Key Market Movements:

- BTC drops below $102K with all sectors in red

- Circle ($CRCL) IPO launches on NYSE at $31, raising $1.1B

- Truth Social submits Bitcoin ETF filing to SEC

Notable Developments:

- Major whale flips position: now holding 1,281 BTC (12x) and 35,939 ETH (25x)

- James Wynn narrowly avoids liquidation with 74K USDC deposit

- Xi Jinping signals openness to US cooperation after Geneva meeting

- Gold reaches $3,390/oz amid market uncertainty

- ECB expected to cut rates due to cooling Eurozone inflation

ETH/USDT trading at $2,600.71 on OKX

🚀 Crypto moves fast. Stay faster. 🚀 Get real-time price predictions, AI-driven market analysis, daily insights and more. Powered by SWFTGPT, the first domain-specific LLM built for #crypto. 📲 swft.pro/#Download #Crypto #AI #DeFi #Web3 #CryptoNews #LLM

Catch up on the hottest crypto headlines with SWFTGPT 🔥 Here’s what’s making waves in the #crypto world today: 🏛️ DOJ continues prosecution of Tornado Cash co-founder Roman Storm — some charges dropped, but key ones remain. 🪙 U.S. Senate eyes stablecoin bill vote before

📰 SWFT GPT Daily – May 27, 2025 Crypto Market Sees Mixed Moves | ETH Surges | Elderglade +285% | SharpLink $425M Deal 🧠 Headlines & Highlights: 🔹 SharpLink closes $425M PIPE with Consensys; will convert to $ETH treasury. 🔹 Cantor Fitzgerald launches $2B Bitcoin financing

🧭 Crypto Market Snapshot – June 2, 2025 Total Cap Down | Volume Sinks | All Sectors Green | $MASK +31.7% | NFT Sector Leads All 16 tracked sectors are up today — led by NFT, RWA, and SocialFi: 🎨 NFT +3.88% (PFVS +13.3%, DOOD +11.9%, ANIME +11.5%) 🏛 RWA +2.43% (KTA +30.4%, OM

🚨 Crypto Market Roundup! 🚨 Here are the key updates: •Bitcoin hit a record high near $112,000 [$1]. •Senate advanced the GENIUS Act for stablecoin regulation . •Trump hosted a dinner for $TRUMP meme coin buyers . •Coinbase joined the S&P 500 despite a probe . •A new

SWFTGPT Daily – May 21, 2025 BTC Hits $106.5K | ETF Inflows Continue | SEC Sues Unicoin | South Korea to Lift Crypto Ban Top Headlines: • James Wynn expands 40x BTC long to $832M, unrealized gains hit $16.5M • Bitcoin ETFs net $329M, led by IBIT’s $287M inflow • SEC charges

📊 Crypto Market Update – June 4, 2025 Market Cap Dips, Volume Climbs | $SUIA +61% | BTC & ETH Dominate 70% of the Market 📰 Crypto News Highlights: 🪪 TRUMP coin partners with Magic Eden to launch official Trump Crypto Wallet 🗳️ South Korea’s election: Democratic candidate Lee

📉 SWFT GPT Daily – May 29, 2025 Crypto Market Dips | SocialFi Pops | FCA Drafts Stablecoin Rules | Ooki +232% 🚀 🧠 Key Headlines: 🔹 UK FCA proposes stablecoin rules: Reserve transparency & custody protection. 🔹 Fed Policy: Stable rates expected till Q3; trade tension clouds

Nasdaq Seeks to Expand Crypto ETF with XRP, SOL, ADA, and XLM

Nasdaq has submitted an application to the SEC requesting the addition of XRP, Solana, Cardano, and Stellar to their cryptocurrency index ETF. This move follows Hashdex's similar filing in March 2025. - Currently, U.S. crypto ETF exposure is limited to Bitcoin and Ethereum - If approved, this would mark a significant expansion in regulated crypto investment options - The application represents growing institutional interest in diverse crypto assets This development could potentially broaden mainstream access to cryptocurrency investments through traditional financial instruments.

Hong Kong Advances Stablecoin Regulation Framework

Hong Kong is implementing comprehensive stablecoin regulations through Chapter 656, set to take effect in August 2025. The legislation establishes a formal licensing system for stablecoin issuers and operators. Key points: - Mandatory licensing for stablecoin issuers - Consumer protection measures - Framework to support digital asset growth - Legislative Council approval in progress The move positions Hong Kong as a leading regulatory hub in the digital asset space, providing clear guidelines for industry participants while prioritizing market stability and user protection.

Circle's USDC Stablecoin Issuer Makes NYSE Debut

Circle, the company behind USDC stablecoin, has successfully completed its Initial Public Offering on the New York Stock Exchange. Trading under ticker $CRCL, shares opened at $31, exceeding initial price targets. Key details: - Raised $1.1 billion in capital - Company valued at $6.2 billion - First major stablecoin issuer to go public - Marks significant milestone for crypto in traditional finance This IPO comes as US regulators continue developing stablecoin frameworks, suggesting growing institutional confidence in regulated digital assets.

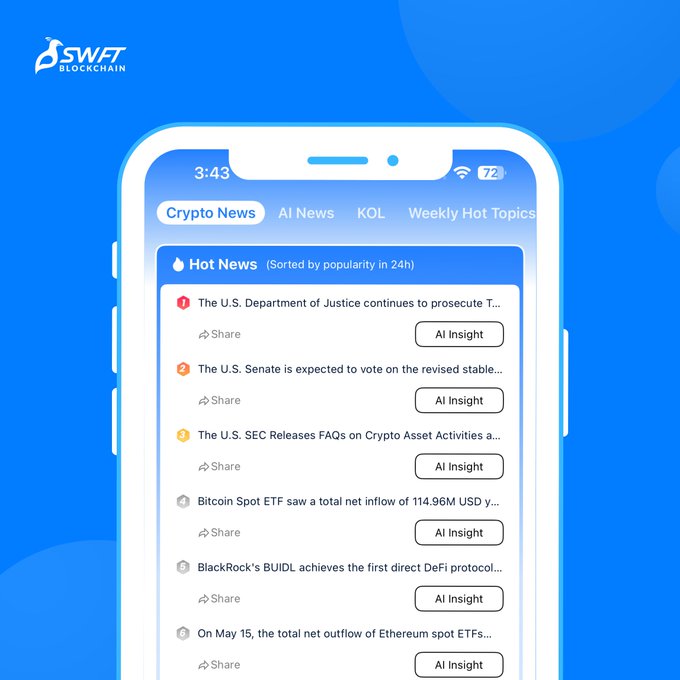

SWFT Blockchain Mobile App Relaunches with Enhanced Features

The SWFT Blockchain mobile app has resumed operations with several key features: - **Cross-chain swaps** now available for major cryptocurrencies including BTC, ETH, and USDT - **Deposit and withdrawal** functionality fully restored - New **AI-powered assistant** for swap optimization - Available on both iOS and Android platforms The app provides a unified interface for managing multiple blockchain assets with enhanced security features. Users can access real-time market insights through the SWFTGPT AI assistant. Download the app at [SWFT Blockchain](http://swft.pro/#Download)