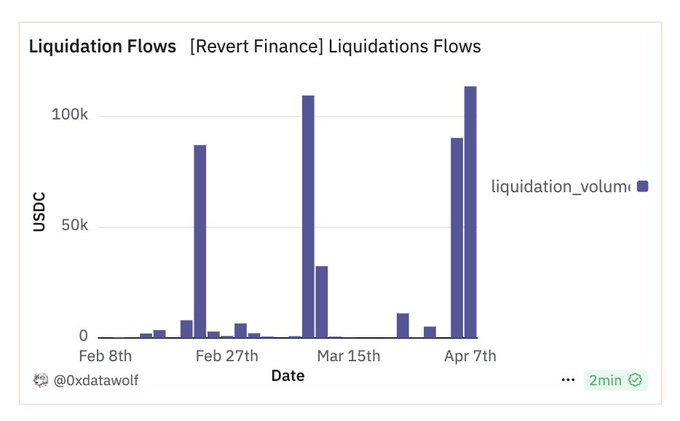

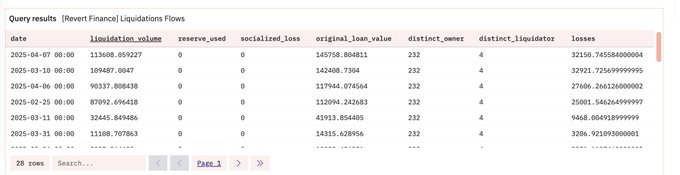

Revert Lend Handles $200K Liquidations Successfully

Revert Lend Handles $200K Liquidations Successfully

🔥 Liquidations Done Right

Revert Lend has efficiently processed liquidations worth over $200,000 in the past 24 hours, maintaining zero bad debt throughout the process.

Key points:

- All liquidations executed without system losses

- Deleverage option available in Borrow panel

- Users can proactively reduce debt using collateral

The platform's performance demonstrates robust risk management systems. Users are reminded to monitor their positions and utilize available tools to maintain healthy collateral ratios.

Revert Lend processed over $200K in liquidations within the last 24 hours, zero bad debt incurred. Reminder: Protect your positions. Use the “deleverage” option in the Borrow panel to reduce debt directly from your collateral.

Revert Finance Publishes Postmortem on Aerodrome Vault Exploit

Revert Finance has released a detailed postmortem following an exploit on their newly deployed Aerodrome USDC lending vault on Base. **Key Details:** - Approximately 50k USDC was lost, primarily from Revert team funds used to seed the vault - All user funds remain safe and unaffected - Only the Aerodrome USDC vault was impacted; other vaults continue operating normally - Deposits to the affected vault have been disabled **Current Status:** - Aerodrome Lend remains paused while the team implements fixes - An additional independent security review is underway before resuming operations - Full incident report available at [Revert Finance's blog](https://paragraph.com/@revertfinance/post%E2%80%91mortem-aerodrome-lend-vault-incident-on-base?referrer=0x8cadb20A4811f363Dadb863A190708bEd26245F8) The team acted quickly to contain the incident and has been transparent about the scope and impact of the exploit.

Revert Lend Celebrates One Year Anniversary as Arbitrum's Largest Uniswap V3 Holder

**Revert Lend marks major milestone** - exactly one year after launching on Arbitrum, the protocol has become the largest Uniswap V3 holder contract on the chain by total value locked (TVL). **Multi-chain expansion underway** - The protocol has successfully expanded beyond Arbitrum and is preparing for Uniswap V4 integration. **Strong utilization metrics** - Recent data shows 98.9% utilization after a whale borrowed $1.5M, with USDC lenders earning 41% APY plus weekly Revert points. The growth trajectory demonstrates solid adoption in the Uniswap V3 ecosystem, positioning Revert Lend as a key infrastructure player for liquidity providers.

Revert Lend Update: USDC Lending Metrics and Weekly Points Distribution

Revert Lend on Arbitrum continues to show strong lending activity with current metrics: - 88% utilization rate - 14% current APY (10% average) - Weekly points distribution for USDC lenders every Friday This follows recent expansion of global USDC lending limit to $25M earlier this month. The platform has maintained consistent utilization rates between 85-95% over the past month, with APY fluctuating between 14-28% based on demand. Visit [Revert Finance](revert.finance/#/lending) to participate in lending.

Revert Lend Maintains High Utilization and Attractive Yields

Revert Lend on Arbitrum continues to demonstrate strong performance metrics: - Current utilization rate: 93% - USDC deposit yield: 25% APY - Additional rewards in Revert Points The protocol has maintained consistently high utilization rates since December 2023, when it reached $2M in USDC deposits. The platform offers automated lending services on Arbitrum with competitive yields for USDC depositors. Learn more at [Revert Finance](revert.finance/#/lending)

Revert Lend Launches on Arbitrum with LP Position Leveraging

Revert Finance has launched its lending platform on Arbitrum, enabling liquidity providers to leverage their LP positions using USD-denominated debt. Key features: - USD-denominated lending for LP positions - Currently live on Arbitrum network - Planned expansion to other networks - 16% APY for USDC lenders - Weekly points rewards system The platform aims to capitalize on alt season by providing leveraging opportunities for liquidity providers while offering attractive yields for lenders. [Learn more about Revert Lend](https://revert.finance/#/lending)