Lista DAO Reaches $4 Billion TVL Milestone in September

Lista DAO Reaches $4 Billion TVL Milestone in September

📈 $4B TVL Reached

Lista DAO achieved significant growth in September 2025, reaching $4 billion in TVL with 85 million lisUSD supply and 45,000 active users.

Key Developments:

- Lista Lending expanded with SolarX Protocol's $SOLX and Terra 2.0's $LUNA2 integration

- Dynamic APR feature reduced borrowing rates by up to 15% during low-demand periods

- Liquidation 2.0 introduced SMS notifications for position management

Ecosystem Growth:

- Completed CertiK audit with full compliance report

- #ListaHack2025 attracted 150+ developers with $50,000 in prizes

- PulseChain DeFi partnership launching cross-chain liquidity campaign mid-October

- slisBNBx qualified for Uniswap V3 $UNI airdrops

Recognition:

Messari Crypto's DeFi Pulse report highlighted Lista DAO as a top performer on BNB Chain.

The protocol continues building on August's success of 1 million BNB staked, with ongoing expansion of collateral options through PancakeSwap LP token integration.

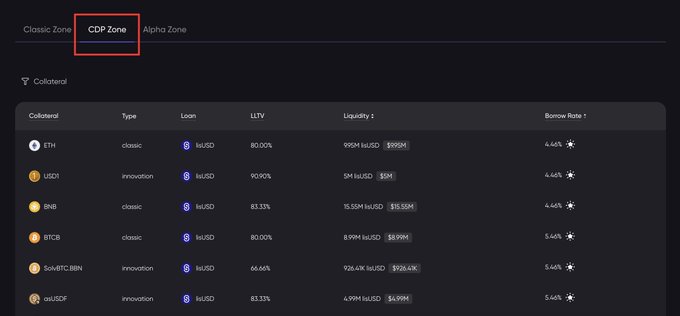

#ListaWeeklyRecap Sep 19, 2025 🗳 DAO & Governance - Week 61 veLISTA rewards ~281K LISTA, 42.74% APR - $LISTA listed on @ChangeNOW_io - Community feedback portal added to homepage 🏦 Lista Lending - Adding CDP zone to Lista Lending: All borrowing in one place - New statera

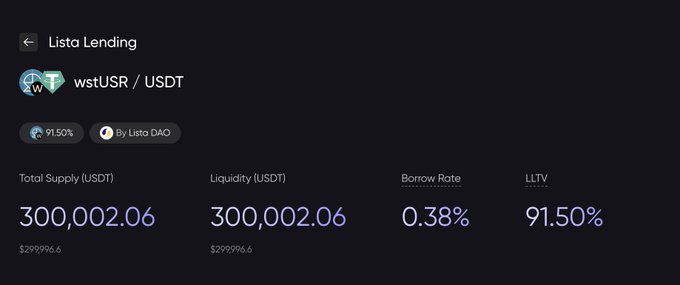

📢 New Market Live: wstUSR/USDT on @lista_dao Collateralize your @ResolvLabs $wstUSR and borrow USDT at ultra-low cost: 🔹 Borrow Rate: 0.38% 🔹 Liquidity: $300K+ 🔹 LLTV: 91.5% 👉 lista.org/lending/market…

Lista Lending UX Update✨ All borrowing in one place. The CDP Zone is now integrated directly into Lista Lending. Users can supply, borrow, and collateralize all in one place. Borrow lisUSD from the CDP Zone: lista.org/lending?zone=2…

LP Power-Up 3-Day Campaign is LIVE! @PancakeSwap x @lista_dao Day 1⚡️ 1️⃣ Deposit any PancakeSwap LP on Lista DAO 2️⃣ Borrow ≥ 50 $lisUSD 3️⃣ Hold the borrowed $lisUSD for at least 15 days to qualify (Before Oct 30th). 🎁100 winners -> 20 USDT each. 👉 lista.org/lending?tab=bo…

🍰 New Collateral Unlocked on @lista_dao CDP @PancakeSwap LP positions now live in the CDP Zone. LPs can now be used as collateral to borrow $lisUSD. More capital efficiency. More utility. 🧵👇

New Statera USDT Vault on @lista_DAO! Statera Labs is a pioneering on-chain hedge fund and risk manager specializing in institutional-grade DeFi vault curation. The vault provides low-risk exposure through collateral backed exclusively by resilient assets such as @ethena_labs

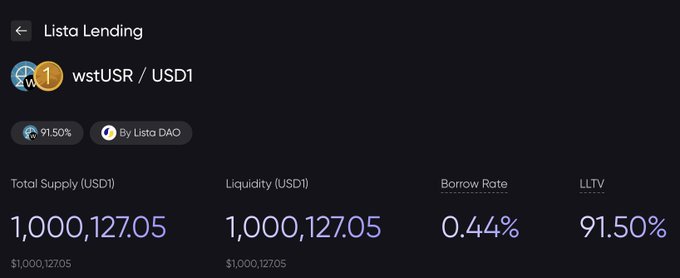

wstUSR/USD1 Lending Market is Live on @lista_dao Users can now collateralize @ResolvLabs $wstUSR to borrow out USD1: 🔸 Borrow Rate: 0.44% 🔸Liquidity: $1M+ USD1 🔸LLTV: 91.5% Fresh liquidity, low cost. 👉 lista.org/lending/market…

#ListaWeeklyRecap Sep 26, 2025 🗳 DAO & Governance - Week 62 veLISTA Rewards ~279K LISTA, 41.90% APR - veLISTA Borrowing Rebate Cap Adjustment - Live Stream AMA with @PancakeSwap on LPs as Collaterals - Joined telegram AMA with @NianNianCTO_BNB community 🏦 Lista Lending - IRM

Morpho Labs MORPHO Token Joins Binance HODLer Airdrops with slisBNB Support

**Morpho Labs $MORPHO** is now supported for Binance HODLer Airdrops using $slisBNB and $slisBNBx tokens. **Key Details:** - Trading begins **October 3rd at 15:00 UTC** - Holders can use their $slisBNB and $slisBNBx to participate in the airdrop event - This continues the pattern of Lista DAO's liquid staking tokens being eligible for major Binance airdrops **Recent Airdrop History:** This marks another significant airdrop opportunity, following recent support for projects like DoubleZero ($2Z), OpenEden ($EDEN), and FalconStable ($FF). The consistent inclusion of Lista DAO's liquid staking tokens in these high-profile airdrops demonstrates their growing utility in the Binance ecosystem. [Read the full announcement](https://www.binance.com/en/support/announcement/d625623188cf455ea2fea7cc48dcabfb) **Take Action:** Check your $slisBNB and $slisBNBx holdings to maximize your airdrop eligibility.

Aster DEX USDF Loop Strategy Improves with Lower Borrowing Rates

**Borrowing rates for USDF looping strategy drop to 1.87%** Aster DEX's asUSDF looping strategy now offers improved yields after borrowing rates decreased from 2.92% to 1.87% on Lista Lending. **How the 4-loop strategy works:** - Mint USDF with USDT - Stake USDF to get asUSDF (+6.2% yield) - Borrow USD1 using asUSDF collateral (-1.87% rate) - Swap USD1 for USDF and repeat - End by depositing USD1 in RE7 Vault (+12.73% supply yield) **Estimated returns reach ~30% APY** with the 4-loop simulation at current rates. The strategy builds on the original looping method introduced in late September, which initially offered ~29.4% APY at higher borrowing costs. [Stake USDF](https://asterdex.com/en/earn/astoken?token=USDF) | [asUSDF/USD1 Market](https://lista.org/lending/market/0x4f9f51fb2cedc44d94fadafb0ebf56ce429a66e72a1d3a80e8903c7bfe09a233)

Lista DAO Releases lisUSD Strategy Guide

Lista DAO published a comprehensive guide outlining **two key strategies** for maximizing returns with their lisUSD stablecoin on BNB Chain. **Strategy 1: Leverage slisBNBx Launchpool Rewards** - Use slisBNB or BNB as collateral to borrow lisUSD - Delegate slisBNBx to earn Binance Launchpool rewards - Loop the process to amplify returns - Earn **dual rewards** from BNB staking and Launchpool participation **Strategy 2: Yield Farm with lisUSD** - Borrow lisUSD while earning Launchpool rewards - Provide liquidity to lisUSD/USD1 pool on PancakeSwap - Generate **multiple income streams** from staking and LP rewards - Minimize impermanent loss through stablecoin pair stability Both strategies combine Lista DAO's liquid staking with CDP leverage to maximize capital efficiency. Users can maintain BNB price exposure while participating in DeFi opportunities. The guide includes step-by-step instructions and video tutorials for implementation.

Lista DAO Passes LIP 20: PancakeSwap LP Integration Approved

Lista DAO's proposal LIP 20 has successfully passed, enabling PancakeSwap LP positions to be used as collateral in their CDP Innovation Zone. Key updates: - Integration includes V2, V3, Infinity, and StableSwap LP positions - Users can now mint lisUSD using PancakeSwap LP tokens - Enhanced capital efficiency through broader collateral options The integration aims to create stronger synergies between both protocols, fostering ecosystem expansion and new revenue opportunities. Want to learn more? Visit [Lista DAO](https://lista.finance) to explore the new collateral options.