sBOLD Yield Opportunities and Ecosystem Growth

sBOLD Yield Opportunities and Ecosystem Growth

🤑 sBOLD's 31% APR Secret

sBOLD holders can now earn 31% APR through Spectra Finance liquidity provision, plus additional fork rewards. The BOLD ecosystem has expanded significantly in just 37 days, offering yield opportunities across 8+ venues:

- Yield-bearing options via K3 Capital (sBOLD) and Yearn (yBOLD)

- Yield tokenization on Pendle and Spectra Finance

- Money market integration with Euler Finance

- LP opportunities on Curve, Ekubo, Aerodrome, Velodrome, and Balancer

The protocol has secured 20+ friendly fork agreements, each committing to airdrop ~4% of tokens to Liquity V2 users. Check your rewards at Dune Analytics.

Liquity SP vaults are now on @superformxyz Earn with 2 new yield-bearing BOLD products - sBOLD by @k3_capital - st-yBOLD by @yearnfi Also on Superform: @eulerfinance Liquity Hub vaults All yield-bearing variants of BOLD are eligible for 20+ airdrops from Liquity forks.

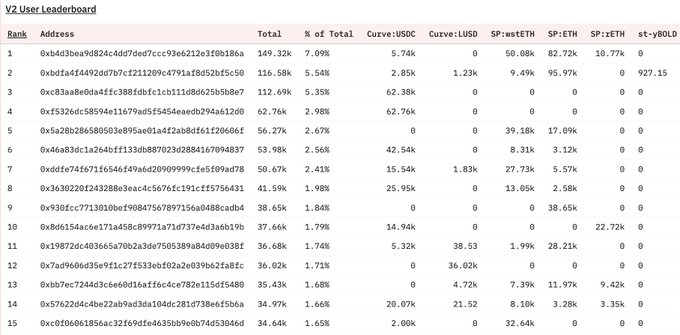

gm The Fork Reward Leaderboard has been updated. It now includes: - V2 Stability Pool depositors - @CurveFinance BOLD LPs - $sBOLD holders by @k3_capital - st $yBOLD holders by @yearnfi - YT and LP on @spectra_finance - YT and LP on @pendle_fi - @EkuboProtocol BOLD LPs

sBOLD is now live on @spectra_finance Yield Tokens offer leveraged exposure to 20+ airdrops, on top of a ~7% stablecoin base rate. time to unpack it 👇

Introducing sBOLD of @LiquityProtocol & @k3_capital The most powerful setup ever launched on Spectra: Yield Tokens offer leveraged exposure to 20+ airdrops, on top of a ~7% stablecoin base rate. Let's unpack it all ↓

Yield opportunities with $BOLD 🟢 Just 37 days in, and BOLD's reach is spreading rapidly across DeFi. Over 8 venues now available to put your BOLD to work & earn double digit yield👇 • Yield bearing BOLD → @k3_capital's sBOLD & @yearnfi's yBOLD • Yield Tokenization →

Pendle is now $BOLD. sBOLD & ysyBOLD are now both part of @pendle_fi Two new markets have emerged: 🔹sBOLD (27 Nov 2025) 🔹Yearn ysyBOLD (27 Nov 2025) Time to dive in 👇

sBOLD yield opportunity 🟡 🟢 sBOLD holders can currently earn over 31% APR providing liquidity for sBOLD on @spectra_finance 💡 A reminder that a portion of these positions also earn additional fork rewards on top of the APRs you see 👇

On @eulerfinance , you can now use $BOLD and $sBOLD as collateral. You can deposit sBOLD (earning 6%), and borrow USDC (rates 4.7%) and loop that further 👀 A reminder that sBOLD is eligible for fork rewards

It's time to be BOLD. Welcoming @LiquityProtocol and BOLD to Euler. - BOLD and sBOLD as collateral - Possible loops both on BOLD and sBOLD - BLTV up to 92.5% for BOLD → USDC/USDT Curated by @K3_Capital ↓

👀

opASF is Asymmetry’s reward derivative, modeled after @eulerfinance's successful rEUL framework. Its goal? To build a War Chest of protocol-owned, revenue-generating assets like vlCVX, vePENDLE, and staked LQTY. No more renting liquidity.

The Airdrop Leaderboard Over 20 friendly fork agreements are now signed. Each fork commits to airdropping ~4% of their token supply to Liquity V2 users. To track and reward contributions to the growth of $BOLD and V2, the following actions have been chosen: 1. @CurveFinance

Liquity V2 Bug Bounty Program Launches on Cantina

Liquity has launched its V2 bug bounty program on Cantina, following the completion of their audit competition which ran from March 21 to April 27, 2025. The audit competition offered up to $350K in rewards for security researchers. Key points: - Bug bounty program is now active on Cantina platform - Previous audit competition concluded successfully - Security researchers can submit findings through [Cantina](https://cantina.xyz) This represents Liquity's continued commitment to security and protocol robustness.

GyroStable Launches Concentrated BOLD-USDC Pool on Balancer

**New Liquidity Developments for BOLD**: - GyroStable establishes concentrated BOLD-USDC pool on Balancer, competing for Protocol Incentive Layer (PIL) emissions - Three additional incentivized pools boost BOLD liquidity: • SmarDex pool on Balancer with Paladin bribes • Ekubo Protocol pool with new incentive campaign • Protocol FX pool on Curve with FXN gauge incentives All initiatives leverage PIL for sustainable rewards. SmarDex proposal currently open for LQTY staker voting. [View GyroStable Proposal](https://voting.liquity.org/t/gyroscope-initiative-bold-usdc/94)

Liquity V2 Explained in Spanish

Liquity, the decentralized borrowing protocol, is launching Version 2 with significant upgrades. Key improvements include: - Multi-collateral support beyond just ETH - Enhanced stability mechanisms - Improved liquidation processes - New governance features The protocol maintains its core principles of transparency and efficiency while expanding functionality. Spanish-speaking users can now access comprehensive documentation and guides in their native language. *Note: This update represents a major evolution for the Liquity ecosystem, making DeFi lending more accessible to the Spanish-speaking community.*

sBOLD Launch Brings Enhanced Yield and Airdrop Exposure

sBOLD, a new yield-bearing token, has launched on Spectra Finance with several key features: - Offers leveraged exposure to 20+ potential airdrops - Provides ~7% stablecoin base rate - Can be used as collateral on Euler Finance - Supports borrowing with up to 92.5% LTV (95% LLTV) - Auto-compounds BOLD yield - Audited by Chain Security and Dedaub The token enables users to earn protocol yield while borrowing, and can be integrated across DeFi platforms and money markets. Users can deposit sBOLD (earning 6%) and borrow USDC at 4.7% rates for additional leverage opportunities.