Size Credit Offers Competitive Fixed Rates for PT-sUSDE Borrowing

Size Credit Offers Competitive Fixed Rates for PT-sUSDE Borrowing

🔒 Fixed Rates Just Got Spicy

Size Credit continues to provide attractive fixed borrowing rates against PT-sUSDE-29MAY2025 collateral, offering rates significantly below Pendle's native yield of 9.93%.

Key points:

- Fixed-rate USDC borrowing available

- Rates consistently below market alternatives

- Multiple duration options from 7 to 160 days

- $1M liquidity on mainnet

- Early exit options available

The platform maintains competitive rates across various assets including ETH, cbETH, cbBTC, and wstETH on Base network. Recent trends show Size's fixed rates outperforming variable rates on platforms like Aave.

Lock in a borrow rate lower than your current Aave one 🔒 Right now, we’ve got market-leading low rates for borrowing against cbETH, cbBTC, wstETH, and ETH Switch to Size today

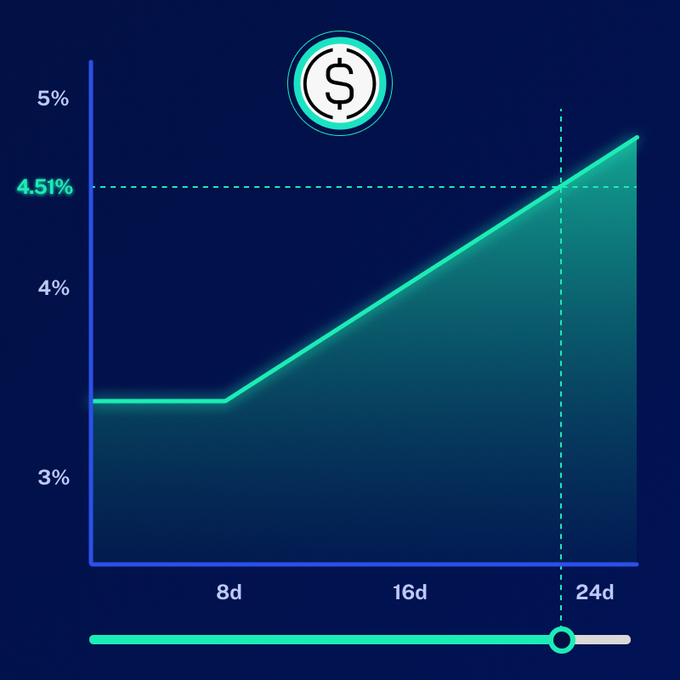

23 days until sUSDe PTs mature 🔓 Squeeze more value from your position now and borrow against it at the market's lowest fixed rates app.size.credit/borrow

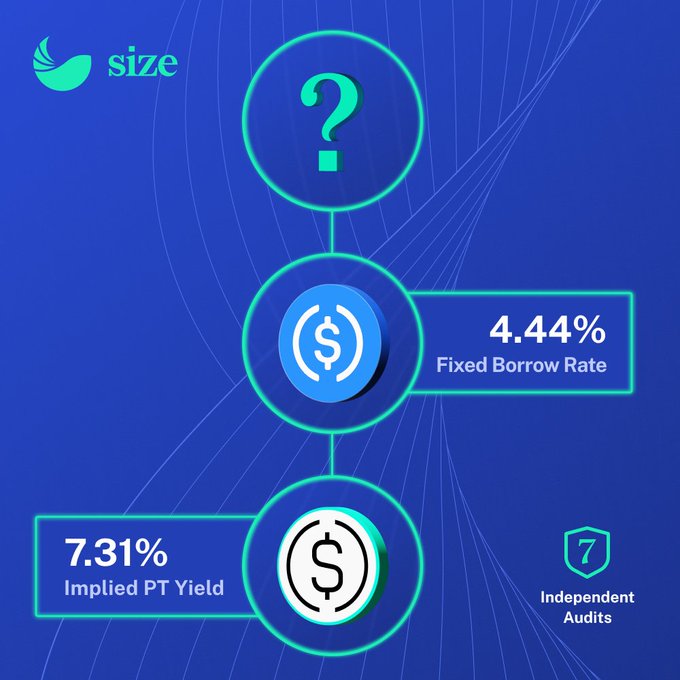

sUSDe PTs are yielding 7.45% Fixed borrow rate on Size? Just 4.76% Do the math

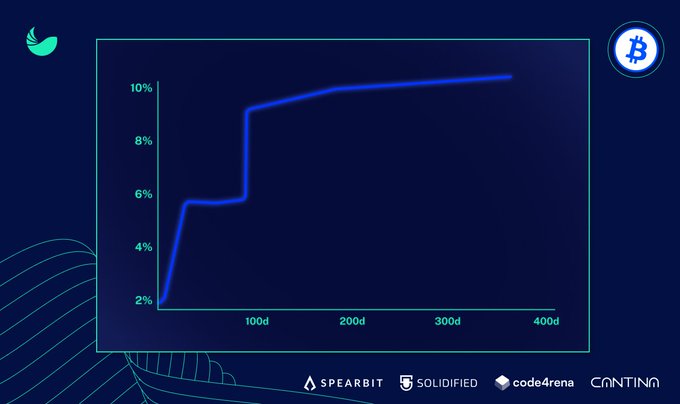

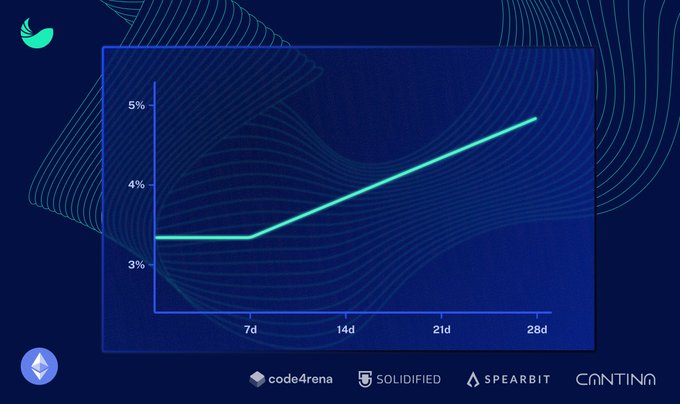

A random pick of ETH-USDC fixed rates on @Base 7d - 2.98% 28d - 5.73% 127d - 8.51% 230d - 9.21% Lock in these, or any rate along the blue, only on Size Credit today

A snapshot of today's cbBTC-USDC fixed borrow rates 👀 7d - 2.3% 30d - 5.46% 90d - 5.58% Head to our Borrow page now and lock down any rate along the blue line 🐋

Lever up your sUSDe PTs with the market's lowest stable borrow rate 🐋 - 4.85% fixed for 21 days (7.35% PT IY) - $1m mainnet liquidity - Exit at any time app.size.credit/borrow

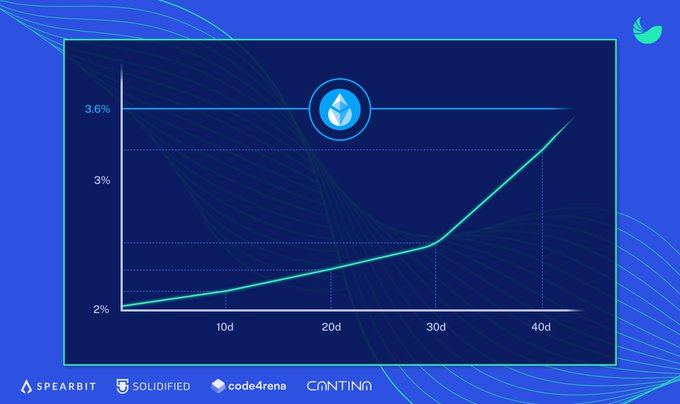

Borrow against wstETH and pay less than the staking yield Fixed rates on Size Credit (vs 3.6% native): 2.15% — 10d 2.33% — 20d 2.5% — 30d 3.27% — 40d

Base(d) borrow rates 🐋 Lock in a loan ~ for any duration ~ against your blue chips on @Base

Make bank when you borrow 🐋 Fixed 1–28 day rates against wstETH — all below the 3.6% staking APR Net the spread now on our /Borrow page

Bullish markets typically drive variable interest rates higher Case in point: USDC borrowing on Aave (Base) has climbed 4.43% → 4.92% in just two weeks Choose any maturity from 1-90 days and lock in a lower, fixed rate on Size today 🐋

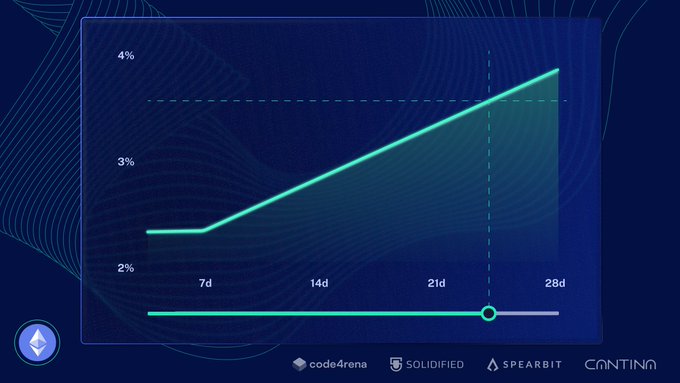

Crypto’s risky enough without getting nuked by rate spikes Lock in a leading fixed USDC borrow rate for 1–28 days using ETH 🐋 app.size.credit/borrow

Market-beating borrow rates against ETH 🐋 Lock in for any duration between 1-28 days today on Size

Aave USDC borrow rates hit 6-month lows (4.47%) Size fixed rates are still cheaper by a margin over the next 30 days Lock one in, exit at any time 🐋

Push your PT yield even higher - loop now with the lowest sUSDe PT fixed borrow rate available 🐋 Only $1m liquidity left at app.size.credit/borrow

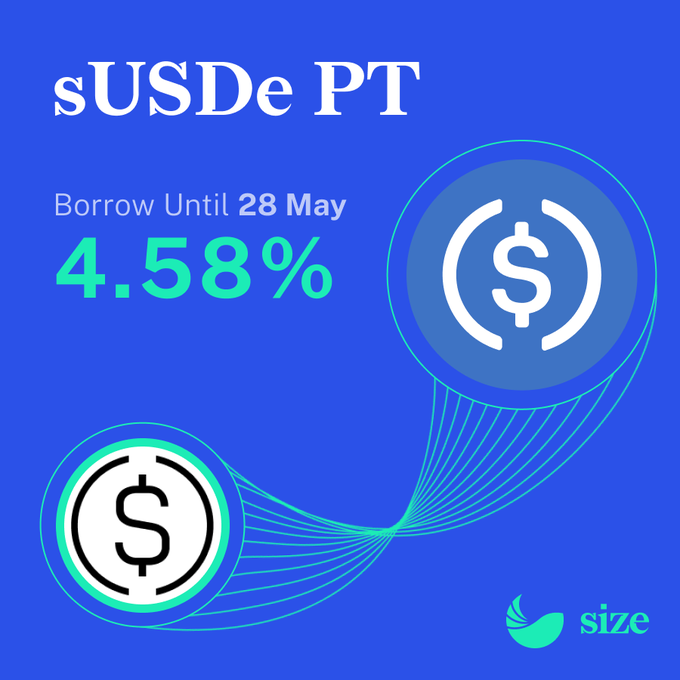

Loop your Ethena sUSDe PTs for moooooar profit Borrow fixed-rate USDC at 4.58% - well below the implied yield (7.92%) app.size.credit/borrow

🎙️ Stream Fallout Sparks

**New Crypto Yield Curve podcast episode** explores the **Stream Finance fallout** and its impact on DeFi trust. Key topics covered: - Why Stream drama dominated crypto timelines - **Code hardening vs. innovation** debate - Potential revival of **onchain insurance** - How to rebuild trust in DeFi protocols The Size core team unpacks lessons from the controversy and discusses **trust bonds** as a potential solution. Episode runs approximately 15 minutes. [Listen now](podcast-link) to hear expert analysis on DeFi's trust crisis.

Size Credit Launches Earn Vaults with 54% APY USDC Yields

**Size Credit's Earn platform** is offering competitive USDC yields through their new vault system. **Key Features:** - Base USDC yield with additional reward boosts - Currently **54% APY** with weekly payouts - Flexible exit terms - withdraw anytime - Pure USDC rewards without leverage or loops **How It Works:** The platform uses "Very Liquid Vaults" that convert term premiums into higher-than-variable returns. Users can deposit USDC and earn boosted rewards while maintaining liquidity. **Access:** Available at [app.size.credit/earn](http://app.size.credit/earn) This represents Size's approach to generating premium yield through fixed-rate lending mechanics.

🎯 Size Protocol Launches P2P Risk Isolation

**Size Protocol** introduces a **Term Structure Order Book** that revolutionizes DeFi lending risk management. Key features: - **P2P settlement and liquidation** - isolates risk between individual borrower-lender pairs - **Minimized socialized losses** - prevents cascade failures affecting the entire protocol - **Unified liquidity** across all maturities for optimal rate discovery The protocol aggregates lending offers protocol-wide, allowing borrowers to secure **fixed rates for any duration** while lenders earn variable rates through Aave integration. This architecture represents a significant departure from traditional pooled lending models, offering more precise risk management. [Learn more in the documentation](https://docs.size.credit/)

🚀 Size Earn Delivers 50%+ USDC Yields

**Size Earn** has maintained **USDC yields above 50% APY** for over a week, offering one of the market's highest returns. **Key Features:** - Premium USDC yield opportunities - **No lock-up periods** - withdraw anytime - Boosted reward system available The platform provides flexible earning options with **variable rates** while users wait for custom yield curve offers to fill. *Ready to explore high-yield opportunities? Check Size Earn's boosted rewards program.*

Size Protocol Launches Term Structure Order Book for Fixed USDC Rates

Size Protocol has introduced its **Term Structure Order Book**, enabling users to access fixed USDC lending rates across any maturity date. Key features: - **Unified liquidity** scaling across all maturities - **Flexible borrowing** - lock in rates for any chosen timeframe - **Competitive rates** - among the lowest fixed USDC rates available The platform allows borrowers to secure **predictable costs** by choosing their preferred maturity dates, while lenders can earn variable rates through Aave integration while waiting for their custom yield curve offers to fill. This launch builds on Size's previous offering of fixed-rate USDC borrowing against cbBTC collateral, expanding the protocol's fixed-rate lending capabilities.