The recent SIP-69 proposal, which aimed to permanently pause SPA minting and renounce contract ownership, did not reach quorum due to:

- Metamask voting technical issues

- Community requests for extended voting time

Key Updates:

- Voting period extended to 7 days for all future proposals

- Revised version of SIP-69 coming soon

- New SIP planned to address quorum requirements

- Forum discussion period changes to be proposed

The changes reflect DAO's commitment to community feedback and governance improvement.

📢 SPArtans! Thanks for voting in SIP-69. However, proposal didn’t pass as quorum wasn't met due to: -Metamask voting glitch -Requests for more voting time We hear you! We’ve updated the voting configurations—SPArtans will now have 7 days to vote going forward.

Sperax USD (USDs) Protocol Overview and Demeter Protocol Launch

Sperax USD (USDs) is a yield-generating stablecoin live on Arbitrum with unique features: - **Auto-yield generation** without staking or manual claims - Native Layer 2 integration for reduced fees - 100% backing by diversified crypto assets The protocol has reached $20M TVL within 2 months of launch. Demeter protocol launches as a complementary service, enabling DAOs to: - Manage DEX liquidity pools across Uniswap, Camelot, and Balancer - Automate pool creation and reward distribution - Access engineering and marketing support Backed by notable investors including Polychain Capital, Jump Trading, and Steve Aoki.

Stablecoin Landscape 2025: A Comprehensive Guide

The stablecoin ecosystem has evolved significantly by 2025, with distinct leaders emerging across different use cases: - **Trading**: Major players optimized for high-volume exchange - **DeFi**: Yield-generating and protocol-native stablecoins - **Global Payments**: Focus on cross-border efficiency and accessibility Key considerations for selection: - Backing mechanism - Regulatory compliance - Network fees - Geographic availability Notable trends include increased adoption in emerging markets, particularly Nigeria, where stablecoins are addressing local financial challenges. [Read the full analysis](https://sperax.io/blog/list-of-stablecoins-in-2025-use-cases-risks-how-to-choose)

Sperax USDs: Auto-Yield Stablecoin Protocol on Arbitrum

Sperax's USDs stablecoin offers unique features on Arbitrum L2: - **Auto-yield generation** without staking or gas fees - 100% backing by diversified crypto assets - Lower transaction costs via Arbitrum integration The protocol's Demeter feature enables DAOs to manage DEX liquidity pools across Uniswap, Camelot, and Balancer without coding expertise. *Notable backers include:* - Polychain Capital - Jump Trading - Amber Group - Outlier Ventures - Steve Aoki

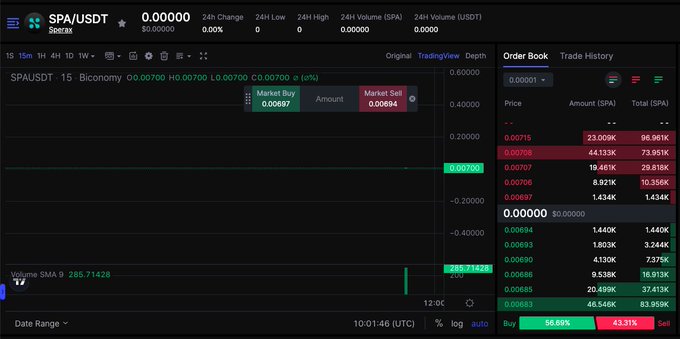

USDs/USDT and SPA/USDT Trading Pairs Launch on Biconomy

Biconomy Exchange has introduced new trading pairs for Sperax USD (USDs) and SPA tokens against USDT. This development expands trading options for these assets on the platform. Key points: - USDs/USDT pair now available - SPA/USDT pair also added - Trading accessible via Biconomy's exchange This listing follows a trend of exchanges expanding USDT trading pairs, as seen with recent additions on other platforms. Traders interested in these new pairs can visit Biconomy's exchange to start trading.