Platform Generates $70,544 Revenue with 12.5% APY Yield

Platform Generates $70,544 Revenue with 12.5% APY Yield

💰 $692K distributed weekly

Weekly Performance Highlights

The platform delivered strong results for the week of October 6-12:

- Revenue: $70,544.26 generated

- Average Yield: 12.5% APY maintained

- Total Distribution: $692,945 paid to users

The consistent double-digit yield demonstrates the platform's ability to generate sustainable returns for crypto holders. This week's performance shows steady revenue generation while maintaining competitive APY rates.

Key Metrics

The $692,945 in yield distributions significantly exceeded the $70,544 platform revenue, indicating strong user participation and capital deployment across various yield strategies.

Users continue benefiting from automated yield optimization without manual intervention required.

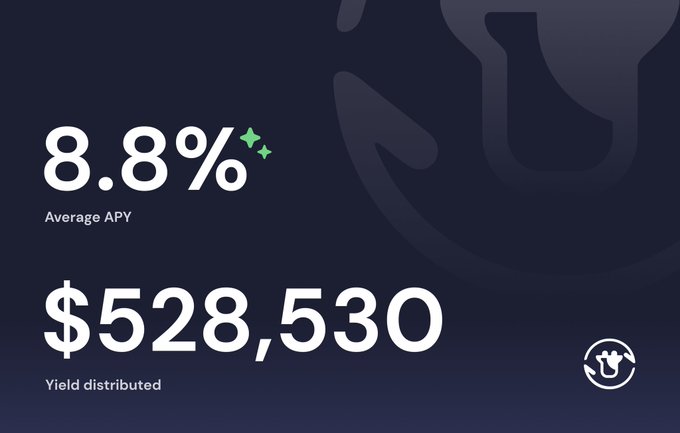

7 Day Yield Summary (Sept. 29- Oct 5)

7 Day Yield Summary (Oct 6 - Oct 12) Platform revenue: $70,544.26 Average Yield: 12.5% APY Yield Distribution: $692,945

7 Day Yield Summary (Sept. 22-28)

🔥 crvUSD Hits 17%

**Curve's crvUSD stablecoin** is now offering **17% APY** through Beefy Finance's yield optimization platform. This represents a significant opportunity for stablecoin holders looking for yield in the current market environment. - **Platform**: Beefy Finance autocompounding - **Asset**: crvUSD (Curve's native stablecoin) - **Current APY**: ~17% Beefy Finance specializes in yield optimization, automatically compounding rewards to maximize returns for users. [Access the vault on Beefy](https://app.beefy.com)

🏦 $140T Fixed-Income Market

**Pendle is targeting the massive $140 trillion fixed-income market** by bringing traditional yield infrastructure on-chain. - Market projected to reach $200 trillion by 2030 - Aims to democratize fixed income beyond institutional access - Beefy now offers 24 Pendle single-asset vaults - **Up to 23% APY with autocompounding** The integration represents a shift from crypto-only yield to broader financial market access. Pendle has already settled $69.8 billion in yield transactions. [Read full article](https://markets.businessinsider.com/news/currencies/pendle-settles-69-8-billion-in-yield-bridging-the-140t-fixed-income-market-to-crypto-1035405834) *Explore yield opportunities through simplified vault access.*

$splUSD Vault Goes Live with Autocompounding Yields

**New $splUSD vault is now operational**, offering autocompounding single asset yields through Trevee's stablecoin infrastructure. Key features: - **Single asset staking** - no need for complex LP pairs - **Automatic compounding** - yields reinvest automatically - **Trevee stablecoin integration** - leveraging established infrastructure This follows previous vault launches offering competitive rates: - $USDC at 36% APY - $USDT at 15% APY on Avalanche The vault provides a **simplified approach** to earning yield on stablecoin holdings without active management requirements.

🚀 Beefy Hits New Milestones

**Beefy delivered strong performance last week** with over $603K in yield distributed at an average **10.7% APY**. Key achievements include: - **17 new strategies** launched - **785K ZAPs** milestone reached - **One-click Lithos LP migration** rolled out - **GHO LP on Base** topped deposit rankings The yield optimizer continues expanding its offerings while maintaining competitive returns for users across multiple chains.

Beefy Maxis Strategy Purchases 3,163 BIFI Tokens Worth $1.07M

**Beefy's automated treasury strategy** made significant moves in 2024, acquiring 3,163 BIFI tokens valued at $1.07 million. The yield optimizer platform expanded its offerings with: - **11 new yield strategies** for users - **5 additional boosts** to enhance returns - New **Linea CLM strategies** for concentrated liquidity management This treasury purchase demonstrates Beefy's commitment to its native token while the platform continues growing its DeFi yield optimization services.