Hegic has integrated portfolio margin trading into their protocol through Sharwa, enabling CEX-like capital efficiency while maintaining DeFi principles. Key updates:

- $100,000 added to Sharwa liquidity pools

- Integration of auto-exercising module running for past year

- Hegic becomes primary options protocol in Sharwa's on-chain portfolio margin system

The protocol has been audited but remains in alpha stage. Users should exercise caution and conduct thorough research before participating.

Previous milestone: Protocol achieved $200M+ notional trading volume on Hegic Herge, averaging $380k daily on Arbitrum.

Congratulations! To support such deep integration with our protocol, Hegic adds ~$100,000 to Sharwa LPs. 💥 Hegic traders are now able to buy options using portfolio margin, which means having CEX-like capital efficiency while maintaining DeFi fundamentals! 💥

Hegic Increases Daily Options Trading Limits to $350k

Hegic has raised its daily trading limits for Call and Put options to $350,000, preparing for anticipated market volatility. This update follows previous limit increases from August 2024, when 0DTE limits were set at $600k per day across BTC/ETH assets. The protocol maintains balanced distribution between: - Different assets (BTC/ETH) - Strategy types (Call/Put options) - Strike prices (04%) Values are dynamically adjusted daily based on option exercises and expirations.

Hegic Launches Season 2 of 0DTE Options Trading Contest

Hegic has launched Season 2 of its 0DTE options trading contest with a guaranteed $25,000 prize pool. Running until May 3, 2025 (15:00 UTC), the contest rewards traders based on their premium payments. Key updates: - Reduced premium requirements for tier upgrades - Top tier now requires $30,000 in premiums - Prizes distributed proportionally to premium payments Traders can track their performance and contest statistics directly in the app under the 0DTE > Trading Contest section.

1.1 WBTC Stolen from Legacy Test Contract

A security incident occurred on February 23, 2025, where a hacker exploited an old test contract from January 2022, successfully extracting 1.1 WBTC. The compromised contract was a legacy test deployment and not part of the current protocol architecture implemented in October 2022. **Key Points:** - Current protocol architecture confirmed safe - Bug bounty program active - Detailed security report available on Discord *For context: December 2024 saw 27 security incidents in Web3 with total losses of $4.11M, marking a significant decrease from November.*

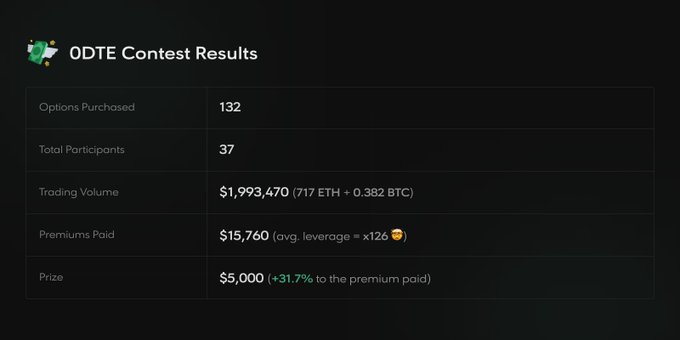

0DTE Contest Prize Distribution Complete

The 0DTE Contest concluded with a successful prize distribution of 7,835 ARB tokens (valued at $5,000) to participants. The transaction was confirmed on Arbitrum blockchain, viewable at Arbiscan. This follows previous contest initiatives, including the Octree HODL contest where 10 random wallets each received 200 BUSD rewards. - Transaction verified on blockchain - Total prize pool: $5,000 in ARB tokens - Distribution completed on November 11, 2024