Messari Report: Chainlink Evolves Into Full-Stack Institutional Platform

Messari Report: Chainlink Evolves Into Full-Stack Institutional Platform

🏗️ Chainlink's institutional makeover

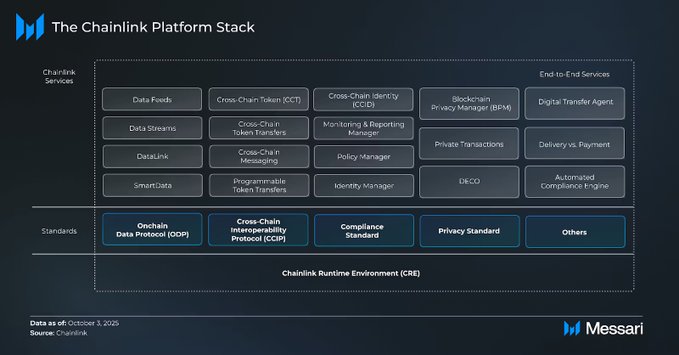

Chainlink transforms beyond price feeds into a comprehensive institutional platform, according to Messari's latest Pulse report.

The oracle network now serves as infrastructure for tokenized assets, combining multiple services into one orchestration layer:

- Data feeds and compliance tools

- Programmability and interoperability features

- Privacy-focused solutions

Top institutions and DeFi protocols are adopting Chainlink's global standards to support the complete lifecycle of tokenized financial products.

This positions Chainlink as the foundational layer for stablecoins, tokenized funds, and financial applications requiring verifiable, compliant infrastructure.

Read the full analysis: Messari Report

As the leading perp DEX with billions in open interest and daily trading volume, @HyperliquidX is emerging as one of the fastest-growing DeFi ecosystems. To accelerate Hyperliquid's growth, Chainlink provides builders with the critical oracle infrastructure that enables faster,

Kinetiq (@kinetiq_xyz)—a leading liquid staking protocol on @HyperliquidX with $1.8B+ in TVL—has made its LST, kHYPE, a Cross-Chain Token (CCT), enabling it to be natively transferable across Ethereum and HyperEVM via Chainlink CCIP. Kinetiq has also adopted Chainlink Data

In the latest Pulse report, @MessariCrypto dives into Chainlink's evolution from price feeds to a full-stack platform and set of global standards adopted by top institutions and DeFi protocols to support the full lifecycle of tokenized assets. messari.io/report/chainli… "By

Chainlink isn’t just powering price feeds anymore; it’s becoming the backbone of onchain finance. With $322B+ in tokenized RWAs and major institutions like J.P. Morgan, Fidelity, UBS, and Swift building on its stack, @chainlink is evolving into a full-stack platform for onchain

FTSE Russell and Major Financial Institutions Explore Onchain Data Standards at SmartCon 2025

**Major financial institutions are accelerating their move to blockchain infrastructure.** At SmartCon 2025, leaders from **FTSE Russell, Tradeweb, Deutsche Börse, and Digital Asset** discussed how onchain data and institutional interoperability are reshaping global finance. **Key developments include:** - FTSE Russell's Head of Digital Assets emphasizing the need for **data standardization onchain** - Focus on **AI-driven automation** converging with blockchain technology - Institutional push for **cross-chain interoperability standards** This follows recent momentum from major players: - **DTCC** planning to tokenize $100 trillion in assets - **J.P. Morgan** highlighting Chainlink's critical role at Federal Reserve conferences - **S&P Global** and **Citi** advancing onchain finance adoption The discussions signal a **coordinated industry effort** to establish blockchain infrastructure standards that can support traditional financial markets at scale.

🏦 UBS Launches First Live Tokenized Fund with Chainlink

**UBS and Chainlink have launched the first live tokenized fund workflow** in production, marking a significant milestone for institutional blockchain adoption. The solution uses Chainlink's Digital Transfer Agent (DTA) standard and Runtime Environment to automate fund subscriptions and redemptions on-chain. **DigiFT's new whitepaper** details how this system operates within Hong Kong's regulatory framework. Key features include: - Automated transaction recordkeeping through smart contracts - Compliance with existing regulatory standards - Scalable infrastructure for tokenized assets Developed under Hong Kong Cyberport's digital asset program, this represents **real-world implementation** of blockchain technology in traditional finance, demonstrating how major banks can integrate on-chain operations while maintaining regulatory compliance.

🔗 Chainlink Slows Down

**Chainlink integration activity decreased significantly this week** with 18 new integrations across 6 services and 15 chains, down from 52 integrations the previous week. **Key new integrations include:** - Major blockchain networks: Aptos, Bittensor, Hedera, Injective - DeFi protocols: Bedrock DeFi, ApeX DEX - Infrastructure projects: Dusk Foundation, Etherlink **Chains seeing activity:** - Established networks: Ethereum, Arbitrum, Base, BNB Chain - Emerging chains: AB Blockchain, Memento, XDC The integration pace has **slowed from recent weeks** when Chainlink saw 52-62 weekly integrations. This week's 18 integrations represents a more moderate expansion rate. [Explore complete ecosystem](https://www.chainlinkecosystem.com/)

21shares Co-Founder Reveals Growth Strategy at SmartCon 2025

At SmartCon 2025, **21shares Co-Founder Ophelia Snyder** outlined the company's disciplined approach to making crypto accessible globally. Key highlights from her presentation: - Emphasized that **changing the world takes time** but requires consistent, step-by-step progress - Shared foundational principles behind 21shares' growth strategy - Focused on expanding crypto accessibility to broader audiences worldwide Snyder's talk provided insights into how traditional financial infrastructure can bridge the gap between crypto and mainstream adoption. [Watch the full presentation](https://youtu.be/E5K7Rvdn0JI)