Iran Faces Potential Nationwide Internet Disruption

Iran Faces Potential Nationwide Internet Disruption

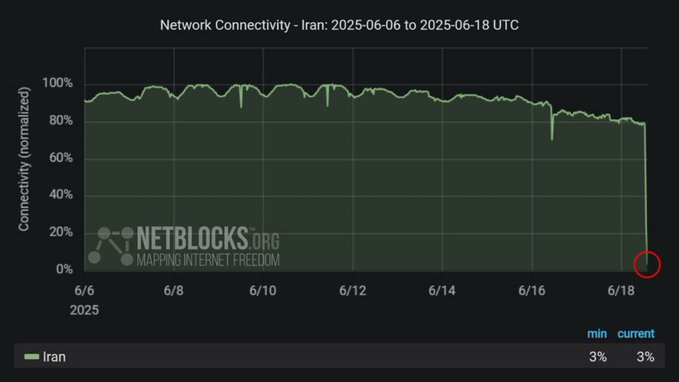

🔌 Iran's Internet Going Dark?

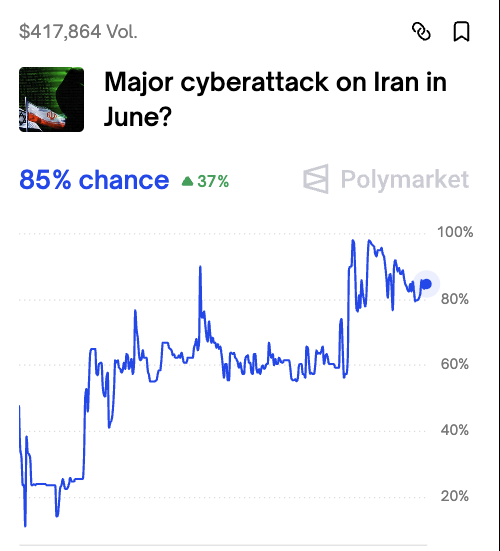

Market indicators suggest Iran may experience a major cyberattack resulting in an extensive internet shutdown, with prediction markets showing an 85% probability. This development comes amid ongoing concerns about Iran's political stability and the status of its Supreme Leader.

- Prediction markets indicate high likelihood of cyber disruption

- Potential for almost complete internet shutdown

- Situation appears connected to broader political tensions

Track live probability updates at Polymarket

This is a developing situation with rapidly changing odds.

BREAKING: Iran may be facing a major cyberattack — "almost complete internet shutdown" 85% chance.

Things are not looking good for Iran's Supreme Leader.

Nuclear Detonation Risk Rises to 18% Amid US-Iran Tensions

The probability of a nuclear weapon being used in 2025 has increased to 18%, according to prediction markets. This comes amid escalating tensions between the US and Iran: - US strike against Iran now estimated at 70% probability - US-Iran nuclear deal chances drop to 37% - Iran-Israel conflict intensifying with mutual strike threats This marks a significant shift from May 2025, when US-Iran nuclear deal prospects were at 65%. Military analysts suggest monitoring the situation closely. *Latest market data indicates heightened regional instability in the Middle East*

Multiple Iran-Related Markets Launch on Polymarket

Several prediction markets focused on potential US-Iran conflict have launched on Polymarket in June 2025: - Latest market questions US strike on Iran's underground nuclear facility - Previous markets cover: * Potential US war declaration * Iran's Supreme Leader possible flight * US Baghdad Embassy evacuation * Tulsi Gabbard resignation The concentration of Iran-focused markets suggests increased attention on Middle East tensions. Markets provide real-time probability estimates based on trader activity.

Iran Considers Closing Strait of Hormuz as US Strike Probability Rises

Iran is evaluating the possibility of closing the Strait of Hormuz, with current prediction markets indicating a 33% probability. This development comes as the likelihood of a US military strike against Iran has increased significantly, now exceeding 70% probability according to market data. The Strait of Hormuz is a critical maritime chokepoint for global oil supply. Key points: - 1 in 3 chance of strait closure - US strike probability >70% - Strike described as potentially imminent

Trump Expected to Reduce China Tariffs by July 2025

Recent market predictions indicate Trump is likely to reduce the majority of tariffs on Chinese goods before July 2025. This marks a significant shift from February when odds were at 14%. The potential policy change suggests an evolving stance on US-China trade relations. Key points: - Timing expected before July 2025 - Represents major shift in trade policy - Market sentiment shows increasing confidence Track market predictions at [Polymarket](https://poly.market/lRijH7O)