Pareto Unveils 2025 Roadmap with 5 Key Milestones

Pareto Unveils 2025 Roadmap with 5 Key Milestones

🏗️ Pareto's Master Plan Revealed

Pareto has released its 2025 strategic roadmap highlighting five core milestones:

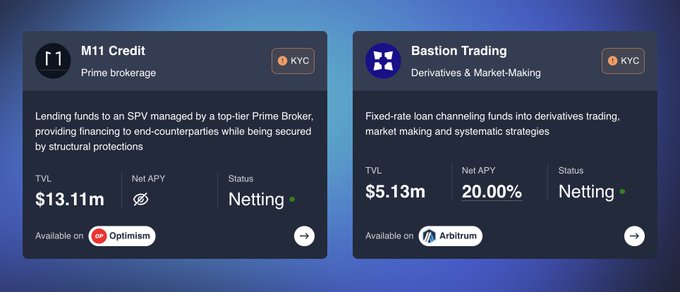

- Credit Vaults: Currently live with $35M TVL and $150M in loans

- Institutional Onboarding: Partnering with major funds like Fasanara Digital and Bastion Trading

- DeFi Integration: Expanding CV use as collateral across multiple chains

- Adoption Program: Launching points system to incentivize CV engagement

- Credit Vaults Factory: Developing one-click pool creation tool

The platform aims to scale private credit issuance on-chain through customizable infrastructure and cross-chain expansion beyond Ethereum, Arbitrum, and Optimism.

Great piece from @TheBlock__ covering our latest Prime Brokerage Credit Vault! Pareto is redefining on-chain private credit with innovation, accessibility, and customization. Learn more about our vision ⤵️

Crypto credit innovator Idle launches onchain private credit vault on Optimism theblock.co/post/334596/cr…

Proud to have collaborated with @Rockaway_X to launch Credit Vaults! CVs deliver multiple benefits: 1️⃣ Customizable credit infra for DeFi 2️⃣ LPs enjoy higher capital efficiency and dynamic interest rate models 3️⃣ Streamlined, cost-effective loan origination for borrowers

1/ 📢 JUST IN — With RockawayX providing 🔑 liquidity, @idlefinance has launched a novel credit vault through its Pareto institutional arm in collaboration with @M11Credit, bringing private credit on-chain for widespread DeFi user participation. Here’s why it matters 🧵👇

Discover how @M11Credit is revolutionizing on-chain credit underwriting with Pareto’s Credit Vaults. Dive into their latest publication about the first CeDeFi private credit solution ⤵️ m11credit.com/publications/m…

The future of private credit is on-chain. Our CeDeFi private credit solution, in partnership with @idlefinance, combines DeFi transparency with TradFi rigor, redefining how institutions access and manage private credit. Learn more in our different publications 🧵⬇️

Just 10 days later, and Pareto's Credit Vaults have extended another $50M in loans — now at $150M total! Borrowers welcomed 😎

In under 4 months since launch, Pareto’s Credit Vaults have facilitated over $100m in loans across Ethereum, @Optimism, and @arbitrum — and we’re just getting started 🚀

Today's two Credit Vault cycles end: 1⃣ @M11Credit curated on @Optimism for USDC lenders 2⃣ @BastionTrading on @arbitrum for USDT lenders Both come with extra $ARB & $OP rewards for LPs 🎁 Start here credit.idle.finance/#/credit

Yesterday, we unveiled Pareto’s 2025 roadmap 💥 Not a fan of long reads? We get it - efficiency matters. Here's the bite-sized version ⤵️ Milestone #1: Credit Vaults launch Already live, with more than $35m in TVL and $150m in loans extended

🎉 Announcing the first Prime Brokerage credit facility in DeFi curated by @M11Credit It will overseas a permissioned evergreen, fixed-rate loan, channeling the funds into the margin lending activities of a top-tier Prime Broker $USDC on @optimism with monthly redemptions

Fasanara Digital Vault Reports 12.85% January Return Amid ETF Outflows

**Key Updates:** - Fasanara Digital's FAS_USDC basis trade vault achieved 12.85% net return in January - Vault enters cycle #5 in February, expecting negative funding period **Market Context:** - U.S. spot Bitcoin ETFs experienced $830M+ in outflows this week - First negative week for ETFs since late January This performance comes during a period of significant institutional fund movement in the crypto market.

Idle Finance Rebrands to Pareto and Announces Token Migration

Idle Finance announced its rebranding to Pareto, transitioning from a yield aggregator to a credit coordination platform. The protocol has attracted $25M in committed TVL through Credit Vaults, with partners including Fasanara Digital, RockawayX, and Maven11 Credit. The $IDLE token will be sunset and migrated to $PAR, with a snapshot planned and new token launch targeted for Q1 2025. The new platform aims to streamline credit markets by reducing bureaucracy while maintaining compliance through KYC integration.

Idle DAO Voting Opens for Rebranding to Pareto

Idle DAO has opened voting on a proposal to rebrand as Pareto, running until December 23, 2024. The transformation aims to position the protocol as DeFi's Credit Coordination Layer. Key aspects of the proposal: - Rebranding from IDLE to PAR token - Introduction of Pareto Credit Vaults - New tokenomics and staking programs - Focus on credit market infrastructure The roadmap includes: - Cross-border payment solutions - Revenue-based financing - Revolving credit facilities - Corporate bond-like instruments Token holders can vote through Snapshot with both IDLE and stkIDLE tokens.

Idle Launches First Private Credit Vault with Fasanara Digital

Idle has launched its first Credit Vault focused on private credit, partnering with Fasanara Digital. The vault operates as an evergreen, variable-rate loan targeting delta-neutral yield strategies. Key features: - Weekly interest distribution and redemptions - Rate pegged to BTC funding rate with 1.5x multiplier - 5% APR minimum return, 30% APR cap - KYC integration through Keyring The private credit market has grown significantly, reaching nearly $2 trillion by 2023 - ten times its 2009 size. This vault aims to bring private credit on-chain while improving efficiency and transparency. Visit credit.idle.finance to participate.