Centrifuge, a platform for on-chain finance, shared a report authored by a member of the Credit Group at MakerDAO. The report focuses on real-world assets (RWA) and tokenization, an area that has been a priority for Centrifuge since its early collaboration with MakerDAO in 2020 to diversify collateral. The author, known for their analysis in this field, aims to help crypto projects better access and manage their treasury holdings through these reports.

Thanks for posting my report! For those who know me for my NM analysis, RWA/tokenization has been my focus since early days when @MakerDAO first started to diversify its collateral through @centrifuge in 2020 I head the Credit Group in the DAO and regularly publish reports to

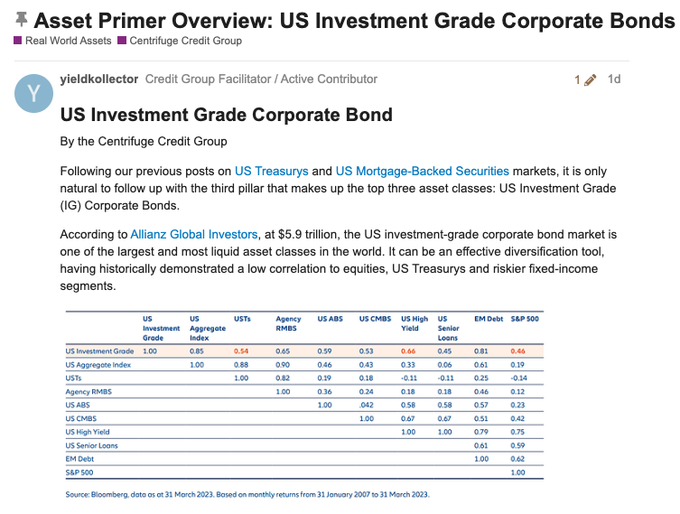

From The Centrifuge Credit Group: A new Asset Primer on US Investment Grade Corporate Bonds: one of the largest and most liquid asset classes in the world. Read on to learn the intricacies of this $5.9 trillion market — and to envision how it'll be revolutionized onchain!

Proof-of-Index Framework Links Official Portfolio Data to Onchain NAV Pricing

Centrifuge has launched Proof-of-Index, a framework that creates verifiable connections between official portfolio data and onchain net asset value pricing for tokenized index funds. **Key Features:** - Built using licensed data from S&P Dow Jones Indices - Provides auditable alignment between tokenized funds and their underlying holdings - Already operational, powering SPXA on Base network - Handles daily rebalancing while maintaining auditability The infrastructure addresses a core challenge in tokenized index funds: ensuring that onchain representations accurately reflect their real-world holdings. The framework aims to bring institutional-grade verification to programmable finance products.

🏦 Institutional Credit Enters DeFi as Tokenization Infrastructure Matures

**Institutional credit is now flowing into DeFi lending markets** as tokenization infrastructure evolves beyond simple issuance. The gap between traditional assets and decentralized finance continues to narrow. **Key developments:** - Centrifuge V3.1 upgrade brings sharper multichain execution across 10 chains - Automated onchain accounting with transparent double-entry bookkeeping - Modular architecture adapts to different asset structures - Distribution capabilities now outpacing basic issuance as competitive differentiator The shift reflects tokenization behaving like infrastructure rather than narrative. Real-world assets are gaining DeFi's composability while maintaining institutional-grade accounting and verification standards. Multichain operations have become table stakes, with hub-and-spoke architecture simplifying deployment. Teams using Whitelabel can launch tokenized assets with real-time, verifiable accounting from day one. The focus has moved from whether to tokenize to which infrastructure can reliably operate tokenized products across chains with full visibility.

Treasury Bills and Credit Products Drive Real-World Asset Adoption Onchain

**Yield-generating products are becoming the primary driver of real-world asset (RWA) adoption in onchain finance.** - Treasury bills and credit instruments are attracting significant attention from onchain allocators - Investors are actively diversifying their portfolios beyond traditional crypto-native yield sources - The shift represents a maturation of the onchain finance ecosystem This development follows the broader trend of RWA tokenization scaling across the industry, with total value locked exceeding $10 billion. Institutional players continue building infrastructure to support these traditional financial instruments onchain.

🏦 ACRDX Launches on Morpho: Apollo Credit Fund Goes Onchain

**ACRDX**, the tokenized Apollo Diversified Credit Fund, is now live on **Morpho**, expanding institutional credit access onchain. **Key Details:** - Provides tokenized exposure to Apollo Global's diversified credit strategy - Initially launched on Plume Network with $50M deployment via Grove Finance - Offers 24/7 access with real-time reporting and programmable settlement **What It Covers:** - Corporate and direct lending - Asset-backed credit strategies - Institutional-grade asset management **Technical Infrastructure:** - Built on Centrifuge's tokenization platform - Data transparency via Chronicle Labs oracles - Cross-chain capability through Wormhole This marks a significant step in bringing traditional credit markets onchain, offering risk-adjusted yield beyond crypto-native assets. The move to Morpho extends ACRDX's reach across DeFi protocols. [Read full details](http://centrifuge.io/blog/acrdx-launch-on-centrifuge)

Centrifuge V3.1 Brings Automated Onchain Accounting to Tokenized Assets

Centrifuge V3.1 introduces fully automated, onchain accounting for tokenized assets, implementing traditional double-entry bookkeeping directly on the blockchain. **Key features include:** - Transparent and auditable accounting by default - Automated NAV calculations and share pricing - Oracle updates that synchronize across multiple chains - Full visibility into pricing logic and state Builders using Centrifuge's Whitelabel solution can now deploy tokenized assets with real-time, verifiable accounting from launch. The update expands support to 10 chains through a hub-and-spoke architecture, allowing teams to launch assets on any supported chain within minutes. This infrastructure update aligns with how institutions currently operate across multiple chains, bringing traditional accounting standards to onchain finance.