Moonwell's USDC Vault now supports Ethereum-backed loans directly in the Coinbase app, expanding beyond Bitcoin lending.

Key developments:

- Curators allocated liquidity to the cbETH/USDC market on Morpho

- Higher borrowing activity drives increased utilization and revenue

- Vault serves as primary liquidity source for ETH-backed loans

Access points:

This expansion follows Moonwell's successful Bitcoin lending integration and represents continued growth in institutional DeFi adoption.

Recap from last week on Moonwell: • New @edge_pod podcast • @Mamo USDC and Bitcoin Account Upgrades • Token2049 interview with @grafacrypto • @Cypher_HQ_ airdrop for Moonwell Card users • Moonwell at DuneCon25 this year • New governance dashboard

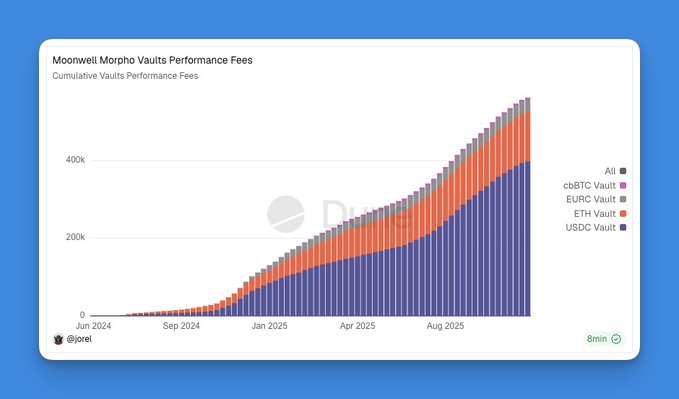

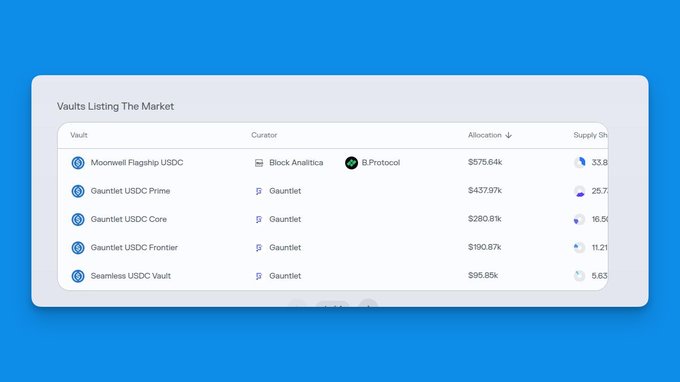

The Moonwell USDC Vault on @Base leads all Moonwell Vaults in fee generation. Demand for loans backed by Bitcoin collateral on Coinbase drives much of this growth. As Coinbase expands loan access globally, this vault will become an even larger source of revenue for Moonwell.

Idle assets hinder progress. The new Moonwell Ecosystem USDC Vault on @Base is designed as a model that other projects can adapt for their own treasuries. WELL tokens on the balance sheet turn into productive liquidity, supporting Moonwell's operations and long-term growth.

🌜🟦🌛 The Moonwell Flagship USDC Vault is now integrated into @FractionAI_xyz on @Base. It's simple to build on top of Moonwell and our @Morpho-powered vaults. Gain access to a steady source of returns and unlock use cases and opportunities for the ecosystem.

Fraction AI is partnering with @MoonwellDeFi to accelerate DeFi’s evolution into DeFAI. Together, we are enabling autonomous agents to deploy capital across the most valuable onchain assets. Moonwell stands out as one of the top protocols in DeFi, delivering dynamic interest

Recap from last week on Moonwell: • Base DeFi podcast with @0xResearch • Shopping with Moonwell Card • @tokenterminal Spotlight: Active users are trending up! • Moonwell USDC Vault facilitating @Coinbase USDC loans • Borrow USDC against WELL, stkWELL, and MAMO (@mamo)

Now Live: WELL Rewards on Moonwell Vaults! 🦋 Deposit into any Moonwell Vault on Base (USDC, ETH, cbBTC, EURC) and earn WELL rewards. Deposited since October 10? Rewards have been retroactively distributed and are ready to claim.

The Moonwell Card connects onchain finance to everyday life. 🌐 Borrow against your crypto or autoload straight from your vault. Shop anywhere Visa is accepted, all while your stablecoins keep earning at 2-3x the rate of inflation.

Highlights from the last week: • Moonwell and @Mamo unification roadmap • Analyzing protocol revenue with @Joel_Obafemi • @FractionAI_xyz integrates the Moonwell USDC Vault • @LukeYoungblood featured in Bloomberg • Spotlight: Turning treasuries into productive liquidity

Moonwell makes lending composable and easy to integrate. Developers build on top. Users get better experiences. The future is onchain. 🛠️

14/ Core primitives form composable ‘money legos’ for modular lending, borrowing, yield, and more Teams like @aave @compoundfinance @eulerfinance @0xfluid @maplefinance @MoonwellDeFi @MorphoLabs @skyEcosystem @Frax @pendle_fi @veda_labs @WisdomTreePrime @Polymarket @synthetix

The Moonwell Flagship USDC Vault on @Base is ready to support Ethereum-backed loans in the @Coinbase app. Our curators have allocated liquidity to the cbETH/USDC market on @Morpho to meet this new demand. Higher borrowing activity increases utilization and revenue for Moonwell.

If you believe in somΞTHing, this one's for you. ETH-backed loans are here. You can borrow USDC against your Ethereum, unlocking liquidity without selling. Available now in the U.S. (ex. NY).

🌜🦋🌛 WELL Rewards Renewed! Over the next 30 days, 3.33M WELL will be distributed across Moonwell Vaults on @Base to sustain their growth and adoption. Powered by @MorphoLabs, the vaults remain the top choice for depositors and continue to set the standard for lending on Base.

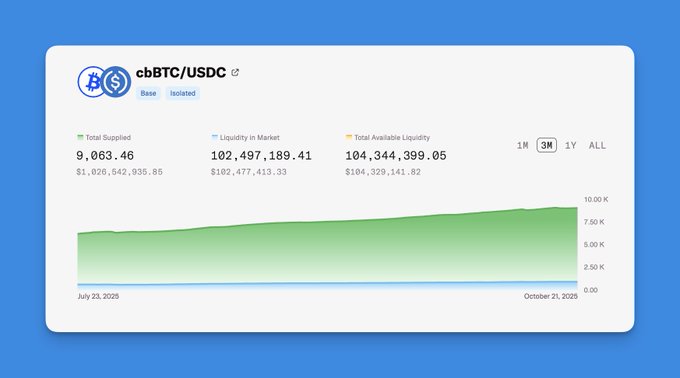

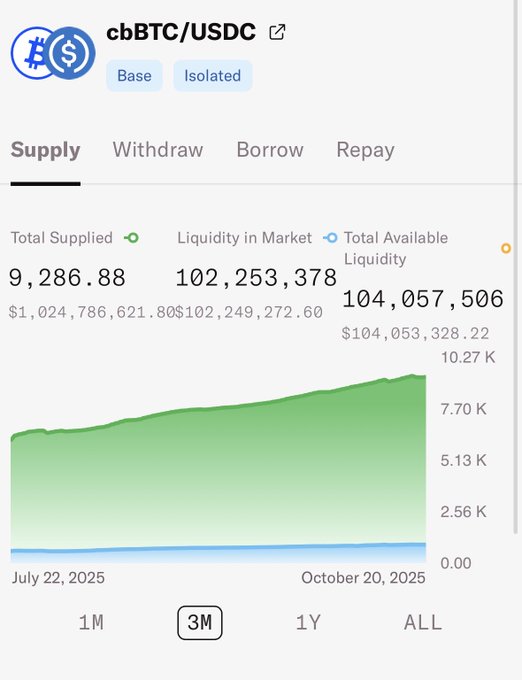

Over $1B is now supplied to the cbBTC/USDC market on @MorphoLabs. @Coinbase’s borrow product drives much of this growth, letting users borrow USDC against Bitcoin. The Moonwell USDC Vault helps provide liquidity for these loans, generating revenue that rewards WELL stakers.

Thought I’d share this : On the Moonwell $CBTC / $USDC market pair : There is currently 9,286 Bitcoin supplied Valued at $1,024,786,621 billion dollars All is $well with @MoonwellDeFi $aero $morpho $mamo $btc #base

ICYMI: A new Moonwell Vault has launched on @Base. The Moonwell Ecosystem USDC Vault, powered by @MorphoLabs and curated by @anthiasxyz, lets you supply USDC that can be borrowed against WELL, staked WELL, and MAMO (@mamo). Rewards for this vault are coming soon. 🦋

Introducing the Moonwell Ecosystem USDC Vault on @Base! 🦋 Built on @MorphoLabs and curated by @anthiasxyz, this strategic vault is designed to support the long-term growth of our ecosystem. Deposit USDC and let it be borrowed against WELL, staked WELL, and MAMO (@mamo).

Recap from last week on Moonwell: • WELL rewards on Moonwell Vaults (@Base) • Fees and revenue integrated on @coingecko • @LukeYoungblood featured in @dlnews • Staking rewards now claimable in Moonwell app • October Governance Call + participation continues to increase

Did you know @MorphoLabs is on @Optimism Mainnet? Earn borrower fees and additional WELL incentives by depositing into the Moonwell Flagship USDC Vault. The vault currently pays a total APY of 8.2%. 🔴

A new way to put USDC to work. 🦋 Next week, the Moonwell Ecosystem USDC Vault goes live. Built on @MorphoLabs, it creates a public credit facility where WELL holders can borrow against their WELL. Part of the growing suite of Moonwell Vaults on @Base.

Financing the long-term growth of the Moonwell ecosystem through @MorphoLabs markets and vaults. Listen to our contributor @LukeYoungblood explain the new private credit facility where WELL on the balance sheet can be used as collateral to borrow USDC.

🌜🦋🌛 A new Moonwell Ecosystem USDC Vault is coming to @Base, built on @MorphoLabs and curated by @anthiasxyz. Stay tuned for more details next week!

The voting period for MIP-B47 has ended. ✅ The proposal has passed and entered the 24-hour Vote Collection period. 🗳 Results: moonwell.fi/governance/pro…

Moonwell Upgrades Oracle Extracted Value Mechanism to Boost Protocol Revenue

Moonwell has deployed an improved version of its Oracle Extracted Value (OEV) mechanism, more than a year after becoming the first lending protocol to implement this technology. **Key developments:** - New OEV contracts are now operational on Base and OP Mainnet - The upgraded system is designed to significantly increase protocol revenue - OEV allows Moonwell to capture value that was previously lost during liquidation events - Additional revenue flows back to WELL token stakers monthly The mechanism enhances capital efficiency by redirecting value that would otherwise be extracted by third parties during oracle price updates and liquidations. This represents a technical advancement in how DeFi protocols can optimize their economic models. For technical details, see the explanation from Luke Youngblood.

Moonwell Launches First Morpho V2 Vault Migration

Moonwell has launched its **Ecosystem USDC V2 Vault**, marking the first transition to the Morpho V2 standard on Base. **Key Updates:** - V2 vaults offer greater flexibility and enhanced capabilities compared to V1 - Deposits remain possible in V1 vaults, but liquidity is expected to migrate to V2 - All remaining Moonwell vaults will transition from V1 to V2 in coming weeks - The vault is now listed in the Morpho app and integrated with Jumper Exchange The upgrade builds on Morpho's existing infrastructure while providing users with improved functionality for their USDC deposits on Base.

Moonwell Closes USDC Vault on Optimism, Shifts Focus to High-Demand Markets

Moonwell has deprecated its Flagship USDC Vault and associated Morpho Isolated Markets on OP Mainnet, redirecting resources toward more productive opportunities. **Key Changes:** - New deposits are no longer accepted - Existing deposits remain fully accessible for withdrawal - No additional changes planned for this vault **Action Required:** - Withdraw remaining funds via [Moonwell](http://moonwell.fi) or Morpho app - Review positions to confirm balances post-withdrawal **Unaffected Services:** - All Moonwell Core Markets on OP Mainnet remain fully operational This follows Moonwell's recent Moonriver deprecation, which was prompted by Chainlink's oracle feed sunset. The protocol reduced collateral factors to 0% across all Moonriver markets to prevent bad debt accumulation. For withdrawal assistance, visit [Moonwell Discord](https://discord.com/invite/moonwellfi).

Moonwell Contributor Luke Youngblood Featured in Bloomingbit

Luke Youngblood, a contributor to the Moonwell protocol, has been featured in coverage by Bloomingbit. This follows previous media attention from Money, highlighting growing interest in Moonwell's work in the DeFi space. **Key Points:** - Moonwell contributor gaining media visibility - Featured across multiple financial media outlets - Reflects broader attention on the protocol's development The coverage comes as Moonwell continues its focus on building secure lending infrastructure in decentralized finance.

Crypto-Backed Loans Surge 32.72% in 2025

**Active crypto-backed loans grew 32.72% throughout 2025**, with the majority secured by Ethereum or Bitcoin collateral. This growth reflects increasing adoption of decentralized lending protocols as users leverage their crypto holdings for liquidity without selling their assets. - Primary collateral types: Ethereum and Bitcoin - Year-over-year growth: 32.72% - Trend indicates growing confidence in crypto-backed lending infrastructure