Key DeFi figures are converging at the Digital Asset Conference in London to discuss the future of decentralized finance.

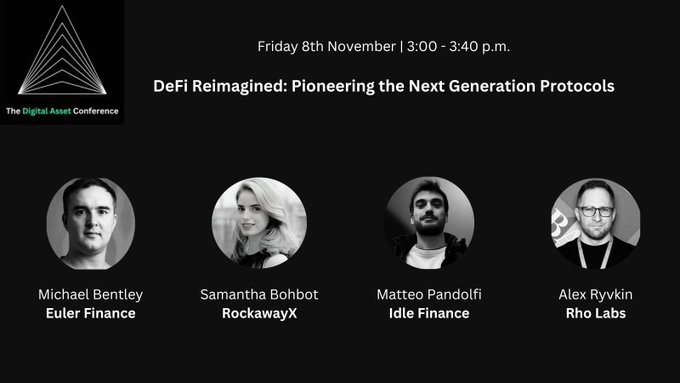

- Panel features @pan_teo_ alongside representatives from Rockaway_X, Euler Finance, and Rho_xyz

- CoW Swap technical lead @fleupold_ leads discussion on next-gen DeFi protocols

- Additional speakers include experts from Kraken and Team Kujira

The conference highlights growing institutional interest in DeFi innovation and market evolution. Sessions focus on technical advances and market opportunities in the space.

Time: March 19th, 2:40 PM

Our co-founder @pan_teo_ is speaking in London this afternoon at the #DigitalAssetConference together with @samantha_bohbot from @Rockaway_X, @euler_mab from @eulerfinance and @alex_ryvkin from @Rho_xyz What’s next for DeFi? #DeFiRenaissance

🔊 🇬🇧 Catch our team at #DigitalAssetConference tomorrow - @samantha_bohbot joining @pan_teo_ @alex_ryvkin and @euler_mab to talk DeFi innovation 👇 🪄 On agenda: rev-generating DeFi tokens $aave $ena $uni pumping

Pareto Unveils 2025 Roadmap with 5 Key Milestones

Pareto has released its 2025 strategic roadmap highlighting five core milestones: - Credit Vaults: Currently live with $35M TVL and $150M in loans - Institutional Onboarding: Partnering with major funds like Fasanara Digital and Bastion Trading - DeFi Integration: Expanding CV use as collateral across multiple chains - Adoption Program: Launching points system to incentivize CV engagement - Credit Vaults Factory: Developing one-click pool creation tool The platform aims to scale private credit issuance on-chain through customizable infrastructure and cross-chain expansion beyond Ethereum, Arbitrum, and Optimism. [Full roadmap details](https://paragraph.xyz/@pareto/the-path-towards-a-scalable-credit-economy)

Fasanara Digital Vault Reports 12.85% January Return Amid ETF Outflows

**Key Updates:** - Fasanara Digital's FAS_USDC basis trade vault achieved 12.85% net return in January - Vault enters cycle #5 in February, expecting negative funding period **Market Context:** - U.S. spot Bitcoin ETFs experienced $830M+ in outflows this week - First negative week for ETFs since late January This performance comes during a period of significant institutional fund movement in the crypto market.

Idle Finance Rebrands to Pareto and Announces Token Migration

Idle Finance announced its rebranding to Pareto, transitioning from a yield aggregator to a credit coordination platform. The protocol has attracted $25M in committed TVL through Credit Vaults, with partners including Fasanara Digital, RockawayX, and Maven11 Credit. The $IDLE token will be sunset and migrated to $PAR, with a snapshot planned and new token launch targeted for Q1 2025. The new platform aims to streamline credit markets by reducing bureaucracy while maintaining compliance through KYC integration.

Idle DAO Voting Opens for Rebranding to Pareto

Idle DAO has opened voting on a proposal to rebrand as Pareto, running until December 23, 2024. The transformation aims to position the protocol as DeFi's Credit Coordination Layer. Key aspects of the proposal: - Rebranding from IDLE to PAR token - Introduction of Pareto Credit Vaults - New tokenomics and staking programs - Focus on credit market infrastructure The roadmap includes: - Cross-border payment solutions - Revenue-based financing - Revolving credit facilities - Corporate bond-like instruments Token holders can vote through Snapshot with both IDLE and stkIDLE tokens.

Idle Launches First Private Credit Vault with Fasanara Digital

Idle has launched its first Credit Vault focused on private credit, partnering with Fasanara Digital. The vault operates as an evergreen, variable-rate loan targeting delta-neutral yield strategies. Key features: - Weekly interest distribution and redemptions - Rate pegged to BTC funding rate with 1.5x multiplier - 5% APR minimum return, 30% APR cap - KYC integration through Keyring The private credit market has grown significantly, reaching nearly $2 trillion by 2023 - ten times its 2009 size. This vault aims to bring private credit on-chain while improving efficiency and transparency. Visit credit.idle.finance to participate.