New Concentrated Liquidity Markets on Sei Network

New Concentrated Liquidity Markets on Sei Network

🐉 New Sei yields incoming

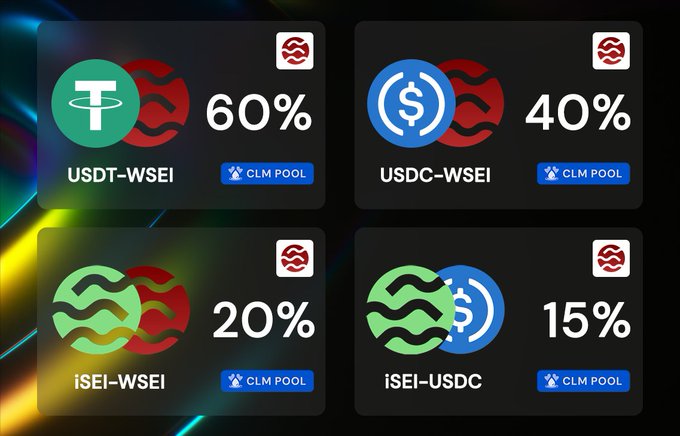

Beefy Finance is launching four new Concentrated Liquidity Markets (CLMs) on Sei Network in collaboration with DragonSwap DEX. The new markets include:

- USDT - WSEI

- USDC - WSEI

- iSEI - WSEI

- iSEI - USDC

These additions expand on Beefy's previous CLM offerings on Sei Network, which included USDT-WSEI and USDC-USDT pairs.

The new markets aim to provide additional yield opportunities for users in the Sei ecosystem. Interested participants can access these markets through the Beefy Finance platform.

MOCA-USDC Vault Launches on Beefy with 80% APY Autocompounding

A new **MOCA-USDC vault** is now available on Beefy Finance through Aerodrome on Base network. **Key Details:** - Current APY: **80% with autocompounding** - Platform: [Beefy Finance](https://app.beefy.com) via Aerodrome - Network: Base - Purpose: Earn yields while supporting the cultural economy The vault allows $MOCA token holders to generate passive income through automated yield optimization. Autocompounding means earned rewards are automatically reinvested to maximize returns over time.

Beefy DAO Opens Q1 2026 Contributor Funding Vote

Beefy DAO has launched three governance proposals for Q1 2026 contributor funding: - **[BIP:94]** Contributor Funding Q1 2026 - **[BIP:95]** Staworth Renewal - **[BIP:96]** Octav Renewal These budget requests cover contributor work scheduled from February through April 2026. The proposals are now live for community voting on [Snapshot](https://snapshot.box/#/s:beefydao.eth). This follows recent DAO activity including a convention budget proposal and a steering proposal exploring protocol coverage through Nexus Mutual.

Beefy Finance Generates $254k Weekly Yield, Launches 36 New Vaults Including TIG and ZEN

Beefy Finance reported $254k in weekly yield generation with Total Value Locked (TVL) increasing 5.7% over 7 days. The platform bought back 30.36 $BIFI tokens during this period. **Key Developments:** - Deployed 36 new vaults featuring TIG, pmUSD, and ZEN - $osETH LP vault offering 5% APY led deposit activity - Published article on "Building Financial Systems" featuring Octav and Staworth - Three new contributor funding proposals (BIPs 94-96) now available for community review The platform highlighted the power of compound interest, noting that doubling a penny daily for 30 days would yield over $5.3 million. Users can explore current vault offerings and APY rates across the platform's expanding ecosystem.

🚀 Monad Launch

**Beefy November Performance:** - **$1.73M yield distributed** at 9% average APY - **24 new strategies** deployed across chains - **23,800 harvests** processed automatically - **382 BIFI tokens** bought back **Major Milestone:** Beefy is now **live on Monad** - expanding DeFi yield opportunities to this high-performance blockchain. The platform continues automating yield farming, turning manual processes into passive income streams for users across multiple networks.

🛡️ DeFi Insurance Works

**Nexus Mutual quickly processed nearly $100k in claims** following the Stream Finance exploit, protecting users across multiple protocols. **Key highlights:** - Claims paid out in **under a week** to affected Beefy, Euler, and Harvest Finance users - Coverage extended across Base, Arbitrum, Avalanche, and Sonic networks - Users were protected despite **not directly using Stream Finance** **The contagion effect:** Many users couldn't withdraw funds due to liquidity issues where xUSD was used as collateral, demonstrating how DeFi protocols' interconnected nature creates cascading risks. **Partners like OpenCover** facilitated the rapid payout process, showcasing how **multi-protocol coverage** can provide a safety net against second-order effects in DeFi. This incident highlights both the **real risks of protocol interdependence** and the **effectiveness of DeFi insurance** when properly implemented.