Renzo Expands Security with Chaos Labs and Nethermind Audits

Renzo Expands Security with Chaos Labs and Nethermind Audits

🔐 Guess Who's Auditing Renzo

Renzo Protocol strengthens its security infrastructure through two key partnerships:

- Integration with Chaos Labs' Edge Risk Oracles for proactive threat mitigation

- Smart contract and bridge audit by Nethermind Security

Additional March highlights:

- REZ listed on Coinbase for spot and perpetual futures trading

- ezETH native restaking launched on Base and Arbitrum

- New integrations with Fluid and SparkDeFi

- ezETH-wstETH pools on Fluid

- Supply/borrow capabilities on SparkDeFi with 80% LTV

Renzo is known for delivering the best performing liquid restaking tokens on the market, but the number one focus is always security. Renzo works with world-class partners like @chaos_labs for advanced threat mitigation solutions to stop potential problems before they have a

1/ @RenzoProtocol is integrating Edge Risk Oracles to protect over $852M of Renzo assets from a range of potential protocol risks. Edge will enable a real-time safeguard, detecting disruptions, withdrawal failures, and systemic risks before they impact users. Learn more:

Renzo Monthly Recap - March 2025 The momentum keeps building. March brought new integrations, partnerships, and launches that drive further adoption. Here’s what Renzo accomplished 🔽

The Base saga continues! Restaking on @base is live with ezETH This allows ETH, wETH, or @LidoFinance’s wstETH to be natively restaked on @Base 🧵🔽

Renzo Protocol is rapidly expanding to @base in an epic saga that has only begun. Here’s a recap of the first chapter: 🔵 REZ Spot on Coinbase 🔵 REZ Perps on Coinbase Advanced + International 🔵 REZ Bridge to Base 🔵 Native Restaking on Base 🔵 More to come 🧵🔽

Renzo is based! In the coming days, Renzo will be expanding to @Base with the launch of new products and services, bringing restaking to the masses. Turn your notifications on and get ready for the launch of DeFi Summer.

$REZ perpetual futures coming soon to @CoinbaseIntExch and @coinbase advanced Stay tuned for further updates and developments as Renzo prepares for a BASEd DeFi summer 🤌🔵

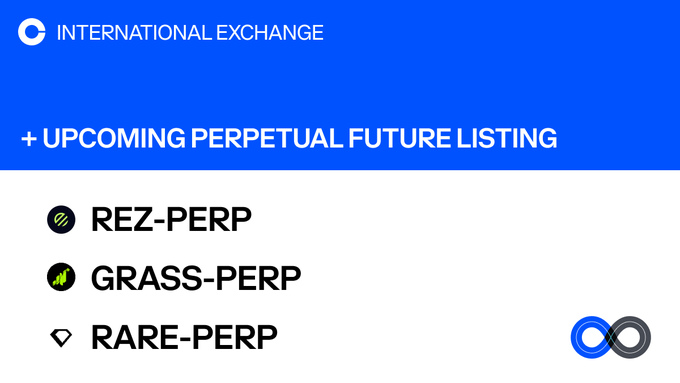

We will add support for Renzo, Grass, and SuperRare perpetual futures on Coinbase International Exchange and Coinbase Advanced. The opening of our REZ-PERP, GRASS-PERP, and RARE-PERP markets will begin on or after 9:30 am UTC 20 MAR 2025. $REZ $GRASS $RARE

Renzo Protocol has enlisted one of the industry's top names in security to audit its core smart contracts. The team looks forward to working closely with @NethermindSec to continue shipping the very best in ETH and SOL LRTs.

We are pleased to announce we have started auditing @RenzoProtocol's core smart contracts! Renzo is a restaking protocol that abstracts and manages AVS strategies for Liquid Restaking Tokens (LRTs), making Ethereum and Solana restaking easy and accessible to everyone.

Renzo’s Season 4 snapshot has been successfully taken as of March 31st, 23:00 UTC 📸 Here’s what you should expect 🔽

Renzo just got even easier to use on @arbitrum with native minting. Arbinauts can now use ETH, wETH, and @LidoFinance’s wstETH on Arbitrum to mint ezETH in one fast, low-gas transaction.

Explore one of the fastest growing L2s, @base Powered by @Coinbase bridge $REZ via @hyperlane

Renzo Partners with Tanssi for Decentralized Economy Development

Renzo, the restaking hub of Eigenlayer, has formed a strategic partnership with Tanssi protocol to advance development in the decentralized economy. This follows Tanssi's recent $6M funding round led by Moondance Labs in March 2024. The collaboration aims to enhance appchain deployment capabilities and expand access to liquid restaking strategies. This partnership represents a significant step in connecting institutional-grade node operations with streamlined blockchain infrastructure. - Focus on improving Actively Validated Services (AVS) - Enhanced risk management capabilities - Expanded opportunities for reward generation *This development builds on Tanssi's growing momentum in the blockchain infrastructure space.*

Kamino Finance Launches One-Click ezSOL Looping Feature

Kamino Finance has introduced a new feature allowing users to instantly loop their ezSOL as collateral to borrow SOL and increase exposure in a single click. The process works through three main steps: - Deposit ezSOL and borrow SOL - Use borrowed SOL to mint more ezSOL - Repeat until reaching desired health factor Key features: - Up to 10x leverage possible - Estimated ~24% APY with current rates - 90% LTV on ezSOL/SOL pair - Enhanced security through ezSOL:jitoSOL exchange rate - Additional REZ token rewards available [Try Kamino's Multiply feature](https://app.kamino.finance/multiply)

Renzo Protocol Joins SparkLend, Enables ezETH Borrowing

SparkLend has expanded its borrowing options by onboarding Renzo Protocol, allowing users to borrow against ezETH tokens. This integration is part of a broader expansion that includes four new assets: - rsETH from KelpDAO - ezETH from Renzo Protocol - tBTC from The T Network - LBTC from Lombard Finance Users can now access these enhanced borrowing capabilities on [Spark's platform](https://app.spark.fi/borrow).

Renzo's ezETH Launches on Fluid with Enhanced Features

Renzo's ezETH has launched on Fluid, offering new DeFi capabilities: - Two new pools available: * ezETH / wstETH * ezETH-ETH / wstETH **Key Features:** - Up to 96% LTV for wstETH borrowing - Smart Collateral and Smart Debt functionality - 4x points earning on all ezETH deposits - Intuitive interface for swapping, lending, and borrowing Users can supply ezETH or ezETH-ETH as collateral, enabling dual-sided rewards through Smart Collateral and Smart Debt systems. [Visit Fluid's documentation](https://fluid.guides.instadapp.io/vault-protocol/vaults-on-fluid) for detailed information.

Renzo Protocol Expands to Base L2 with REZ/USDC Pool Launch

Renzo Protocol has expanded to Base, one of the fastest-growing L2 networks powered by Coinbase. The integration features: - First REZ DeFi integration on Base through REZ/USDC pool on Aerodrome Finance - Bridge functionality powered by Hyperlane - Additional rewards for LP providers Users can access the new features through: - [Aerodrome Finance](https://aerodrome.finance/pools) for liquidity provision - [Renzo Bridge Dapp](https://app.renzoprotocol.com/bridge) for token bridging Support available via [Discord](https://discord.gg/renzoprotocol)