dYdX Launches Token Buyback Program and 2025 Roadmap

dYdX Launches Token Buyback Program and 2025 Roadmap

🤔 dYdX's Secret Sauce Revealed

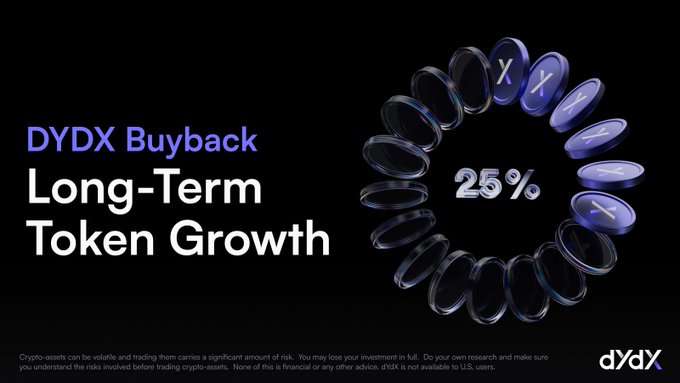

dYdX has implemented a significant tokenomics update through its first-ever buyback program. Key points:

- 25% of net protocol fees now allocated to buying and staking $DYDX tokens

- New fee distribution: 40% staking rewards, 25% buybacks, 25% MegaVault, 10% treasury

2025 Development Roadmap:

- Immediate focus: Indexer reliability, faster deposits via Skip protocol

- Mobile interface launch and trading feature improvements

- Future plans include IBC Eureka integration for Ethereum connectivity, spot trading, and multi-asset margining

The program aims to strengthen alignment between platform growth and token value.

A standout feature of the new dYdX Buyback Program is how it creates shared value across the ecosystem. By allocating 25% of net protocol fees toward purchasing and staking $DYDX, the program ensures that as the platform grows, so does the benefit to both token holders and the

A key benefit of the dYdX Buyback program is to align incentives between all stakeholders. Now, both token holders and the dYdX network will benefit from platform growth, thanks to 25% of all net protocol fees going directly into buying and staking $DYDX tokens - significantly

Buybacks create long term alignment between the dYdX platform and the $DYDX token. Put simply, the higher the volume on dYdX, the more fees will be generated, which allows for more tokens to be bought back and staked to dYdX validators.

The $DYDX Buyback Program. Reinforcing the community’s confidence in $DYDX’s potential while aligning tokenholders with the ecosystem. Excited for what lies ahed.

The first-ever $DYDX buyback program signals strong community confidence, unlocking its true potential while aligning token holders with the ecosystem. Read more 👉 dydx.xyz/blog/dydx-buyb…

The community has voted for a new generation for the $DYDX token. Through a shift in tokenomics, there's plenty of updates for token holders to look forward to 🚀 Here's a look at how protocol fees on dYdX are distributed ⤵️

The buyback program signals dYdX’s strong conviction in the $DYDX token’s long-term role in the ecosystem. With Spot Trading & Multi-Asset Margining coming soon through IBC Eureka, $DYDX token utility is positioned to grow alongside the ecosystem. ➡️ dydx.xyz/blog/dydx-buyb…

dYdX, committed to true decentralisation since 2017. For 8 years, the community has been empowered to shape the future of dYdX through governance. On March 24th, the community voted for the first-ever $DYDX buyback program, with 25% of all dYdX net protocol fees going towards

morning routine on lock

dYdX is integrating IBC Eureka to connect with Ethereum - enabling smooth asset and user flow from Ethereum, Solana, and L2s like Base. This upgrade also unlocks new features like Spot Trading and Multi-Asset Margining on dYdX. Bridge on IBC Eureka ➡️ go.cosmos.network

With the Buyback Program live, dYdX protocol revenue is now allocated as: 🔹 10% - Treasury 🔹 25% - MegaVault 🔹 25% - Buybacks 🔹 40% - Staking Rewards. A structure built for long-term sustainability and network growth 🤝

The $DYDX buyback program. Marking a major milestone in aligning the long-term value of the dYdX protocol with the $DYDX token. Read more ➡️ dydx.xyz/blog/dydx-buyb…

So the $DYDX buyback program was introduced on March 24th. If you aren't already aware of the mechanics of the buyback, this video will tell you everything you need to know 👇

25% buybacks could be just the start for $DYDX. Community discussions are ongoing for up to 100% 🫡 Stay tuned, anon.

dYdX will unlock its full potential with IBC Eureka! An upgrade that can enable the introduction of new innovative features on dYdX such as Spot Trading, Multi-Asset Margining, and much more through EVM Support. Find out more ⤵️

IBC Eureka is LIVE! → Transfers faster than Ethereum finality → Send from Ethereum for as low as $1 → 1-click experience that supports your favorite wallet Starting with Ethereum, @cosmoshub, @babylonlabs_io, Cosmos chains, and soon, IBC everywhere🧵

A lot is coming for dYdX in 2025 on the software side, so let's have a look at the roadmap ahead: Immediate Priorities (Next Two Months) 🔹 Indexer Reliability: The dYdX Chain performs well, but the website stability suffers in volatile markets due to Indexer issues. It's a

dYdX Launches Surge Season 11 with $100K Trading Competition and Zero-Fee Bitcoin Trading

**dYdX Surge Season 11 is now live**, introducing several trader incentives: - **$100K trading competition** hosted on [bonk.trade](http://bonk.trade) - **Zero-fee perpetuals** for $BTC and $BONK trading pairs - **Liquidation rebates** offering up to $1M in returns - **$200K Affiliate Booster Program** for referrals The competition leaderboard is already active, with traders competing for rewards on the dYdX-powered platform. [Learn more about Season 11](http://www.dydx.xyz/blog/february-kickoff-surge-season-11-and-200k-affiliate-booster-program)

dYdX Trading League Rewards Claim Deadline Today

**Final hours to claim dYdX Trading League rewards** Traders who participated in dYdX Trading Leagues have until **January 31** to claim their rewards. This is the last opportunity to collect any earned incentives from the competition. **Key details:** - Claims close today, January 31 - Participants should check eligibility status - Unclaimed rewards will be forfeited after the deadline Traders can verify their eligibility and claim rewards at [dydx.xyz/trading-league-rewards](https://dydx.xyz/trading-league-rewards?utm_source=dYdXTwitter&utm_medium=GlobalSocial&utm_campaign=GlobalSocial) **Action required:** Check your account and claim any pending rewards before the deadline passes.

dYdX Expands Affiliate Program with $100K Whale Bonuses

dYdX has upgraded its Affiliate Booster Program for January-February 2026 with significant enhancements: **Key Updates:** - Up to **$100K in whale bonuses** now available - Enhanced rewards for top-performing affiliates - $100K total reward pool based on referral volume - Higher volume generates larger reward share The program maintains the same basic structure while offering substantially increased incentives. Affiliates can register through the [official form](https://docs.google.com/forms/d/e/1FAIpQLSdEwim0YvS-KHpyEsV1JCuDU3ax3GWqr9bfRsAzYvlIJQJkPg/viewform). Registration is open for those looking to participate in the expanded program.

dYdX Opens Liquidation Rebate Claims for Surge Season 10 Traders

dYdX has activated liquidation rebate claims for the first half of January, targeting traders who participated in **Surge Season 10**. **Key Details:** - Traders who were active during Surge Season 10 may qualify for rebates - Claims are now available for the first half of January 2026 - Eligible users can check their status and claim at [dydx.xyz/liquidation-rebates](https://dydx.xyz/liquidation-rebates) This follows a similar program for Surge Season 9, which offered up to $1M in liquidation rebates to participants. *Check your eligibility and claim any available rebates through the official portal.*

dYdX Client Libraries Compromised on PyPI and NPM

**Malicious versions** of dydx-v4-clients were uploaded to PyPI (version 1.1.5.post1) and NPM (versions 3.4.1, 1.22.1, 1.15.2, 1.0.31). **If you're using these versions, your funds are at risk.** The official versions hosted on the dydxprotocol GitHub repository are **safe and do not contain malware**. - Check your dependencies immediately - Update to verified versions from official sources - Review recent transactions if you used affected versions