Solv Protocol Dominates Bitcoin Finance on Soneium

Solv Protocol Dominates Bitcoin Finance on Soneium

🚀 Velodrome's Bitcoin King

Solv Protocol continues to strengthen its position in Bitcoin Finance on Soneium's Superchain. Recent data shows SolvBTC dominating DEX volume on Velodrome, capturing 9x more volume than all other DEXs combined on the network.

Key developments:

- SolvBTC is the leading Bitcoin token on Soneium

- Velodrome emerges as the primary liquidity hub

- Platform continues building infrastructure for Bitcoin scaling on Superchain

This follows Solv's expansion across multiple chains including Core DAO, Solana, and Berachain, where they've established significant presence in Bitcoin-based DeFi services.

Solv Protocol is now powering BTC yield for @binance Earn. Our institutional-grade BTCFi strategies are live in Binance’s On-Chain Yield suite, right after our first Shariah-compliant BTC product. Here’s how Solv’s integration with Binance Earn helps unlock for institutional

New to BTC Staking? Earn on-chain yields of up to 1.1% - 3.8% APR* with your idle BTC — no bridges, no wallets, no gas. Earn SOLV rewards seamlessly via @SolvProtocol, all within Binance. Stake now 👇

Solv Shines at TOKEN2049 Dubai! 🌍 We upgraded SolvBTC's institutional infrastructure, scaled yields to Telegram's 950M users, and unlocked new capital markets this week. A recap 🧵👇

Weekly Digest: Solv Unlocks $5T with Institutionalized Bitcoin Product This week, Solv achieved the first-ever Shariah-compliant Bitcoin yield product. Certified halal yields. Institution-ready, with potential for $5T+ in untapped sovereign wealth funds. A recap for the week

Solv Weekly Digest: Bitcoin Pizza Day Special! 🍕 15 years after 10,000 BTC bought two pizzas, Solv continues to cook up the best Bitcoin yields in the space. What went down this week 👇

We're on a mission to bring institutional BTC yield to @solana, at scale. Now, we become an Institutional Guardian on @ZeusNetworkHQ, securing the permissionless bridge alongside @MechanismCap, @animocabrands & @anagramxyz. Here’s what 1% of Bitcoin liquidity on Solana means

Solv has integrated Chainlink Proof of Reserve (PoR) for real-time transparency. This secures over $2B+ in tokenized BTC and RWA yield products, including SolvBTC, xSolvBTC, and Solv Protocol itself. A new standard for institutional-grade Tokenized Bitcoin Finance 👇

Solv deepens its strategic alignment with @Coredao_Org as Bitcoin Finance gains momentum. SolvBTC.CORE is now the largest asset on @colend_xyz, Core’s leading lending protocol. Solv is the composable Bitcoin Finance protocol that allows BTC holders to earn yield through Core's

State of @Coredao_Org Q1 Key Update: Core’s DeFi TVL rose 40% QoQ to 1.1 billion CORE. Leaders: @colend_xyz (266.5M CORE), @Pell_Network (248.4M CORE), @BitFluxFi (183.1M CORE). Q1 Highlights: - Core and @maplefinance announced lstBTC for liquid BTC staking with top-tier

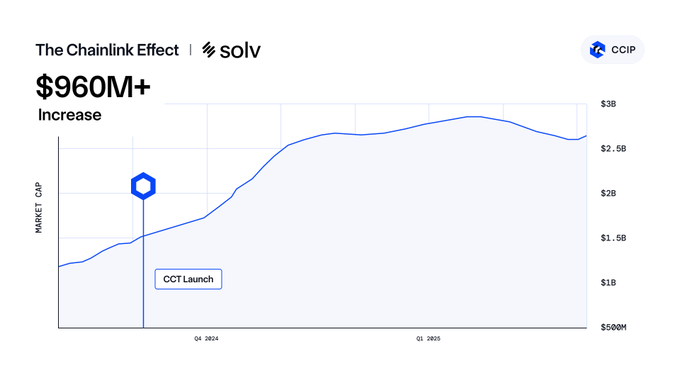

With @chainlink's CCT standard, Solv achieves composable liquidity and programmable yield. unlocking seamless BTC asset mobility across chains. Solv is accelerating Bitcoin.

After @SolvProtocol adopted the Cross-Chain Token (CCT) standard, the Bitcoin staking protocol surged to $2.5B+ TVL—with $1.16B+ in cross-chain transfers via CCIP. Cross-chain by Chainlink → a catalyst for growth uniquely enabled by CCIP and a thriving community.

Solv is institutionalizing Bitcoin by bringing RWA-backed yields to Wall Street. This week: 🔹 BlackRock BUIDL & Hamilton Lane SCOPE back the first RWA BTC yield. 🔹 Solv is Binance Earn’s exclusive BTC fund manager. More on how Solv brings institutional BTC and RWA to you👇

SolvBTC continues to lead Bitcoin Finance on @soneium. Solv is building the foundation to scale Bitcoin on Superchain.

Leading BTC on Soneium 💿 In the last 24 hours, Velodrome has captured 9x the volume of all other DEXs on @soneium combined for the leading BTC token, $SolvBTC. Velodrome––the liquidity hub of the Superchain

Even as Boyco sunsets, Solv continues to deliver the highest Bitcoin yields on ₿erachain. SolvBTC.BERA on @berachain targets 8% real-time APR through a combination of BGT emissions, Solv S2 points, and team-based community boosts. Introducing our new 🐻⛓ journey on Berachain:

Solv acc(SOL)erates Bitcoin Finance with @chainlink. Solv + Chainlink CCIP = Institutional-Grade Interoperability With Chainlink CCIP now deployed on @solana mainnet, Solv’s strategy to expand Bitcoin use cases across the cross-chain ecosystem is scaling fast. This unlocks

Chainlink CCIP is officially live on @solana mainnet, supercharging the growth of Solana DeFi by unlocking access to $18B+ of Assets. prnewswire.com/news-releases/… Solana devs now have access to the standard for cross-chain interoperability, joining Data Feeds and Data Streams

Solv Protocol lands on @solana via @InterportFi Powered by @chainlink‘s CCIP, SolvBTC, xSolvBTC, and SolvBTC.JUP are now live, bringing 1% of BTC liquidity to the fastest L1.

SolvBTC is now live on @solana — bridge it via @InterportFi A new chapter for BTC-backed assets. SolvBTC, xSolvBTC, and SolvBTC.JUP now seamlessly move to Solana. 🚀 Powered by @chainlink #CCIP & @SolvProtocol

Solv’s Vision for Bitcoin Finance at TOKEN2049 Dubai! @RyanChow_DeFi discussed with @BTCTN on how Solv is laying the groundwork for Bitcoin Finance—from native BTC to composable assets. This is just the beginning! Watch the full interview 👇

🔥 Bitcoin DeFi is finally catching fire and @RyanChow_DeFi is lighting the match! At @token2049 Dubai, @_dsencil sits down with the founder of @SolvProtocol to unpack: 🔸ERC-3525: The future of tokenized finance 🔸On-chain yield for $BTC holders Watch the full interview👇

Solv Protocol Q4 Report Shows Strong Growth in Bitcoin Yield Platform Adoption

**Alea Research has released comprehensive Q4 coverage of Solv Protocol**, highlighting the growing adoption of BTC+ as a streamlined Bitcoin yield platform. **Key developments include:** - Launch of Bitcoin-backed RWA Vault in partnership with Binance and BNB Chain, featuring Circle's USYC as underlying product - $6.5M in institutional deposits within days of vault launch - Protocol fees and revenue growth despite market volatility and DeFi exploit concerns - Integration with Anchorage Digital's institutional custody platform for compliant SolvBTC operations - Real-time data dashboards via Token Terminal showing Solv ranked 2nd in weekly fees growth among liquid staking protocols The report emphasizes Solv's position as the largest onchain BTC reserve manager, focusing on sustainable yield generation through tokenized real-world assets including Treasuries and investment-grade credit. The platform addresses Bitcoin's income generation challenge while maintaining institutional-grade security and compliance standards. [Read full Q4 report](https://solv.finance)

🏛️ Solv Protocol Secures MiCA License for EU Bitcoin Operations

**Solv Protocol has achieved MiCA compliance**, positioning its Bitcoin reserve for European expansion. **Key developments:** - Acquired MiCA license through Netherlands authorities - Enables operation in EU financial markets under regulatory framework - Anchors the largest on-chain BTC reserve to European regulatory standards **What this means:** The compliance marks a significant step for decentralized Bitcoin finance in Europe. Solv can now expand its Financial NFT platform—which enables trading of vesting vouchers and other tokenized assets—within EU markets under established regulatory oversight. This regulatory approval provides a foundation for institutional participation in on-chain Bitcoin products while maintaining compliance with European financial standards.

Multi-Protocol Strategy Offers 8%+ Returns on Bitcoin Holdings

A DeFi strategy enables Bitcoin holders to earn stablecoin yields while maintaining BTC ownership through a multi-step process: **The Strategy:** - Collateralize SolvBTC on Venus Protocol to borrow $U at 0.82% - Supply $U to $U/$USDT liquidity pool on Lista DAO earning 5.74% - Borrow $USDT against LP tokens at 2.5% - Deploy $USDT either back to Venus (6.11% APY via PRIME) or Lista DAO (5.74% APY) **Net Returns:** 8.16% to 8.53% annually **Additional Incentives:** - 240K in Lista DAO rewards - Venus Protocol PRIME benefits - Exclusive Solv merchandise - $300 in $U giveaway The approach allows users to generate stablecoin income from Bitcoin without selling their holdings, combining multiple protocols for optimized yields.

Alea Research Report Highlights Solv's Bitcoin Mobility via Chainlink CCIP

**Alea Research has published a report examining Solv Protocol's asset mobility infrastructure powered by Chainlink's Cross-Chain Interoperability Protocol (CCIP).** Key findings: - Solv operates the largest onchain Bitcoin reserve with enhanced productivity - Products integrated with Chainlink CCIP have processed over $1.3B in cumulative cross-chain transfer volume - The infrastructure combines CCIP for cross-chain transfers with Chainlink Proof of Reserve for transparent asset backing **Background Context** Solv's Bitcoin Finance infrastructure received recognition in the White House Digital Assets Report (EO14178) as critical infrastructure for stablecoins, tokenized funds, and digital assets. The protocol specializes in creating Financial NFTs that represent various crypto assets, including vesting tokens and lock-up allocations. The integration demonstrates practical application of cross-chain technology for Bitcoin-based financial products, enabling asset movement across different blockchain networks while maintaining security and transparency through oracle-based verification systems. [Read the full Alea Research report](https://twitter.com/AleaResearch)

Solv Protocol Upgrades to FROST Network for Bitcoin Threshold Signatures

Solv Protocol has completed a major infrastructure upgrade, transitioning from SAL to **FROST Network-based architecture** for Bitcoin-compatible threshold signing. **Key Technical Changes:** - FROST multi-signatures enable distributed custody and governance - No modifications required to Bitcoin's core protocol - Institutional-grade security through threshold cryptography **Benefits of the Upgrade:** - Enhanced security through distributed control - Improved accountability and auditability - Higher execution scalability for SolvBTC - Easier integration for DeFi ecosystems The upgrade positions SolvBTC as a more resilient Bitcoin execution layer, moving beyond basic staking abstractions to provide enterprise-grade infrastructure for institutions. [Read full details](https://blockchainreporter.net/solv-drives-frost-threshold-signatures-for-bitcoin-mainnet-execution/)