Wall St Bulls

Wall Street Bulls is a collection of 10,000 unique NFTs on the Ethereum blockchain. Inspired by the Wall Street degen culture, The Wall Street Bulls have a roadmap packed with some of the most unique utility. Your Bull doubles as membership into the upcoming Options Market; a place where your Bull can become either rich or poor, but always more rare. You would also get access to our free sister NFT collections The Wall Street Interns and The Wall Street Assets. Exclusive Merch of your Bull and the upcoming Trading Floor will all be unlocked by the community through the roadmap activation.

Examining the Epstein-Bitcoin Theory: What the Evidence Shows

Fri 6th Feb 2026

A theory has emerged suggesting Jeffrey Epstein may have been involved in Bitcoin's creation. The claim lacks substantiated evidence and appears to be speculative content.

**Key Points:**

- The identity of Bitcoin's creator, Satoshi Nakamoto, remains unknown since 2009

- No credible evidence links Epstein to Bitcoin's development

- The theory appears in memecoin-related content rather than investigative journalism

Bitcoin's whitepaper was published in 2008 by the pseudonymous Satoshi Nakamoto. Despite numerous theories over the years, no definitive proof has identified the creator.

Read more: [Wall Street Memes article](https://wallstmemes.com/news/memecoins/did-jeffrey-epstein-secretly-invent-bitcoin-heres-everything-we-know/?utm_source=Twitter&utm_medium=Wallstmemes+-+Twitter&utm_campaign=Articles)

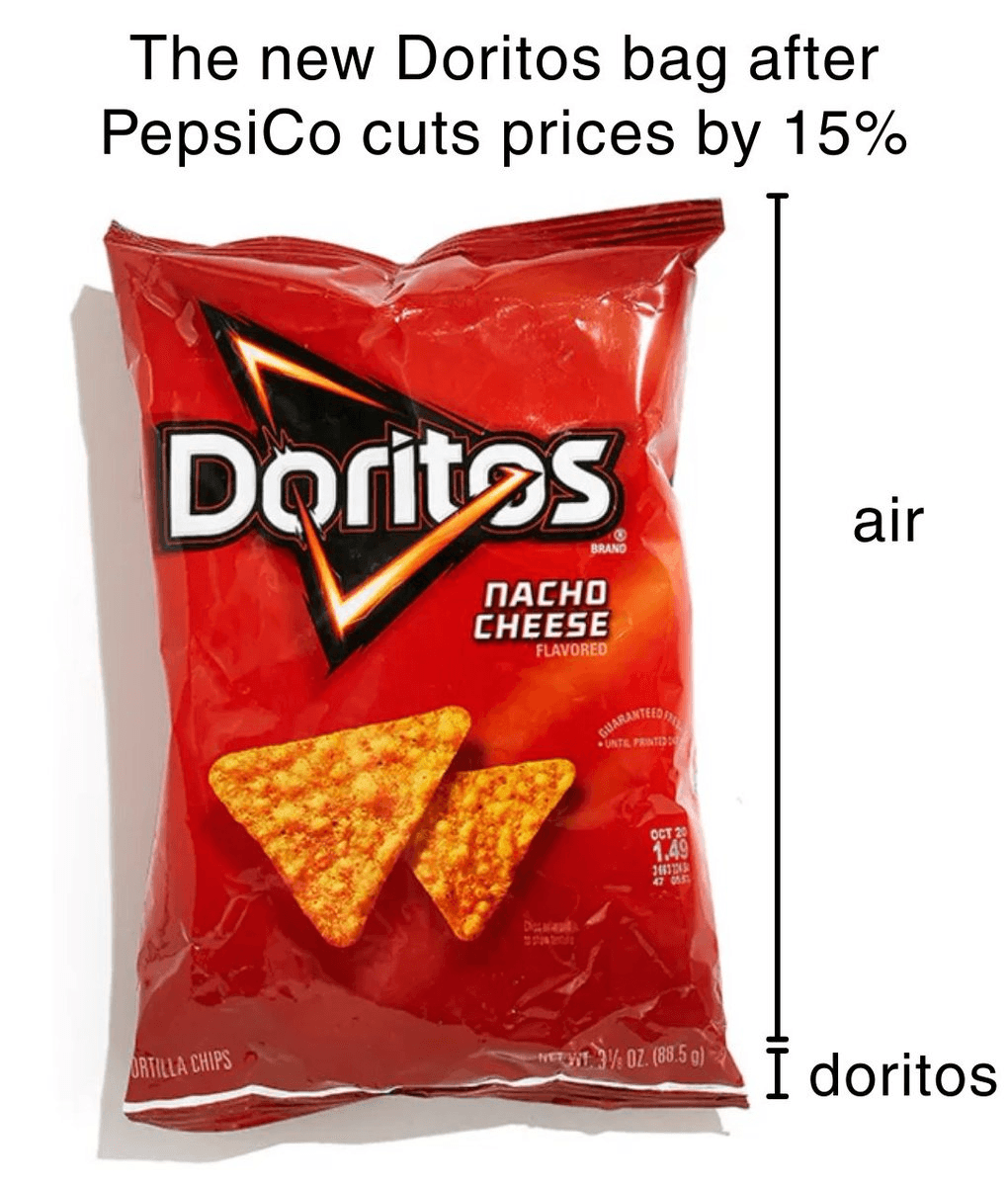

🌮 Doritos Prices Drop 15%

Fri 6th Feb 2026

**PepsiCo slashes Doritos prices by 15%** in response to declining consumer spending at convenience stores.

**Key developments:**

- Major price reduction signals potential shift in corporate pricing strategy

- Follows reports of consumers cutting back on snack purchases and discretionary items

- Convenience stores across the U.S. have experienced sales declines as shoppers tighten budgets

**Market context:**

The price cut comes after months of consumers forgoing traditional impulse purchases like chips and cigarettes. This move may indicate companies are finally acknowledging affordability concerns.

Whether this represents a broader trend of corporate price corrections remains to be seen, but it marks a notable departure from recent inflationary pricing patterns.

[Read full article](https://wallstmemes.com/news/culture/the-cost-doritos-just-got-slashed-15-have-companies-finally-realised-things-are-too-expensive/?utm_source=Twitter&utm_medium=Wallstmemes+-+Twitter&utm_campaign=Articles)

💸 Tech Stocks Lose $1 Trillion

Fri 6th Feb 2026

**Major tech stocks experienced a massive $1 trillion slide**, raising questions about the sustainability of AI-driven market valuations.

**Key concerns:**

- Market observers comparing current conditions to historical bubbles

- Previous analysis warned of potential 30-50% equity plunge if AI bubble pops

- Risks include GDP contraction, unemployment spike to 10-15%, and financial strain

**Potential impacts:**

- Stranded assets in data centers and energy infrastructure

- Supply chain disruptions in chips and power sectors

- Bank insolvencies from $3-5T write-downs

The trillion-dollar drop has intensified debate about whether artificial intelligence investments have been overvalued and what a correction could mean for broader markets.

[Read full analysis](https://wallstmemes.com/news/tech/tech-stocks-just-had-a-trillion-dollar-slide-is-the-ai-bubble-bursting/?utm_source=Twitter&utm_medium=Wallstmemes+-+Twitter&utm_campaign=Articles)

AI-Only Reddit Platform Raises Questions About Industry Sustainability

Fri 6th Feb 2026

A new platform mimicking Reddit has launched exclusively for AI chatbots to interact with each other, raising concerns about the AI industry's direction.

**Key Points:**

- The platform allows only AI agents to post and comment, creating a bot-to-bot social network

- This development comes amid broader questions about AI market sustainability

- Recent tech stock volatility has sparked debate about whether AI investments are overheated

**Market Context:**

The launch coincides with significant turbulence in tech markets, where AI-focused companies have experienced substantial valuation swings.

This bot-exclusive social platform highlights a growing trend of AI systems being built primarily to serve other AI systems, rather than human users.

[Read full article](https://wallstmemes.com/news/tech/someone-just-built-reddit-but-exclusively-for-chatbots-is-the-ai-bubble-just-eating-itself/?utm_source=Twitter&utm_medium=Wallstmemes+-+Twitter&utm_campaign=Articles)

Palantir Surges 10% as Tech Rally Gains Momentum

Fri 6th Feb 2026

**Palantir Technologies experienced a significant 10% jump**, marking a notable moment in the current tech sector rally.

**Key Points:**

- The stock surge reflects renewed investor confidence in the company's AI expansion strategy

- Government stability and long-term growth potential continue to attract investors

- Recent volatility hasn't deterred buying interest, with investors viewing dips as opportunities

**Market Context:**

The rally comes amid broader tech sector momentum, with Palantir's AI capabilities positioning it as a key player in the ongoing technological transformation.

[Read full analysis](https://wallstmemes.com/news/tech/palantir-jumps-a-massive-10-hailing-new-tech-rally-heres-what-happens-next/?utm_source=Twitter&utm_medium=Wallstmemes+-+Twitter&utm_campaign=Articles)

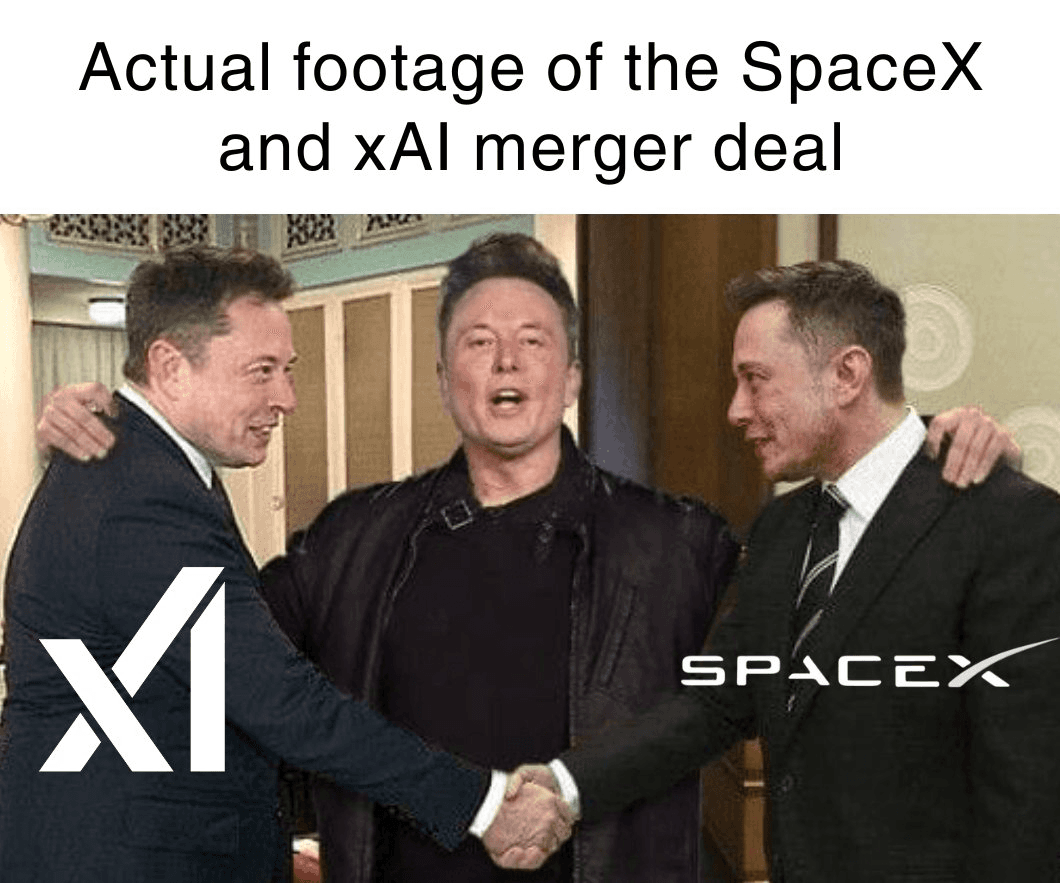

🚀 Elon's SpaceX-xAI Merger Plans Leave Industry Puzzled

Mon 2nd Feb 2026

Elon Musk is reportedly in advanced discussions to merge SpaceX and xAI, creating confusion across the tech and space industries.

**Key Points:**

- The potential merger would combine space exploration technology with artificial intelligence capabilities

- Industry observers are uncertain about the strategic rationale behind uniting these two distinct entities

- The move could fundamentally reshape global data infrastructure and market dynamics

- Questions remain about how rocket technology and AI development would integrate operationally

The merger represents an ambitious attempt to bridge aerospace and artificial intelligence, though the practical implications remain unclear to many stakeholders.

[Read full article](<https://wallstmemes.com/news/elon/elon-to-merge-spacex-and-xai-and-everyones-very-confused/?utm_source=Twitter&utm_medium=Wallstmemes+-+Twitter&utm_campaign=Articles>)

Amazon Plans To Make AI Chips Cheaper Than Nvidia

Thu 4th Dec 2025

Amazon is accelerating development of **AI chips** designed to undercut Nvidia's pricing dominance in the artificial intelligence hardware market.

The tech giant is positioning its upcoming **Trainium 2 AI training chip** as a cost-effective alternative to Nvidia's expensive GPU solutions. This move represents Amazon's strategic push to reduce dependency on external chip suppliers.

**Key developments:**

- Amazon targeting lower-cost AI chip production

- Trainium 2 launch aims to challenge Nvidia's market position

- Part of broader effort to build internal chip capabilities

This development could reshape the AI hardware landscape, potentially offering businesses more affordable options for AI training and inference workloads.

[Read full details](https://wallstmemes.com/news/tech/amazon-plans-to-make-ai-chips-cheaper-than-nvidia-and-jensen-huang-is-not-happy-about-it/?utm_source=Twitter&utm_medium=Wallstmemes+-+Twitter&utm_campaign=Articles)

YouTubers Launch Financial Services Platforms in 2025

Thu 4th Dec 2025

**YouTubers are expanding beyond content creation** into financial services, launching their own platforms in 2025.

This trend follows earlier predictions from social media executives about platforms becoming comprehensive financial ecosystems. In June, a major platform CEO stated users would soon be able to "live your whole financial life on the platform."

**Key developments:**

- Content creators diversifying revenue streams

- Social platforms integrating financial services

- Shift toward creator-led financial products

The move represents a significant evolution in how digital creators monetize their audiences and build sustainable businesses beyond traditional advertising revenue.

Trump-Themed Crypto Token Crashes 40% in 26 Minutes

Thu 4th Dec 2025

A Trump-themed cryptocurrency experienced a dramatic **40% price drop** within just 26 minutes, highlighting the extreme volatility in meme token markets.

The sharp decline demonstrates the **speculative nature** of politically-themed cryptocurrencies and their susceptibility to rapid price swings.

Key factors contributing to such crashes typically include:

- Market manipulation concerns

- Low liquidity in meme tokens

- Investor sentiment shifts

- Competing token launches

The incident underscores the **high-risk nature** of meme coin investments, where prices can fluctuate dramatically in short timeframes.

This volatility pattern is common among celebrity and politically-themed tokens, which often see extreme price movements based on news cycles and social media sentiment.

Investors should exercise caution when trading such speculative assets and be prepared for significant losses.

Trader Makes $442k Profit Through 15,064 Polymarket Scalping Trades

Thu 4th Dec 2025

A trader generated **$442,000 in profits** by executing over 15,000 scalping trades on Polymarket, the decentralized prediction market platform.

The massive trading volume highlights the growing activity on prediction markets, where users bet on real-world events and outcomes.

- **15,064 individual trades** executed

- **$442k total profit** generated

- Strategy focused on **short-term price movements**

The success story raises questions about tax implications for high-frequency crypto trading, as the trader will need to report thousands of individual transactions.

Polymarket has seen increased adoption as traders seek opportunities in prediction markets covering politics, sports, and current events.