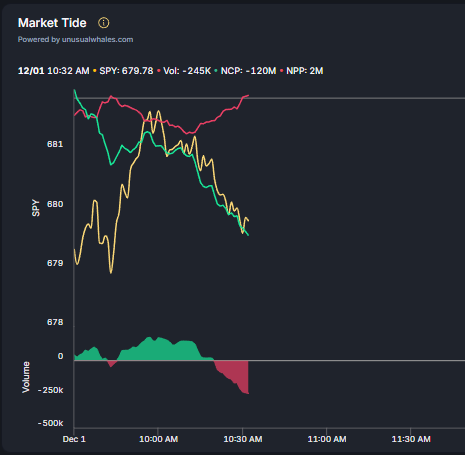

Options Market Shows Bearish Tilt as Call Premium Turns Negative

Options Market Shows Bearish Tilt as Call Premium Turns Negative

📉 Calls Going Negative

Market sentiment shifts bearish as options premiums show a negative lean across the board.

Key developments:

- Limited call participation observed in today's trading session

- Net call premium remains steadily negative throughout the day

- Ask-call activity significantly reduced compared to recent sessions

The data suggests traders are positioning more defensively, with reduced bullish bets in the options market. This bearish tilt in premiums often indicates cautious sentiment among institutional and retail traders.

Market wide options premiums with a slightly bearish lean. Limited ask-call participation so far today, with net call premium steadily negative. unusualwhales.com/flow/overview?…

Rep. Massie Calls for Commerce Secretary Lutnick's Resignation Over Epstein Connection

**Representative Thomas Massie has publicly called for Commerce Secretary Howard Lutnick to resign**, citing connections to Jeffrey Epstein. **Key Development:** - CBS reports that Epstein files reveal Lutnick and Epstein were in business together - Massie's statement marks a significant political challenge to the Commerce Secretary - The revelation adds to ongoing scrutiny of officials with ties to Epstein **Background:** Howard Lutnick currently serves as U.S. Commerce Secretary. The newly surfaced documents indicate a business relationship between Lutnick and Jeffrey Epstein, the disgraced financier. This development raises questions about vetting processes and potential conflicts of interest in high-level government positions.

Apollo Structures $3.4B Lending Deal for Nvidia Chips Leased to xAI

**Apollo Global Management is finalizing a $3.4 billion lending arrangement** tied to Nvidia chips being leased to xAI, Elon Musk's artificial intelligence company, according to the Information. This deal represents a significant financing structure in the AI infrastructure space, where **high-value GPU assets are being used as collateral** for large-scale lending. **Key details:** - The lending is secured against Nvidia chips leased to xAI - Apollo is providing the $3.4 billion facility - This follows a trend of major chip agreements in the AI sector The arrangement highlights how **AI compute infrastructure is becoming a financeable asset class**, with institutional lenders like Apollo treating advanced chips as valuable collateral. This comes after OpenAI's previous multi-billion-dollar chip agreement with AMD, signaling growing institutional interest in AI hardware financing.

Trump Jr.'s Board Positions Coincide with Federal Benefits for Companies

**Citizens for Responsibility and Ethics in Washington (CREW) reports a pattern of companies benefiting after adding Donald Trump Jr. to their leadership.** - Two companies received advantages from the Trump administration after appointing Trump Jr. to their board or advisory positions - A third company with Trump Jr. on its board may benefit from a new Trump healthcare initiative - Trump Jr. previously joined a trading platform as an advisor in January 2025, following predictions of his father's political return The timing raises questions about potential conflicts of interest between family business relationships and government policy decisions. CREW's findings suggest a correlation between Trump Jr.'s corporate appointments and subsequent federal benefits to those organizations.

Top 10% of US Earners Drive Nearly Half of Consumer Spending

**Economic concentration reaches new heights** as the wealthiest 10% of American earners now account for nearly half of all consumer spending in the United States, according to Financial Times reporting. This spending concentration highlights growing wealth inequality in the American economy. The data reveals how consumer markets are increasingly dependent on high-income households for economic activity. **Context of wealth distribution:** - Baby boomers control over 50% of America's wealth - Most boomer wealth is tied to real estate holdings - Spending power increasingly concentrated at the top The trend suggests that economic growth and consumer-facing businesses are becoming more reliant on the purchasing decisions of affluent Americans, while the majority of households hold diminishing economic influence. This concentration of spending power has implications for retail strategies, economic policy, and wealth distribution debates.

Trump Policies Drive Global Shift Toward China

The Financial Times reports a significant geopolitical reversal: Trump's policies are inadvertently strengthening China's global relationships. **Key Development:** - Countries worldwide are increasingly warming to China as a response to current US administration strategies - This marks a dramatic shift from October 2025, when the US threatened global "decoupling" from China over potential export controls **Context:** The turnaround represents a major unintended consequence of US foreign policy, with nations reconsidering their alliances and trade partnerships in response to American positioning.