dYdX Expands Market Offerings with New Listings

dYdX Expands Market Offerings with New Listings

🚀 New Markets Just Dropped

dYdX continues to expand its trading options through Instant Market Listings. Recent additions include $IQ (IQAICOM), $AERGO, $WCT (WalletConnect), and several other tokens. The platform now features over 180 tradable markets, with new listings being added regularly through their permissionless listing system. MegaVault provides liquidity across all markets while offering yield opportunities to depositors. The platform maintains steady growth in both market offerings and trading volume.

New Instant Market Listing: #VIRTUAL @virtuals_io is now available to trade on dYdX! Get started ➡️ dydx.trade/trade/VIRTUAL-…

It's been a week since the launch of dYdX Unlimited 🚀 The new Instant Market Listings feature has been popular, with 16 new markets launched by the community! Have a look at some of the new markets available ⤵️

New Instant Market Listing: $BERA @berachain is now tradeable on dYdX! Get started ➡️ dydx.trade/trade/BERA-USD

Market Spotlight: $KRL @kryll_io is now available to trade on dYdX, but what is Kryll³ all about? Time to find out. Get started ➡️ dydx.trade/trade/KRL-USD?…

Decentralisation is about giving back the power to the users, and it's time for others to follow dYdX's lead. As a pioneer in DeFi, dYdX wants to move the needle in the right direction with the Unlimited Launch, and it starts with addressing the listing process. 🧵 More below

New Instant Market Listing: $IP @StoryProtocol is now available to trade on dYdX! Get started ➡️ dydx.trade/trade/IP-USD

21 new markets listed via Instant Market Listings since launch 🫡 Big up the dYdX community.

Your gateway to automatic liquidity and yield is here. Say hello to MegaVault. Get started 👉 dydx.foundation/blog/how-to-de…

Launchable Market: $BNX @binary_x is now launchable on dYdX (it's also up +55% today 👀) Launch here ➡️ dydx.trade/trade/BNX-USD?…

Just hours after the launch of #dYdXUnlimited, the new Instant Market Listings feature is already being embraced by the community 🫡 New tokens listed: 🔹 $LUCE 🔹 $ONT 🔹 $GOAT The power to list and trade any market instantly is here. What will you list next? 👀

Want to learn more about the new Instant Market Listings feature on dYdX? Complete the latest dYdX @GalxeQuest and get rewarded with points that will give you the opportunity to claim exclusive dYdX merch, and $USDC rewards 🤝 Join here ➡️ app.galxe.com/quest/dYdX/GCe…

Want to list your favourite tokens on dYdX? Through the new Instant Market Listings feature, anyone can list a new market and start trading immediately 🫡 Here's a guide on how to list a new market 👇

Launchable Market: $KDA You can now launch @kadena_io on dYdX! Start here ➡️ dydx.trade/trade/KDA-USD

New Instant Market Listing: $MOVE You can now trade @movementlabsxyz on dYdX! Get started ➡️ dydx.trade/trade/MOVE-USD…

New Instant Market Listing: $KOMA Koma Inu is now tradable on dYdX! Start here ➡️ dydx.trade/trade/KOMA-USD…

New Launchable Market: $IQ You can now launch @IQAICOM via the markets page on dYdX! Launch here ➡️ dydx.trade/trade/IQ-USD

Launchable Market: $AERGO @aergo_io is now launchable from the markets page on dYdX! Launch here ➡️ dydx.trade/trade/AERGO-US…

Have you explored all the new dYdX Unlimited features? Through MegaVault, Instant Market Listings, and the new Affiliate and Trading Rewards programs, dYdX Unlimited is tailored to suit all types of users. Here's everything you need to know ⤵️ dydx.foundation/blog/enter-the…

New Instant Market Listing: $AERGO @aergo_io is now tradable on dYdX! Start here ➡️ dydx.trade/trade/AERGO-US…

Launchable Market: $UXLINK You can now launch @UXLINKofficial on dYdX! Get started ➡️ dydx.trade/trade/UXLINK-U…

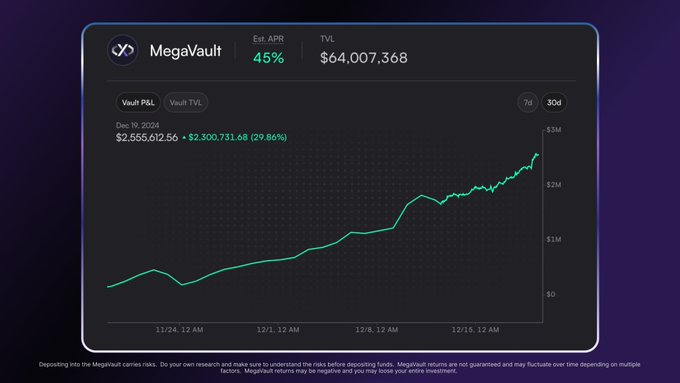

$70M in MegaVault deposits. Big shoutout to the dYdX community 🫡

New Instant Market Listing: $VET You can now trade @vechainofficial on dYdX! Get started ➡️ dydx.trade/trade/VET-USD?…

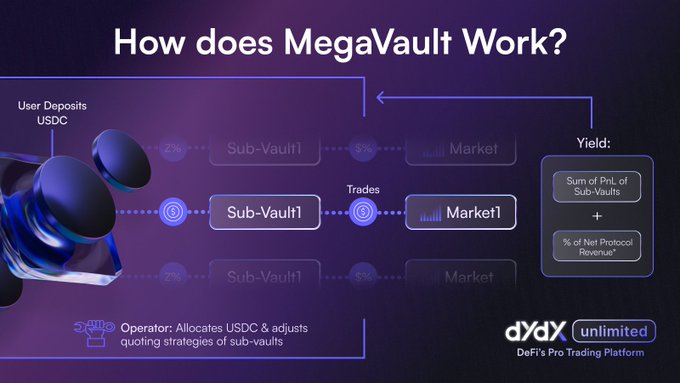

Instant Market Listings will allow you to trade any market instantly with liquidity. MegaVault provides these markets with liquidity whilst also giving you an opportunity to earn yield—pretty cool, right? Let's dive into the mechanics 👇 dydx.foundation/blog/megavault…

New Instant Market Listing: $TROY You can now trade @TROY_DAO on dYdX! Get started ➡️ dydx.trade/trade/TROY-USD…

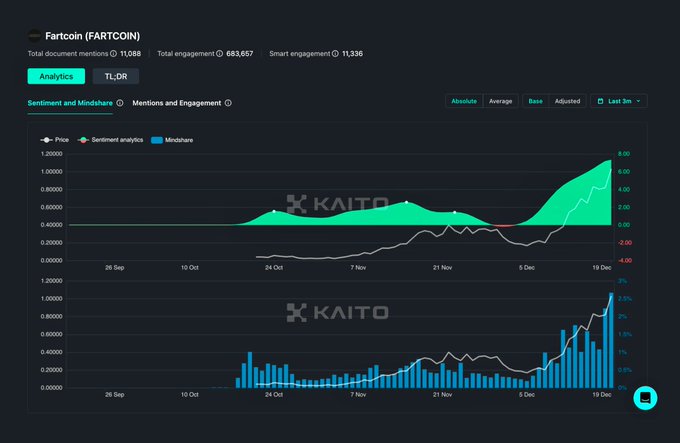

New Instant Market Listing: #FARTCOIN @FartCoinOfSOL is now available on dYdX! Get started ➡️ dydx.trade/trade/FARTCOIN…

New Instant Market Listing: $VVV You can now trade @AskVenice on dYdX! Start here ➡️ dydx.trade/trade/VVV-USD?…

Want to list a new market via the new Instant Market Listings feature? Here's how you can in just a few simple steps 🤝 Visit dYdX ➡️ dydx.trade/markets?utm_so…

Deposit into MegaVault, earn yield. The upcoming dYdX MegaVault provides liquidity to all markets on dYdX, whilst also ensuring that you earn rewards. Time to dive into the mechanics ⤵️

New Instant Market Listing: $NC You can now trade @nodepay_ai on dYdX! Get started ➡️ dydx.xyz/token-launch/n…

So dYdX Unlimited is on the horizon. An upgrade to dYdX that aims to provide users with a true DeFi experience, through instant market creation and liquidity. Here's a list of features to be excited for 🤝

New listing: $GRASS @getgrass_io is now available on dYdX thanks to Instant Market Listings! Visit dYdX ➡️ dydx.trade/trade/GRASS-US…

Launchable Market: $PARTI @ParticleNtwrk is now launchable via the markets page on dYdX! Start here ➡️ dydx.trade/trade/PARTI-US…

The launch of dYdX Unlimited introduced a new permissionless era to DeFi trading. Through features like Instant Market Listings and MegaVault, users are enabled to trade the markets they want with instant liquidity—a true game changer. 🧵 Let's dive a bit deeper

The dYdX Affiliate Program, coming soon. If you're curious to know the difference in commissions between standard and VIP affiliates, give this a read ⤵️

New Instant Market Listing: $YFI You can now trade @yearnfi on dYdX! Get started ➡️ dydx.trade/trade/YFI-USD?…

New Instant Market Listing: $KAITO You can now trade @KaitoAI on dYdX! Start here ➡️ dydx.trade/trade/KAITO-USD

New week, new milestone. dYdX has reached 150 tradable markets 💪 Explore here ➡️ dydx.trade/markets?utm_so…

The Unlimited era is here, and the numbers show for it 🫡 During launch week, dYdX achieved some incredible milestones, all thanks to you, the community. Here's a recap ⤵️

A new dYdX quest is now available on @GalxeQuest! Get involved, get rewarded 🫡 Join here ➡️ app.galxe.com/quest/dYdX/GCq…

New Instant Market listing: $GLMR @MoonbeamNetwork is now tradable on dYdX! ➡️ dydx.trade/trade/GLMR-USD…

Have a specific market that you want to trade on dYdX? Launch it via the new Instant Market Listings feature 🤝 Here are some that are currently available to list ⤵️

New Instant Market Listing: $MAD @madcoinvip is now tradable on dYdX! Get started 👉 dydx.trade/trade/MAD,RAYD…

New Instant Market Listing: $SCRT @SecretNetwork is now available to trade on dYdX! Get started ➡️ dydx.trade/trade/SCRT-USD…

New Instant Market Listing: $GNO @GnosisDAO is now tradable on dYdX! Get started ➡️ dydx.trade/trade/GNO-USD?…

New Instant Market Listing: $SPX @spx6900 is now tradable on dYdX! Start here ➡️ dydx.trade/trade/SPX-USD

dYdX has always been about offering the best decentralised perp trading experience for users. The new Instant Market Listing feature introduced as part of dYdX Unlimited is just the first step to providing the best on-chain trading experience. Let's dive into the why ⤵️

New Instant Market Listing: $MELANIA You can now trade Melania on dYdX! Get started ➡️ dydx.trade/trade/MELANIA-…

New Instant Market Listing: #AI16Z You can now trade AI16Z on dYdX! Get started ➡️ dydx.trade/trade/AI16Z-US…

dYdX Affiliates have already referred $1 billion in trading volume 🚀 Here's how to join and start climbing the leaderboard 🏆 Find out more ➡️ dydx.foundation/blog/dydx-affi…

Put your $USDC to work with the upcoming dYdX MegaVault. MegaVault operates as an aggregation of several "sub-vaults," each designed to optimise returns across different automated strategies. Deposit, and qualify to earn yield immediately 🤝

Turn every trade into a win with the new Trading Rewards program on dYdX! Available to all dYdX users 🫡 Get started ➡️ dydx.foundation/blog/enter-the…

New Instant Market Listing: $NIL You can now trade @nillionnetwork on dYdX! Get started ➡️ dydx.xyz/token-launch/n…

Launchable Market: $RARE You can now launch @SuperRare via the markets page on dYdX! Start here ➡️ dydx.trade/trade/RARE-USD…

New Instant Market Listing: $MNRY @moonraygame is now tradeable on dYdX! Get started ➡️ dydx.trade/trade/MNRY-USD…

New Instant Market Listing: $ORCA You can now trade @orca_so on dYdX! Start here ➡️ dydx.trade/trade/ORCA-USD…

MegaVault TVL surpasses $50M 🚀 The dYdX community making it happen 🫡

New Instant Market Listing: $API3 @Api3DAO is now tradable on dYdX! Start here ➡️ dydx.xyz/token-launch/a…

Want to launch your favourite markets on dYdX? Here's everything you need to know ⤵️ dydx.foundation/blog/instant-m…

New Instant Market Listing: $NMR You can now trade @numerai on dYdX! Start here ➡️ dydx.trade/trade/NMR-USD

500+ markets on dYdX loading... ▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▓▒▒▒▒▒

New Instant Market Listing: $NFT @apenftorg is now tradable on dYdX! Start here ➡️ dydx.trade/trade/NFT-USD?…

Let's talk MegaVault, and how you could benefit from it. MegaVault operates as a master liquidity pool for all dYdX markets, giving depositors a share of dYdX protocol fees and PnL from the vault. Consider it a flywheel, as seen here 👇

Launchable market: #BABYDOGE You can now list @BabyDogeCoin on dYdX, with instant liquidity 🤝 Start here ➡️ dydx.trade/trade/BABYDOGE…

New Instant Market Listing: $STEEM @steemit is now tradable on dYdX! Start here ➡️ dydx.trade/trade/STEEM-US…

Provide liquidity, earn yield 🤝 MegaVault gives you the opportunity to put your $USDC to work, and generate returns. Time to break it down ⬇️ dydx.foundation/blog/megavault…

New Instant Market Listing: $AITECH @AITECHio is now available to trade on dYdX! Get started ➡️ dydx.trade/trade/AITECH-U…

New Instant Market Listing: $KRL You can now trade @kryll_io on dYdX! Start here ➡️ dydx.trade/trade/KRL-USD?…

Total open interest on dYdX is approaching $500M 🚀 All thanks to you, the community 🤝

Enter the Unlimited era: Instant Market Creation, Automatic Liquidity.

Launchable Market: $HYPE You can now launch @HyperliquidX on dYdX! Get Started ➡️ dydx.trade/trade/HYPE-USD

183 tradable markets on dYdX. And growing 🫡

New Instant Market Listing: $MAJOR You can now trade on MAJOR dYdX! Start here ➡️ dydx.trade/trade/MAJOR-US…

New Instant Market Listing: $TRUMP @realDonaldTrump's meme coin is now available to trade on dYdX! Get started ➡️ dydx.trade/trade/TRUMP-USD

New Instant Market Listing: $BABY @babylonlabs_io is now tradable on dYdX! Get started 👉 dydx.trade/trade/BABY-USD…

250+ new users have been referred to dYdX since the launch of the Affiliate Program 🚀 Thank you for helping shape the future of DeFi, one referral at a time 🤝

The new dYdX Affiliate Program is all about giving back to the users. Which is why dYdX is giving affiliates access to lifetime commissions and instant payouts 🤝 Learn more about the program ⤵️ dydx.foundation/blog/dydx-affi…

New Instant Market Listing: $MORPHO You can now trade @MorphoLabs on dYdX! Get started ➡️ dydx.trade/trade/MORPHO-U…

Liquidity is vital, and it has typically been a challenge for many CEXs and DEXs, especially when it comes to derivatives trading. Through the launch of dYdX MegaVault, anyone can deposit liquidity and profit from market making and protocol fees. By allowing users to earn yield

Launchable Market: $CARV You can now launch @carv_official on dYdX! Start here 👉 dydx.trade/trade/CARV-USD…

303 launchable markets on dYdX, which you can list instantly. Here's a look at some of the tokens available ⤵️

New Instant Market Listing: $SAGA @Sagaxyz__ is now tradable on dYdX! Get started ➡️ dydx.trade/trade/SAGA-USD…

Launchable Market: $VINE You can now launch Vine Coin on dYdX! Start here ➡️ dydx.trade/trade/VINE-USD…

500+ markets are now launchable on dYdX via Instant Market Listings btw (In case you were wondering)

New Instant Market Listing; $ELX You can now trade @elixir on dYdX! Get started ➡️ dydx.trade/trade/ELX-USD?…

The power of dYdX Affiliates. Since the Unlimited launch they've generated over $2B in referred trading volume 🤝 Huge.

New Instant Market Listing: $ZETA You can now trade @zetablockchain on dYdX! Get started ➡️ dydx.trade/trade/ZETA-USD…

New Instant Market Listing: $SSV @ssv_network is now available to trade on dYdX! Get started ➡️ dydx.trade/trade/SSV-USD

"How can I benefit as a dYdX Affiliate?" Let's take a look. Find out more ➡️ dydx.foundation/blog/dydx-affi…

Launchable Market: $RARE You can now launch @SuperRare on dYdX! Start here 👉 dydx.trade/trade/RARE-USD…

New Instant Market Listing: $PI @PiCoreTeam is now available to trade on dYdX! Get started ➡️ dydx.trade/trade/PI-USD

Over 50 new markets have been successfully launched on dYdX since the introduction of Instant Market Listings 🚀 With 500+ more markets available to launch, now would be a good time to highlight some 🤝 🧵 Time to dive in

New Instant Market Listing: $COOKIE You can now trade @cookiedotfun on dYdX! Get started ➡️ dydx.trade/trade/COOKIE-U…

Huddle up on dYdX 🚀 @pudgypenguins $PENGU is now a launchable market! Start here ➡️ dydx.trade/trade/PENGU-US…

New Instant Market Listing: $BANANA @BananaGunBot is now tradable on dYdX 🍌 Get started ➡️ dydx.trade/trade/BANANA-U…

New market: $ATH @AethirCloud has just been listed via Instant Market Listings and is now available on dYdX! Get started ➡️ dydx.trade/trade/ATH-USD?…

MegaVault is finally live on dYdX 🙌 You can now provide liquidity to all dYdX markets, and earn a share of dYdX protocol fees as well as a share of MegaVault's PnL. Get started ➡️ youtube.com/watch?v=K1HWg9…

If you're looking for a way to list any market instantly and be able to trade it with leverage, look no further. Instant Market Listings on dYdX is coming soon to make it happen for you. Find out more ⬇️ dydx.foundation/blog/instant-m…

New Instant Market Listing: $G You can now trade @GravityChain on dYdX! Get started ➡️ dydx.trade/trade/G-USD?ut…

Why MegaVault is a Game Changer in Liquidity Provision Let’s break it down with numbers: 🔹 A 20% yield in $USDC could be considered attractive 🔹 dYdX protocol fees last year were around $40M. 🔹 The MegaVault will receive 50% of those protocol fees, which would have been

196 markets available on dYdX. 42 listed since November, 2024. The power of Instant Market Listings.

New Instant Market Listing: $QNT @quant_network is now tradable on dYdX! Get started ➡️ dydx.trade/trade/QNT-USD?…

New Instant Market Listing: $FORTH You can now trade @AmpleforthOrg on dYdX! Start here ➡️ dydx.trade/trade/FORTH-US…

Everything you need to know about the upcoming dYdX MegaVault feature lives in this video. Hear from @CryptoCow33 as he gives you the low-down 🫡 Watch here ➡️ youtube.com/watch?v=NPqpNu…

New Community Market Listing: $S @SonicLabs is now available to trade on dYdX! Get started ➡️ dydx.trade/trade/S-USD

Looking to list any market instantly and be able to trade it with leverage? Instant Market Listings is your answer ⬇️ dydx.foundation/blog/instant-m…

✅ $̶̶̶4̶0̶̶̶M̶̶̶ ✅ $̶5̶0̶M̶ ✅ $̶6̶0̶M̶ MegaVault TVL surpasses the $60M milestone and continues to perform with a PnL of $2M despite market conditions 💪

Launchable Market: #GRIFFAIN @griffaindotcom is in the Top 3 for AI mindshare this week and you have the opportunity to list it on dYdX 🤝 Start here ➡️ dydx.trade/trade/GRIFFAIN…

The power of Instant Market Listings. Since the launch of Unlimited last week, 17 new markets have been listed on dYdX, with over 500 more markets available to be launched 🚀 Here's a glance at some ⤵️

Turn every trade into a win on dYdX. As part of #dYdXUnlimited, you will have the opportunity to access a whole new batch of trading rewards. Here's a look at what you can be excited for ⤵️

New Instant Market Listing: $AIXBT You can now trade @aixbt_agent on dYdX! Get started ➡️ dydx.trade/trade/AIXBT-US…

So the biggest upgrade to dYdX is going live this month. Time to give you a refresh on what you can expect. Have a read ⤵️ dydx.foundation/blog/coming-so…

A new era in DeFi trading has begun. Since the launch of Instant Market Listings on dYdX, the total number of traded markets is now at 167 🚀 And there are still over 500 markets available to launch - here's a look at some ⤵️

Want to list any market on dYdX instantly with immediate liquidity? Instant Market Listings enables you to do this. Here's a guide on everything you need to know 🤝 Watch here ➡️ youtube.com/watch?v=Sp4PLN…

New Instant Market Listing: $CIG You can now trade @cigonsolana on dYdX! Get started ➡️ dydx.trade/trade/CIG,RAYD…

Launchable Market: $T @TheTNetwork is now launchable from the markets page on dYdX! Start here ➡️ dydx.trade/trade/T-USD?ut…

New Community Market Listing: $HYPE @HyperliquidX is now available to trade on dYdX! Get started ➡️ dydx.trade/trade/HYPE-USD

New Instant Market Listing: $PNUT @pnutsolana is now available on dYdX! Visit dYdX ➡️ dydx.trade/trade/PNUT-USD…

New Instant Market Listing: $PENGU You can now trade @pudgypenguins on dYdX! Huddle up ➡️ dydx.trade/trade/PENGU-US…

Launchable Market: #GRIFFAIN You can now launch and trade @griffaindotcom instantly on dYdX! Get started ➡️ dydx.trade/trade/GRIFFAIN…

New Instant Market Listing: #MOODENG MOODENG-USD is now available on dYdX! Get started ➡️ dydx.trade/trade/MOODENG-…

List any market at any time with instant liquidity. The power of Instant Market Listings⚡️ Watch this space.

MegaVault: your gateway to automatic liquidity and yield. By allowing everyone to provide liquidity to dYdX, MegaVault ensures every market has the liquidity it needs, when it needs it 🧵 Learn more about how MegaVault operates

Instant Market Listings. List and trade the markets that you want instantly, with liquidity. Here's how it's going to work 👇

Launchable Market: $ALCH You can now launch @alchemistAIapp via the markets page on dYdX! Start here ➡️ dydx.trade/trade/ALCH-USD…

New Instant Market Listing: $GAS You can now trade @Neo_Blockchain (GAS) on dYdX! Get started ➡️ dydx.xyz/token-launch/g…

Launchable Market: #ZEREBRO You can now launch @0xzerebro on dYdX! Start here ➡️ dydx.trade/trade/ZEREBRO-…

With Instant Market Listings, you can now list and trade any market with instant liquidity. Trade what you want, not what others say you can 🫡 See how it works ➡️ dydx.foundation/blog/instant-m…

A (very) simple guide on how to list a new market on dYdX. Click on the link below to view all the launchable markets 🤝 ➡️ dydx.trade/markets?utm_so…

New Instant Market Listing: $ME You can now trade @MagicEden on dYdX! Start here ➡️ dydx.trade/trade/ME-USD?u…

Launchable market: #CHILLGUY You can now launch and trade @chillguycto on dYdX with instant liquidity 👀 Start here ➡️ dydx.trade/trade/CHILLGUY…

New Instant Market Listing: $BADGER You can now trade @BadgerDAO on dYdX! Start here ➡️ dydx.trade/trade/BADGER-U…

180 tradable markets on dYdX. Instant Market Listings making an impact 🤝 (200 🔜)

You can now list any market, at any time. With Instant Market Listings, anyone can create a new market and start trading right away. 🧵 Here's everything you need to know

Introducing the dYdX Affiliate Program. A program designed to reward the top dYdX ambassadors, empowering the community like never before. 🧵 Let's dive into the details

New Instant Market Listing: $WCT You can now trade @WalletConnect on dYdX! Get started ➡️ dydx.trade/trade/WCT-USD?…

New Instant Market Listing: $USUAL You can now trade @usualmoney on dYdX! Get started 👉 dydx.trade/trade/USUAL-US…

just gna leave this here ➡️ dydx.trade/trade/FARTCOIN…

dYdX Launches $20M Surge Trading Program

dYdX has launched Surge, a 9-month trading program offering up to $20M in total rewards, with $2M distributed monthly through December 2025. Key features: - Rewards based on overall platform engagement, not just P&L - Multiple earning opportunities for all participant levels - Monthly competitions with consistent reward distribution - Focus on ecosystem value creation and community participation The program aims to incentivize sustained platform activity rather than short-term trading gains. Participants can earn points through various platform interactions, with rewards distributed based on leaderboard rankings. Learn more: [dYdX Surge Program](https://www.dydx.xyz/blog/dydx-surge)

dYdX Launches Token Buyback Program and 2025 Roadmap

dYdX has implemented a significant tokenomics update through its first-ever buyback program. Key points: - 25% of net protocol fees now allocated to buying and staking $DYDX tokens - New fee distribution: 40% staking rewards, 25% buybacks, 25% MegaVault, 10% treasury 2025 Development Roadmap: - Immediate focus on indexer reliability and faster deposits - New mobile interface and trading features coming - Integration with IBC Eureka to enable Ethereum connectivity - Plans for spot trading and multi-asset margining [Learn more about the buyback program](https://www.dydx.xyz/blog/dydx-buyback-program)

Critical DYDX Bridge Migration Deadline Approaching

**Important Notice**: Over 110M ethDYDX tokens remain unmigrated to native $DYDX on the dYdX Chain. @NethermindEth has proposed to discontinue bridge support in approximately 45 days. After this deadline, **unbridged tokens may become non-convertible**. Key Information: - Proposal details: [View on Mintscan](https://www.mintscan.io/dydx/proposals/189) - Migration guide: [How to Bridge](https://www.dydx.foundation/how-to-bridge/overview) **Action Required**: Token holders should complete migration before the bridge closure to maintain token convertibility.

dYdX Foundation CEO Joins The Zeall Show for DeFi Discussion

Charles Haussy, CEO of dYdX Foundation, is featured on The Zeall Show hosted by @0xa8l for an in-depth discussion about decentralized finance (DeFi). This follows a series of high-profile DeFi conversations on the platform, including a recent interview about DeFi options with Stryke and Orange Finance. The live discussion explores: - Current state of DeFi - dYdX's role in the ecosystem - Future developments in decentralized exchanges Watch the conversation here: [The Zeall Show](https://www.youtube.com/watch?v=yfKBznNrZC8)