Due to increased volatility, the epoch duration for Stake & Cover Pool is extended to 45 days starting from November 17. This change is implemented to ensure stable revenue streams without negative peaks.

🗓️ IMPORTANT UPDATE FOR STAKE & COVER POOL PARTICIPANTS Due to sharply increased volatility, the Epoch duration is increased to 45 days. This will allow to support stable revenue streams without negative peaks. The change will be applied from the next epoch (starting Nov 17).

Hegic Increases Daily Options Trading Limits to $350k

Hegic has raised its daily trading limits for Call and Put options to $350,000, preparing for anticipated market volatility. This update follows previous limit increases from August 2024, when 0DTE limits were set at $600k per day across BTC/ETH assets. The protocol maintains balanced distribution between: - Different assets (BTC/ETH) - Strategy types (Call/Put options) - Strike prices (04%) Values are dynamically adjusted daily based on option exercises and expirations.

Hegic Launches Season 2 of 0DTE Options Trading Contest

Hegic has launched Season 2 of its 0DTE options trading contest with a guaranteed $25,000 prize pool. Running until May 3, 2025 (15:00 UTC), the contest rewards traders based on their premium payments. Key updates: - Reduced premium requirements for tier upgrades - Top tier now requires $30,000 in premiums - Prizes distributed proportionally to premium payments Traders can track their performance and contest statistics directly in the app under the 0DTE > Trading Contest section.

1.1 WBTC Stolen from Legacy Test Contract

A security incident occurred on February 23, 2025, where a hacker exploited an old test contract from January 2022, successfully extracting 1.1 WBTC. The compromised contract was a legacy test deployment and not part of the current protocol architecture implemented in October 2022. **Key Points:** - Current protocol architecture confirmed safe - Bug bounty program active - Detailed security report available on Discord *For context: December 2024 saw 27 security incidents in Web3 with total losses of $4.11M, marking a significant decrease from November.*

Hegic Adds $100k to Sharwa LPs, Launches Portfolio Margin Trading

Hegic has integrated portfolio margin trading into their protocol through Sharwa, enabling CEX-like capital efficiency while maintaining DeFi principles. Key updates: - $100,000 added to Sharwa liquidity pools - Integration of auto-exercising module running for past year - Hegic becomes primary options protocol in Sharwa's on-chain portfolio margin system The protocol has been audited but remains in alpha stage. Users should exercise caution and conduct thorough research before participating. Previous milestone: Protocol achieved $200M+ notional trading volume on Hegic Herge, averaging $380k daily on Arbitrum.

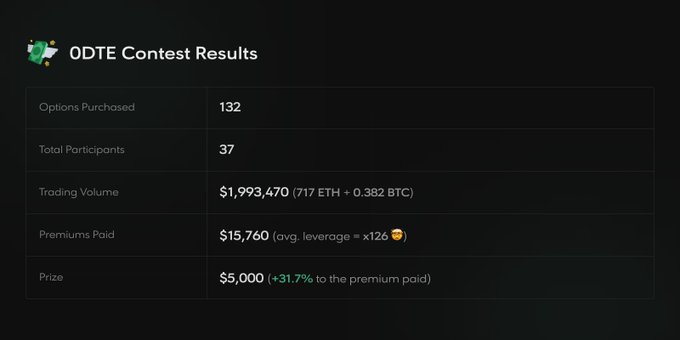

0DTE Contest Prize Distribution Complete

The 0DTE Contest concluded with a successful prize distribution of 7,835 ARB tokens (valued at $5,000) to participants. The transaction was confirmed on Arbitrum blockchain, viewable at Arbiscan. This follows previous contest initiatives, including the Octree HODL contest where 10 random wallets each received 200 BUSD rewards. - Transaction verified on blockchain - Total prize pool: $5,000 in ARB tokens - Distribution completed on November 11, 2024