🏦 Institutional Credit Enters DeFi as Tokenization Infrastructure Matures

🏦 Institutional Credit Enters DeFi as Tokenization Infrastructure Matures

🏦 Credit crosses over

Institutional credit is now flowing into DeFi lending markets as tokenization infrastructure evolves beyond simple issuance. The gap between traditional assets and decentralized finance continues to narrow.

Key developments:

- Centrifuge V3.1 upgrade brings sharper multichain execution across 10 chains

- Automated onchain accounting with transparent double-entry bookkeeping

- Modular architecture adapts to different asset structures

- Distribution capabilities now outpacing basic issuance as competitive differentiator

The shift reflects tokenization behaving like infrastructure rather than narrative. Real-world assets are gaining DeFi's composability while maintaining institutional-grade accounting and verification standards.

Multichain operations have become table stakes, with hub-and-spoke architecture simplifying deployment. Teams using Whitelabel can launch tokenized assets with real-time, verifiable accounting from day one.

The focus has moved from whether to tokenize to which infrastructure can reliably operate tokenized products across chains with full visibility.

The conversation around tokenization has shifted. Institutions are no longer deciding whether to tokenize; they're evaluating which infrastructure to trust with production. Here's what that clarity means: > Issuance is only the starting point. > Tokenization without

Multichain is how institutions operate now. Infrastructure should match. With Centrifuge V3.1 expanding support to 10 chains, teams using Whitelabel will launch tokenized assets on any supported chain in minutes. Hub-and-spoke architecture simplifies deployment and operations.

Index tokenization goes beyond single assets. It requires infrastructure that handles daily rebalancing while staying auditable. Centrifuge's Proof-of-Index framework, built with licensed data from @SPDJIndices, delivers that: verifiable, programmable, institutional-grade.

Tokenization turns static holdings into transferable positions.

Launching tokenized assets is step one. Operating them reliably across chains without losing visibility is where infrastructure actually gets tested.

Underlying data verifiable at the asset level in real time. That’s the only way tokenized products can scale. Tokenization demands institutional standards for verifiability, risk management, and transparency. That’s why we chose @ChronicleLabs as our primary oracle partner.

This week reinforced a simple reality about tokenization: the hard part isn’t issuing assets, it is operating, monitoring, and proving how they behave across chains. 1️⃣ Visibility and verification matter more than launch speed. Monitoring, data integrity, continuous

Security doesn't move the needle for allocators until it's demonstrated over time. A badge from one audit reads like a checkbox. Multiple audits, live bounties, continuous scanning, real capital flowing. That pattern is what institutional investors actually trust. For

Institutions don’t test infrastructure. They allocate to what’s already trusted. In 2025, that trust showed up as real capital on Centrifuge rails: • TVL grew to $1.3B following allocations from @grovedotfinance and @sparkdotfi. • JAAA consolidated as the largest

Tokenization is becoming a core product and distribution lever. Real-world assets are integrating directly into lending, trading, and collateral workflows onchain. Insightful report by @block_stories featuring @itsbhaji.

.@centrifuge CEO @itsbhaji expects asset management and tokenzation to move closer in 2026. Key insight: Bonds, equities, and private credit will drive the next wave of RWA growth, with yield-generating assets increasingly being looped through onchain lending markets.

Most explorers weren't built for tokenized products that operate across chains. But asset managers and allocators need to see the full picture: price updates, mints, redemptions. Unified status, not disconnected events. Centrifugescan was built for this. centrifuge.io/blog/centrifug…

Tokenization runs regardless of market swings. · Institutional credit now usable in DeFi lending markets · Multichain infrastructure upgrading with v3.1 · Distribution outpacing issuance as the differentiator The gap between traditional assets and DeFi markets is closing.

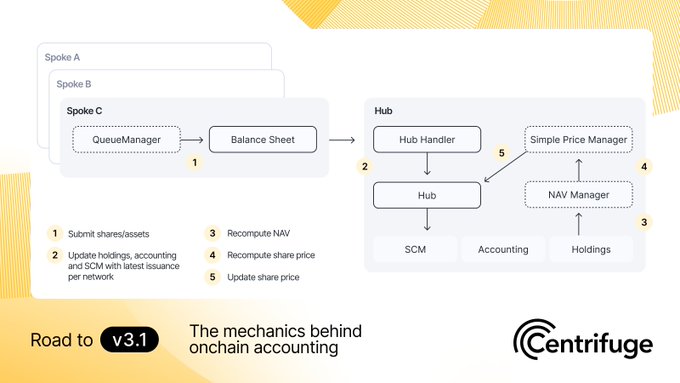

Fully onchain and automated accounting of tokenized assets. One of the key features coming with Centrifuge V3.1: Traditional accounting logic, but implemented onchain. Double-entry bookkeeping that's transparent and auditable by default. · Automated NAV calculations and share

Tokenized assets have real momentum. And real expectations. In 2026, RWA security is about defensibility under scrutiny, not just audited contracts. That means financial correctness, constrained admin power, continuous security in production, and explicit offchain trust

RWAs are moving from pilots to production finance. Going into 2026, the gating factor is security maturity, not narrative. Cantina and @Centrifuge published a practical guide on securing real-world assets. Details below.

Tokenization is behaving like infrastructure, not a narrative. > Daily market operations become programmable > Asset managers already see a tool, not a bet > Real utility attracts capital even when attention moves elsewhere Compounding starts from here.

Infrastructure for multichain products: Sees across all venues, reconstructs intent through execution, and surfaces failures in product terms. centrifuge.io/blog/centrifug…

Make it tokenized. Make it collateral. 24/7 markets are inevitable.

Everyone in the world deserves the same wealth creation opportunities. Currently this isn’t possible. The solution is clear: Tokenization.

Coming in V3.1: sharper multichain execution. · Expanded network support · Automated onchain accounting built in · Modular architecture that adapts to different asset structures Real-world assets are gaining DeFi's utility and composability.

“V3 is built to support multiple asset types onchain, from complex credit like AAA CLOs, to index funds like the tokenized S&P 500, and freely transferable tokens called deRWAs.” In the final episode of the V3 Series, @offerijns and @mustermeiszer2 show how Centrifuge V3 enables

Proof-of-Index Framework Links Official Portfolio Data to Onchain NAV Pricing

Centrifuge has launched Proof-of-Index, a framework that creates verifiable connections between official portfolio data and onchain net asset value pricing for tokenized index funds. **Key Features:** - Built using licensed data from S&P Dow Jones Indices - Provides auditable alignment between tokenized funds and their underlying holdings - Already operational, powering SPXA on Base network - Handles daily rebalancing while maintaining auditability The infrastructure addresses a core challenge in tokenized index funds: ensuring that onchain representations accurately reflect their real-world holdings. The framework aims to bring institutional-grade verification to programmable finance products.

Treasury Bills and Credit Products Drive Real-World Asset Adoption Onchain

**Yield-generating products are becoming the primary driver of real-world asset (RWA) adoption in onchain finance.** - Treasury bills and credit instruments are attracting significant attention from onchain allocators - Investors are actively diversifying their portfolios beyond traditional crypto-native yield sources - The shift represents a maturation of the onchain finance ecosystem This development follows the broader trend of RWA tokenization scaling across the industry, with total value locked exceeding $10 billion. Institutional players continue building infrastructure to support these traditional financial instruments onchain.

🏦 ACRDX Launches on Morpho: Apollo Credit Fund Goes Onchain

**ACRDX**, the tokenized Apollo Diversified Credit Fund, is now live on **Morpho**, expanding institutional credit access onchain. **Key Details:** - Provides tokenized exposure to Apollo Global's diversified credit strategy - Initially launched on Plume Network with $50M deployment via Grove Finance - Offers 24/7 access with real-time reporting and programmable settlement **What It Covers:** - Corporate and direct lending - Asset-backed credit strategies - Institutional-grade asset management **Technical Infrastructure:** - Built on Centrifuge's tokenization platform - Data transparency via Chronicle Labs oracles - Cross-chain capability through Wormhole This marks a significant step in bringing traditional credit markets onchain, offering risk-adjusted yield beyond crypto-native assets. The move to Morpho extends ACRDX's reach across DeFi protocols. [Read full details](http://centrifuge.io/blog/acrdx-launch-on-centrifuge)

Centrifuge V3.1 Brings Automated Onchain Accounting to Tokenized Assets

Centrifuge V3.1 introduces fully automated, onchain accounting for tokenized assets, implementing traditional double-entry bookkeeping directly on the blockchain. **Key features include:** - Transparent and auditable accounting by default - Automated NAV calculations and share pricing - Oracle updates that synchronize across multiple chains - Full visibility into pricing logic and state Builders using Centrifuge's Whitelabel solution can now deploy tokenized assets with real-time, verifiable accounting from launch. The update expands support to 10 chains through a hub-and-spoke architecture, allowing teams to launch assets on any supported chain within minutes. This infrastructure update aligns with how institutions currently operate across multiple chains, bringing traditional accounting standards to onchain finance.