Pyth Network continues its expansion across blockchain ecosystems with significant developments in 2025:

- Integration with equity blocks, marking a new milestone in traditional finance integration

- Notable partnerships with Adrastia Oracle and Galxe

- Launch of Express Relay system for improved performance

- Successful deployment on multiple chains including Aptos, TON Blockchain, and integration with Hyperliquid

- syUSD feed now available across 100+ blockchains

- Enhanced presence through Kronos Research on Pyth Insights Hub

Proof of Pyth on @ton_blockchain 🔮

🚨 Tradoor has integrated Pyth Price Fees on TON! What this means for you: ✅ Real-time, accurate prices from first-party sources ✅ Fairer trades and increased reliability ✅ On-chain, transparent data you can trust @PythNetwork gives Tradoor the same pricing power used

Proof of Pyth 🔮

We believe yield is a core pillar of DeFi and should be accessible beyond the boundaries of any single chain. Introducing Yield Perpetual Futures Markets powered by @PythNetwork. Now, trade protocol yield rates without locking up your assets.

$syUSD shows proof of Pyth 🔮 The feed is live and available on 100+ blockchains permissionlessly.

Big milestone for Synnax: syUSD is now live on @PythNetwork — oracle for real-time, low-latency price feeds used across major DeFi protocols. With native syUSD pricing available, syUSD can now integrate into lending markets, and other DeFi applications that rely on trusted

Proof of Pyth 🔮

Hyperpie now integrates with @PythNetwork to power its price feed infrastructure!📡 By leveraging real-time, high-fidelity price feeds from Pyth, we're enhancing the accuracy and reliability of @Hyperpiexyz_io’s DeFi operations — from liquidity strategies to staking and

Preuve de Pyth 🔮

🚨 @PythNetwork intègre les prix des plus grands ETF en temps réel dans la DeFi 🌐 Le leader des oracles ouvre la voie à une finance programmable mêlant actifs traditionnels et crypto 👇 coinacademy.fr/actu/pyth-netw…

Proof of Pyth 🔮

Proof of Pyth 🔮

1/ Kamino Swap has surpassed $300M volume after 3 weeks of being live! Across 5 aggregated routes and 4 searchers via @PythNetwork—with more routes coming soon👀

Proof of Pyth 🔮

Most people have no idea what market data is but it powers every trade, every app, every moment in DeFi. Fear not. Here’s an easy break down on how market data works and why @PythNetwork is the electricity of the global financial system ⚡

Pyth MDPs are excited to publicly back their proof of Pyth 🔮

alphanonce is live on @PythNetwork OIS publisher if you have $PYTH left, stake it to us We are publishing the fastest crypto pricing data into PYTH by utilizing our existing HFT data feed capabilities

Proof of Pyth Entropy 🎲

gWOM 🐻 Introducing $WOM Experiments - a new token playground powered by $WOM on @arbitrum, using @PythNetwork. Games. Perps. Lottery, and more. Simple, yet fun mechanics that give $WOM holders many ways to earn on your bag 💸 $WOM was always meant to be used. This is a step

Proof of Pyth on @Aptos 🔮

Both $stkAPT and $kAPT are now officially listed on @PythNetwork, bringing real-time, reliable on-chain pricing to @Aptos and over 100 ecosystems powered by Pyth! More composability. More integrations. More utility. This unlocks seamless integration of $stkAPT and $kAPT into

Proof of Pyth 🔮 Hyperliquid.

LND will be live on @HyperliquidX Price feeds powered by our partners @PythNetwork Incentives will be live on @merkl_xyz Date & Time: 05/05/25 9am UTC Hyperliquid

Proof of Pyth 🔮

Introducing Megapot, the world’s largest onchain jackpot Buy a $1 ticket to win $100,000 or deposit as an LP and play as the house! Live on Base and all EVM chains with $20M in jackpots run 🧵

Proof of Pyth 🔮

Introducing Stress Indicators—a new metric from Credora offering a transparent view into asset peg stability. Built on real-time data from @PythNetwork, these indicators provide DeFi participants with a data-driven tool to assess market confidence and liquidity stress. Live

Proof of Pyth 🔮

We’re fully transparent with our users, and we’re excited to work with @PythNetwork 🐻 Our Junky Bets function thanks to Pyth Entropy, which serves as Oracle for all our games, including Ursaroll, HoneyFlip, Junky Slots, and Blinko 🎰 With @PythNetwork , our beras can feel safe

Be Limitless and show proof of Pyth 🔮

At Limitless, clear and fast resolutions are a top priority. Most markets are automatically resolved via @PythNetwork – decentralized, reliable, and verifiable. You don't have to worry about manipulations or wait for days for your payout. That's the Limitless way.

Proof of Pythians 🔮

Proof of Pyth 🔮

🦄 The @Uniswap incentivized markets are live on @unichain using @PythNetwork for real-time pricing! 🔮 Incentives are managed by @gauntlet_xyz and powered by @merkl_xyz.

Proof of Pyth 🔮 @KronosResearch now public on the Pyth Insights Hub

We’re proud to be one of the top contributors of real-time, high-frequency price data to @PythNetwork, helping power a more transparent and reliable DeFi ecosystem. Explore our performance—and see how institutional-grade signals are shaping the future of decentralized oracles.

Proof of Pyth 🔮

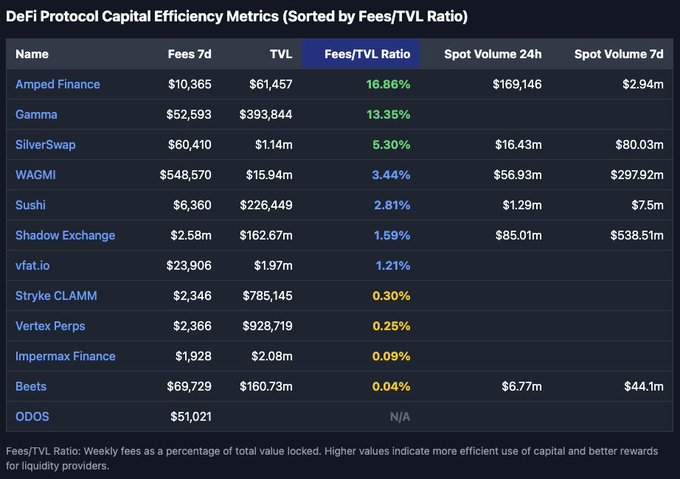

Check the numbers yourself, data is sourced from defillama.com/chain/Sonic We are proud to be the most capital efficient market in regards to fees earned to perform swaps on, largely thanks to our @PythNetwork oracle-driven model.

Proof of Pyth on @TradeOnDESK 🔮

DESK 🤝 @PythNetwork – Proof of Pyth 🔮 In the desert of market volatility, real-time price accuracy is king. That’s why DESK integrates Pyth—bringing high-frequency, low-latency oracles to power CEX-grade Perp trading on-chain. Precision fuels the edge. Trade with the best

Proof of Pyth with @AdrastiaOracle and @Galxe 🔮

1/ 🚀 A month in review with @PythNetwork, @Galxe, and @GravityChain Adrastia's Pyth Price Feed Updater is a white-glove service that streamlines the process of updating Pyth feeds with the utmost reliability, precision, and speed. In June, Gravity partnered with @QuickNode to

Proof of Pyth 🔮

1/ Kamino's Limit Order product has now surpassed $150M in all-time volume! Powered by @PythNetwork Express Relay, Kamino Limit Orders gives Solana users the best price fills at lightning speeds. Zero Fees. Zero Slippage. Zero MEV.

Proof of Pyth 🔮

We hit a record 1900 live viewers today on Beyond The Price with @CHOPPAtheSHARK Feels a bit surreal tbh, humbling and only makes us want to do a lot more Huge S/O to @timerugged (RainFi), @Crypto_Tom111 (Curvance), @timahhl (Titan), and @gidwell0x (Suilend) for coming on

Proof of Pyth 🔮

Proof of Pythians 🔮

You can call them Impact Awards or Pythian Pesos (please call them Pythian Pesos) but after all it is only about one thing - rewarding Pythians for their contributions Here is a quick guide on what PPs are, how they work and their importance in @PythNetwork ecosystem🔮

Proof of Pyth 🔮

1/ Introducing Stormbit: The zkTLS Credit Layer Borrow up to 99% of your asset’s value. No liquidations. No margin calls. Programmable credit — only at stormbit.finance

Proof of Pyth 🔮

Welcome to Hemi mainnet! Today’s milestone comes with $440M in TVL (incl. $285M on our staking platform), and more than active 50 ecosystem partners! One Network, Powered by Bitcoin & Ethereum. Learn more. ⤵️ hemi.xyz/blog/hemi-laun…

Proof of Pyth on each Equity Block 🫡

Proof of Pyth 🔮

Convergent is proud to be #PoweredByPyth. We integrate @PythNetwork’s real-time price feeds to enable accurate collateral valuation, stable liquidations, and secure borrowing in our LST-backed stablecoin system. As we go live with $CVGT, we look forward to building toward a

Proof of Pyth 🔮

1/ Kamino's Limit Order product has surpassed $200M in all-time volume! In March alone, Limit Orders has facilitated over $100M volume, powered by @PythNetwork Express Relay Road to $1B volume🫡

Proof of Pyth Express Relay 🔮

1/ Ranger Spot is now live. @solana’s liquidity is scattered—we’ve brought it together in one Meta Aggregator that taps into top liquidity venues, including: @JupiterExchange @DFlowProtocol @okx @KaminoFinance @PythNetwork Best price. Every venue. One terminal.

Proof of Pyth 🔮

.@PythNetwork data is coming to @N1Chain Next-gen high frequency apps on N1 require ultra-low latency data. We're excited to work with Pyth to bring high fidelity, institutional-grade price data to N1.

🔮 Pyth Dominates DeFi

**Pyth Network has become the backbone of DeFi**, securing a dominant position across the cryptocurrency ecosystem. **Key metrics:** - Powers **60% of derivatives and crypto markets** - Secured over **$1.5 trillion in transaction volume** - Trusted by **600+ applications** across **100+ blockchains** - Accounts for **99% of traded volume** on 23 blockchains The oracle network's extensive reach demonstrates its critical role in providing reliable price data for decentralized finance protocols. **What's next:** Pyth is expanding into traditional finance through **Pyth Pro**, aiming to bridge the gap between DeFi and TradFi markets.

🔮 Oracle Enhancement

**Pyth Network** is collaborating with Hyperliquid builders to deliver premium oracle data through the **HIP 3.1 Oracle Enhancement Proposal**. Key highlights: - Direct data sourcing from primary sources - Focus on highest quality oracle feeds - Enhanced integration with Hyperliquid ecosystem The proposal aims to improve data reliability and accuracy for decentralized applications requiring precise oracle information.

🎯 Prediction Markets Go Onchain

**Pyth Network partners with Kalshi** to bring regulated prediction market data onchain across 100+ blockchains. Developers can now access **real-time odds** for: - Elections - Federal Reserve rate decisions - Sports championships - Other major events This integration enables builders to create **derivatives, perpetuals, and new financial products** using live prediction market pricing. Kalshi operates as a regulated prediction market platform, making this the first major partnership bringing compliant prediction market data to DeFi. Read the full announcement: [BusinessWire release](https://www.businesswire.com/news/home/20251013872939/en/Pyth-Network-Partners-With-Kalshi-to-Deliver-Real-Time-Prediction-Market-Data-Onchain)

Global Finance Evolution Requires Enhanced Data Infrastructure

The financial industry is undergoing a fundamental transformation that hinges on **improved data quality and accessibility**. Traditional financial systems are being challenged by the need for more transparent, real-time, and reliable data sources. This shift represents a critical foundation for the next generation of global finance. Key developments include: - Growing demand for better data in internet capital markets - Recognition that data infrastructure is the cornerstone of financial innovation - Movement toward more sophisticated oracle networks and data providers The emphasis on data quality suggests that **financial institutions and technology providers are prioritizing infrastructure over flashy applications**. This foundational approach could lead to more stable and trustworthy financial systems. As the industry matures, the focus on robust data architecture indicates a shift from experimental phases to building sustainable, scalable financial infrastructure.

📊 Pyth Pro Launches

**Pyth Pro** launches as a comprehensive solution to the broken $50B market data industry. The traditional market data system suffers from: - Fragmented access and uneven pricing - Regional monopolies limiting innovation - Institutions paying more for less coverage **Key Features:** - Single subscription for **2,000+ real-time price feeds** - Coverage across all major asset classes - Direct access from 125+ leading trading firms and exchanges - Sub-100ms latency with 1.4 bps accuracy **Three-tier structure** adapts to different institutional needs, from DeFi protocols to traditional finance firms. Jump Trading Group joins the early access program, highlighting institutional demand for transparent, source-direct market data. [Request early access](https://tally.so/r/3xG8E5?utm_source=organic_social&utm_medium=x_post&utm_campaign=2510_post&utm_term=pythproevergreen)