Moonwell DeFi Sees Remarkable Growth on Base Network

Moonwell DeFi Sees Remarkable Growth on Base Network

🚀 Moonwell's Meteoric Rise

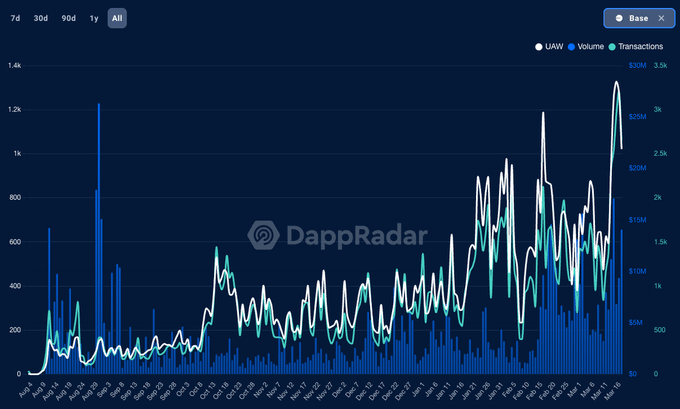

Moonwell DeFi, a lending platform on the Base network, has experienced significant growth in recent weeks. According to statistics shared by Gauntlet, Moonwell's active wallets have increased from 7,300 to 18,700 since January. The platform's total value locked (TVL) has risen from under $40 million to over $108 million during the same period. Fees paid to lenders on Moonwell now stand at $2.3 million per year, excluding rewards, while the protocol's revenue is at $485,000 per year. These figures highlight Moonwell's rapid adoption and the growing interest in decentralized finance (DeFi) on the Base network.

It's still early in our @Base liquidity journey, but @MoonwellDeFi has seen some remarkable growth in the last few weeks: - Active wallets up from 7.3K to 18.7K since Jan. - TVL from <$40m to >$108M since Jan. - Fees to lenders now @ $2.3M/year (not counting rewards) - Protocol

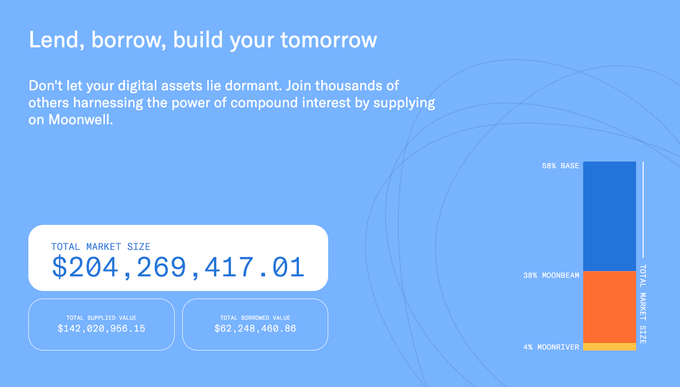

Moonwell's market size has now surpassed $200M! 🔥 In the past 30 days on @Base and @MoonbeamNetwork, we've seen an impressive ~19k unique active wallets, ~51k transactions, and around $230M in volume. Join us and experience lending made simple — 🌜 moonwell.fi 🌛

And it's live! The gas target has been increased by 50% (to 3.75 mgas/s), with plans to increase it further early next week One small step in a larger effort to reduce fees on Base

Since we rolled out 4844, we’ve seen a 5x increase in demand on @base, driving fees back up To reduce fees and scale, we’re increasing the gas target 50% (to 3.75 mgas/s) tomorrow and then to 5 mgas/s following an observation period, targeting early next week

Thanks to last week's Ethereum upgrade, transaction fees on @Base were significantly reduced. This led to the highest number of unique active wallets and transactions ever on Moonwell! Lower fees are essential to bringing the world onchain 🌜🌐🌛

We're excited to share that Moonwell on @Base has reached a new milestone — $70M in Total Value Locked! 🌜🔵🌛 Thank you to the community for your steadfast support. Together, we're advancing onchain finance and creating a more inclusive global economy!

The Dencun upgrade is now live! A big thank you to the @Base and @OPLabsPBC teams for their incredible work in scaling Ethereum. At 0:00 UTC, expect to see significantly reduced fees on Base 🔵 Lending and borrowing on Moonwell is about to become more affordable than ever! 🌜🌛

blobs are live on ethereum! @base and the superchain will upgrade to leverage them at 00:00:01 UTC tomorrow / 5p PST today two years of hard work alongside thousands of other contributors around the world - about to pay off!

And just like that, $100M in Total Value Locked on @Base! Thank you to the community for your continued support. This milestone wouldn't have been possible without you. 🌜🔵🌛

🌜🔵🌛 @Base season is here! Moonwell has now reached $90M in Total Value Locked! A big thank you to everyone who has tried Moonwell in recent weeks. We're incredibly grateful for the support as we work toward simplifying DeFi and promoting financial inclusion worldwide.

Moonwell is lending made simple. We're committed to streamlining onchain finance, empowering both beginners and seasoned experts alike to do more with their crypto. Join us today at moonwell.fi 🌜🌛

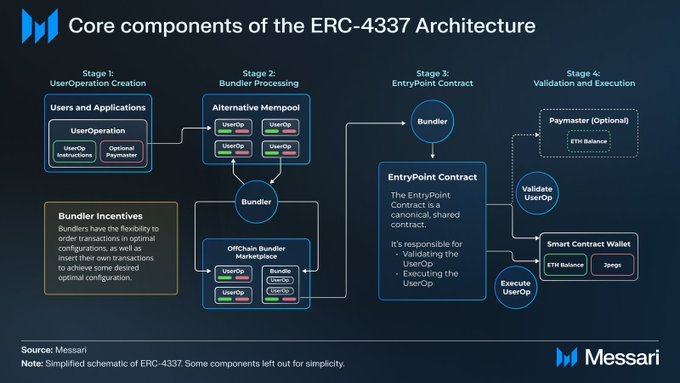

Smart wallets are coming to @Base! - Create a wallet with a secure passkey on your mobile device (no seed phrases) - Use your favorite apps like @MoonwellDeFi and @aerodromefi with biometric signing (FaceID) - Bundlers process tx more efficiently - Paymasters pay tx fees 🌜🔵🌛

🌜🌛 New rewards are now live on Moonwell's USDC market! The Moonwell community is committed to promoting the adoption of @Circle's USDC on @Base. In collaboration with @Gauntlet_xyz, 50,000 USDC have been made available to those supplying this popular stablecoin on Moonwell.

Moonwell Q4 Revenue Surges 71% to $901K, Driven by Base Network Growth

**Moonwell's Q4 Performance Shows Strong Growth** Moonwell reported Q4 revenue of **$901.21K**, marking a **71% increase** from Q3. The growth was primarily driven by activity on Base network. **Key Revenue Drivers:** - Fee growth on Base directly converted to protocol revenue - Increased borrowing demand led to higher interest rates - Higher rates generated more revenue for WELL token reserve auctions **Broader Q4 Metrics:** - Fees, revenue, and monthly active users all increased quarter-over-quarter - Capital utilization improved, with less idle assets - Growth sustained despite cooling market conditions The revenue cycle creates a positive feedback loop: more borrowing activity → higher rates → increased revenue → more WELL tokens acquired through monthly reserve auctions. Full Q4 report available on [Binance](https://www.binance.com/en/square/post/35170977363625) and Token Terminal.

Moonwell Completes Moonriver Shutdown Following Chainlink Oracle Deprecation

Moonwell has officially deprecated its protocol on Moonriver network following Chainlink's decision to discontinue oracle feeds starting February 1st. **Key Actions Taken:** - Proposal MIP-R38 passed, setting all market collateral factors to 0% - Collateral factors were gradually reduced over recent months - Bad debt risk to the protocol has been eliminated **What Users Need to Know:** - Users with supplied collateral can withdraw anytime via the market or Portfolio page - Risk parameters were managed by Anthias Labs, Moonwell's risk manager - Support available on [Discord](https://discord.com/invite/moonwellfi) for withdrawal assistance The decision prioritizes user safety as the underlying oracle infrastructure becomes unavailable. Full details in [MIP-R38](https://moonwell.fi/governance/proposal/moonriver?id=72).

📞 Moonwell January Governance Call Tomorrow at 17:00 UTC

Moonwell's monthly governance call, hosted by Boardroom, takes place tomorrow at 17:00 UTC on X Spaces. **What to Expect:** - Latest governance news and updates from contributors - Current market analysis and insights - Community discussion and Q&A [Set your reminder](https://x.com/i/spaces/1OdKrOBYzDQGX?s=20) to join the conversation and stay informed about protocol developments.

🚀 ETH Loans Now Live

**Moonwell's USDC Vault now supports Ethereum-backed loans** directly in the Coinbase app, expanding beyond Bitcoin lending. **Key developments:** - Curators allocated liquidity to the cbETH/USDC market on Morpho - Higher borrowing activity drives increased utilization and revenue - Vault serves as primary liquidity source for ETH-backed loans **Access points:** - [Explore USDC Vault](https://moonwell.fi/vaults/deposit/base/mwusdc) - [Real-time tracking](https://morpho.blockanalitica.com/base/vaults/vaults?search=moonwell) This expansion follows Moonwell's successful Bitcoin lending integration and represents continued growth in institutional DeFi adoption.

Moonwell Launches New Governance Dashboard and Expands Bitcoin Lending Features

**Moonwell** rolled out several key updates this week: - **New governance dashboard** created by @joel_obafemi to track reserve auctions and vote-to-claim staking rewards - **Mamo account upgrades** for USDC and Bitcoin functionality - **Bitcoin borrowing discussion** on Edge Podcast featuring @LukeYoungblood and @GrafaCrypto about using Moonwell Vaults on Base - **$CYPR airdrop rewards** for Moonwell Card users from Cypher - **DuneCon25 presence** with contributor @danimimm attending in Buenos Aires The governance improvements aim to **increase community participation** through enhanced tracking of reserve auctions and staking rewards.