Revert Lend Update: USDC Lending Metrics and Weekly Points Distribution

Revert Lend Update: USDC Lending Metrics and Weekly Points Distribution

🏦 USDC Lending Just Got Juicy

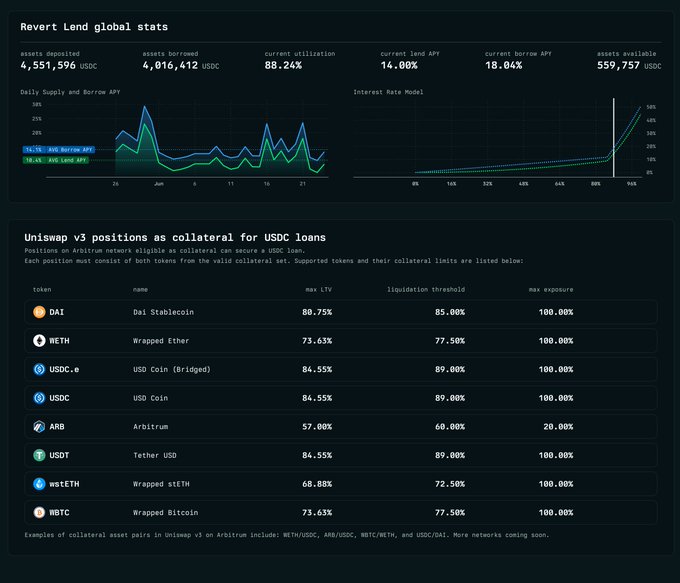

Revert Lend on Arbitrum continues to show strong lending activity with current metrics:

- 88% utilization rate

- 14% current APY (10% average)

- Weekly points distribution for USDC lenders every Friday

This follows recent expansion of global USDC lending limit to $25M earlier this month. The platform has maintained consistent utilization rates between 85-95% over the past month, with APY fluctuating between 14-28% based on demand.

Visit Revert Finance to participate in lending.

Revert Lend utilization pushing 88%, and currently paying 14% APY (10% avg) to USDC lenders on @arbitrum Also, points for lenders dropping every Friday.

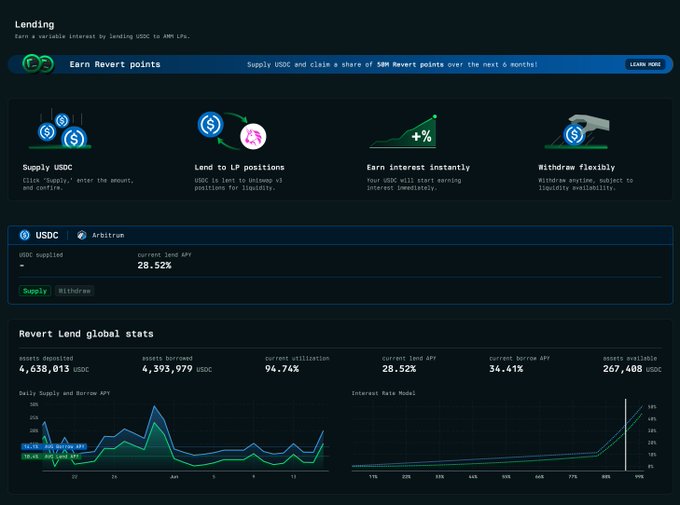

Global USDC Lend limit raised to $25M. Currently 94% utilized, paying 28% APY (10.4% avg). Points drop to USDC lenders every Friday.

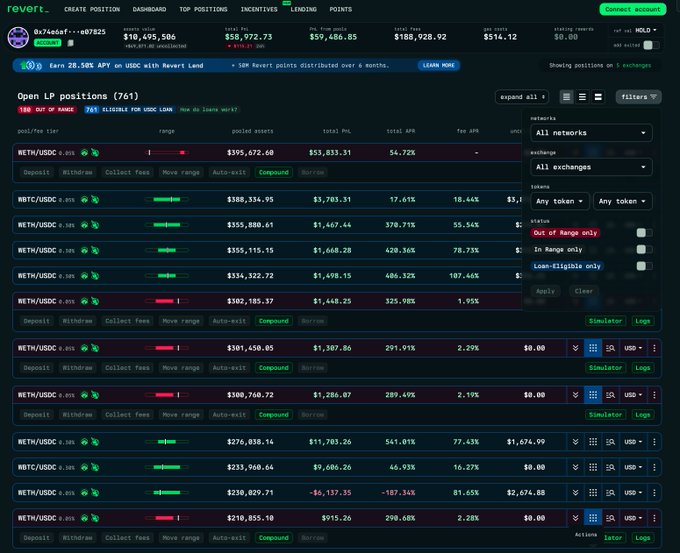

We said we were coming. Now Revert Lend is the #1 Uniswap V3 liquidity-holder contract on Arbitrum with $10.49M TVL. Mainnet and Base next.

Revert Finance Publishes Postmortem on Aerodrome Vault Exploit

Revert Finance has released a detailed postmortem following an exploit on their newly deployed Aerodrome USDC lending vault on Base. **Key Details:** - Approximately 50k USDC was lost, primarily from Revert team funds used to seed the vault - All user funds remain safe and unaffected - Only the Aerodrome USDC vault was impacted; other vaults continue operating normally - Deposits to the affected vault have been disabled **Current Status:** - Aerodrome Lend remains paused while the team implements fixes - An additional independent security review is underway before resuming operations - Full incident report available at [Revert Finance's blog](https://paragraph.com/@revertfinance/post%E2%80%91mortem-aerodrome-lend-vault-incident-on-base?referrer=0x8cadb20A4811f363Dadb863A190708bEd26245F8) The team acted quickly to contain the incident and has been transparent about the scope and impact of the exploit.

Revert Lend Celebrates One Year Anniversary as Arbitrum's Largest Uniswap V3 Holder

**Revert Lend marks major milestone** - exactly one year after launching on Arbitrum, the protocol has become the largest Uniswap V3 holder contract on the chain by total value locked (TVL). **Multi-chain expansion underway** - The protocol has successfully expanded beyond Arbitrum and is preparing for Uniswap V4 integration. **Strong utilization metrics** - Recent data shows 98.9% utilization after a whale borrowed $1.5M, with USDC lenders earning 41% APY plus weekly Revert points. The growth trajectory demonstrates solid adoption in the Uniswap V3 ecosystem, positioning Revert Lend as a key infrastructure player for liquidity providers.

Revert Lend Maintains High Utilization and Attractive Yields

Revert Lend on Arbitrum continues to demonstrate strong performance metrics: - Current utilization rate: 93% - USDC deposit yield: 25% APY - Additional rewards in Revert Points The protocol has maintained consistently high utilization rates since December 2023, when it reached $2M in USDC deposits. The platform offers automated lending services on Arbitrum with competitive yields for USDC depositors. Learn more at [Revert Finance](revert.finance/#/lending)

Revert Lend Launches on Arbitrum with LP Position Leveraging

Revert Finance has launched its lending platform on Arbitrum, enabling liquidity providers to leverage their LP positions using USD-denominated debt. Key features: - USD-denominated lending for LP positions - Currently live on Arbitrum network - Planned expansion to other networks - 16% APY for USDC lenders - Weekly points rewards system The platform aims to capitalize on alt season by providing leveraging opportunities for liquidity providers while offering attractive yields for lenders. [Learn more about Revert Lend](https://revert.finance/#/lending)