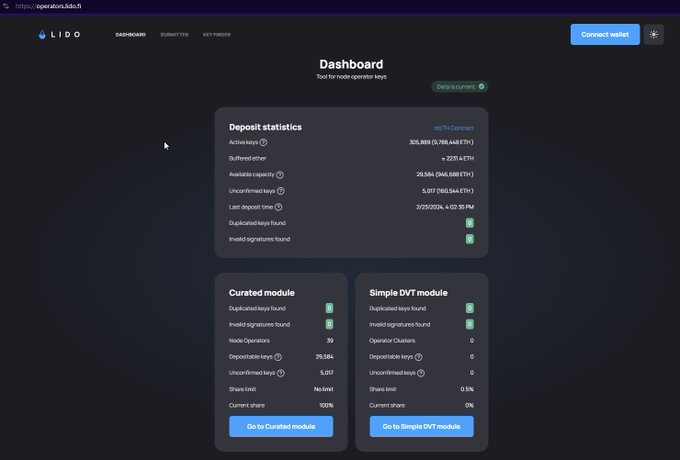

139 net-new node operators have been chosen to join the Lido protocol through the @ObolNetwork onboarding, marking a significant increase. Out of 195 testnet participants evaluated, 161 have been selected across various categories. These candidates demonstrated strong performance and reliability. The selected operators will run nodes in 36 countries using diverse infrastructure. Over 250 new Node Operators are expected to run DVT based validators in the first few months, representing a 700% increase. More stakers are anticipated to be proposed after the @SSV_Network testnet concludes. Interested parties can apply for the next testnets scheduled for March.

"I love the smell of DVT in the morning!" The @LidoFinance Simple DVT module has been deployed, and in the coming weeks clusters including over 100 community stakers (solos and small groups) will deploy Distributed Validators on mainnet, powered by @ObolNetwork and @ssv_network.

The first mainnet participants of the Lido Simple DVT Module have been selected. Onboarding of the @ObolNetwork candidates would see 139 net-new node operators join the Lido protocol - a ~400% increase even before considering @ssv_network candidates 📈 research.lido.fi/t/staking-rout…

200 new node operators are about to be onboarded to @LidoFinance through the launch of the first lido v2 module, the simple dvt module. @composeus explains how this is a major step forward for lido's decentralization and a win for smaller solo validators. youtube.com/watch?v=LbkxL-…

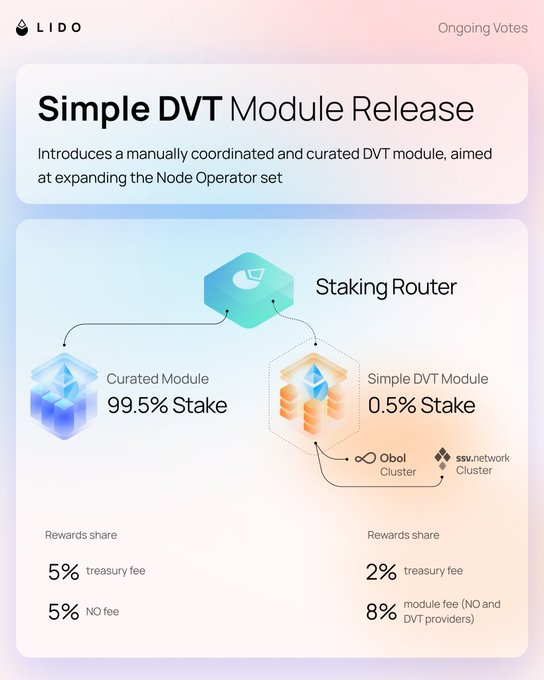

The Lido DAO has voted to approve the deployment of the Simple DVT module, the first Staking Router module geared towards increasing the adoption of DVT in the Lido protocol and broadening the Node Operator base through the addition of community stakers. vote.lido.fi/vote/172

Ethereum Staking Reaches Historic Milestone at 30% of Total Supply

Ethereum has achieved a new all-time high in staking participation, with **30% of all ETH now staked** on the network. This milestone represents continued growth in network security and validator participation. The increase from 29% in July 2025 demonstrates sustained confidence in Ethereum's proof-of-stake consensus mechanism. Key implications: - Reduced circulating supply may impact market dynamics - Enhanced network security through broader validator distribution - Growing institutional and retail commitment to long-term holding The rising staking ratio reflects maturation of Ethereum's transition to proof-of-stake, which was completed in September 2022.

🏗️ Lido V3 Launches

Lido V3 has officially launched, introducing modular infrastructure for Ethereum staking with two distinct products: **Lido Core** continues powering stETH through 600+ distributed Node Operators, while **stVaults** enables customizable staking configurations for institutions and specialized use cases. Key highlights: - **Early adopter incentive**: 0% infrastructure fee (down from 1%) until March 31, 2026 for vaults exceeding 250 ETH - **Ethereum Client Team Vault**: First multi-operator DVT vault operated by Signal, ChainSafe, Develpment, and Nethermind - prioritizing security and Ethereum alignment - **CSM expansion**: Community Staking Module share limit increased from 5% to 7.5%, enhancing permissionless participation - Conservative initial configuration focusing on validator performance, operator quality, and client diversity stVaults allow institutions to select their own node operators, choose custodial arrangements, and maintain transparency while optionally minting stETH for liquidity. [Learn more about Lido V3](https://blog.lido.fi/lido-v3-is-live-modular-infrastructure-for-a-new-paradigm-of-ethereum-staking/)

🔐 Obol Launches Ethereum Client Team Vault on Lido V3

Obol has launched the **Ethereum Client Team Vault**, a multi-operator staking solution built on Lido V3 using Distributed Validator Technology (DVT). **Key Features:** - Operated by four Ethereum client teams: Sigma Prime, ChainSafe, Develp, and Nethermind - Conservative configuration with no leverage or complex DeFi strategies - Focuses on validator performance, operator quality, client diversity, and decentralization **What Makes It Different:** - First curated, operator-specific vault with rewards tied to a defined set of operators - Allows users to express preferences for client diversity and multi-operator security - Leverages Lido's trusted infrastructure without complex deposit flows or new smart contracts The vault targets ETH-aligned stakers, DAO treasuries, and capital allocators seeking secure, low-risk staking that supports Ethereum's core development teams. [Read the complete case study](https://blog.lido.fi/lido-v3-obol-multi-operator-distributed-validators-on-lido-stvaults)

Community Event Calendar Updates Available

Multiple community events have been scheduled and are now available for registration. **Key Details:** - Events scheduled for January 21, 22, 28, and 30, 2026 - Registration and calendar integration available through [Luma](https://luma.com/aimtqioq) - All events use the same registration link for easy access Community members can add these dates directly to their calendars and find additional event information through the provided link.

Lido V3 Builders Showcase stVaults Innovation

Lido is hosting a **stVaults Builders Fireside Chat** on February 3rd at 2pm UTC to highlight new staking products built with Lido V3. **Featured builders:** - Northstake - PierTwo - RockSolid The session will explore novel staking solutions enabled by the V3 upgrade and stVaults infrastructure. This follows the broader Lido V3 launch celebration scheduled for the same day, which includes additional participants like P2P Validator and Linea. [Join the conversation](https://lido.fi) to learn how builders are leveraging the new staking architecture.