Tokenized treasuries were just the beginning. While T-bills proved blockchain infrastructure works, the real institutional transformation requires bringing diversified, yield-bearing assets onchain.

The next wave includes:

- Structured finance products

- Private credit instruments

- Non-correlated asset classes

This evolution addresses DeFi's core challenge: limited collateral options. Moving beyond government securities unlocks new liquidity sources for decentralized finance.

Infrastructure requirements are steep - institutions need robust, compliant platforms that can handle complex financial products. Centrifuge has been building this foundation since 2017.

The market is transitioning from proof-of-concept to scale. Early tokenized assets demonstrated technical feasibility, but institutional adoption demands sophisticated asset management capabilities.

Explore institutional-grade tokenized assets at app.centrifuge.io

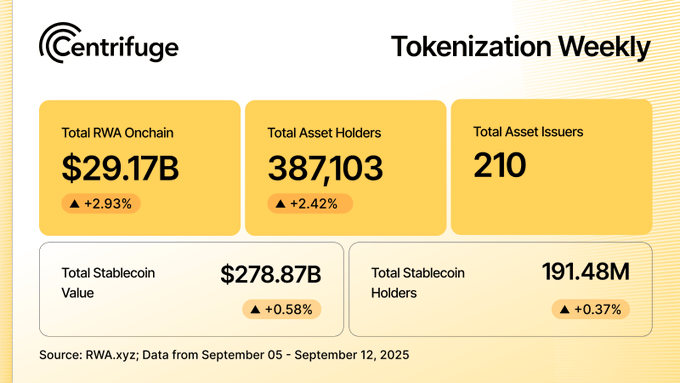

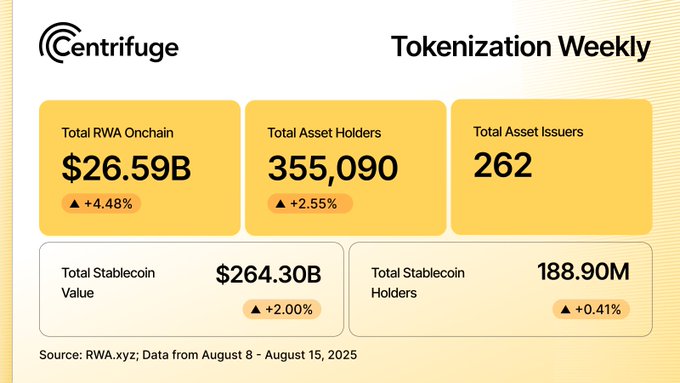

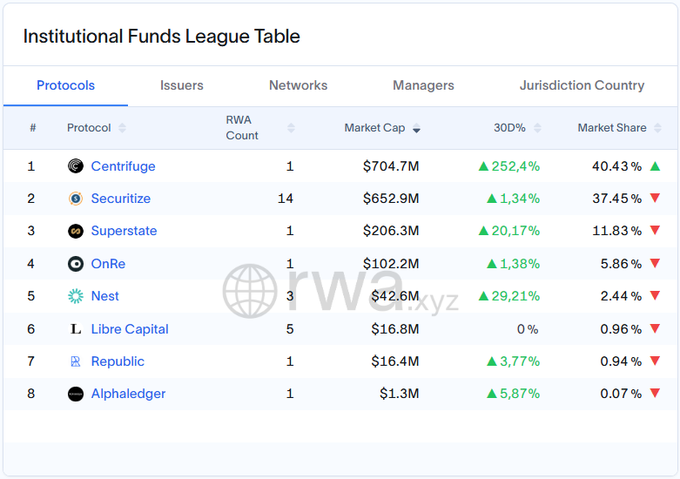

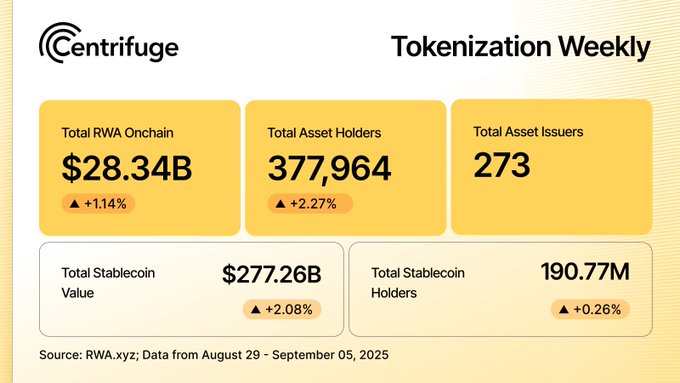

A powerful and transparent financial layer is being forged, driven by institutional adoption. The tokenized asset ecosystem continues to expand on a bedrock of high-quality assets like treasuries and credit. Explore the latest data on this fundamental shift 👇

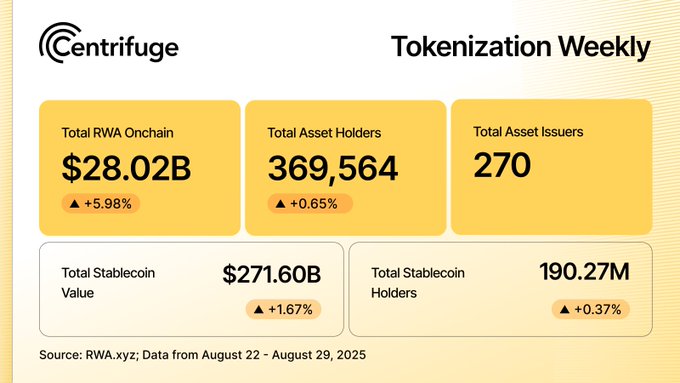

Amid the market's noise, the signal is clear: the onchain economy is growing. RWAs continue to provide a stable foundation for DeFi, with fundamental growth week after week. Here's your latest signal boost 👇

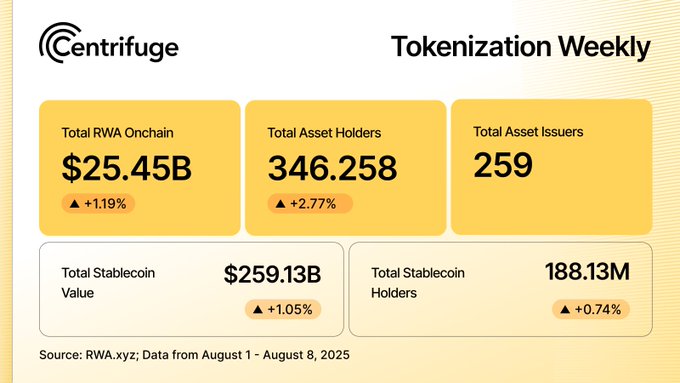

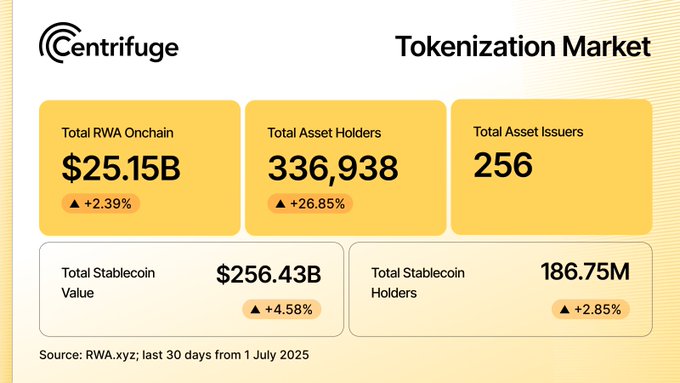

The real story of market adoption is told by the growth of the network itself. Each new asset holder and issuer onchain makes the ecosystem more resilient and decentralized. This is the foundation for a more open economy being built, week by week. Here's your weekly briefing on

"Centrifuge plays a central role in this system, handling the full tokenization pipeline from asset onboarding to issuance. Their infrastructure enables strategies like JAAA and JTRSY to launch, scale, and operate across chains with institutional clarity and onchain

Grove expands to @avax. With a $250M target deployment into tokenized institutional credit strategies, @JHIAdvisors’ JAAA and JTRSY, Grove is laying the foundation for scalable, institutional credit onchain. What this unlocks → grove.finance/blog

First, it was tokenized treasuries. Then, CLOs. The next frontier for institutional-grade RWAs is coming to @Centrifuge. Stay tuned 👀

The future of finance is not a battle between TradFi and DeFi, but their convergence into a single, global market. This evolution requires a common language, a universal, chain-agnostic infrastructure capable of bringing any RWA onchain. That is what we are building at

RWAs are the next pillar of global finance. And @joinrepublic agrees. That's why today, Centrifuge is excited to announce a strategic investment from Republic Digital’s Opportunistic Digital Assets Fund. From pioneer to leader in tokenized finance, Centrifuge is setting the bar

The Horizon RWA market by @aave is live, with Centrifuge at launch. RWAs are no longer just tokens onchain. They’re active collateral powering real-time liquidity. For the first time, Aave users can borrow stablecoins against: 📌 Tokenized U.S. Treasuries (JTRSY) 📌 AAA-rated

Great to join Will Beeson on the Rebank podcast! Our COO Jürgen Blumberg and CEO @itsbhaji dive deep into the evolution of Centrifuge, the drivers of RWA adoption, and how we see DeFi and TradFi converging into "just finance." Listen to the full episode to hear how tokenized

🎧 Ep 248: Scaling Tokenized Real World Assets with Centrifuge Bhaji Illuminati and Jürgen Blumberg of Centrifuge join Will Beeson, CFA Beeson to explore: ➡ The evolution of Centrifuge from esoteric assets like invoice financing to treasuries, CLOs, and beyond ➡ Why buy-side

As founders of @rwasummit, we’re proud to return to The William Vale in Brooklyn this September as Title Partner for the flagship event’s third consecutive year, where the leading minds in crypto and capital markets meet. Our CEO, @itsbhaji, will take the stage to tackle the

Real-world yield doesn't just mean treasuries. The largest pools of institutional capital are traditional assets with limited liquidity. Soon, they will be unlocked on @Centrifuge. The next generation of institutional RWAs is loading 🔄

Goldman Sachs. BlackRock. Invesco. Jürgen Blumberg helped build the ETF market from the inside. Now he joins Centrifuge as COO, and CIO of @anemoycapital, to lead the shift from legacy structures to regulated, onchain investment products. Blumberg’s move is a signal:

Centrifuge V3 is now live on @avax, with its first major deployment on the way. @grovedotfinance is allocating up to $250M into the Janus Henderson Anemoy AAA CLO Strategy (JAAA), part of a $1B partnership with Centrifuge and @JHIAdvisors to scale institutional credit onchain.

A great discussion on the institutional adoption of RWAs. Our CEO, @itsbhaji, joined the latest episode of @TokenizedPod to talk about Centrifuge's pioneering role in the space since 2017, the debate on tokenized deposits, and the future of onchain finance. Check it out 👇

🚨 Ep. 46 of @TokenizedPod: Every Bank Should Tokenize Deposits @sytaylor & @cuysheffield are joined by: ➡️ @KAndrewHuang, Founder @conduitxyz ➡️ @itsbhaji, CEO @centrifuge To discuss: ⚙️ Centrifuge's role in tokenizing real world assets since 2017 🥊 Debate on tokenized

Why did a 20-year ETF veteran from Goldman Sachs & BlackRock join @centrifuge? Because as our new COO Jürgen Blumberg explains, tokenization today feels just like the early days of ETFs: A moment where a new technology challenges the entire financial system.

Goldman Sachs. BlackRock. Invesco. Jürgen Blumberg helped build the ETF market from the inside. Now he joins Centrifuge as COO, and CIO of @anemoycapital, to lead the shift from legacy structures to regulated, onchain investment products. Blumberg’s move is a signal:

The financial system is being rewritten on new rails. From institutional credit funds moving operations onchain to tokenized treasuries becoming a core DeFi primitive, the groundwork for a more open economy is being laid. Here's your weekly briefing on the real progress in

"Once an asset is onchain, the most interesting question is what you can do with it," as our CEO, @itsbhaji, said on the @TokenizedPod. This is the fundamental question we answer by building open, multichain infrastructure. We create the tools, like our deRWA tokens, that

On the latest episode of Tokenized, Bhaji Illuminati (@itsbhaji), CEO of @centrifuge asks the question: “What do you do after tokenizing an asset?” Hear her thoughts below 👇 🎙️ Listen to the latest episode of Tokenized: tokenized.simplecast.com/episodes/every… 📷 Watch on YouTube:

The most powerful force in finance is compounding growth. Week after week, the onchain economy expands as more assets, holders, and issuers build a stronger, more resilient foundation. This is how a new system is built, with a relentless progress. Here's your weekly briefing👇

Most “multichain” protocols fragment liquidity. Centrifuge unifies it. In this first deep dive on Centrifuge V3, we sat down with Jeroen Offerijns (@offerijns), CTO, and Frederik Gartenmeister (@mustermeiszer2), Head of Product, to unpack the core technical unlocks: - Chain

Liquidity fragmentation ends now. Centrifuge V3 is LIVE, first launching on @ethereum, @plumenetwork, @base, @arbitrum, @avax, and @BNBCHAIN, with chain interoperability powered exclusively by @wormhole. Fund managers can manage liquidity across multiple chains from a single

We're at a rare inflection point in finance. Our new COO, Jürgen Blumberg, saw this happen once before with the rise of ETFs. Here’s his take on why the opportunity in tokenization is just as profound, and why the time to build is now!

Traditional finance is clogged with intermediaries, adding costs and complexity. Tokenization on @centrifuge will change that. By representing RWA onchain, we aim to reduce reliance on these intermediaries, creating a more open, transparent, and efficient way to access finance.

The gravity of onchain finance is growing stronger. Week by week, the pull of real-world yield and transparent infrastructure brings more assets, holders, and issuers into the ecosystem, building undeniable momentum. Here's your weekly look at the numbers 👇

Institutional trust meets DeFi composability. In Part 2 of our deep dive series, @offerijns and @mustermeiszer2 explore the "why" behind Centrifuge V3: our core design philosophy for bridging two financial worlds. Read more at: centrifuge.io/blog/centrifug…

Data integrity is the bedrock of institutional trust in DeFi. @rwa_xyz has upgraded its analytics dashboard to fully support Centrifuge V3, our scalable, multi-chain protocol for asset tokenization.

Grove Labs co-founder (@0x_roo) on our partnership with @grovedotfinance & @avax: Combining our technologies "lays the foundation for a new era of scalable onchain credit markets.” Read more in @CoinDesk's article: coindesk.com/business/2025/…

Tokenized T-bills proved the rails work. They were the gateway. But the future of the onchain economy won't be financed by treasuries alone. The true institutional leap, and the solution for DeFi's collateral, is bringing diversified, yield-bearing, non-correlated assets

The onchain economy is growing, driven by the adoption of institutional-grade assets like tokenized treasuries and credit funds. This fundamental shift is building a resilient foundation for the future of finance. Here's the latest data on this progress 👇

RWA Summit Opens Tomorrow: Builders and Institutions Unite to Fix Finance

The **RWA Summit** kicks off tomorrow in Brooklyn, bringing together builders and traditional institutions to address fundamental issues in finance. Centrifuge CEO emphasizes the event's mission: *"bringing every perspective to have the real conversations needed to move the industry forward."* Key focus areas include: - Whether RWAs have achieved product-market fit - Bridging the gap between traditional finance and DeFi - Rebuilding ETFs onchain The summit features industry leaders discussing the current state and future of real-world assets in crypto, marking its third consecutive year at The William Vale. [Learn more about the summit](https://www.rwasummit.io/brooklyn-2025)

AI Agents Managing Assets: RWA Summit Panel Discussion

**AI-powered asset management** is taking center stage at the RWA Summit. Martin Quensel will join industry experts including: - Stephanie Rowton from S&P Dow Jones Indices - Melody He from Spartan Group The panel, moderated by Michael Casey, will explore whether we're entering an era where **AI agents handle our financial assets**. This mainstage discussion promises insights into the intersection of artificial intelligence and asset management - a topic gaining significant traction in the financial sector.

ETFs vs. Tokenization: The Next Evolution of Finance

**ETFs created a multi-trillion dollar industry** - but what's next for asset management? Centrifuge COO **Jürgen Blumberg** will debate this question at the RWA Summit mainstage alongside market leaders in a panel titled "ETFs vs. Tokenization." **Key advantages of tokenization over traditional ETFs:** - **Always liquid** - breaks the 9-to-5 market hours barrier - **Different liquidity profiles** - not limited to liquid instruments only - **Fully backed fund tokens** - direct access to underlying assets Blumberg, an ETF veteran, sees tokenization as equally profound to the ETF revolution. The **growing onchain investor ecosystem** demands native digital assets, driving strong momentum for tokenized funds. The long-term vision involves **deconstructing the entire fund value chain** - from issuance to reporting - and rebuilding it natively onchain for greater efficiency and transparency.

Chronicle Labs Launches VAO Dashboard for Tokenized Treasury Transparency

**Chronicle Labs has launched the VAO Dashboard**, bringing unprecedented transparency to tokenized treasury funds. The new dashboard provides users with **complete visibility** into how asset data is: - Sourced from real-world markets - Verified through cryptographic proofs - Monitored continuously onchain **Key benefits include:** - Enhanced trust in tokenized assets through verifiable data - Real-time monitoring of treasury fund performance - Transparent data sourcing methodology The dashboard initially supports the **JTRSY tokenized treasury fund**, one of the leading products in the space. Users can now track exactly how real-world financial data flows into onchain representations. This launch addresses a critical need in **tokenized finance**: establishing trust through data verification. By making the entire data pipeline transparent, Chronicle Labs enables investors to verify asset backing independently. [Explore the VAO Dashboard](https://chroniclelabs.org/dashboard/vao/janus-henderson-anemoy-treasury-fund)

Nasdaq Files for Tokenized Securities Trading

**Nasdaq has filed with the SEC** to enable trading of tokenized securities on its platform, marking a significant step toward blockchain-based traditional finance. **Key challenges ahead:** - Settlement infrastructure needs major upgrades - Complex regulatory hurdles remain unresolved - Market efficiency and accessibility could improve significantly The filing represents a **landmark move** that could revolutionize securities trading by bringing traditional equities onto blockchain networks. General Counsel Eli Cohen analyzed the regulatory complexities for The Defiant, highlighting that while the concept is promising, the **real work lies in building proper infrastructure**. Read the full analysis: [The Defiant](https://thedefiant.io/news/tradfi-and-fintech/nasdaq-s-tokenized-equities-filing-highlights-settlement-and-infrastructure-challenges)