2025 marked RWA tokenization's evolution from experimentation to institutional infrastructure.

Three major reports confirm the shift:

- Birdeye RWA Spectrum 2025 shows institutions moving real capital onchain across credit, equities, and funds - no longer just testing pilots

- Keel Finance's tokenization regatta demonstrates accelerating institutional adoption across platforms

- Centrifuge's year-end analysis identifies key trends: regulated custody, benchmarks, and real equity moving from concept to production

The foundation is set for 2026's challenge: institutional deployment at scale.

1️⃣ Birdeye RWA Spectrum 2025: research.birdeye.so/rwa-spectrum-2… 2️⃣ Keel Finance - Tokenization Regatta: x.com/keel_fi/status… 5️⃣ Centrifuge - 2025 RWA Tokenization Trends: centrifuge.io/blog/real-worl…

Today, we take the first step on our roadmap to significantly develop the market for tokenized assets on @Solana. Season 1 of the Keel Tokenization Regatta is now open, and with it, $500m becomes available for Solana native RWAs.

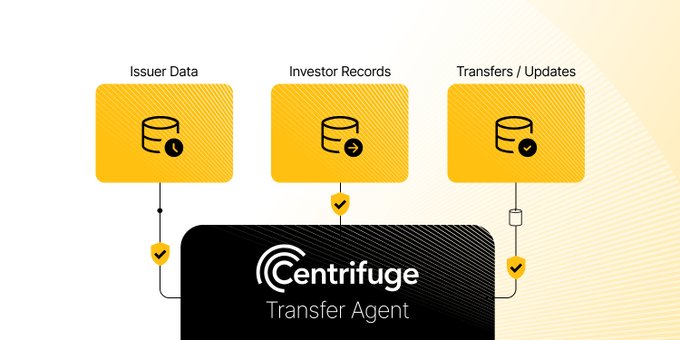

“This is a pivotal moment — not just for @caesar_data or Centrifuge, but for crypto-native startups everywhere. With an SEC-registered transfer agent, we can issue tokenized equity with the same protections as traditional securities while benefiting from the speed,

Today we’re excited to announce, through our partnership with @Centrifuge, Caesar will become the first AI company taking steps towards issuing onchain equity.

“A lot has changed in the RWA markets...” From being one of the few early builders to hundreds of RWA products today, our CTO @offerijns explains how Centrifuge V3’s open platform lets any builder launch faster, safer, and cheaper. That’s the next big unlock for RWAs.

Most onchain equity today is synthetic. Price exposure, not ownership. Real onchain equity: actual shares on blockchain with full legal rights, issued by the company and recorded in a regulated registry. That difference is everything. Let's take a dive into it 🧵

The important shift here isn’t just the issuer, it’s the move toward equity structures that behave like traditional shares, now supported onchain. @Eli5DeFi captured that distinction well. More teams are starting to think this way as tokenization expands beyond credit into

Wow, this is huge. The partnership between @caesar_data and @centrifuge marks the first token-native startup evolving into a traditional equity company, native to Web3. TL;DR • Creating legally recognized company shares not token-like shares • Shares will be on-chain, using

Ep.3 of our V3 Series is LIVE: "Investor Experience" @offerijns & @mustermeiszer2 break down how Centrifuge V3 uses ERC7540 for seamless RWA integrations and secure cross-chain asset movement. Discover how V3 sets a new standard for DeFi investors and real-world assets 👇

Centrifuge CEO, Bhaji Illuminati, lays out what’s next for asset management: Moving from limited hours to a 24/7 model powered by tokenization. Running funds becomes easier, faster, and fully onchain. At Centrifuge we are leading this shift 🔨

“Five days a week doesn’t work anymore. It has to be 24/7. It has to be all the time. Tokenization will shave costs out of the process. It will be easier, faster, and better to run these funds onchain.” - @itsbhaji of @centrifuge

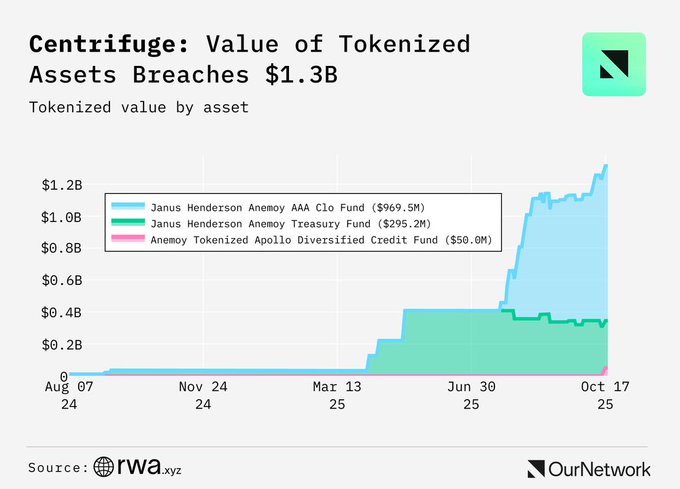

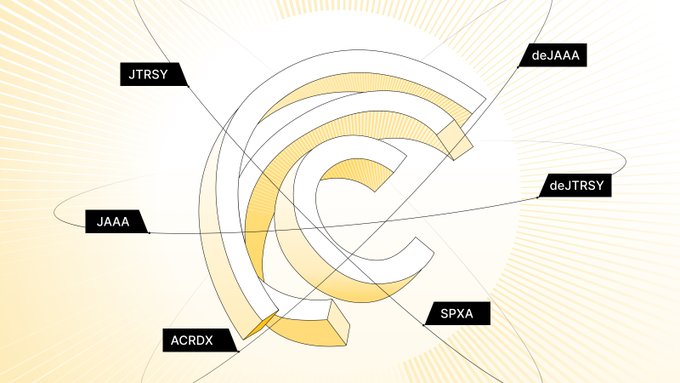

2025 has been a breakthrough year for @Centrifuge! We've reached $1.3B TVL across products like JTRSY, JAAA, and ACDRX, opening real-world assets to DeFi participants. Recent milestones include integration with @Aave’s Horizon, bringing DeFi access to more users. We’ve also

Launch and manage RWAs across any blockchain, directly from a single platform. @Centrifuge V3 delivers seamless multichain control for the next era of asset tokenization. Watch our CTO, @offerijns, share how we’re unlocking new possibilities 👇

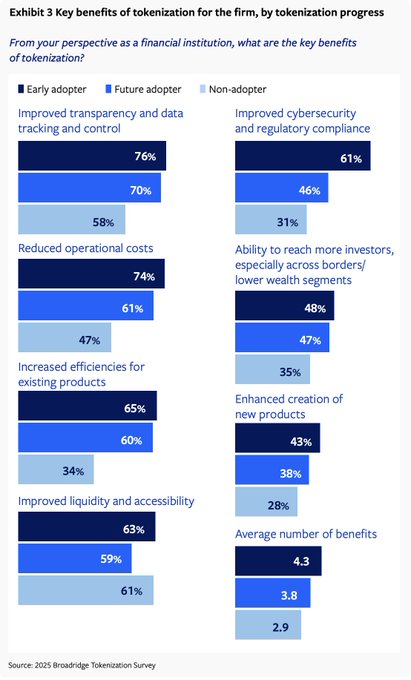

The latest @Broadridge research confirms the impact of tokenized RWAs: • 76% of adopters benefit from better transparency • 74% cut down costs • 61% gain more liquidity Driven by these results, @Centrifuge is enabling institutional access and real-world value with next-gen

Lesson 1: Tokenized funds are moving toward utility. For years, buying an RWA token and holding it was the only option. 2025 showed the change. @Aave Horizon made the first real move: RWAs becoming usable as collateral. If assets can work in DeFi, they start to unlock value.

The onchain equity era is taking shape. Momentum is building as equity and index products take the spotlight, and Centrifuge bridges institutional frameworks onto blockchain rails. Three distinct moves signaled the next wave for RWAs 👇 1️⃣ S&P 500 Whitepaper:

Find Centrifuge CEO Bhaji Illuminati in New York this week, leading key conversations on tokenisation and the future of onchain finance. The Bridge Conference 2025 – The Definitive Conference for Institutional Crypto Panel: “The Missing Privacy Layer: Enabling Compliant

A major step forward for crypto-native companies and a milestone for onchain corporate finance. @caesar_data has chosen Centrifuge to offer tokenized equity through Centrifuge’s SEC-registered transfer agent. This establishes a precedent for how token-native startups can mature

Markets don’t stand still, and neither does onchain finance. RWAs are moving from idea to industry foundation and Centrifuge is building what the next wave needs: scale, trust, and real impact.

2025 was the year RWA tokenization moved from experimentation to institutional infrastructure. Looking back at how the market got here 👇 1️⃣ Institutional Capital at Scale: @birdeye_so RWA Spectrum confirms the shift. Institutions are moving real capital onchain across credit,

The growth described by @nottellingyou73 reflects a shift from RWA narratives to actual institutional-scale fund distribution onchain. Centrifuge’s infrastructure is built precisely for this model: regulated fund issuance, multichain distribution, and institutional-grade

🚨 Centrifuge: The Quiet RWA Giant Moving $1.3B Onchain Everyone’s been talking about RWAs for like 2 years but most of it has been just talk Now we’re finally seeing meaningful dollars move on-chain and $CFG is one of the under discussed giants behind it 1. Centrifuge is an

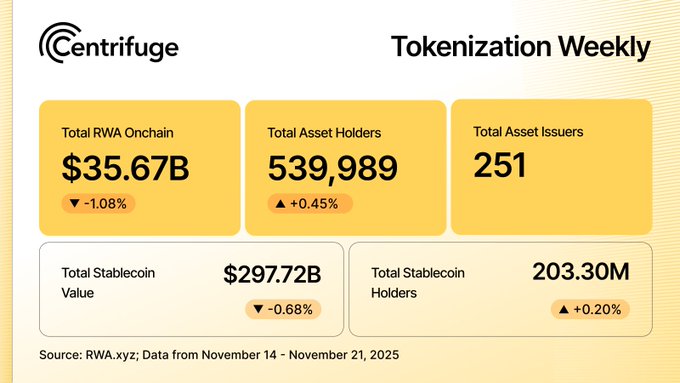

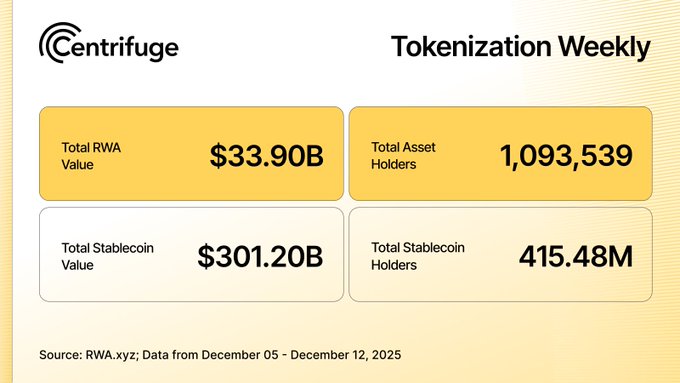

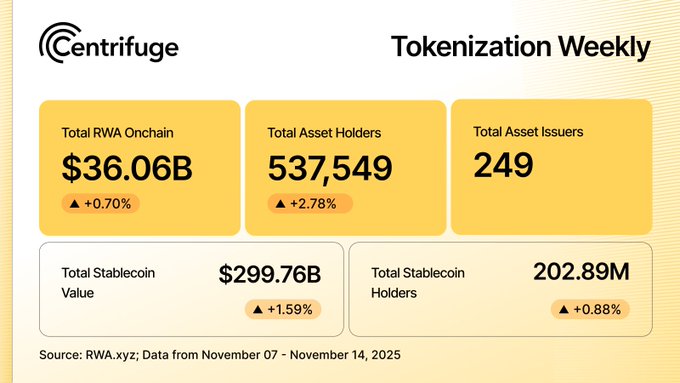

Tokenization is shaping up to be the next big wave in digital finance. Week by week, the ecosystem shows resilient growth, stronger engagement, and expanding reach across the board. 🧵 Discover what’s fueling this week's ongoing momentum 👇

A precise read of what’s actually changing: equity structures with real corporate mechanics are beginning to operate directly onchain. As @stacy_muur notes, a meaningful development for crypto-native companies, and for the category.

This is a very important precedent. @caesar_data (a token-native startup) is moving toward issuing actual company equity onchain, using @centrifuge’s SEC-registered transfer-agent infrastructure. Not “equity-like tokens.” Actual legally recognized shares… onchain. If this

Q3 was a monumental quarter for @Centrifuge 🔥 We moved beyond headlines to real KPIs, new Apollo & S&P funds, TVL above $1B, and a powerhouse exec joining the team. 🧵 Dive in for all the highlights 👇

From U.S. Treasuries to diversified credit and equities, the universe of onchain RWA is expanding. @Centrifuge powers both regulated funds & deRWA (e.g., deJAAA, deJTRSY), offering new access models for a wider range of users, from institutions to individuals.

Centrifuge V3 introduces the ERC7540 standard to DeFi, advancing composability and automation. Smart contracts interact like money legos, enabling seamless integration of tokenized assets. Watch @offerijns explain how Centrifuge V3 works with this standard 👇

Centrifuge keeps expanding what can be built onchain, from equity to CLOs and treasuries, giving companies a growing menu of real-world assets to work with. This week highlighted how different builders are tapping that toolkit in their own ways. 1️⃣ @falconfinance adds JAAA as

Tokenized assets are steadily redefining digital markets. Each week, we’re seeing persistent growth, increased participation, and more players entering the space. 🧵 Dive into this week’s key developments and drivers from Centrifuge below 👇

Credit built the foundation. Now, tokenized assets expand to onchain equity. Centrifuge infrastructure is powering this next chapter.

Most "onchain equities" still run on Excel cap tables and PDFs. If you tokenize a share but the legal record lives in a siloed database, you've built a wrapper, not onchain equity. Real onchain equity requires upgrading the infrastructure itself: the Transfer Agent.

The new RWA data report by @birdeye_data is out. Three signals align directly with how Centrifuge sees the market: • Demand is accelerating: RWAs have moved from “testing” to meaningful allocation. Credit, equities, and fund structures are scaling across every major venue.

It's here 🙌 The Everything-Onchain Era: A RWA Spectrum Report, co-authored by @inside_r3 with strategic support from @centrifuge and @xStocksFi is now LIVE. Key highlights 🧵 research.birdeye.so/rwa-spectrum-2…

The real unlock in tokenization is ownership onchain. Real equity, real rights, real cap tables. That's the chapter Centrifuge is writing now.

If you learned one thing about tokenization in 2025, make it this: utility started to matter. The industry started moving away from pure yield chasing toward building real infrastructure. Here are the 3 lessons that defined the year 🧵

Automating RWA tokenization: No more costly, risky one-off deployments. Centrifuge V3 Whitelabel lets you deploy new tokens across chains with a single contract call. Scalable. Simple. Next level. Watch CTO @offerijns break it down 👇

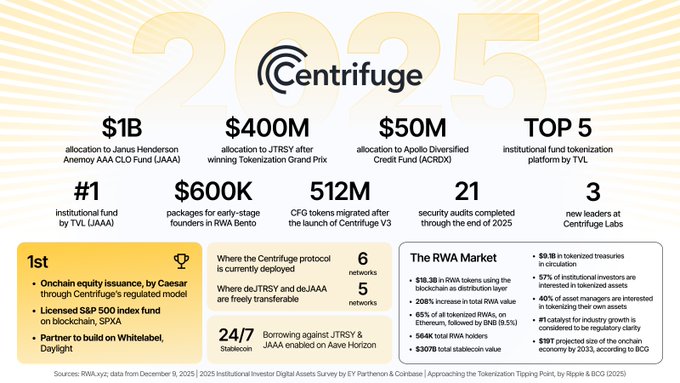

2025: Tokenization scaled, and Centrifuge set the pace. Our rails powered credit, equities and onchain indices, driving key market firsts. The CFG Renaissance reshaped how builders bring assets onchain and raised standards across the market. These 25 from 2025 show the shift.

Strong momentum behind our 25 numbers from this year. A defining one for both Centrifuge and the whole industry, as RWAs began accelerating on the path from billions to trillions. Here’s our deep dive into the 2025 metrics: centrifuge.io/blog/real-worl…

“V3 is built to support multiple asset types onchain, from complex credit like AAA CLOs, to index funds like the tokenized S&P 500, and freely transferable tokens called deRWAs.” In the final episode of the V3 Series, @offerijns and @mustermeiszer2 show how Centrifuge V3 enables

Caesar is now the first crypto-native company to issue equity fully onchain with SEC-registered infrastructure from Centrifuge. This shows how Web3-native businesses can reach institutional standards without leaving onchain rails. The playbook for programmable ownership is

DeFi users don’t want to think about “RWAs.” They want safer yield, simple UX, and assets that work anywhere. @lista_dao integrating Centrifuge-powered Treasuries and AAA CLOs on @BNBCHAIN is a clear step in that direction: access to tokenized products abstracted behind a

2025 Final Sprint: Introducing Lista RWA @lista_dao brings real-world yield onchain to @BNBCHAIN, with RWA integrations via @centrifuge and price feeds powered by @chainlink. Deposit USDT to receive a yield-accruing RWA backed by: - U.S. Treasury Bills - AAA-rated CLOs

Centrifuge V3 is raising the bar for onchain assets. Tokenized credit, S&P 500 index fund, deRWAs, and now onchain equities, with @Caesar_data as the first issuer. Together, these show how V3 can power everything from institutional credit strategies to index-style products and

We’re kicking off our Centrifuge V3 Series, a new video dive into the next evolution of RWAs and DeFi! Ep. 1: “Centrifuge V3 Intro” ft. our CTO @offerijns & Head of Product @mustermeiszer2. They break down how V3 was built, why it matters, and how its modular design levels up

“Minting a token is easy. Tokenizing something with real value behind it is the hard part.” In Episode 4 of the V3 Series, @offerijns & @mustermeiszer2 explain how Centrifuge V3 automates the entire tokenization flow, launching assets across multiple chains with a single call,

Years of groundwork and collaboration in bringing RWAs to Ethereum have brought us here. We are committed to advancing the future of finance with partners across the @Ethereum ecosystem. The journey to mainstream adoption continues, and @Centrifuge is building with the industry

1/ Now live: the Ethereum for Institutions site Ethereum is the neutral, secure base layer where the world's financial value is coming onchain Today, we’re launching a new site for the builders, leaders, and institutions advancing this global movement

Proof-of-Index Framework Links Official Portfolio Data to Onchain NAV Pricing

Centrifuge has launched Proof-of-Index, a framework that creates verifiable connections between official portfolio data and onchain net asset value pricing for tokenized index funds. **Key Features:** - Built using licensed data from S&P Dow Jones Indices - Provides auditable alignment between tokenized funds and their underlying holdings - Already operational, powering SPXA on Base network - Handles daily rebalancing while maintaining auditability The infrastructure addresses a core challenge in tokenized index funds: ensuring that onchain representations accurately reflect their real-world holdings. The framework aims to bring institutional-grade verification to programmable finance products.

🏦 Institutional Credit Enters DeFi as Tokenization Infrastructure Matures

**Institutional credit is now flowing into DeFi lending markets** as tokenization infrastructure evolves beyond simple issuance. The gap between traditional assets and decentralized finance continues to narrow. **Key developments:** - Centrifuge V3.1 upgrade brings sharper multichain execution across 10 chains - Automated onchain accounting with transparent double-entry bookkeeping - Modular architecture adapts to different asset structures - Distribution capabilities now outpacing basic issuance as competitive differentiator The shift reflects tokenization behaving like infrastructure rather than narrative. Real-world assets are gaining DeFi's composability while maintaining institutional-grade accounting and verification standards. Multichain operations have become table stakes, with hub-and-spoke architecture simplifying deployment. Teams using Whitelabel can launch tokenized assets with real-time, verifiable accounting from day one. The focus has moved from whether to tokenize to which infrastructure can reliably operate tokenized products across chains with full visibility.

Treasury Bills and Credit Products Drive Real-World Asset Adoption Onchain

**Yield-generating products are becoming the primary driver of real-world asset (RWA) adoption in onchain finance.** - Treasury bills and credit instruments are attracting significant attention from onchain allocators - Investors are actively diversifying their portfolios beyond traditional crypto-native yield sources - The shift represents a maturation of the onchain finance ecosystem This development follows the broader trend of RWA tokenization scaling across the industry, with total value locked exceeding $10 billion. Institutional players continue building infrastructure to support these traditional financial instruments onchain.

🏦 ACRDX Launches on Morpho: Apollo Credit Fund Goes Onchain

**ACRDX**, the tokenized Apollo Diversified Credit Fund, is now live on **Morpho**, expanding institutional credit access onchain. **Key Details:** - Provides tokenized exposure to Apollo Global's diversified credit strategy - Initially launched on Plume Network with $50M deployment via Grove Finance - Offers 24/7 access with real-time reporting and programmable settlement **What It Covers:** - Corporate and direct lending - Asset-backed credit strategies - Institutional-grade asset management **Technical Infrastructure:** - Built on Centrifuge's tokenization platform - Data transparency via Chronicle Labs oracles - Cross-chain capability through Wormhole This marks a significant step in bringing traditional credit markets onchain, offering risk-adjusted yield beyond crypto-native assets. The move to Morpho extends ACRDX's reach across DeFi protocols. [Read full details](http://centrifuge.io/blog/acrdx-launch-on-centrifuge)

Centrifuge V3.1 Brings Automated Onchain Accounting to Tokenized Assets

Centrifuge V3.1 introduces fully automated, onchain accounting for tokenized assets, implementing traditional double-entry bookkeeping directly on the blockchain. **Key features include:** - Transparent and auditable accounting by default - Automated NAV calculations and share pricing - Oracle updates that synchronize across multiple chains - Full visibility into pricing logic and state Builders using Centrifuge's Whitelabel solution can now deploy tokenized assets with real-time, verifiable accounting from launch. The update expands support to 10 chains through a hub-and-spoke architecture, allowing teams to launch assets on any supported chain within minutes. This infrastructure update aligns with how institutions currently operate across multiple chains, bringing traditional accounting standards to onchain finance.