Beefy November Performance:

- $1.73M yield distributed at 9% average APY

- 24 new strategies deployed across chains

- 23,800 harvests processed automatically

- 382 BIFI tokens bought back

Major Milestone: Beefy is now live on Monad - expanding DeFi yield opportunities to this high-performance blockchain.

The platform continues automating yield farming, turning manual processes into passive income streams for users across multiple networks.

Crypto took a hit last week with BTC sliding under $81K 📉 and the market bleeding red, but DeFi didn’t slow down. Beefy delivered $394K in yield at a 9.2% average APY, steady as ever. The team also showed up strong at Multichain Day by @wrappedxyz during Devconnect, with

Past week Beefy distributed ~$460K in yield, with Yield Basis token listing, Pendle gUSDC vault topping deposits (~16% APY), CeDe trading comp live on Binance, DevConnect Argentina prep, and DAO vote BIP[92] underway.

Cryptos Not Dead Beefy hit Buenos Aires for Multichain Day by @wrappedxyz during Devconnect and the energy was unreal. The biggest Ethereum gathering ever with 14,500 attendees and the first “Ethereum World’s Fair” at La Rural. Vitalik unveiled Kohaku privacy wallets and

Beefy keeps expanding the yield yield map: new strategies across Ethereum, Base and Berachain, with APYs running from strong double-digits to full 🔥. If you want real on-chain productivity, this lineup speaks for itself.

November stats: $1.73M yield distributed (9% avg. APY) 24 new strategies deployed 23.8 thousand harvests 382 BIFI bought back Live on Monad! Beefy users save time and money - turning manual grind into passive cashflow.

Beefy just wrapped another strong week: $438K in yield distributed at a 9.4% average APY, 4 new strategies live, and 6,181 harvests processed. Fresh listings like SEND and kVCM are in, while UNI, NOICE, DOGINME and CLANKER keep pulling hot yield. BIFI buybacks hit 101.52 tokens

$495K in yield past week at an average of 10.3% APY, launched 8 new strategies, completed 6,273 harvests, and saw PYSUD vaults top deposits. We are gearing up for Multichain Day in Buenos Aires, are you going to be there?

Past week Beefy distributed over $507K in yield at an average 9.2% APY. Hot yield came from VIRTUAL, while Pendle stablecoin vaults led in deposits. We also added splUSD and are gearing up to deploy on Monad and MegaETH from day one. BIFI keeps compounding strong - 5 years of

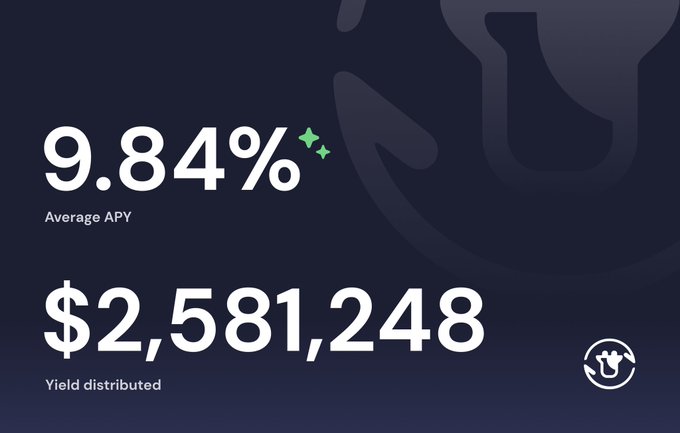

$2.58M yield distributed to Beefy users in October — avg 9.8% APY on all strategies

Last week Beefy distributed over $603K in yield at an average 10.7% APY, launched 17 new strategies, hit 785K ZAPs, rolled out one-click Lithos LP migration, and saw GHO LP on Base take the top spot for deposits.

Beefy Weekly: just went live on Monad with 5 fresh vaults, pushed out 10 new ones overall, hit 6,111 autocompounds, and scooped up 99.09 $BIFI on the buyback. With ~$218M in deposits, Beefy delivered $299K in yield to its users this week.

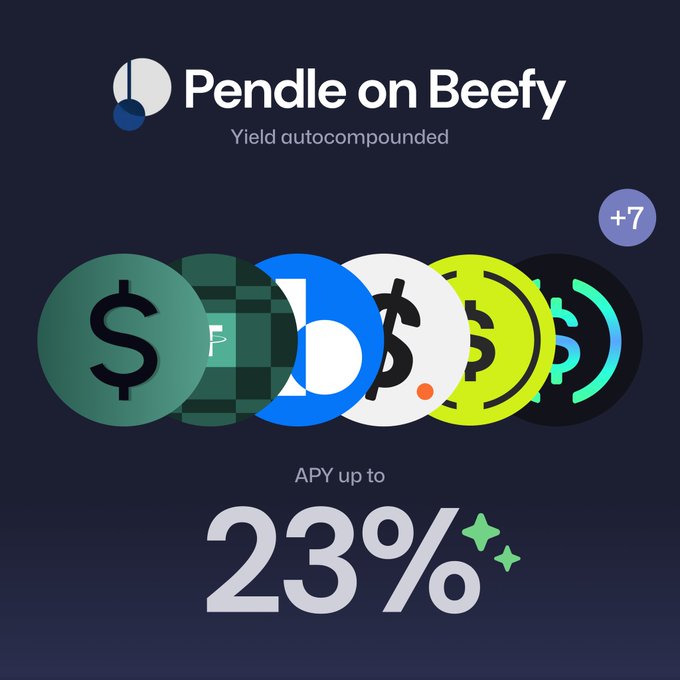

The $140T fixed-income market is coming on-chain and Beefy’s already giving you access. 24 Pendle single-asset vaults. Up to 23% APY. Autocompounded. Effortless yield from the future of finance.

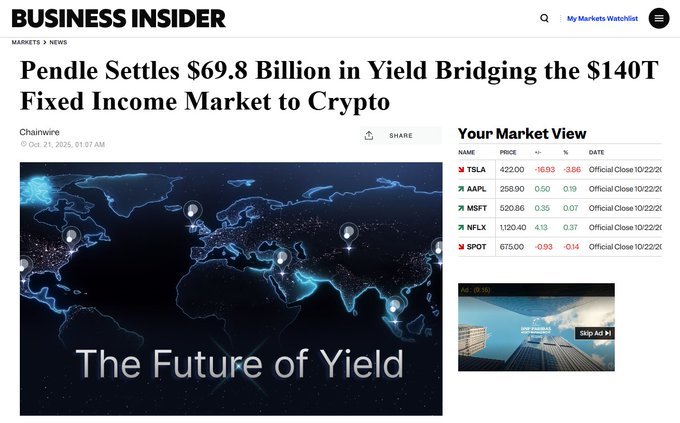

Pendle’s ambitions go far beyond DeFi. We’re building yield infrastructure that targets the $140 trillion fixed-income market, on track to surpass $200 trillion by 2030. We aim to democratize fixed income, transforming a market once reserved for institutions into an open,

$FAIR VC Agent and BEEFY Yield Optimizer Launch

Two new crypto tools have emerged in the DeFi space: - **$FAIR** - A VC agent designed to identify promising projects in their early stages - **BEEFY** - A yield optimizer (YO) that discovers and maximizes yield opportunities Both tools aim to help users find alpha opportunities in the crypto market. $FAIR focuses on early-stage project discovery, while BEEFY specializes in optimizing yield farming strategies. These launches follow $beef coin's fair launch earlier this month.

Beefy Launches PrismFi Concentrated Liquidity Managers on MegaETH

Beefy has deployed new PrismFi concentrated liquidity managers on the MegaETH network, offering two vault options: - **WETH-USDm pair**: 40% APY available at [app.beefy.com/vault/prism-cow-megaeth-weth-usdm-rp](https://app.beefy.com/vault/prism-cow-megaeth-weth-usdm-rp) - **WETH-BTCb pair**: 24% APY available at [app.beefy.com/vault/prism-cow-megaeth-weth-btcb-rp](https://app.beefy.com/vault/prism-cow-megaeth-weth-btcb-rp) These "cowcentrated" liquidity vaults automate position management for users seeking yield on their crypto assets through the Beefy platform.

🛡️ DeFi Insurance Works

**Nexus Mutual quickly processed nearly $100k in claims** following the Stream Finance exploit, protecting users across multiple protocols. **Key highlights:** - Claims paid out in **under a week** to affected Beefy, Euler, and Harvest Finance users - Coverage extended across Base, Arbitrum, Avalanche, and Sonic networks - Users were protected despite **not directly using Stream Finance** **The contagion effect:** Many users couldn't withdraw funds due to liquidity issues where xUSD was used as collateral, demonstrating how DeFi protocols' interconnected nature creates cascading risks. **Partners like OpenCover** facilitated the rapid payout process, showcasing how **multi-protocol coverage** can provide a safety net against second-order effects in DeFi. This incident highlights both the **real risks of protocol interdependence** and the **effectiveness of DeFi insurance** when properly implemented.

🚀 Buenos Aires Breakthrough

**Ethereum's biggest gathering ever** hit Buenos Aires with 14,500 attendees at Devconnect's first Ethereum Worlds Fair. **Major announcements dropped:** - Vitalik unveiled **Kohaku privacy wallets** - Pushed for **100x L1 gas limit increase** - **Bhutan launched national digital ID** on Ethereum - New **Ethereum Interoperability Layer (EIL)** unified all L2s **Real-world demos showcased:** - Tokenized S&P 500 shares - Biometric payments - Stablecoin remittances for everyday use From Aave Horizon to Centrifuge RWAs and Chainlink ACE, the week proved **Ethereum is evolving beyond crypto** into the global settlement layer for money, identity, and governance. Beefy shared how their yield architecture is adapting for the next wave of interoperability. *The question remains: Will ETH price catch up before quantum computing threatens elliptic curve cryptography?*