Polymarket

Benefits and Features Try Polymarket Today

Polymarket is the world’s leading prediction market platform, allowing users to bet on the outcome of real-world events across a variety of topics such as politics, sports, and pop culture. By leveraging the wisdom of the crowd, Polymarket provides real-time probabilities of event outcomes, enabling users to profit from their knowledge and insights.

Polymarket offers a unique opportunity to monetize your understanding of current events. Users can trade shares in the outcome of future events, with prices reflecting the current market consensus on probabilities. The platform ensures high accuracy through the aggregation of diverse opinions and data sources. Additionally, Polymarket's intuitive interface and comprehensive market options make it easy for both novice and experienced traders to engage and potentially profit.

Dive into Polymarket and start betting on the future today. Whether you’re confident in predicting political elections, sports results, or other significant events, Polymarket allows you to put your knowledge to the test. Join a community of savvy traders, make informed decisions, and see how accurate your predictions can be. Sign up now and experience the thrill of prediction markets firsthand.

Mob Surrounds and Climbs Polymarket Portal in Seattle

🚨 Clavicular Faces Felony Charges

Epstein Death Statement Dated Day Before Alleged Death Found in Recent Files

🚨 America's Population Tipping Point

Buy Now Pay Later Coming to Rent Payments in America

Kamala Harris Rebrands Gen Z Content Hub to Headquarters68

U.S. Embassy Issues Urgent Evacuation Warning for Americans in Iran

Bitcoin Crash Below $30k Now More Likely Than ATH Recovery

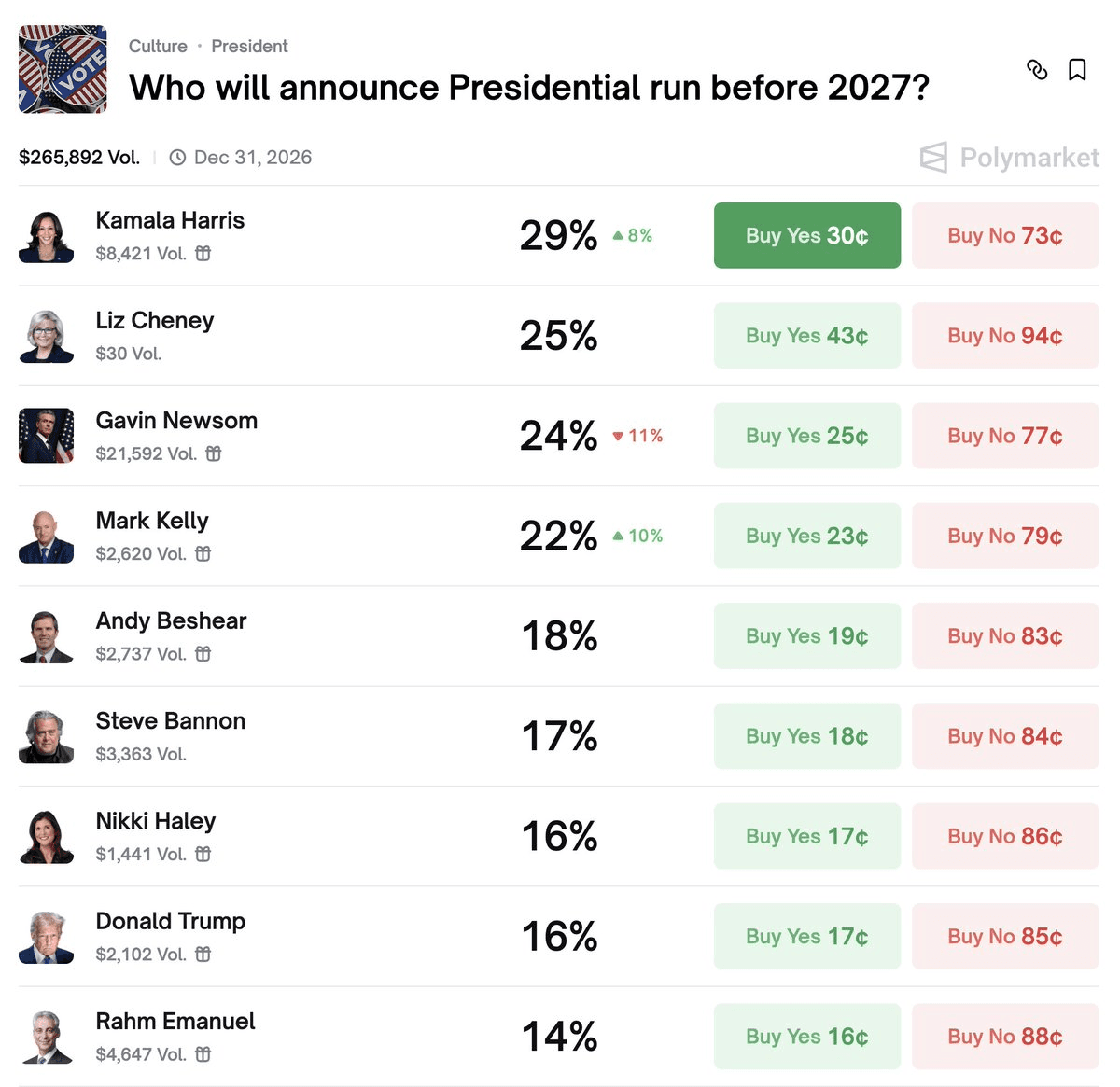

🗳️ Kamala Harris Leads 2028 Presidential Race Predictions

🤝 Polymarket Partners with USDC