Protocol Incentivized Liquidity (PIL) Updates and Voting Changes

Protocol Incentivized Liquidity (PIL) Updates and Voting Changes

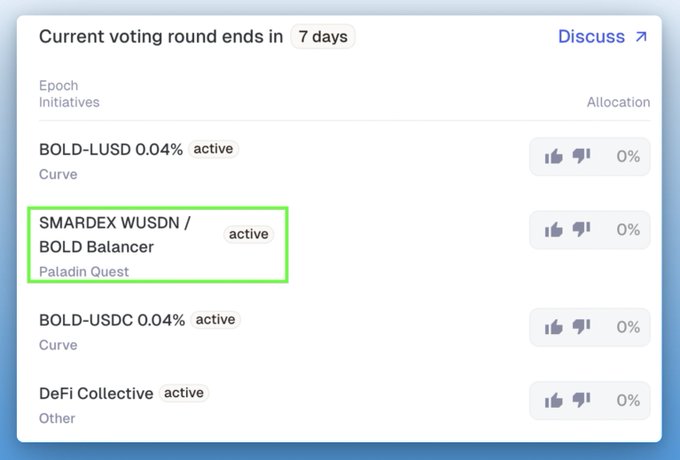

🗳️ Your Votes Need Moving

Key Updates for LQTY Voters:

- EkuboProtocol has initiated a new voting initiative with active bribing program

- Voters need to migrate their votes to the new initiative (marked with 🟩)

- EkuboProtocol secured 4.39% of last epoch's votes, earning 1,500 BOLD in PIL rewards

- Protocol commits to 11 weeks of incentives to establish BOLD trading presence

Important Reminders:

- Voting power increases over time

- No lockup or withdrawal penalties

- V2 contract deposits required for voting

Track distributions: Dune Dashboard View proposals: Liquity Forum

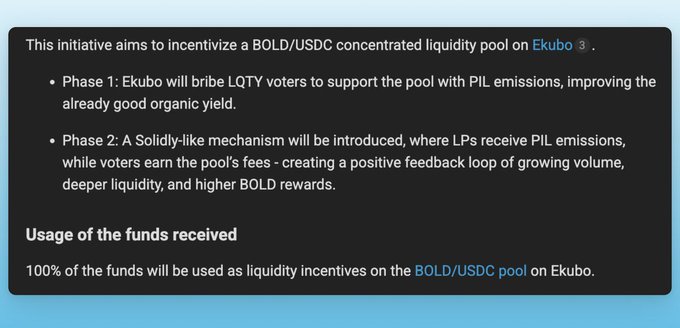

PIL Initiatives Update Here’s what’s new: 1. New initiative by @EkuboProtocol 2. @SmarDex positive bribe return 3. Steady growth of $LQTY stakers 1. @EkuboProtocol, a capital-efficient AMM, has launched a BOLD/USDC pool. PIL funds will support LP incentives, with bribes and

Fresh $BOLD Liquidity Three new incentivized pools are being set up to boost BOLD liquidity and rewards: @SmarDex launched a pool on @Balancer, utilizing PIL funds to bribe via @Paladin_vote @EkuboProtocol set up a pool soon to receive rewards through their new incentive

New bribes for $LQTY voters After @SmarDex, now @EkuboProtocol joins the bribe game. They secured 4.39% of this epoch's votes, earning 1,500 $BOLD in PIL rewards. Now committing to 11 weeks of incentives to cement themselves as a core BOLD trading venue. The next epoch starts

Important PIL Update If you voted for @EkuboProtocol, please move your votes to their new initiative. They've started bribing and plan to continue for the foreseeable future Move your votes from 🟥 to🟩.

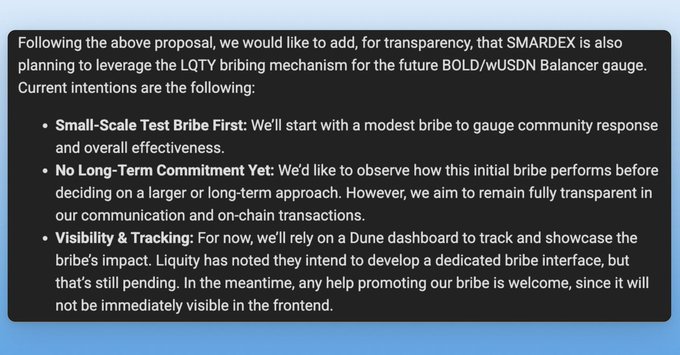

New Initiative up for voting. @SmarDex will create an incentivized pool on @Balancer with the goal of improving liquidity and returns for $BOLD holders. Details: voting.liquity.org/t/smardex-wusd… They also plan to begin bribing once the Balancer gauge is live.

Liquity V2 Bug Bounty Program Launches on Cantina

Liquity has launched its V2 bug bounty program on Cantina, following the completion of their audit competition which ran from March 21 to April 27, 2025. The audit competition offered up to $350K in rewards for security researchers. Key points: - Bug bounty program is now active on Cantina platform - Previous audit competition concluded successfully - Security researchers can submit findings through [Cantina](https://cantina.xyz) This represents Liquity's continued commitment to security and protocol robustness.

GyroStable Launches Concentrated BOLD-USDC Pool on Balancer

**New Liquidity Developments for BOLD**: - GyroStable establishes concentrated BOLD-USDC pool on Balancer, competing for Protocol Incentive Layer (PIL) emissions - Three additional incentivized pools boost BOLD liquidity: • SmarDex pool on Balancer with Paladin bribes • Ekubo Protocol pool with new incentive campaign • Protocol FX pool on Curve with FXN gauge incentives All initiatives leverage PIL for sustainable rewards. SmarDex proposal currently open for LQTY staker voting. [View GyroStable Proposal](https://voting.liquity.org/t/gyroscope-initiative-bold-usdc/94)

Liquity V2 Explained in Spanish

Liquity, the decentralized borrowing protocol, is launching Version 2 with significant upgrades. Key improvements include: - Multi-collateral support beyond just ETH - Enhanced stability mechanisms - Improved liquidation processes - New governance features The protocol maintains its core principles of transparency and efficiency while expanding functionality. Spanish-speaking users can now access comprehensive documentation and guides in their native language. *Note: This update represents a major evolution for the Liquity ecosystem, making DeFi lending more accessible to the Spanish-speaking community.*

sBOLD Yield Opportunities and Ecosystem Growth

sBOLD holders can now earn 31% APR through Spectra Finance liquidity provision, plus additional fork rewards. The BOLD ecosystem has expanded significantly in just 37 days, offering yield opportunities across 8+ venues: - Yield-bearing options via K3 Capital (sBOLD) and Yearn (yBOLD) - Yield tokenization on Pendle and Spectra Finance - Money market integration with Euler Finance - LP opportunities on Curve, Ekubo, Aerodrome, Velodrome, and Balancer The protocol has secured 20+ friendly fork agreements, each committing to airdrop ~4% of tokens to Liquity V2 users. Check your rewards at [Dune Analytics](https://dune.com/liquity/v2-leaderboard).

sBOLD Launch Brings Enhanced Yield and Airdrop Exposure

sBOLD, a new yield-bearing token, has launched on Spectra Finance with several key features: - Offers leveraged exposure to 20+ potential airdrops - Provides ~7% stablecoin base rate - Can be used as collateral on Euler Finance - Supports borrowing with up to 92.5% LTV (95% LLTV) - Auto-compounds BOLD yield - Audited by Chain Security and Dedaub The token enables users to earn protocol yield while borrowing, and can be integrated across DeFi platforms and money markets. Users can deposit sBOLD (earning 6%) and borrow USDC at 4.7% rates for additional leverage opportunities.