Coinage DAO Completes Third Monthly Token Burn Based on Content Views

Coinage DAO Completes Third Monthly Token Burn Based on Content Views

🔥 Watch. Burn. Repeat.

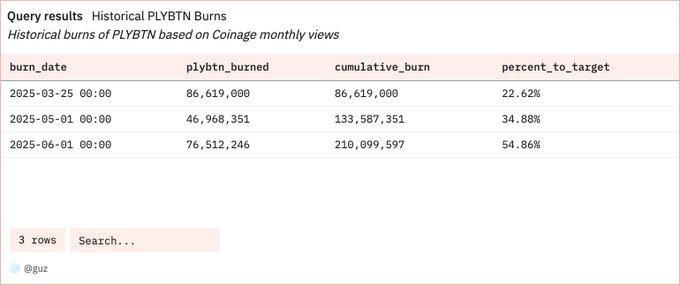

The Coinage DAO has completed its third consecutive monthly token burn, destroying 76,512,246 $PLYBTN tokens based on May's viewing metrics across X and YouTube platforms.

This burn follows their March 2025 initiative where they introduced the READ/WATCH/OWN monthly burn mechanism, which ties token burns to content view counts. The program began with an initial burn of 86 Million $PLYBTN (~$50,000).

The consistent monthly burns demonstrate the sustainability of their content-driven tokenomics model, originally inspired by a Solana contentcoin experiment.

NEW❤️🔥: The Coinage DAO wants to thank those of you who watched our content on X or YouTube in May Your views contributed to us burning 76,512,246 $PLYBTN in what is now our 3rd consecutive monthly burn You have a lot of choices for crypto content. Thanks for choosing us ▶️

Ethereum Co-Executive Director Discusses Fusaka Upgrade Impact on ETH

**Ethereum Foundation co-Executive Director Tomasz Stanczak** was featured in a detailed discussion about the upcoming **Fusaka upgrade** and its implications for ETH. Key highlights from the interview: - Deep dive into what the Fusaka upgrade will change for Ethereum - Insights from one of Ethereum's top leadership figures - Technical and strategic implications explored The **full interview is available** for those wanting comprehensive details on this significant network upgrade. [Watch the complete discussion](https://youtu.be/zMoavAd7FT8?si=Nxwg2uIweVxJuVCJ)

MicroStrategy Raises $1.4B Cash Buffer Using Nuclear Reactor Battery Metaphor

**MicroStrategy's Strategic Cash Move** Michael Saylor explained the company's $1.4B cash buffer using a creative metaphor: *"We're basically using a nuclear reactor to spin a generator to charge a battery."* **Key Points:** - The cash buffer serves **two different types of investors** - Saylor's spaceship analogy illustrates the company's Bitcoin strategy - This follows MicroStrategy's ongoing Bitcoin accumulation approach **Context:** - Company holds significant Bitcoin reserves - Strategy aims to balance different investor needs - Part of broader Bitcoin-focused corporate strategy The metaphor highlights how MicroStrategy uses Bitcoin as a power source to generate value for various stakeholder groups. [Read the full analysis](https://coinage.substack.com/p/is-bitcoin-bottoming-as-strategy)

Bitcoin Shows Signs of Recovery as MicroStrategy Concerns Diminish

Bitcoin appears to be finding support levels as fears surrounding MicroStrategy's leveraged Bitcoin strategy begin to subside. The cryptocurrency has shown resilience despite previous concerns about MSTR's potential impact on broader market stability. **Key developments:** - Bitcoin establishing potential bottom formation - Reduced anxiety over MicroStrategy's debt-funded Bitcoin purchases - Market sentiment shifting from extreme fear to cautious optimism The so-called "doom loop" scenario - where MSTR's stock decline could force Bitcoin sales, creating further downward pressure - appears less likely as both assets stabilize. **Market implications:** - Institutional Bitcoin exposure through MSTR remains significant - Correlation between MSTR stock and Bitcoin price continues - Broader crypto market watching for sustained recovery signals This development comes after weeks of volatility tied to concerns about leveraged corporate Bitcoin strategies and their potential systemic risks to the cryptocurrency market.

SEC Chair Paul Atkins Pushes to Reduce Capital Market Barriers for Americans

**SEC Chair Paul Atkins is advocating for broader access to capital markets**, stating that the current path to public ownership has become too narrow and costly. Key points from Atkins' push: - **Excessive regulations** create more friction than benefit - Current rules make public ownership **costlier and more burdensome** - Focus on **increasing access for all Americans** This aligns with previous statements about making the U.S. the **crypto capital of the world** through regulatory clarity and innovation-friendly oversight. The move signals a potential shift toward **harmonized digital asset regulation** and reduced barriers for companies seeking public markets.

Do Kwon Apologizes, Requests 5-Year US Prison Term Before South Korea Transfer

**Terra founder Do Kwon formally apologized** to users who lost funds in the ecosystem collapse, asking a US court for no more than 5 years in prison. **Key developments:** - Kwon expressed deep regret: *"I am deeply sorry for letting down the many users... who put their faith in me"* - His legal team requested the 5-year limit so he can serve remaining time in South Korea near family - **Jump Trading relationship disclosed** - Kwon admitted failing to publicly reveal Jump's support during the 2021 UST de-peg crisis - Attorneys described Kwon as being in a *"loop of regret"* **What's next:** Kwon faces separate legal proceedings in South Korea after completing any US sentence. The court filing represents his attempt to minimize US prison time while acknowledging responsibility for the Terra ecosystem's collapse that wiped out billions in investor funds.