composable assets. This is just the beginning! Watch the full interview 👇

🔥 Bitcoin DeFi is finally catching fire and @RyanChow_DeFi is lighting the match! At @token2049 Dubai, @_dsencil sits down with the founder of @SolvProtocol to unpack: 🔸ERC-3525: The future of tokenized finance 🔸On-chain yield for $BTC holders Watch the full interview👇

Evaluating DeFi Vaults as Market Volatility Shifts Capital to Structured Products

Market volatility is pushing capital away from high-risk assets toward stable structured products that offer sustainable yields. The challenge now is evaluating DeFi Vaults that mirror traditional finance's structured products. **Key developments:** - Capital is flowing from risk-on assets to more stable, yield-generating products - DeFi Vaults are emerging as the crypto equivalent of TradFi structured products - Evaluation frameworks are needed to assess these new financial instruments This shift reflects a maturing DeFi ecosystem where investors seek both stability and returns, similar to traditional finance. The focus is on sustainable yields rather than speculative gains. [Learn more about evaluating DeFi Vaults](https://solv.finance/home)

Solv Protocol Joins Canton Network as Validator, Bringing Bitcoin Liquidity to Institutional DeFi

Solv Protocol, the largest onchain Bitcoin reserve, is joining [Canton Network](https://twitter.com/CantonNetwork) as a validator. This integration brings MiCA-compliant, FROST-secured Bitcoin liquidity to Canton's $6T+ institutional blockchain ecosystem. **Key developments:** - Solv positions itself as the institutional Bitcoin DeFi infrastructure - Enables BTC to be used for programmable yields in compliant, privacy-preserving finance - Canton Network partners include Goldman Sachs, HSBC, and Nasdaq - Supports tokenized collateral, settlement, and structured financial products This follows Solv's recent MiCA license acquisition through Netherlands authorities and a security audit with Offside Labs. The move accelerates institutional Bitcoin adoption within European regulatory frameworks. [Read the full announcement](https://insights.solv.finance/solv-joins-canton-as-validator-on-the-6t-institutional-network-bringing-mica-compliant-frost-secured-bitcoin-liquidity/)

🔮 a16z Commits to Decade-Long Bitcoin Vision

**Major crypto investor a16z announces 10-year commitment to Bitcoin ecosystem** Andreessen Horowitz (a16z), one of crypto's largest institutional backers, has signaled its willingness to maintain a decade-long investment horizon in Bitcoin infrastructure. The announcement comes as Bitcoin builders and ecosystem partners gather to discuss the network's long-term development trajectory. Key participants include: - Rootstock (RSK) - Bitcoin smart contract platform - Babylon Labs - Bitcoin staking infrastructure - Solv Protocol leadership The discussion focuses on **practical builder perspectives** rather than price speculation, examining how Bitcoin's infrastructure will evolve over the next 10 years. This patient capital approach contrasts with typical crypto investment timelines and suggests growing institutional confidence in Bitcoin's fundamental technology development beyond market cycles.

Protocol Highlights $600M+ in Active Collateralized Bitcoin Holdings

A decentralized finance protocol is drawing attention to its substantial Bitcoin collateral position, with over $600 million in active collateralized BTC. **Key Points:** - The protocol enables users to borrow against Bitcoin without wrapping tokens or using centralized custodians - Represents a non-custodial approach to Bitcoin-backed lending - Offers an alternative to traditional wrapped Bitcoin solutions This development highlights the growing infrastructure for Bitcoin utility in decentralized finance, allowing holders to access liquidity while maintaining control of their assets.

🛍️ Solv Protocol Launches Merchandise Store

Solv Protocol has opened an official merchandise store, expanding its brand presence beyond DeFi infrastructure. **Key Details:** - Store accessible at [solvstore.myshopify.com](https://solvstore.myshopify.com) - Follows broader trend of crypto projects offering branded merchandise - Comes after Solana Pay integration enabled crypto payments across hundreds of stores The launch represents a straightforward brand extension for the Financial NFT platform, allowing community members to purchase Solv-branded items. This follows the January announcement highlighting Solana Pay's growing merchant adoption, which enables purchases using SOL, USDC, BONK, and other tokens across various product categories including tech, merchandise, food and beverage, and lifestyle goods.