Revert Finance Increases USDC Lending Limit to $25M

Revert Finance Increases USDC Lending Limit to $25M

💰 USDC Lending Just Got Bigger

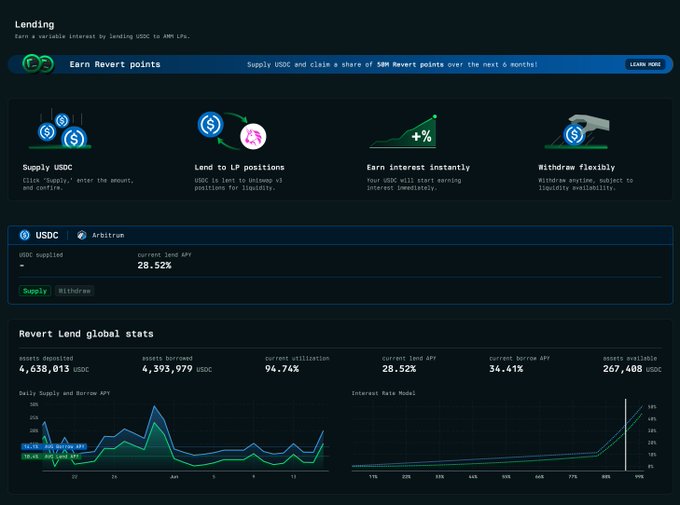

Revert Finance has expanded its USDC lending capacity to $25M, marking significant growth from its initial $1M limit set in November 2024. The protocol currently shows:

- 94% utilization rate

- 28% current APY

- 10.4% average APY

Weekly point rewards are distributed to USDC lenders every Friday. This increase represents the platform's third major lending limit expansion, demonstrating sustained demand for its lending services.

Global USDC Lend limit raised to $25M. Currently 94% utilized, paying 28% APY (10.4% avg). Points drop to USDC lenders every Friday.

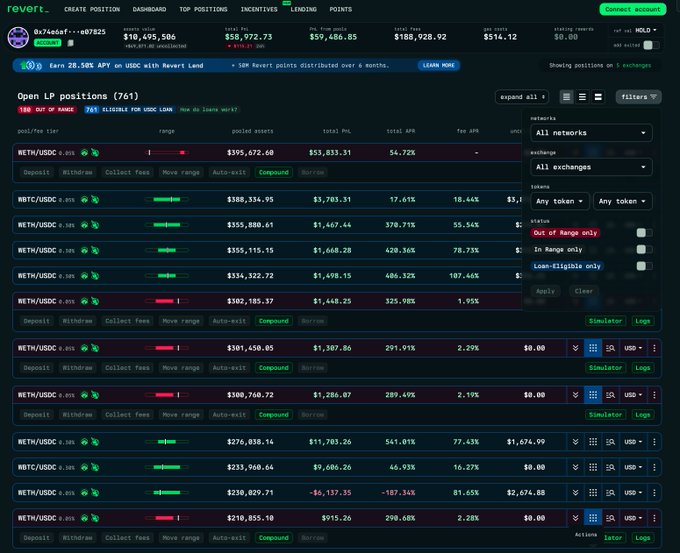

We said we were coming. Now Revert Lend is the #1 Uniswap V3 liquidity-holder contract on Arbitrum with $10.49M TVL. Mainnet and Base next.

Revert Lend Becomes Top Uniswap V3 Liquidity Provider on Arbitrum

**Revert Lend** has achieved a significant milestone by becoming the largest Uniswap V3 liquidity-holder contract on Arbitrum, with $10.49M in Total Value Locked (TVL). The protocol rapidly advanced from its $8M position as second-largest holder on June 12th, surpassing the previous leader GMX timelock vault. - Current TVL: $10.49M - Network: Arbitrum - Next targets: Ethereum mainnet and Base *The team has announced plans to replicate this success on additional networks.*

Revert Lend Maintains High Utilization and Attractive Yields

Revert Lend on Arbitrum continues to demonstrate strong performance metrics: - Current utilization rate: 93% - USDC deposit yield: 25% APY - Additional rewards in Revert Points The protocol has maintained consistently high utilization rates since December 2023, when it reached $2M in USDC deposits. The platform offers automated lending services on Arbitrum with competitive yields for USDC depositors. Learn more at [Revert Finance](revert.finance/#/lending)

Revert Lend Launches on Arbitrum with LP Position Leveraging

Revert Finance has launched its lending platform on Arbitrum, enabling liquidity providers to leverage their LP positions using USD-denominated debt. Key features: - USD-denominated lending for LP positions - Currently live on Arbitrum network - Planned expansion to other networks - 16% APY for USDC lenders - Weekly points rewards system The platform aims to capitalize on alt season by providing leveraging opportunities for liquidity providers while offering attractive yields for lenders. [Learn more about Revert Lend](https://revert.finance/#/lending)

Revert Lend Handles $200K Liquidations Successfully

Revert Lend has efficiently processed liquidations worth over $200,000 in the past 24 hours, maintaining zero bad debt throughout the process. Key points: - All liquidations executed without system losses - Deleverage option available in Borrow panel - Users can proactively reduce debt using collateral The platform's performance demonstrates robust risk management systems. Users are reminded to monitor their positions and utilize available tools to maintain healthy collateral ratios. [View detailed analytics](https://dune.com/0xdatawolf/revert-finance)