Hong Kong Stablecoin Regulation Set for August 2025

Hong Kong Stablecoin Regulation Set for August 2025

🇭🇰 HK's Crypto Plot Thickens

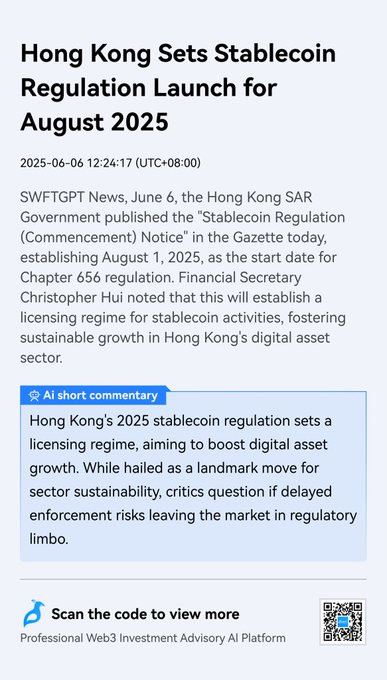

Hong Kong is implementing comprehensive stablecoin regulations through Chapter 656, scheduled to take effect in August 2025. The initiative, which has been in development since 2023, introduces a new licensing framework aimed at fostering digital asset market growth.

Key points:

- New regulatory framework under Chapter 656

- Implementation date: August 2025

- Focus on stablecoin oversight and market development

- Part of ongoing crypto regulatory efforts since 2023

This marks a significant step in Hong Kong's push to become a major digital asset hub.

🚨 Hong Kong sets the stage for stablecoin regulation starting Aug 2025! 📜 Chapter 656 introduces a licensing regime to boost digital asset growth.

xStocks Launches on Bridgers: Trade Tokenized Stocks Across Chains

xStocksFi introduces blockchain-based representations of major stocks on Solana. These SPL tokens are backed 1:1 by actual shares from companies like Google, Tesla, Apple, and Nvidia. Key features: - Non-custodial execution - Smart cross-chain routing - Permissionless DeFi access - Available tokens: $GOOGLX, $TSLAX, $AAPLX, $NVDAX Trading is now live on [Bridgers platform](https://dapp.bridgers.xyz) with secure, contract-powered execution. Try the platform to start trading tokenized stocks across different blockchain networks.

Bitcoin ETF Inflows Continue Strong Momentum

Bitcoin spot ETFs maintained their positive trajectory with $2.39B in inflows last week, marking six consecutive weeks of growth. Key highlights: - BlackRock's IBIT leads the pack with $2.57B in inflows - Total IBIT assets now at $56.97B - Consistent with May's trend of $2B bi-weekly inflows This sustained institutional interest signals growing mainstream adoption of Bitcoin through regulated investment vehicles. *Note: These figures represent a continuation of the strong institutional demand seen since the ETFs' launch.*

Daily Web3 Community Update - July 21st, 2025

A slight change in the weather today as our usual sunny greetings show some clouds. The community's daily gm tradition continues, marking 75+ consecutive days of morning greetings. This small variation from :sunny: to :partly_sunny: represents the first weather emoji change in several weeks. - Consistent community engagement maintained - First weather emoji variation since June 19th - Strong continuation of the gm/gm frens tradition *The subtle shift in emoji choice reflects the community's attention to detail in their daily interactions.*

SharpLink Gaming Files to Raise $5B for Ethereum Purchases and Gaming Growth

SharpLink Gaming has filed to raise $5 billion in additional funding to support Ethereum purchases and expand their blockchain gaming initiatives. This move follows their recent acquisition of 5,188 ETH ($15.76M), which brought their total Ethereum holdings to 285,894 ETH (approximately $871M). The company has amended their sales agreement to accommodate this substantial capital raise, signaling an aggressive expansion of their crypto gaming and ETH treasury strategy. - Current ETH holdings: 285,894 ETH ($871M) - New funding target: $5 billion - Focus areas: Ethereum acquisition & blockchain gaming This represents one of the largest institutional moves into Ethereum and blockchain gaming to date.

Kraken Lists SoSoValue Token for AI-Powered Trading

SoSoValue's token ($SOSO) will be listed on Kraken, offering AI-powered insights and index trading tools. The U.S. House passed two major crypto bills - the GENIUS and CLARITY Acts, with CBDC restrictions under review. Trump hints at potential Fed Chair replacement, with Hassett mentioned as candidate. Talos acquired Coin Metrics in $100M+ deal to enhance data capabilities. Bank of America confirms progress on stablecoin development. Trump Media plans AI integration for Truth Social platform. Windtree aims to become first Nasdaq firm with direct BNB exposure via $200M investment.