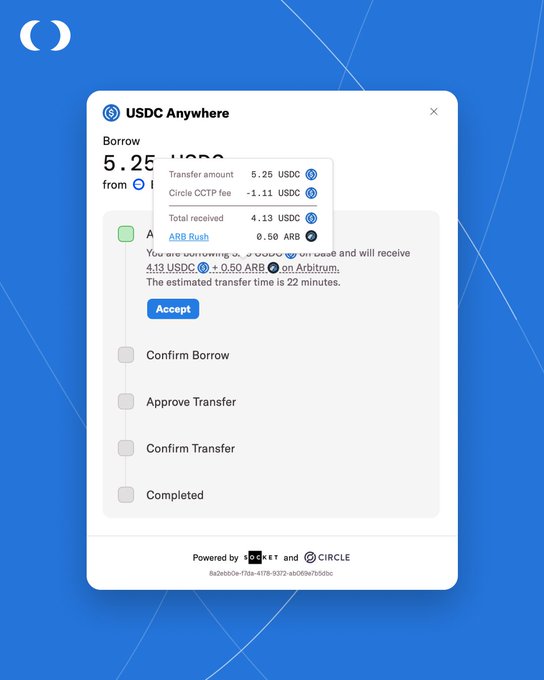

Thanks to SocketDotTech and Moonwell's new USDC Anywhere feature, users can now earn ARB rewards by borrowing USDC on Arbitrum.

Get in on the #ARBRush 🏃 action! Thanks to @SocketDotTech and Moonwell's new USDC Anywhere feature, you are now able to earn ARB rewards by borrowing USDC on @Arbitrum. 👉 moonwell.fi/markets/borrow…

An epic first month of Socket ARB Rush 🔵 In just 3 weeks, we have onboarded $300M+ liquidity into @arbitrum. If you bridged through any Socket ecosystem app, check & claim your rewards here: socketscan.io/rewards

Moonwell Completes Moonriver Shutdown Following Chainlink Oracle Deprecation

Moonwell has officially deprecated its protocol on Moonriver network following Chainlink's decision to discontinue oracle feeds starting February 1st. **Key Actions Taken:** - Proposal MIP-R38 passed, setting all market collateral factors to 0% - Collateral factors were gradually reduced over recent months - Bad debt risk to the protocol has been eliminated **What Users Need to Know:** - Users with supplied collateral can withdraw anytime via the market or Portfolio page - Risk parameters were managed by Anthias Labs, Moonwell's risk manager - Support available on [Discord](https://discord.com/invite/moonwellfi) for withdrawal assistance The decision prioritizes user safety as the underlying oracle infrastructure becomes unavailable. Full details in [MIP-R38](https://moonwell.fi/governance/proposal/moonriver?id=72).

📞 Moonwell January Governance Call Tomorrow at 17:00 UTC

Moonwell's monthly governance call, hosted by Boardroom, takes place tomorrow at 17:00 UTC on X Spaces. **What to Expect:** - Latest governance news and updates from contributors - Current market analysis and insights - Community discussion and Q&A [Set your reminder](https://x.com/i/spaces/1OdKrOBYzDQGX?s=20) to join the conversation and stay informed about protocol developments.

Moonwell Q4 Report Shows Growth in Fees, Revenue and Active Users

Moonwell's Q4 2025 performance demonstrated measurable growth across key metrics, according to Token Terminal's latest report. **Key Highlights:** - Fees and revenue increased quarter over quarter - Monthly active users grew during the period - Growth occurred despite cooling market conditions - Usage metrics aligned with economic performance The report emphasizes that capital remained productive rather than idle throughout Q4. The data shows consistent user engagement translating into platform economics. The full analysis is available on [Binance Square](https://www.binance.com/en/square/post/35170977363625) and X.

Moonwell Adjusts Base Vault Incentives Through February

Moonwell has recalibrated its incentive structure on Base to balance competitive returns with sustainable liquidity management. **Distribution Details:** - Total allocation: 2,192,599.32 WELL tokens - Distribution period: January 16 - February 2 **Vault Breakdown:** - USDC: 1,356,324.84 WELL - ETH: 454,278.62 WELL - EURC: 271,049.85 WELL - cbBTC: 110,946.01 WELL The adjustments aim to align incentive spending with actual vault utilization while maintaining attractive yields for liquidity providers.

🚀 ETH Loans Now Live

**Moonwell's USDC Vault now supports Ethereum-backed loans** directly in the Coinbase app, expanding beyond Bitcoin lending. **Key developments:** - Curators allocated liquidity to the cbETH/USDC market on Morpho - Higher borrowing activity drives increased utilization and revenue - Vault serves as primary liquidity source for ETH-backed loans **Access points:** - [Explore USDC Vault](https://moonwell.fi/vaults/deposit/base/mwusdc) - [Real-time tracking](https://morpho.blockanalitica.com/base/vaults/vaults?search=moonwell) This expansion follows Moonwell's successful Bitcoin lending integration and represents continued growth in institutional DeFi adoption.