Nvidia Tanks as Michael Burry Compares AI Bubble to 2008 Crisis

Nvidia Tanks as Michael Burry Compares AI Bubble to 2008 Crisis

📉 Burry's 2008 Warning

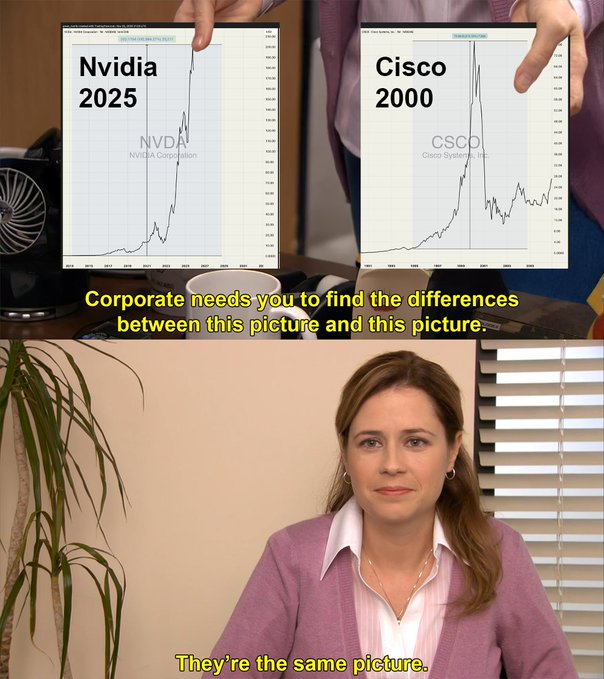

Nvidia shares plummeted after Michael Burry, the investor famous for predicting the 2008 financial crisis, drew parallels between the current AI market and the housing bubble that led to the Great Recession.

Key developments:

- Nvidia stock experienced significant decline following Burry's comments

- The "Big Short" investor compared AI hype to pre-2008 market conditions

- This follows Nvidia's recent pushback against Burry's bearish stance

Market context: Burry's comparison suggests the AI sector may be overvalued, similar to how mortgage-backed securities were before the 2008 crash. His track record of identifying market bubbles has investors paying attention.

The tech giant had previously issued a memo to Wall Street analysts defending against Burry's bearish arguments, indicating growing tension between bulls and bears on AI valuations.

Nvidia Just Tanked & Burry Dropped A Bombshell Comparison With The ’08 Bubble Read blog: wallstmemes.com/news/stonks/nv…

Nvidia have emailed a memo to Wall St analysts to push back on Michael Burry's bearish arguments Read blog: wallstmemes.com/news/stonks/nv…

Michael Burry Warns of Market Bubble with GME Reference

**The Big Short** investor Michael Burry posted "Remember GME" on social media, signaling potential market bubble concerns. Burry's cryptic message references the 2021 GameStop squeeze that exposed market vulnerabilities and retail trading frenzies. **Key bubble warning signs** identified include: - Excessive speculation in meme stocks - Disconnect between valuations and fundamentals - Widespread retail FOMO behavior - Overleveraged positions across markets - Institutional complacency Nvidia reportedly pushed back against Burry's bearish stance through analyst communications, suggesting tension between bulls and bears. Burry previously predicted the 2008 housing crisis and has been vocal about current market conditions. [Read the full analysis](https://wallstmemes.com/news/stonks/michael-burry-just-brought-up-gme-here-are-5-more-red-flags-that-signal-a-bubble/)

Nvidia Faces $180B Loss as Meta Eyes Google Chips Over Current Suppliers

**Nvidia faces potential $180 billion market cap loss** as Meta considers switching to Google's custom chips for AI infrastructure. The move reflects **growing competition in the AI chip market**, with tech giants developing alternatives to Nvidia's dominant GPU offerings. - Meta's potential shift could significantly impact Nvidia's revenue stream - Google's custom silicon presents viable alternative for large-scale AI operations - Decision highlights broader trend of tech companies reducing hardware dependencies This follows recent volatility in Nvidia stock, which previously dropped $800 billion amid **AI sector concerns and rising competition**. The semiconductor giant's dominance in AI training chips faces increasing pressure as major customers explore in-house solutions.

Larry Summers Resigns from OpenAI Board Amid Harvard Epstein Investigation

**Larry Summers has stepped down from OpenAI's board of directors** as Harvard University launches a probe into his relationship with Jeffrey Epstein. The former Treasury Secretary confirmed his resignation Wednesday morning, coinciding with reports that Harvard will investigate his ties to the convicted financier. **Key developments:** - Summers exits OpenAI board amid mounting pressure - Harvard opens formal investigation into Epstein connections - Timing suggests coordinated response to controversy The dual departures mark a significant fall for the prominent economist, who previously served as Harvard's president and held senior roles in multiple administrations. **Impact on OpenAI unclear** as the AI company continues rapid expansion despite board changes.

Bitcoin Hits Lowest Month Since 2022 Crypto Crash

Bitcoin has dropped to its **lowest monthly performance** since the 2022 crypto market crash, raising questions about the sustainability of the current market cycle. Key developments: - Monthly performance matches 2022 crash levels - Previous bounce attempts have shown only slight recovery - Market sentiment shifting as historical bull run patterns face challenges The decline marks a significant shift from earlier optimism, with traders now questioning whether the recent bull market momentum can continue. Historical data suggests this level of monthly weakness typically signals broader market uncertainty. **Market watchers** are closely monitoring whether this represents a temporary correction or the beginning of a more sustained downturn similar to the 2022 crash period. Read the full analysis: [Bitcoin market analysis](https://wallstmemes.com/news/memecoins/bitcoin-hits-lowest-month-since-the-2022-crypto-crash-are-we-so-over/?utm_source=Twitter&utm_medium=Wallstmemes+-+Twitter&utm_campaign=Articles)