Enzyme Onyx addresses different protocol needs across three key stages:

- Pre-TGE: Early participation incentives to build community

- Post-TGE: Strengthen Total Value Locked (TVL) after token launch

- Mature stage: Manage liquidity across multiple assets including stablecoins and liquid staking tokens

The platform provides structured, on-chain strategies that protocols can adopt when timing is right for their development phase. Each stage requires different tooling approaches, but most protocols eventually need comprehensive on-chain financial infrastructure.

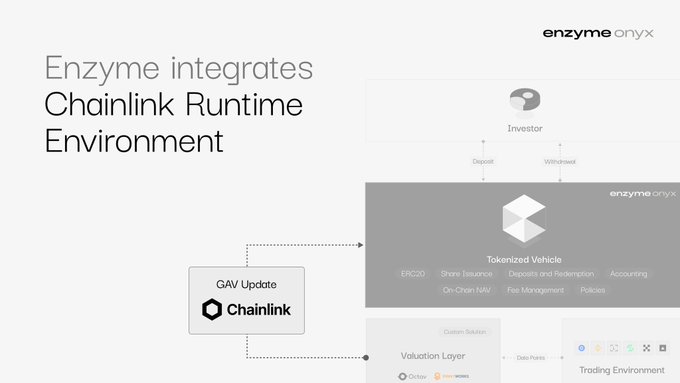

Enzyme is proud to be integrating the @Chainlink Runtime Environment (CRE). The integration of CRE will support Onyx users by streamlining NAV and reporting processes across networks and data sources. enzyme.finance/blog-posts/enz…

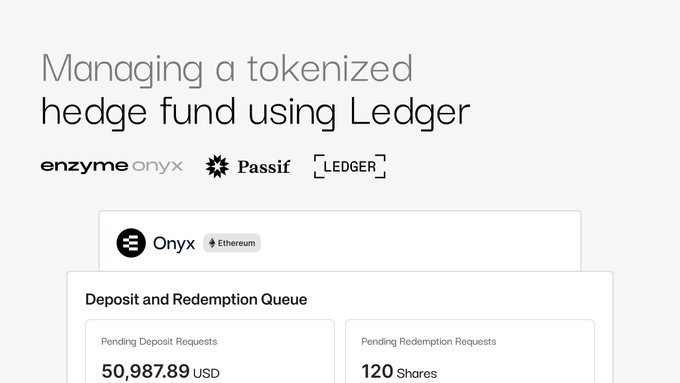

Did you know you can now use @Ledger to run a hedge fund? Passif runs its delta-neutral hedge fund fully on-chain through Enzyme Onyx, executing its decentralized strategy using Ledger Wallet. Read the full story: enzyme.finance/blog-posts/dep…

💪 @CupOJoseph and @NeriteOrg needed a core stack to launch their latest tBTC yield product on @Arbitrum, Enzyme Onyx delivered. @TheTNetwork's tBTC holders now have a seamless way to generate yield through Nerite's native stablecoin USND and lending protocol. Curious to learn

Last week we announced our integration of @Chainlink Runtime Environment (CRE), here’s a closer look at what it unlocks for Enzyme Onyx 👇1/7 🧵

Enzyme is proud to be integrating the @Chainlink Runtime Environment (CRE). The integration of CRE will support Onyx users by streamlining NAV and reporting processes across networks and data sources. enzyme.finance/blog-posts/enz…

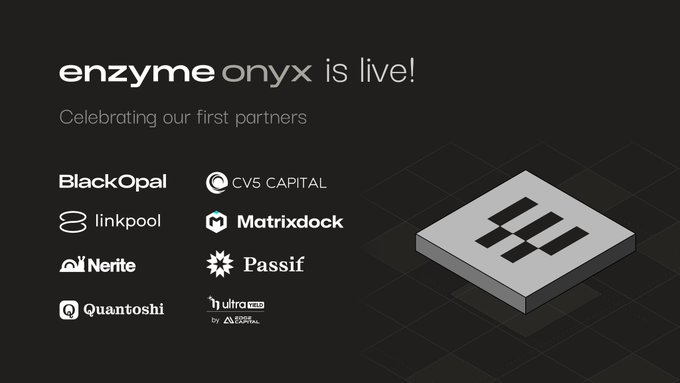

Fund platforms can leverage Enzyme Onyx as their core stack to enable their clients to deploy tokenized funds seamlessly. @cv5capital is already doing it. Here’s how: enzyme.finance/blog-posts/enz…

Protocols don’t all need the same tooling at the same time, but most eventually need a structured, on-chain strategy. Here’s where Onyx fits 👇 1️⃣ Pre-TGE: early participation incentives 2️⃣ Post-TGE: strengthen TVL 3️⃣ Mature stage: manage liquidity across assets (stables,

A tokenized hedge fund, built and operated through Enzyme Onyx. Passif’s Alpha Fund runs a sophisticated, multi-strategy portfolio with real-time investor visibility and T+0 liquidity all without custom backend engineering. enzyme.finance/blog-posts/dep…

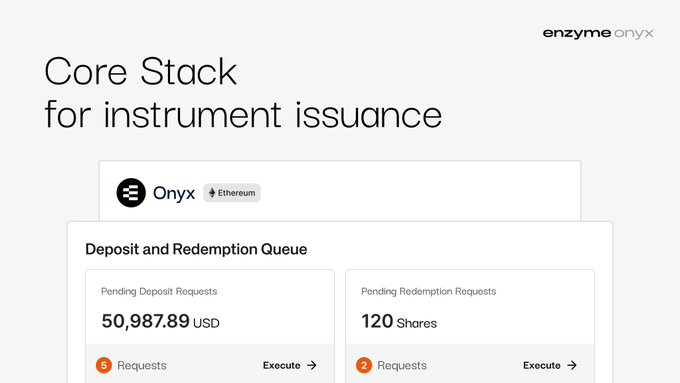

Today, we’re proud to unveil Enzyme Onyx: the tech stack to issue, structure, and administer next-generation financial products capable of delivering investment strategies across any asset class, protocol, or network 👇 enzyme.finance/products/onyx?…

What defines a modern tech stack for financial product issuance? ✓ Granular accounting controls ✓ Comprehensive subscription management ✓ Institutional-grade fee framework ✓ Flexible architecture The Enzyme Onyx Administration App delivers all of this out of the box. Deploy

“Onyx lets us structure and run our entire fund stack without ever touching custom infrastructure” - Eriz Zarate (@its_eriz), Founder of Passif.xyz This is exactly what Enzyme Onyx was built for: a core stack that lets managers issue and operate tokenized hedge

A tokenized hedge fund, built and operated through Enzyme Onyx. Passif’s Alpha Fund runs a sophisticated, multi-strategy portfolio with real-time investor visibility and T+0 liquidity all without custom backend engineering. enzyme.finance/blog-posts/dep…

If you can build the strategy, you shouldn’t have to build the infrastructure. Enzyme Onyx gives asset managers what they need to run tokenized fund strategies without custom systems or backend engineering. With built-in accounting, fee frameworks, and controlled

Enzyme Partners with 1Token to Solve Multi-Venue Asset Valuation

Asset managers running strategies across centralized exchanges, DeFi protocols, and multiple wallets face a critical challenge: accurate reporting. Inconsistent data sources make it difficult to provide reliable valuations to investors. **The Solution** Enzyme has partnered with [1Token](https://enzyme.finance/blog-posts/enzyme-and-1token-partnership?utm_source=x&utm_medium=organic&utm_content=post) to address this problem: - Reconciles data from both CeFi and DeFi sources - Provides unified valuation across multiple venues - Helps managers maintain investor confidence through transparent reporting This follows Enzyme's recent integration with Octav, showing a pattern of building infrastructure for cross-chain and multi-venue asset management. **Why It Matters** As crypto strategies become more complex, spanning different chains and platforms, accurate position tracking becomes essential for institutional adoption and investor trust.

On-Chain Spot Markets Gain Institutional Traction with Improved Execution

On-chain spot markets are narrowing the price gap with traditional venues while maintaining self-custody and instant settlement advantages. **Key developments:** - Capital efficiency improving through faster block times and enhanced execution infrastructure - Trading volume expanding as tooling matures - Institutional participants now actively monitoring the space **Market context:** This follows 3x year-over-year growth in USDC's share of spot trading volume through September 2025. Stablecoins are increasingly powering settlement and providing 24/7 market liquidity beyond traditional banking hours. The shift represents a tangible evolution from theoretical concepts to operational reality in capital markets infrastructure.

Chainlink CRE Automates Multi-Chain Asset Reporting for Fund Managers

**Multi-chain complexity solved**: As investment products expand across different blockchains, reporting becomes increasingly complex for asset managers. **Automated data sourcing**: Chainlink's CRE (Crypto Reporting Engine) automatically pulls and verifies NAV and performance data from: - On-chain sources - Centralized finance platforms - Traditional financial systems **Pain point addressed**: The solution eliminates manual reporting work that previously required tracking assets across multiple chains and platforms. **Verification built-in**: All data is automatically verified, reducing errors and ensuring accuracy for compliance and investor reporting.

Enzyme.Myso Introduces Institutional-Grade Options for On-Chain Yield Generation

Enzyme.Myso is advancing DeFi with institutional-grade on-chain options trading. The platform offers: - Native on-chain options strategies - Fully auditable transaction flows - Infrastructure designed for DAOs and institutions **Real-world implementation**: Compound DAO recently integrated covered calls into their treasury strategy using Enzyme.Myso, targeting approximately 15% APY while maintaining controlled risk exposure. This development signals a shift in how DAOs can optimize idle capital through sophisticated options strategies. *Learn more at* [Enzyme Finance](http://enzyme.finance/products/myso)