Beefy Finance reports strong weekly performance with $500K in yield volume and multiple new opportunities.

Key Highlights:

- SKY token now available with 18% APY

- Balancer USDT/GHO/USDC pool leads deposits

- 11 new yield strategies launched

- New BeefyPod episode released

The platform continues expanding its DeFi yield optimization services with diverse token offerings and competitive returns for users.

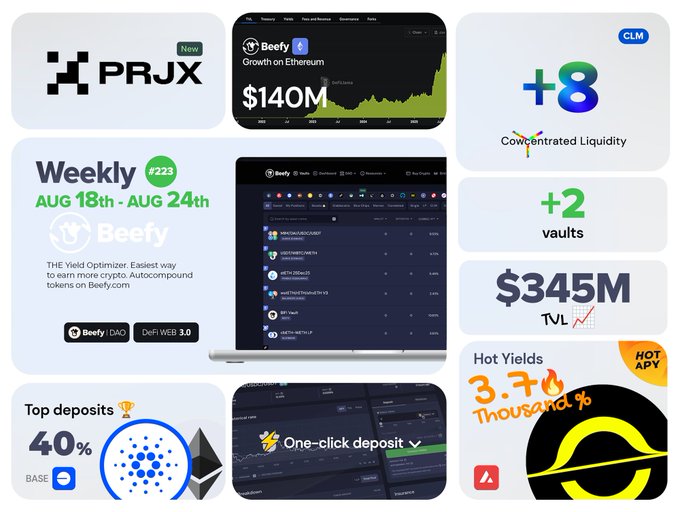

Beefy Weekly Highlights #223 • @capmoney_ officially launched 🚀 • $350M TVL across 1100+ Products 📈 • 10 new yield strategies! 🛠️

Beefy Weekly Highlights #224 • Balancer USDT/GHO/USDC top deposits 🏅 • EDGE APY 💎 • $500K in Yield Volume 🎚️ • SKY on Beefy 18% APY 🌌 • New BeefyPod released 📻 • 11 new yield strategies! 🛠️

🌾 Seven New Single-Asset Vaults Launch on Neverland Money

**New Yield Opportunities Available** Seven single-asset vaults have been added to [Neverland Money](https://twitter.com/Neverland_Money), expanding earning options for crypto holders. **Available Vaults:** - earnAUSD - WMON - AUSD - USDC - USDT0 - WETH - WBTC These vaults allow users to deposit individual assets and earn yield without needing to provide liquidity pairs. The addition covers major stablecoins (USDC, USDT0, AUSD) and wrapped versions of leading cryptocurrencies (WETH, WBTC). Single-asset vaults simplify the yield farming process by eliminating impermanent loss risks associated with liquidity pools.

🗳️ Beefy DAO Votes on Protocol Coverage Fund

Beefy DAO is voting on **BSP:04**, a steering proposal to explore reallocating protocol revenue toward a new Protocol Coverage Fund. **Key Details:** - The fund would finance [@NexusMutual](https://twitter.com/NexusMutual) coverage for Beefy users - This is a non-binding proposal to gauge community support - Vote is live on [Snapshot](https://snapshot.box/#/s:beefydao.eth/proposal/0x214a93fa1d8f1c6fc04457a2687cad1186ab16126a5ad4a71f3f58ed921c8462) The proposal represents a potential shift in how Beefy allocates its protocol revenue, prioritizing user protection through insurance coverage.

Beefy Finance Ships 4 New Strategies, Completes 23.67 BIFI Buyback as USDS LP Hits ~10% APY

**Q3 financials released** as December momentum continues with four new strategy launches and a token buyback. **New strategies deployed:** - reUSD - reUSDe - NOCK - osETH **Key metrics:** - Completed 23.67 BIFI buyback with price trending upward - USDS LP leading deposits at approximately 10% APY - FRAX yield showing increased activity The platform continues executing on its roadmap with consistent product delivery and returns for users.

Beefy Q3 2025 Financial Report Released

Beefy has published its Q3 2025 quarterly financial report, covering the period from July to September 2025. The yield optimization platform continues its regular quarterly reporting practice, providing transparency on: - Revenue generation and treasury performance - Governance incentive distributions - Overall net asset position - Platform operations and developments This follows their Q2 report which showed $810,154 in total revenue, $432,328 in treasury strategy income, and net assets of $5.78 million. [Read the full Q3 report](https://beefy.com/articles/2025-q3-report/)

🚀 Monad Launch

**Beefy November Performance:** - **$1.73M yield distributed** at 9% average APY - **24 new strategies** deployed across chains - **23,800 harvests** processed automatically - **382 BIFI tokens** bought back **Major Milestone:** Beefy is now **live on Monad** - expanding DeFi yield opportunities to this high-performance blockchain. The platform continues automating yield farming, turning manual processes into passive income streams for users across multiple networks.