Renzo Expands Security with Chaos Labs and Nethermind Audits

Renzo Expands Security with Chaos Labs and Nethermind Audits

🔐 Guess Who's Auditing Renzo

Renzo Protocol strengthens its security infrastructure through two key partnerships:

- Integration with Chaos Labs' Edge Risk Oracles for proactive threat mitigation

- Smart contract and bridge audit by Nethermind Security

Additional March highlights:

- REZ listed on Coinbase for spot and perpetual futures trading

- ezETH native restaking launched on Base and Arbitrum

- New integrations with Fluid and SparkDeFi

- ezETH-wstETH pools on Fluid

- Supply/borrow capabilities on SparkDeFi with 80% LTV

Renzo is known for delivering the best performing liquid restaking tokens on the market, but the number one focus is always security. Renzo works with world-class partners like @chaos_labs for advanced threat mitigation solutions to stop potential problems before they have a

1/ @RenzoProtocol is integrating Edge Risk Oracles to protect over $852M of Renzo assets from a range of potential protocol risks. Edge will enable a real-time safeguard, detecting disruptions, withdrawal failures, and systemic risks before they impact users. Learn more:

Renzo Monthly Recap - March 2025 The momentum keeps building. March brought new integrations, partnerships, and launches that drive further adoption. Here’s what Renzo accomplished 🔽

The Base saga continues! Restaking on @base is live with ezETH This allows ETH, wETH, or @LidoFinance’s wstETH to be natively restaked on @Base 🧵🔽

Renzo Protocol is rapidly expanding to @base in an epic saga that has only begun. Here’s a recap of the first chapter: 🔵 REZ Spot on Coinbase 🔵 REZ Perps on Coinbase Advanced + International 🔵 REZ Bridge to Base 🔵 Native Restaking on Base 🔵 More to come 🧵🔽

Renzo is based! In the coming days, Renzo will be expanding to @Base with the launch of new products and services, bringing restaking to the masses. Turn your notifications on and get ready for the launch of DeFi Summer.

$REZ perpetual futures coming soon to @CoinbaseIntExch and @coinbase advanced Stay tuned for further updates and developments as Renzo prepares for a BASEd DeFi summer 🤌🔵

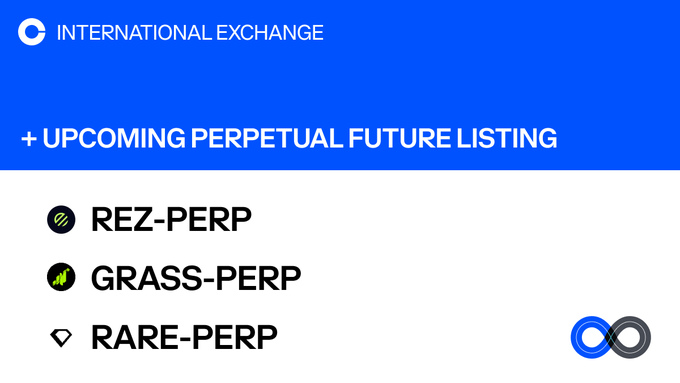

We will add support for Renzo, Grass, and SuperRare perpetual futures on Coinbase International Exchange and Coinbase Advanced. The opening of our REZ-PERP, GRASS-PERP, and RARE-PERP markets will begin on or after 9:30 am UTC 20 MAR 2025. $REZ $GRASS $RARE

Renzo Protocol has enlisted one of the industry's top names in security to audit its core smart contracts. The team looks forward to working closely with @NethermindSec to continue shipping the very best in ETH and SOL LRTs.

We are pleased to announce we have started auditing @RenzoProtocol's core smart contracts! Renzo is a restaking protocol that abstracts and manages AVS strategies for Liquid Restaking Tokens (LRTs), making Ethereum and Solana restaking easy and accessible to everyone.

Renzo’s Season 4 snapshot has been successfully taken as of March 31st, 23:00 UTC 📸 Here’s what you should expect 🔽

Renzo just got even easier to use on @arbitrum with native minting. Arbinauts can now use ETH, wETH, and @LidoFinance’s wstETH on Arbitrum to mint ezETH in one fast, low-gas transaction.

Explore one of the fastest growing L2s, @base Powered by @Coinbase bridge $REZ via @hyperlane

🔗 Renzo Goes Live on Monad App Hub with Curvance Integration

**Renzo launches on Monad App Hub** with full integration into Curvance's lending platform. Users can now: - Bridge $ezETH directly to Monad - Use ezETH as **core collateral** in Curvance 1-Click Borrowing - Access simple leverage and auto-looping features - Earn boosted yields across the Monad ecosystem This partnership brings **EigenLayer restaking** into one of DeFi's most capital-efficient lending markets. The integration allows ezETH holders to maximize their yield potential through automated strategies on Monad. *Bridge ezETH to Monad via the Renzo interface and start earning enhanced returns today.*

Renzo Enables ezETH Bridging to Ink Network Through Unified Interface

**Renzo Protocol** has integrated **Ink Network** bridging capabilities directly into its user interface, allowing users to seamlessly bridge ezETH tokens to the Ink blockchain. **Key Features:** - Direct bridging through [Renzo's platform](https://app.renzoprotocol.com/bridge?toChainId=57073) - Unified interface for multiple blockchain routes - Instant ezETH transfers to Ink Network The integration represents Renzo's continued expansion of cross-chain functionality for its liquid restaking token. **More DeFi integrations** are planned for the near future. *Start bridging ezETH to Ink Network through Renzo's streamlined interface.*

Renzo Launches $REZ Buyback Program Targeting 10% of Total Supply

**Renzo Protocol** has initiated a major **$REZ buyback and burn program** targeting 10% of total token supply over 6 months. **Key Details:** - 9% of purchased tokens will be **burned**, 1% allocated to $ezREZ stakers - **75-100% of protocol revenue** will fund the program - Initial 1% purchase (2.3% of circulating supply) already executed - Automated market buys designed to minimize slippage **Why Now?** With 42.6% of $REZ in circulation, Renzo considers itself substantially decentralized. The protocol is generating real revenue with new products in pipeline, creating opportunity to return value to token holders. **Implementation:** Buybacks will be automated through [smart contract](https://etherscan.io/address/0x8d8Cf66582e5866c99fDb548E424b13d26B28599). Burns go directly to dead address. Monthly reports will track progress via Dune Dashboard. The proposal is live on [governance forum](https://gov.renzoprotocol.com/t/rez-buyback-burn-program/251) for community discussion before Snapshot voting.

Renzo Protocol Joins SparkLend, Enables ezETH Borrowing

SparkLend has expanded its borrowing options by onboarding Renzo Protocol, allowing users to borrow against ezETH tokens. This integration is part of a broader expansion that includes four new assets: - rsETH from KelpDAO - ezETH from Renzo Protocol - tBTC from The T Network - LBTC from Lombard Finance Users can now access these enhanced borrowing capabilities on [Spark's platform](https://app.spark.fi/borrow).

Renzo's ezETH Launches on Fluid with Enhanced Features

Renzo's ezETH has launched on Fluid, offering new DeFi capabilities: - Two new pools available: * ezETH / wstETH * ezETH-ETH / wstETH **Key Features:** - Up to 96% LTV for wstETH borrowing - Smart Collateral and Smart Debt functionality - 4x points earning on all ezETH deposits - Intuitive interface for swapping, lending, and borrowing Users can supply ezETH or ezETH-ETH as collateral, enabling dual-sided rewards through Smart Collateral and Smart Debt systems. [Visit Fluid's documentation](https://fluid.guides.instadapp.io/vault-protocol/vaults-on-fluid) for detailed information.