Curve's crvUSD stablecoin is now offering 17% APY through Beefy Finance's yield optimization platform.

This represents a significant opportunity for stablecoin holders looking for yield in the current market environment.

- Platform: Beefy Finance autocompounding

- Asset: crvUSD (Curve's native stablecoin)

- Current APY: ~17%

Beefy Finance specializes in yield optimization, automatically compounding rewards to maximize returns for users.

solidity // insert curve shill // crvUSD printing on beefy - ~17% APY🔥 contract CurveShill { string public constant msg = "crvUSD x beefy = yield.goBRRRR(17);"; }

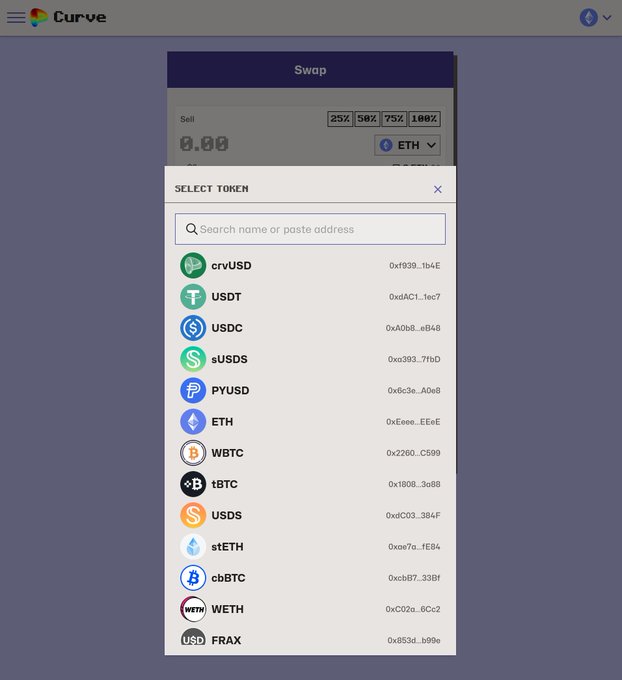

Did you ever think of what determines the sorting order of coins when you swap on Curve? If you don't connect your wallet - highest volume coins go first. Today that is crvUSD

🏦 $140T Fixed-Income Market

**Pendle is targeting the massive $140 trillion fixed-income market** by bringing traditional yield infrastructure on-chain. - Market projected to reach $200 trillion by 2030 - Aims to democratize fixed income beyond institutional access - Beefy now offers 24 Pendle single-asset vaults - **Up to 23% APY with autocompounding** The integration represents a shift from crypto-only yield to broader financial market access. Pendle has already settled $69.8 billion in yield transactions. [Read full article](https://markets.businessinsider.com/news/currencies/pendle-settles-69-8-billion-in-yield-bridging-the-140t-fixed-income-market-to-crypto-1035405834) *Explore yield opportunities through simplified vault access.*

$splUSD Vault Goes Live with Autocompounding Yields

**New $splUSD vault is now operational**, offering autocompounding single asset yields through Trevee's stablecoin infrastructure. Key features: - **Single asset staking** - no need for complex LP pairs - **Automatic compounding** - yields reinvest automatically - **Trevee stablecoin integration** - leveraging established infrastructure This follows previous vault launches offering competitive rates: - $USDC at 36% APY - $USDT at 15% APY on Avalanche The vault provides a **simplified approach** to earning yield on stablecoin holdings without active management requirements.

🚀 Beefy Hits New Milestones

**Beefy delivered strong performance last week** with over $603K in yield distributed at an average **10.7% APY**. Key achievements include: - **17 new strategies** launched - **785K ZAPs** milestone reached - **One-click Lithos LP migration** rolled out - **GHO LP on Base** topped deposit rankings The yield optimizer continues expanding its offerings while maintaining competitive returns for users across multiple chains.

Beefy Maxis Strategy Purchases 3,163 BIFI Tokens Worth $1.07M

**Beefy's automated treasury strategy** made significant moves in 2024, acquiring 3,163 BIFI tokens valued at $1.07 million. The yield optimizer platform expanded its offerings with: - **11 new yield strategies** for users - **5 additional boosts** to enhance returns - New **Linea CLM strategies** for concentrated liquidity management This treasury purchase demonstrates Beefy's commitment to its native token while the platform continues growing its DeFi yield optimization services.