Major blockchain networks are joining forces to standardize digital payments across the industry.

Polygon has joined the Blockchain Payments Consortium alongside Fireblocks, Mysten Labs, Monad Foundation, Solana Foundation, Stellar Development Foundation, and TON Foundation.

The consortium aims to:

- Define common frameworks for blockchain payments

- Standardize digital asset transactions across networks

- Create frictionless payment infrastructure

The timing is significant - stablecoins settled over $15 trillion onchain in 2024, surpassing the combined volume of Visa and Mastercard.

This collaboration could establish the foundation for seamless cross-chain payments and broader crypto adoption in traditional commerce.

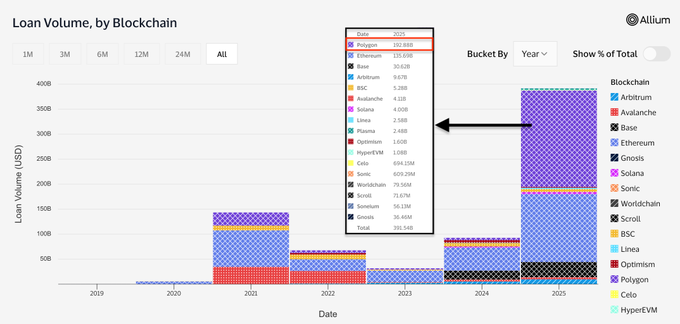

The @Visa x @AlliumLabs report just dropped. Polygon leads all chains in stablecoin lending this year, with $192 B+ in volume. That's more than Ethereum, Arbitrum, Base and Solana. The numbers speak for themselves.

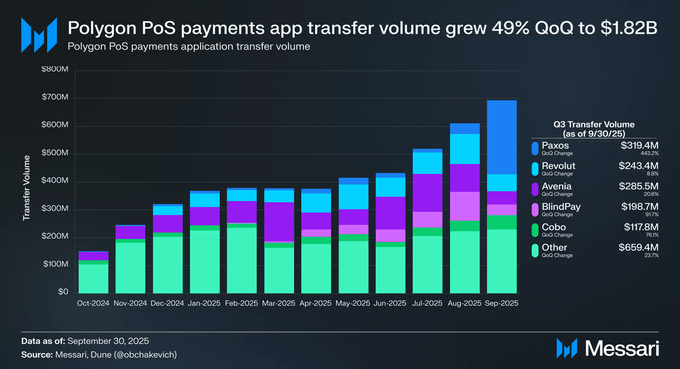

If it’s payments, it’s Polygon. Q3 2025 proved it. Payments apps moved $1.82B on Polygon across 50 platforms. Up 49% from Q2 And stablecoin-linked crypto card volume grew to $322M across Visa and Mastercard The @MessariCrypto Polygon Q3 report is out, with much more data to

With over $15T settled onchain in 2024, stablecoins now move more than Visa and Mastercard combined. We're proud to join the Blockchain Payments Consortium to help define a common framework and shape the future foundation for frictionless blockchain payments.

Introducing the Blockchain Payments Consortium (BPC). A new alliance uniting @ton_blockchain, @0xPolygon, @solana, @SuiNetwork, @StellarOrg , @Mysten_Labs, @monad, and @FireblocksHQ to accelerate the future of blockchain payments. Together, we’re defining the standards that

DeCard x Polygon • 150M+ merchants worldwide • support for USDC + USDT0 • real-world use for your magic internet money

purple chain 💜💙dragons DeFi TVL on Polygon reached $1.14B in Q3 And @QuickswapDEX TVL went up 15% during the period

Crypto’s entire market cap went up by 21% in Q3 But POL’s went up 39% to $2.4B

One of the biggest stablecoin rollouts ever. And it's on Polygon. @DCS_DeCard has enabled instant USDC and USDT0 payments to 150M+ merchants worldwide. Users: turn stablecoins into spendable money by depositing directly into DeCard accounts on Polygon.

Paying with crypto is as easy as tapping your credit card 💳 From June to August, stablecoin cards processed $381M in combined Mastercard and Visa volume on Polygon

Polymarket Becomes Official UFC Prediction Market Partner

**Polymarket has secured a major partnership** as the official prediction market of the UFC, marking a significant milestone for decentralized betting platforms. **Key developments:** - UFC partnership brings mainstream sports exposure to onchain prediction markets - Platform powered by Polygon blockchain for fast, low-cost transactions - Builds on recent Google search integration announcement This partnership represents **growing institutional adoption** of decentralized prediction markets in traditional sports entertainment. With UFC's massive global audience, Polymarket gains unprecedented mainstream visibility. The timing aligns with Polymarket's broader expansion strategy, including upcoming Google search integration that will expose odds to 8.5M daily searches. **Why it matters:** Traditional sports partnerships validate prediction markets as legitimate alternatives to conventional betting platforms, potentially accelerating mainstream crypto adoption.

Polygon Targets Financial Inclusion Through Asset Tokenization in Emerging Markets

**Polygon positions tokenization as breakthrough for financial inclusion** Polygon team members with emerging market experience see tokenization as a generational opportunity to provide financial access to previously excluded populations. **Key developments:** - Assets can now be represented and exchanged outside traditional finance limitations - Technology enables bypassing restricted financial infrastructure in emerging markets - Polygon CEO Sandeep Nailwal published op-ed in Entrepreneur magazine outlining tokenization strategy **Market context:** Tokenized financial and real-world assets projected to exceed $4 trillion by 2030, representing significant growth opportunity. The initiative addresses decades of financial exclusion by leveraging blockchain technology to create accessible asset representation and exchange mechanisms. [Read full op-ed](https://www.entrepreneur.com/leadership/imagine-owning-part-of-the-world-from-your-phone-heres/498737)

Argentina Sponsors Aleph Festival for Latin American Blockchain Builders

Argentina is sponsoring the **Aleph Festival**, targeting developers building blockchain solutions for Latin America. The focus areas include: - **Onchain payments** systems - **Interoperability** solutions - **Governance** platforms - **Real World Assets (RWA)** integration This initiative continues Argentina's push to bring the country onchain, building on previous movements to establish blockchain infrastructure in the region. The festival represents a significant opportunity for Latin American developers to showcase their blockchain projects and connect with sponsors interested in regional adoption.

RWA Industry Faces Reality Check: Not All Growth Is Real

**Real-World Asset tokenization needs a reality check**, according to Polygon Labs' Global Head of Payments & RWAs. The **RWA revolution** requires three critical foundations: - **Verifiable assets** with proven ownership - **Clear regulatory frameworks** for compliance - **Actual usage** beyond speculation **Current challenges** include: - Many projects lack real substance behind growth claims - Tokenizing assets like US Treasuries offers **no competitive moat** - Missing infrastructure for custody, trading, and redemption **Real estate emerges as the sweet spot** for tokenization due to high value, illiquidity, and suitability for fractional ownership. **Key insight**: Intermediaries won't disappear - they'll evolve. Winners will be protocols embedding KYC, legal logic, and risk scoring into smart contracts. **The bottom line**: Programmable finance must be matched with programmable trust. Without verified data and legal enforceability, blockchain remains "code floating in a vacuum." Read the full analysis: [Cointelegraph Op-Ed](https://cointelegraph.com/news/not-all-rwa-growth-is-real-and-the-industry-knows-it)

USDQ Stablecoin Launches on Polygon with MiCA Compliance

**USDQ stablecoin** is now available on Polygon through Ubyx, marking another milestone for the purple chain's payment infrastructure. Key highlights: - **MiCA compliant** - meets European regulatory standards - Available via **@ubyx_** platform - Expands Polygon's stablecoin ecosystem alongside existing USDC support This launch builds on Polygon's growing reputation as a **payment-focused blockchain**, following previous integrations like Circle Gateway's sub-500ms USDC liquidity and Wyoming's state-issued stablecoin. The addition strengthens Polygon's position in the **regulated stablecoin market**, particularly for European users seeking compliant digital payment solutions.