Size Protocol Yield Curve Update and Borrowing Opportunity

Size Protocol Yield Curve Update and Borrowing Opportunity

🏹 Yield Curve Gets Kinky

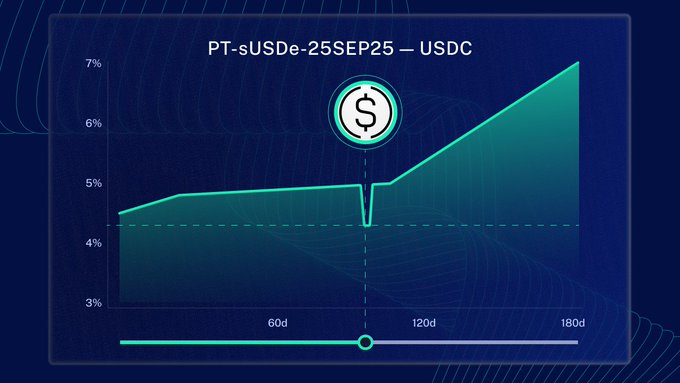

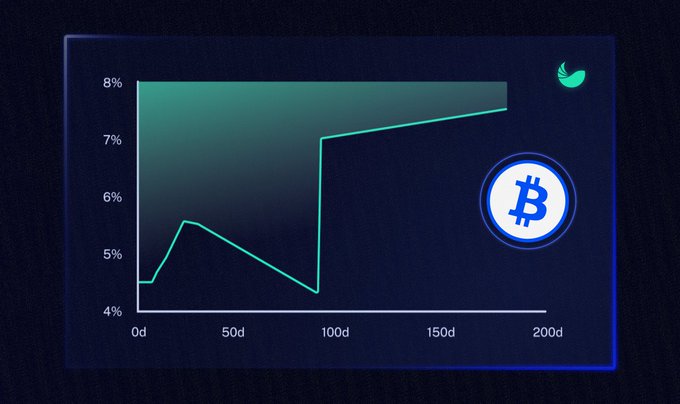

Size Protocol's latest PT market yield curve shows an advantageous dip in borrow rates for the September 27-30 period. This presents a strategic opportunity for users to:

- Convert idle Principal Tokens (PTs) into USDC liquidity at reduced costs

- Access fixed-rate borrowing against various PT collateral types

- Take advantage of temporary rate discounts

The platform continues to offer fixed-rate lending with unified liquidity across multiple maturities, maintaining its position as a key DeFi borrowing venue.

Visit Size Protocol to explore current rates.

PT profit made EZ Lock in a borrow rate against your PT-sUSDE-29MAY2025 well below the native 9.93% Pendle yield app.size.credit/borrow

Triple fixed loops with PT-wstUSR-25SEP25 1. Earn 7.6% fixed PT yield 🔒 2. Borrow USDC at a fixed 5.1% rate with PTs until 25 Sept 🔒 3. Secure 2.5% fixed spread and unlock idle liquidity 🔒 app.size.credit/borrow

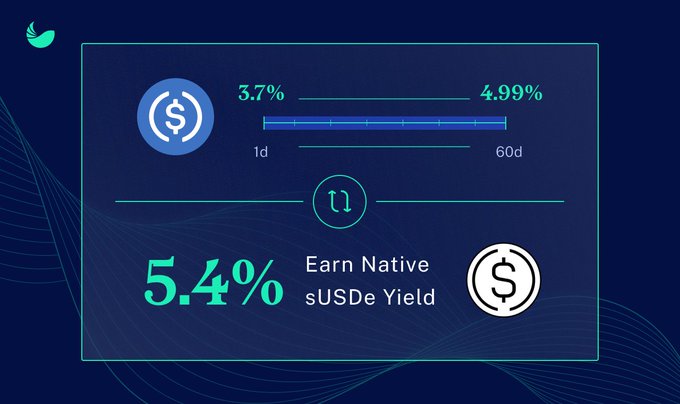

Layer profit on profit with fixed rates Borrow USDC for 1–60 days using sUSDe collateral and arb Ethena’s 5.4% yield app.size.credit/borrow 🔗

Fixed in, fixed out 🔐 Deposit PT-wstUSR-25SEP → borrow USDC at a fixed rate Lock in the spread, hold to maturity, and capture the carry app.size.credit/borrow

Fixed costs. Fixed yield. Fixed gains. Lock in a return simply by borrowing USDC with your PT-wstUSR-25SEP collateral on Size 🔐 app.size.credit/borrow

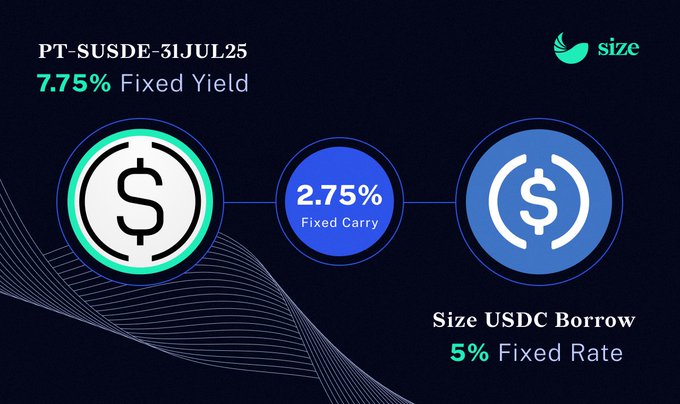

Supersize your loop stacks ⇪⇪⇪ Borrow low USDC fixed rates using PT-sUSDE-31JUL25 as collateral for the deepest, most resilient yield spreads in DeFi app.size.credit/borrow

🐋 Size + PTs = Optimized Returns Lock in these fixed spreads today: • 8.219% PT-sUSDE-31JUL25 yield vs. 5% borrow → +3.22% • 7.985% PT-wstUSR-25SEP25 yield vs. 5.09% borrow → +2.90% app.size.credit/borrow

Liquidity on tap 🌊 Only Size aggregates protocol-wide lending offers so borrowers can lock in fixed rates for any duration app.size.credit/borrow

The new Size PT market yield curve is... kinky Slurp that 27-30 Sept borrow rate dip while it lasts and turn idle PTs into low-cost USDC liquidity 🧃

Gains to set your watch to ⌚️ Borrow fixed-rate USDC against fixed-yield sUSDe PTs and earn a fixed spread at maturity app.size.credit/borrow

NEW PT MARKET 🐋 Juice moar profit from your @ResolvLabs PTs by sniping a low fixed rate against them Move fast and you’ll pay just 6.28% APR to borrow until Sept 24 Collateral Asset: PT-wstUSR-25SEP Borrow Asset: USDC app.size.credit/borrow

NEW Fixed / Fixed Market (🔒,🔒) Unlock USDC liquidity and lock in your spread by borrowing against your sUSDe PTs on Size Borrow from 4.98% until 27 Sept at app.size.credit

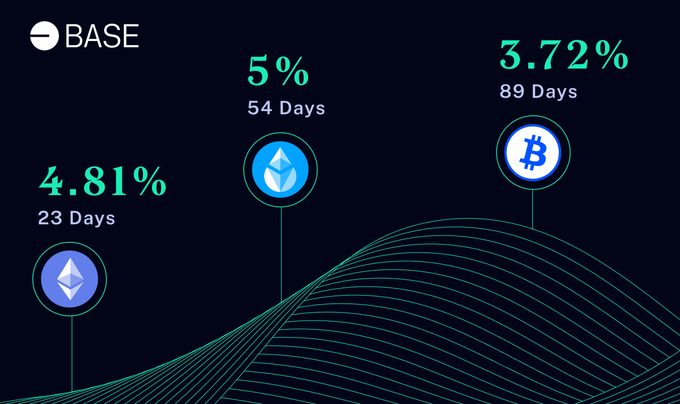

Don't compromise on your fixed loan terms 🔴 Lock in a low borrow rate ~ for any maturity ~ using @Base blue chips like cbBTC, ETH, and wstETH 🔵 app.size.credit/borrow

Three collateral options Three random maturities Three ways to lock in fixed-rate USDC borrowing - all lower than mainstream variable rates app.size.credit/borrow

Fixed rates, your dates 📆 Borrow USDC against cbBTC on Size and lock your costs for any timeframe

Fix your borrow rate 🔧 Secure a flat USDC rate for any maturity using cbBTC — and exit anytime app.size.credit/borrow

RWA Skepticism and Innovation in DeFi

Recent discussions in the DeFi space highlight growing skepticism about Real World Assets (RWAs). @RobAnon94 shares critical insights on @infinifilabs' potential solutions in a Crypto Yield Curve episode. Earlier developments showed promise with smart wallets like @CoinbaseWallet improving RWAfi accessibility. These innovations aimed to streamline lending and yield farming for various assets: - Precious metals - Luxury watches - Real estate @_ConorMoores' interview with @fabricaland provided detailed perspectives on RWA implementation and onchain real estate opportunities.

Fix PT returns. Nix uncertainty.

Size Protocol announces improvements to Principal Token (PT) returns, eliminating market uncertainty. This update builds on previous fundamentals-focused changes from March and April 2025. Key updates: - Enhanced fixed-rate lending mechanism - Streamlined liquidity management - Improved yield calculations The protocol continues optimizing its fixed-rate lending infrastructure while maintaining the core benefits for both lenders and borrowers. *Lenders* maintain variable rate earnings through Aave integration while awaiting custom yield curve offers. *Borrowers* retain access to optimal fixed rates across all maturity options.

Size Credit Offers Competitive Fixed Rates for PT-sUSDE Borrowing

Size Credit continues to provide attractive fixed borrowing rates against PT-sUSDE-29MAY2025 collateral, offering rates significantly below Pendle's native yield of 9.93%. Key points: - Fixed-rate USDC borrowing available - Rates consistently below market alternatives - Multiple duration options from 7 to 160 days - $1M liquidity on mainnet - Early exit options available The platform maintains competitive rates across various assets including ETH, cbETH, cbBTC, and wstETH on Base network. Recent trends show Size's fixed rates outperforming variable rates on platforms like Aave.

Size Protocol Launches Fixed-Rate Earn Product on Base

Size Protocol has introduced a new Earn product featuring Collections - curated baskets of fixed-rate yields. The product, launched on Base network, currently offers: - Expert-curated fixed yield opportunities - 71% bonus APY paid in USDC - Protection from market volatility through fixed rates The Collections feature allows users to access optimized yields selected by experts, providing a streamlined approach to fixed-rate lending. Users can now deposit on Base to participate in the first Collection. [Join Base Collection](https://base.size.protocol)