Pyth Pro launches as a comprehensive solution to the broken $50B market data industry.

The traditional market data system suffers from:

- Fragmented access and uneven pricing

- Regional monopolies limiting innovation

- Institutions paying more for less coverage

Key Features:

- Single subscription for 2,000+ real-time price feeds

- Coverage across all major asset classes

- Direct access from 125+ leading trading firms and exchanges

- Sub-100ms latency with 1.4 bps accuracy

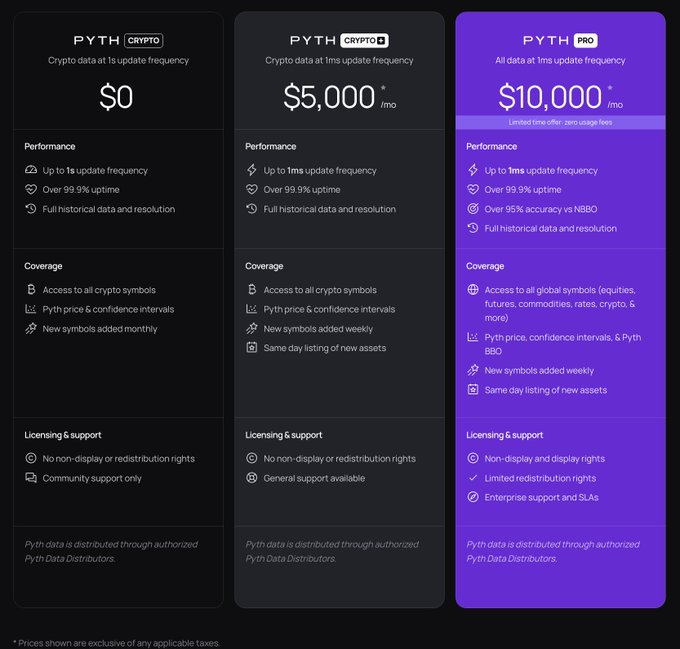

Three-tier structure adapts to different institutional needs, from DeFi protocols to traditional finance firms.

Jump Trading Group joins the early access program, highlighting institutional demand for transparent, source-direct market data.

The leading overnight US equities operator, @BlueOceanATS, has joined Pyth Network as the latest market data provider, bringing SEC-registered, institutional US equity pricing during critical after-hours trading periods. Trade US equities 24 hours a day, five days a week ⬇️

Data doesn’t keep office hours. Pyth is introducing After Hours price data: real-time prices, starting with 20 US equities, streaming 24/5 to blockchains worldwide. Stay connected to the market’s pulse, even when the exchange floor is closed 🧵

The market data industry powers every trade and risk model. But it wasn’t built for today’s global markets. Pyth Pro rebuilds the market data supply chain for the modern era. Fragmented access, uneven pricing, and regional monopolies turned data into a constraint. Firms pay more

Global Finance Evolution Requires Enhanced Data Infrastructure

The financial industry is undergoing a fundamental transformation that hinges on **improved data quality and accessibility**. Traditional financial systems are being challenged by the need for more transparent, real-time, and reliable data sources. This shift represents a critical foundation for the next generation of global finance. Key developments include: - Growing demand for better data in internet capital markets - Recognition that data infrastructure is the cornerstone of financial innovation - Movement toward more sophisticated oracle networks and data providers The emphasis on data quality suggests that **financial institutions and technology providers are prioritizing infrastructure over flashy applications**. This foundational approach could lead to more stable and trustworthy financial systems. As the industry matures, the focus on robust data architecture indicates a shift from experimental phases to building sustainable, scalable financial infrastructure.

🗡️ Perp DEX Wars

**Perpetual DEX competition** heats up as industry experts prepare for battle. - Live discussion featuring @Tristan0x from @bulletxyz_ - **Tomorrow at 10AM UTC** on X and YouTube - Focus on the competitive landscape of perpetual derivatives exchanges The session will likely cover market dynamics, trading features, and strategic positioning among leading perp DEX platforms. *Tune in to catch the latest developments in decentralized derivatives trading.*

📊 Pyth Launches 42 US Economic Indicators Across 100+ Blockchains

**Pyth Network has launched 42 U.S. macroeconomic data points** across more than 100 blockchain networks, making critical economic indicators accessible onchain for the first time. **Key economic data now available includes:** - Gross Domestic Product (GDP) - Consumer Price Index (CPI) - Producer Price Index (PPI) - Other major economic indicators This represents a significant expansion from the 23 GDP data points previously available. The data is accessible **permissionlessly**, meaning any developer or protocol can integrate these feeds without requiring approval. **Why this matters:** Traditional financial markets rely heavily on these economic indicators for decision-making. By bringing this data onchain, Pyth enables decentralized applications to build more sophisticated financial products that can react to real-world economic conditions. The oracle network positions itself as providing "the price of everything, everywhere" - extending beyond typical crypto price feeds to include traditional economic metrics. [View the complete list of economic data feeds](https://insights.pyth.network/price-feeds?assetClass=ECO)

CASH Stablecoin Goes Live on 100+ Blockchains via Pyth Network

**CASH**, Phantom's fully backed stablecoin issued by Bridge, has launched its price feed across **100+ blockchains** through the Pyth Network. The open-loop stablecoin is already being utilized by early adopters including: - **Loopscale Labs** - **Kamino** Developers interested in integrating CASH can access the feed and documentation at [Pyth's price feed portal](https://insights.pyth.network/price-feeds/Crypto.CASH%2FUSD). This expansion significantly increases CASH's accessibility across the multi-chain ecosystem, providing builders with reliable price data for their applications.