Ondo Global Markets Aims to Revolutionize Securities Trading

Ondo Global Markets Aims to Revolutionize Securities Trading

🌎 Wall Street Goes Global

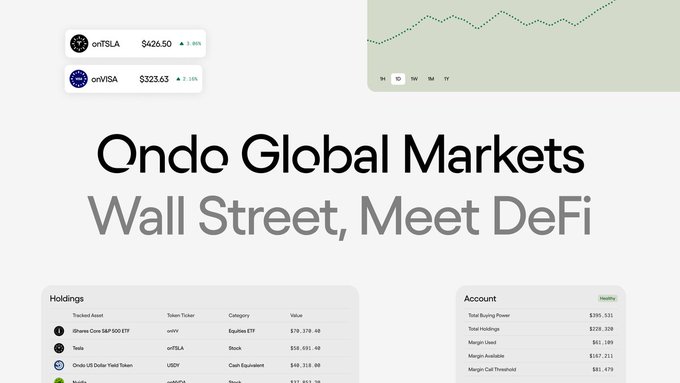

Ondo Finance is launching Ondo Global Markets to provide global investors with 24/7 access to US securities. The platform will enable seamless trading of stocks, ETFs, and bonds with instant settlement and full DeFi composability.

Similar to how stablecoins transformed access to USD globally, Ondo Global Markets aims to make the $44T annual US securities trading volume accessible worldwide. The platform addresses key limitations of traditional markets including high costs, slow settlement, limited hours, and restricted access.

Key features include:

- Always-on trading (24/7/365)

- Instant settlement

- Global accessibility

- DeFi composability

- Programmable liquidity

Ondo Global Markets will do for US securities what stablecoins did for the US dollar. Traditional markets are siloed and access-restricted. Ondo Global Markets changes that—making tokenized equities fully composable with DeFi and globally accessible. Just as $220B in

What stablecoins did for dollars, Ondo is doing for securities. Ondo Global Markets will bring publicly traded stocks, bonds, and ETFs onchain—accessible everywhere 24/7, easily tradable, and built for DeFi. The US markets, reimagined for the world. Learn more about Ondo

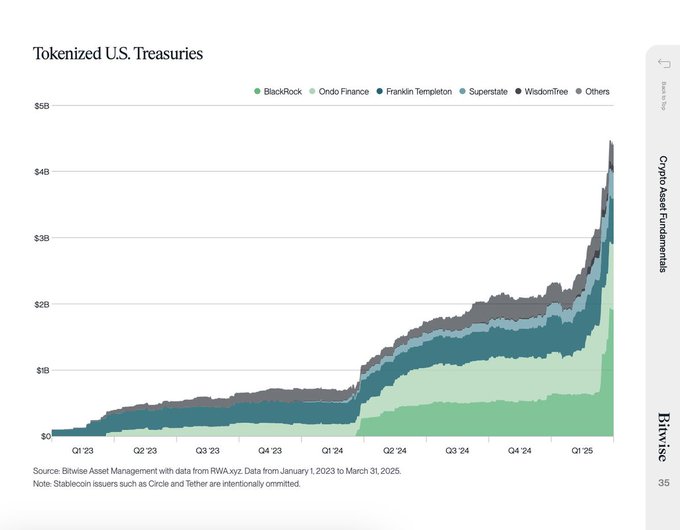

Hockey-stick charts tell big stories. The growth of tokenized treasuries is accelerating—and Ondo is proud to be at the forefront, alongside traditional institutions like BlackRock and Franklin Templeton.

The @Mastercard Newsroom recently spoke with Ian De Bode, Ondo's Chief Strategy Officer, about Mastercard's partnership with Ondo, and the opportunities unlocked by tokenization. Ian explained, "Bank infrastructure doesn't operate 24/7. The blockchain does. For time-sensitive

1/ @Mastercard is bringing Ondo Finance into the Multi Token Network (MTN) as the first RWA provider on the network. The MTN enables banks to offer digital financial services to integrated businesses, and Ondo’s Short Term US Treasuries Fund (OUSG) will be the first tokenized

Bringing RWAs onchain requires institutional-grade infrastructure—not buzzwords. At Ondo Finance, we're setting new standards for onchain finance through infrastructure and products like OUSG—the benchmark for instant, tokenized US Treasuries liquidity. Built-in redundancy

Ian De Bode, Ondo’s Chief Strategy Officer, is now live on Nasdaq @TradeTalks, discussing the modernization of financial markets.

.@OndoFinance @OmniFDN @SmarshInc & Dr. Merav Ozair join @JillMalandrino on @Nasdaq #TradeTalks to discuss modernizing financial markets and positioning the US as the global leader in digital asset innovation. x.com/i/broadcasts/1…

At Ondo, we’re helping lead the world’s most robust real-world asset ecosystem alongside a growing network of institutions and service providers. From global asset managers and major TradFi firms to DeFi-native platforms, the Ondo Ecosystem brings together those working to bring

Could the tokenized RWA market reach $100B in 2025? We think so. In an interview with @scottmelker on TheStreet Roundtable, @nathanlallman projected that the tokenized RWA market could do just that. Ondo’s recent growth to ~$1B in TVL reflects that momentum, as traditional

“We started with treasuries but soon it will be stocks and ETFS… making them globally available to an investor base that clearly wants access to US assets.” “I think most exchanges and distribution platforms are going to start offering stocks… ideally tokenized stocks, and

Ondo Global Markets is where public securities become public infrastructure. Welcome to Wall Street 2.0.

1/ Amidst the shuffle of the Ondo Summit, you might have missed an important chain expansion for our tokenized US Treasuries. Ondo is bringing yield-bearing assets to the @StellarOrg network, a leading payments ecosystem. With a keen focus on the Global South, Stellar has made

Ondo’s products “climbed to just shy of $1B combined, a 53% surge in market value over the past month,” reports @CoinDesk. “We believe the growth of the tokenized treasury market cap during the recent crypto downturn reflects a flight to quality,” explained Brian Choe, head of

The tokenized treasury market surged to a fresh record of $4.2 billion as the crypto correction accelerated inflows, per @RWA_xyz, @OndoFinance, @Securitize, @superstatefunds were among the biggest gainers. By @sndr_krisztian trib.al/x8cdYrI

1/ Ondo Finance has surpassed $1B in Total Value Locked (TVL)! This milestone is a testament to market-wide appetite for institutional-grade, composable tokenized US Treasuries. Yet, this is just the beginning. Tokenization represents a multi-trillion dollar opportunity and we

Yieldcoins are quietly reshaping finance: protecting users from inflation, empowering people with self-custody, improving access, and providing the freedom to use your assets as collateral. We are proud to offer innovative products and realize our vision of Wall Street 2.0,

1/ The tokenized US Treasuries market has surpassed $4B in size, according to @RWA_xyz—growth catalyzed by Ondo Finance’s market leadership. What stablecoins took four years to achieve, tokenized Treasuries achieved in two, demonstrating strong demand for safe, liquid,

From Fidelity’s tokenized US Treasuries entry to JPMorgan’s prediction on the growth of yieldcoins, US financial institutions are busy developing their digital asset capabilities. Here are the key recent developments you don’t want to miss.👇

American Markets, Global Access. Ondo is unlocking access to US financial markets for everyone. Our billboards in DC highlight the vital role of tokenization ahead of key policy discussions at the SEC’s Crypto Task Force Roundtables and the DC Blockchain Summit.

Tokenization is a hot topic at the NYSE. “The appetite for tokenization right now is very high because people look at the product market fit [of stablecoins] and say: what’s next?” Ondo’s Ian De Bode explains: “I expect a lot of crypto exchanges to offer stocks and the like

Catch Ian De Bode, Ondo’s Chief Strategy Officer, live from the New York Stock Exchange on FintechTV today at 9:20 AM ET for the latest tokenization insights: fintech.tv

This week, fintech leaders shared their optimism about tokenization. Companies like @Mastercard, @RobinhoodApp, @PayPal, and @Stripe see its potential to reshape finance. Here are some key developments you may have missed. 👇

We are excited to announce that Patrick McHenry (@PatrickMcHenry), former Chairman of the House Financial Services Committee and a key architect of US financial policy, is joining Ondo Finance as Vice Chairman of the advisory board. Chairman McHenry brings decades of experience

ICYMI: Ondo Finance and @Mastercard have aligned to bring tokenized RWAs to Mastercard's MTN. This partnership enables MTN participating businesses who have onboarded with Ondo to: • Access OUSG directly on the Multi-Token Network • Settle crypto payments through traditional

1/ @Mastercard is bringing Ondo Finance into the Multi Token Network (MTN) as the first RWA provider on the network. The MTN enables banks to offer digital financial services to integrated businesses, and Ondo’s Short Term US Treasuries Fund (OUSG) will be the first tokenized

1/ @Mastercard is bringing Ondo Finance into the Multi Token Network (MTN) as the first RWA provider on the network. The MTN enables banks to offer digital financial services to integrated businesses, and Ondo’s Short Term US Treasuries Fund (OUSG) will be the first tokenized

The total tokenized US Treasuries market has surpassed $5B for the first time, according to rwa.xyz, following continued demand for high-quality tokenized RWAs. Ondo is proud to maintain its market distribution leadership, with over 80% of the market by number of

"That's the reason why BlackRock's in the action. That's the reason why all these large financial players are clearly going to be in the action here—of using better software to do what they currently do." At the Ondo Summit, @PatrickMcHenry highlighted why tokenization is the

We are excited to announce that Patrick McHenry (@PatrickMcHenry), former Chairman of the House Financial Services Committee and a key architect of US financial policy, is joining Ondo Finance as Vice Chairman of the advisory board. Chairman McHenry brings decades of experience

With Ondo Global Markets, stocks and ETFs go from ticker symbols to building blocks. Onchain, programmable, accessible.

To accelerate our vision for Wall Street 2.0 and help institutions take advantage of tokenization, we are building Ondo Chain. Ondo Chain combines the openness of public blockchains with the compliance and security features of permissioned chains—designed from the ground up to

1/ Today, we’re thrilled to announce Ondo Chain, our new Layer 1 blockchain purpose-built for institutional-grade RWAs. Design advisors for the chain include new members of the Ondo Ecosystem: Franklin Templeton, Wellington Management, WisdomTree, Google Cloud, ABN Amro, Aon,

Liquidity matters for tokenized US Treasuries. It’s the defining factor that separates being stuck in an illiquid fund from having seamless access to your money when market opportunities arise. Ondo stands out—offering multiple liquidity options for tokenized US Treasuries,

Ondo Vice Chairman @PatrickMcHenry joined @CoinDesk Markets Daily to discuss the latest on digital assets in the United States. McHenry explained how Ondo enables “global markets to participate with American securities using the best technology available, on crypto rails.” He

The tokenized US Treasuries market has reached $3.9B, reflecting a 6.39% increase over just the past week, according to @RWA_xyz. Ondo has been at the forefront of this recent growth, with a 56% increase in TVL over 30 days, approaching $900M in TVL. The primary driver behind

First it was stablecoins. Now it’s US capital markets. “I think the same rails that gave people global access to the US dollar will now give global access to US capital markets,” explained Ondo’s Ian De Bode live on Nasdaq @TradeTalks. “We fundamentally believe that the next

Ian De Bode, Ondo’s Chief Strategy Officer, is now live on Nasdaq @TradeTalks, discussing the modernization of financial markets.

Traditional equities markets face inefficiencies that hinder both investors and market performance, with key challenges including: • High costs • Slow settlement • Limited market hours • Walled gardens • Manual processes Ondo Global Markets removes these limitations with

Yield-bearing assets are going mainstream. “Yield-bearing stablecoins currently make up just 6% of the total stablecoin market cap but could expand significantly, potentially capturing up to 50% of the market,” according to @JPMorgan analysts. Speaking with @TheBlock__,

EXCLUSIVE: JPMorgan sees yield-bearing stablecoins growing from 6% to 50% of market share theblock.co/post/348449/jp…

“Ondo is laying the groundwork for tokenized finance.” @MessariCrypto's latest report highlights that "if RWAs, Ondo Finance, and broader institutional participation continue to gain momentum, this could mark one of the most significant shifts in financial markets to date.” At

Ondo Global Markets “represents the next stage in the evolution of financial markets, where the best of DeFi and the best of TradFi combine to create markets that are more transparent, more efficient, and more accessible.” — @nathanlallman

“Every stock, every bond, every fund—every asset—can be tokenized. And if they are, it will revolutionize investing.” BlackRock, the world’s largest asset manager, is placing a bold bet on the future of finance. In its latest Chairman’s Letter, BlackRock CEO Larry Fink explains

"You'll be able to move collateral onchain outside of traditional bank & broker dealer hours, and outside of traditional holiday & weekend hours." — Cynthia Lo Bessette, Head of Digital Asset Management at Fidelity Investments, on the benefits of tokenization. Bringing

Why are institutions choosing tokenized assets? Because they offer greater efficiency than their traditional counterparts. A recent example highlights this perfectly: Santander Corporate & Investment Bank and JPMorgan completed two successful intraday repo trades, where

Ian De Bode, Ondo's Chief Strategy Officer, was tapped as an external expert for Ripple and BCG's new report, Approaching the Tokenization Tipping Point. The report echoes what we’ve long believed: tokenization is the foundational infrastructure for a more efficient, inclusive,

By 2033, a $0.6T → $18.9T shift is coming as tokenization reshapes global finance. Why? 🏛️ Regulation & institutional adoption 🏙️ Real-world assets like bonds & real estate 🔀 Faster, interoperable financial infrastructure The institutions that act now will lead the next

Ondo Chain is purpose-built for the future of public markets, creating the infrastructure equities need to thrive onchain. This is how we bridge the gap—where institutional-grade finance meets decentralized infrastructure, unlocking the full potential of equities in DeFi.

This week’s tokenization theme: accelerating global institutional adoption. From India’s Axis Bank to Japan’s SMBC, major financial institutions around the world are embracing tokenization. Here are the key developments you won’t want to miss. 👇

Catch Ian De Bode, Ondo’s Chief Strategy Officer, live from the New York Stock Exchange on FintechTV today at 9:20 AM ET for the latest tokenization insights: fintech.tv

We have a big week ahead on Market Movers… • Monday @ 9:20 AM: Patrick L Young (@FrontierFinance), Founder & Chairman of Exchange Invest (@Exchange_Invest) • Tuesday @ 9:50 AM: Nilmini Rubin (@nilminirubin), Chief Policy Officer at Hedera (@hedera) • Wednesday @ 9:20 AM:

“The United States is open for business.” Ondo Vice Chairman @PatrickMcHenry joined @CNBC Asia to discuss the $64T tokenization opportunity and Ondo’s role in bringing RWAs onchain at scale. “Firms like Ondo are best in class” in the tokenization of real-world assets. “We have

Wall Street is warming up to tokenization amid a regulatory shift. “There’s certainly been a sea change in institutional interest,” @nathanlallman told @scottmelker on TheStreet Roundtable. He pointed to new OCC guidance and the repeal of SAB 121 as major

🏦 Institutions Prep for Onchain Future

At Binance Blockchain Week in Dubai, Ondo President Ian De Bode emphasized how **tokenization is reshaping finance**. The key message was clear: **major institutions are preparing for an onchain future**. This follows recent regulatory support, with: - **Paul Atkins (SEC Chairman)** calling tokenization inevitable for keeping the US competitive - **BlackRock's leadership** highlighting tokenization's potential for enormous growth - **Major financial institutions** converging at the upcoming Ondo Summit in February 2026 The institutional momentum is building as traditional finance recognizes blockchain's role in modernizing capital markets. From tokenized Treasuries to stocks and ETFs, the infrastructure for bringing trillions onchain is taking shape. **The shift from experimentation to implementation is accelerating across the financial sector.**

Silver Outperforms Google Stock in 2025 as Precious Metals Shine

**Silver has outperformed Google stock ($GOOGL) in 2025**, highlighting the continued strength of precious metals in investment portfolios. This performance reinforces why **precious metals deserve a place in traditional investment strategies**. Investors can now access these assets alongside stocks through blockchain technology. **Key highlights:** - Silver beats major tech stock performance - Precious metals proving portfolio value - Traditional assets now available onchain [Ondo Global Markets](https://summit.ondo.finance/2026) offers access to over 100 tokenized stocks and ETFs, including gold and silver ETFs, bringing traditional assets to the blockchain. **Learn more at the upcoming summit** - view speakers and RSVP at the link above.

Onchain Stocks Set for Mainstream Adoption in 2026

**2025 marked the emergence of onchain stocks** as a significant trend in the tokenization space. **The next phase begins in 2026**, when these blockchain-based equity instruments are expected to gain widespread mainstream adoption. Key developments: - Onchain stocks gained traction throughout 2025 - Infrastructure and regulatory frameworks matured - **2026 positioned as the breakthrough year** for mass market acceptance This progression follows the broader tokenization trend that has seen various traditional assets move onto blockchain platforms, offering improved accessibility and programmability.

Nasdaq Embraces Tokenization as Next Evolution in Securities Trading

**Nasdaq is positioning itself at the forefront of securities tokenization**, with Head of Digital Assets Matt Savarese describing it as the natural next step after the transition from paper to electronic trading. The exchange is actively working to **support tokenized stocks and ETFs**, building on their earlier SEC filing to allow trading of tokenized securities on their platform. **Key developments:** - Nasdaq views tokenization as an evolutionary step in market infrastructure - The exchange is developing capabilities for tokenized traditional securities - This follows their September regulatory filing with the SEC **Market implications:** - Could increase trading efficiency and market accessibility - Represents institutional validation of blockchain-based securities - May face regulatory hurdles as the framework develops Nasdaq's embrace of tokenization signals **growing institutional confidence** in blockchain technology for traditional financial markets, potentially paving the way for broader adoption across major exchanges.

Major Onchain Stock Purchases Hit $1.2M This Week Led by Google

**Large institutional money is flowing into tokenized stocks this week**, with over $1.2 million in major purchases recorded onchain. **Top purchases include:** - $500,000 in Google (GOOGLon) - $273,506 in QQQ ETF - $200,705 in Meta - $150,000 each in Alibaba and NVIDIA The **Google purchase executed as a single transaction** on BNB Chain, demonstrating how tokenized stocks can handle large orders efficiently. **Ondo's tokenized stocks inherit traditional exchange liquidity**, allowing these substantial onchain orders to execute with the same efficiency as conventional stock trades. This activity signals **growing institutional adoption** of tokenized traditional assets in DeFi.