Chainlink integration activity decreased significantly this week with 18 new integrations across 6 services and 15 chains, down from 52 integrations the previous week.

Key new integrations include:

- Major blockchain networks: Aptos, Bittensor, Hedera, Injective

- DeFi protocols: Bedrock DeFi, ApeX DEX

- Infrastructure projects: Dusk Foundation, Etherlink

Chains seeing activity:

- Established networks: Ethereum, Arbitrum, Base, BNB Chain

- Emerging chains: AB Blockchain, Memento, XDC

The integration pace has slowed from recent weeks when Chainlink saw 52-62 weekly integrations. This week's 18 integrations represents a more moderate expansion rate.

⬡ Chainlink Adoption Update ⬡ This week, there were 17 integrations of the Chainlink standard across 6 services and 11 different chains: Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Linea, MegaETH, Memento, Plasma, Solana, TAC. New integrations include @balconytech,

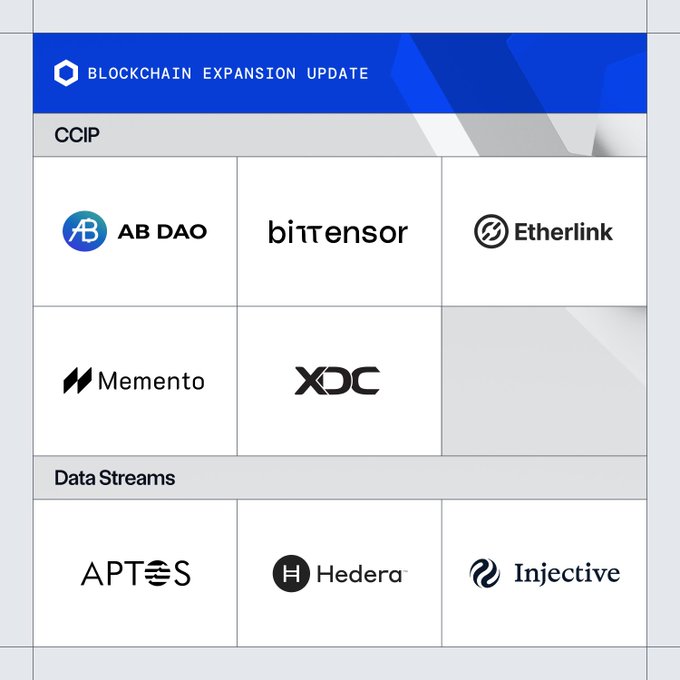

BLOCKCHAIN EXPANSION UPDATE This week, Chainlink services expanded across the following blockchains: CCIP • AB Blockchain • Bittensor • Etherlink • Memento • XDC Data Streams • Aptos • Hedera • Injective EVM

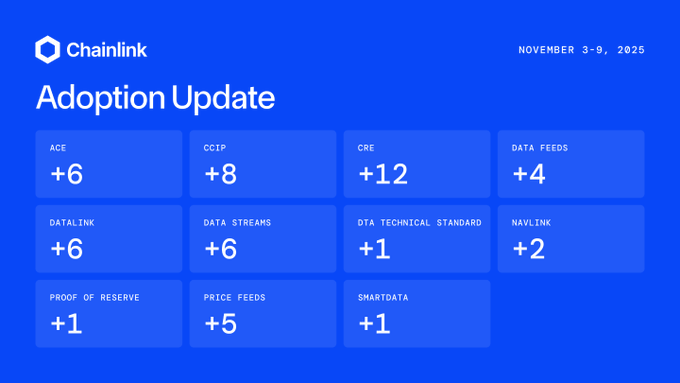

⬡ Chainlink Adoption Update ⬡ This week, there were 52 integrations of the Chainlink standard across 11 services and 15 different chains: 0G, Aptos, Arbitrum, Avalanche, Base, BNB Chain, Ethereum, HyperCore, HyperEVM, Ink, Monad, Plasma, Ronin, Sei, and X Layer. New

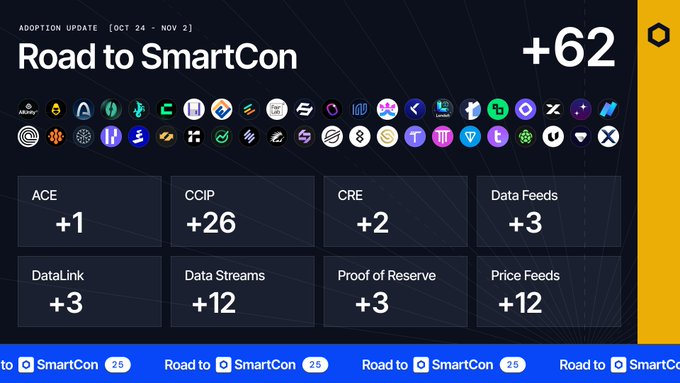

⬡ Chainlink Adoption Update ⬡ This week, there were 62 integrations of the Chainlink standard across 8 services and 24 different chains: Arbitrum, Arc, Avalanche, Base, Berachain, BNB Chain, Canton Network, Corn, Ethereum, Etherlink, Katana, Linea, Mantle, Monad, opBNB,

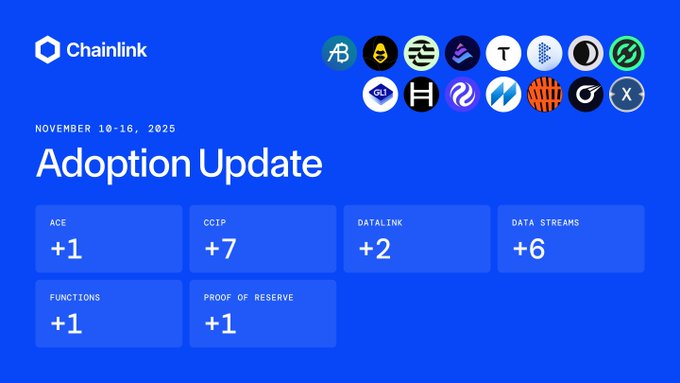

⬡ Chainlink Adoption Update ⬡ This week, there were 18 integrations of the Chainlink standard across 6 services and 15 different chains: AB Blockchain, Aptos, Arbitrum, Base, Bittensor, BNB Chain, Dusk, Ethereum, Etherlink, Hedera, Injective EVM, Mantle, Memento, Optimism, and

FTSE Russell and Major Financial Institutions Explore Onchain Data Standards at SmartCon 2025

**Major financial institutions are accelerating their move to blockchain infrastructure.** At SmartCon 2025, leaders from **FTSE Russell, Tradeweb, Deutsche Börse, and Digital Asset** discussed how onchain data and institutional interoperability are reshaping global finance. **Key developments include:** - FTSE Russell's Head of Digital Assets emphasizing the need for **data standardization onchain** - Focus on **AI-driven automation** converging with blockchain technology - Institutional push for **cross-chain interoperability standards** This follows recent momentum from major players: - **DTCC** planning to tokenize $100 trillion in assets - **J.P. Morgan** highlighting Chainlink's critical role at Federal Reserve conferences - **S&P Global** and **Citi** advancing onchain finance adoption The discussions signal a **coordinated industry effort** to establish blockchain infrastructure standards that can support traditional financial markets at scale.

🏦 UBS Launches First Live Tokenized Fund with Chainlink

**UBS and Chainlink have launched the first live tokenized fund workflow** in production, marking a significant milestone for institutional blockchain adoption. The solution uses Chainlink's Digital Transfer Agent (DTA) standard and Runtime Environment to automate fund subscriptions and redemptions on-chain. **DigiFT's new whitepaper** details how this system operates within Hong Kong's regulatory framework. Key features include: - Automated transaction recordkeeping through smart contracts - Compliance with existing regulatory standards - Scalable infrastructure for tokenized assets Developed under Hong Kong Cyberport's digital asset program, this represents **real-world implementation** of blockchain technology in traditional finance, demonstrating how major banks can integrate on-chain operations while maintaining regulatory compliance.

Messari Report: Chainlink Evolves Into Full-Stack Institutional Platform

**Chainlink transforms beyond price feeds** into a comprehensive institutional platform, according to Messari's latest Pulse report. The oracle network now serves as **infrastructure for tokenized assets**, combining multiple services into one orchestration layer: - Data feeds and compliance tools - Programmability and interoperability features - Privacy-focused solutions Top institutions and DeFi protocols are adopting Chainlink's **global standards** to support the complete lifecycle of tokenized financial products. This positions Chainlink as the **foundational layer** for stablecoins, tokenized funds, and financial applications requiring verifiable, compliant infrastructure. Read the full analysis: [Messari Report](https://messari.io/report/chainlink-a-full-stack-institutional-platform)

21shares Co-Founder Reveals Growth Strategy at SmartCon 2025

At SmartCon 2025, **21shares Co-Founder Ophelia Snyder** outlined the company's disciplined approach to making crypto accessible globally. Key highlights from her presentation: - Emphasized that **changing the world takes time** but requires consistent, step-by-step progress - Shared foundational principles behind 21shares' growth strategy - Focused on expanding crypto accessibility to broader audiences worldwide Snyder's talk provided insights into how traditional financial infrastructure can bridge the gap between crypto and mainstream adoption. [Watch the full presentation](https://youtu.be/E5K7Rvdn0JI)