Bitfinex Launches Alpha Report for Professional Traders

Bitfinex Launches Alpha Report for Professional Traders

🧠 Your Trading Crystal Ball

Bitfinex has introduced a new professional research product called Bitfinex Alpha, targeting sophisticated traders and investors. The service provides:

- In-depth market insights and real-time data analysis

- Professional-grade research on crypto markets

- Weekly coverage of macro trends and on-chain metrics

- Institutional-level liquidity flow analysis

The report aims to help traders make more informed decisions through comprehensive market intelligence and technical analysis. Recent editions have covered Bitcoin's consolidation in the $100K-$110K range and institutional flow patterns.

Amid one of the most turbulent periods for global markets in years, Bitcoin is showing impressive resilience. Despite a 32% drawdown from January highs, BTC has since rebounded and is holding steady. Is Bitcoin finally being recognised as a macro hedge? blog.bitfinex.com/bitfinex-alpha…

Bitcoin just faced one of its toughest weeks: 🚨 $400M+ in long liquidations, 3 days in a row 📉 Down 11.5% from May highs With macro chaos rising - oil prices, stagflation, geopolitics - can BTC still be the safe haven traders hope for? blog.bitfinex.com/bitfinex-alpha…

gm ☕️ Imagine having a secret key to trading insights. Bitfinex Alpha is just that, your cheat code in the crypto game. Like finding the map to a treasure! 🗺️ bitfinex.com/bitfinex-alpha/

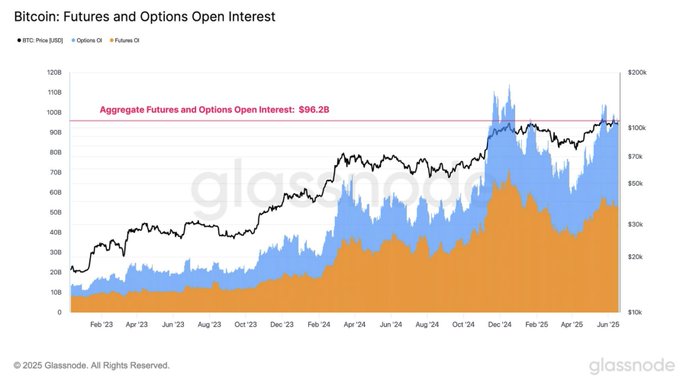

Crypto derivatives are shaping the future of market dynamics, with futures and options open interest near $100B. These growing markets will be key to price discovery and volatility. What’s next for crypto trading? Discover more in Bitfinex Alpha: blog.bitfinex.com/bitfinex-alpha…

For traders who demand depth and clarity: Bitfinex Alpha offers weekly, institutional-grade insights into crypto markets, macro trends, on-chain data, and liquidity flows. Are you getting the analysis you need to trade with conviction? go.bitfinex.com/AlphaSignUpPage

Bitcoin surged 14% in April, rebounding 32% from lows and reclaiming key levels. On-chain data looks bullish, could a breakout be next? Watch our Bitfinex Alpha video for more details. And don’t miss the full Bitfinex Alpha here: blog.bitfinex.com/bitfinex-alpha…

BTC closed last week nearly flat, down just 0.65%, while US equities saw sharp declines. At first glance, it looked like strength - but it may have been a lagging reaction. What’s next for the markets? Find out in this week’s Bitfinex Alpha: blog.bitfinex.com/bitfinex-alpha…

US consumer prices rose less than expected in May, easing pressure - for now. But inflation risks remain as trade tariffs & geopolitics threaten global markets. Will crypto become the safer long-term option in this increasingly uncertain time? blog.bitfinex.com/bitfinex-alpha…

After a 32% dip from January highs, Bitcoin has roared back with a 50% rally to $111,880 and is now in a healthy consolidation phase. With macro headwinds rising, can BTC keep leading the way? blog.bitfinex.com/bitfinex-alpha…

Looking to refine your trading and investment strategies? Our detailed weekly analysis in Bitfinex Alpha keeps you informed and ahead of the markets! Stay updated, sign up now: go.bitfinex.com/AlphaSignUpPage

“Bitcoin’s recent rally follows a near-flawless setup backed by institutional inflows and growing optimism around regulatory clarity.” — Jag Kooner, Head of Derivatives @ Bitfinex Read more on @Theblock__ theblock.co/post/353833/bi…

Stay informed. Trade smarter. Bitfinex Alpha delivers exclusive market intelligence, macro trend analysis, and actionable forecasts to help you navigate the week ahead. Sign up here: go.bitfinex.com/AlphaSignUpPage

Stay ahead of the crypto curve with Bitfinex Alpha! 📩 Weekly insights, pro market analysis & details you won’t find anywhere else. Don’t just trade - trade informed. Sign up now: go.bitfinex.com/AlphaSignUpPage

Crypto markets faced a shakeup, but strong Bitcoin ETF inflows show rising institutional confidence. With derivatives resetting and funding rates stabilising, the future hinges on whether this demand continues or if market sentiment shifts. Read more: blog.bitfinex.com/bitfinex-alpha…

🧠 Smart traders read Bitfinex Alpha. Weekly insights, pro-level market analysis, all straight to your inbox. Don't just trade. Trade smarter. 🔔 Sign up now: go.bitfinex.com/AlphaSignUpPage

Stay ahead of the curve with institutional-grade crypto insights! Sign up to Bitfinex Alpha for weekly deep dives into market trends, macro drivers, and on-chain analytics. Start reading smarter: go.bitfinex.com/AlphaSignUpPage

Real demand is driving the Bitcoin price as measured by Cumulative Volume Delta, which measures the sum of buys and sells, and is firmly positive across major exchanges, showing real demand - not just leverage. ✅ 🎥 Watch the full Bitfinex Alpha breakdown here!

Want to stay one step ahead of the markets? Unlock a world of insights with Bitfinex Alpha! Your exclusive source for market intelligence, macro trends, and real-time forecasts. 👉 Get the edge you need — sign up today: go.bitfinex.com/AlphaSignUpPage

Bitcoin pulls back. Its first major correction since April. The move comes as macro tensions rise… Is this a healthy reset or the start of something bigger? blog.bitfinex.com/bitfinex-alpha…

“Bitcoin is now at a crossroads—balanced between structural support and waning bullish momentum, waiting for its next macro cue.” Bitfinex analysts @coindesk coindesk.com/markets/2025/0…

Access exclusive insights, macroeconomic trends, and real-time market forecasts designed for traders who seek a competitive edge. Bitfinex Alpha is your trusted resource for in-depth market intelligence! Sign up today and enhance your trading strategy: go.bitfinex.com/AlphaSignUpPage

“The risk of a short-term correction continues to build — especially in the absence of a strong catalyst to push Bitcoin decisively above the current all-time high,” Bitfinex analysts @cointelegraph cointelegraph.com/news/bitcoin-p…

"Vertical acceleration is off the table." - Bitfinex Alpha @FXLeadersCom fxleaders.com/news/2025/07/0…

Bitcoin’s rally pulls back as $1.9B+ in liquidations clear excess leverage. Strong spot demand fades amid rising sell pressure from long-term holders. Watch our markets outlook video & read the full analysis in Bitfinex Alpha👇 blog.bitfinex.com/bitfinex-alpha…

Ready to trade smarter? Access in-depth market insights, real-time data analysis, and professional-grade research with the Bitfinex Alpha report — tailored for sophisticated traders and investors. go.bitfinex.com/AlphaSignUpPage

"Bitcoin consolidates ahead of Q3." - Bitfinex Alpha x.com/TheBlock__/sta…

Macro tailwind crucial for bitcoin during historically soft start to Q3, analysts say theblock.co/post/360527/ma…

Want expert crypto insights delivered straight to your inbox? Join Bitfinex Alpha for deep-dive market analysis, fresh trends, and the latest macro news to stay ahead in crypto. Don’t miss out, sign up today! 🔔 go.bitfinex.com/AlphaSignUpPage

Serious trading demands serious insights. Bitfinex Alpha delivers in-depth crypto market analysis, on-chain data, macro trends & liquidity flows - every week. Stay informed. Trade with confidence. go.bitfinex.com/AlphaSignUpPage

Bitcoin reclaimed $85K last week, jumping 6.67% on the back of macro relief after @realDonaldTrump’s 90-day tariff pause. The good news is that the rebound was spot-driven — not leveraged — signaling real buyer conviction. Get the full analysis: blog.bitfinex.com/bitfinex-alpha…

The markets are flashing warning signs: a weaker dollar, surging Treasury yields, spiking volatility, and collapsing consumer confidence... Investors are bracing as uncertainty deepens.

Euphoria Rising? Bitcoin Relative Unrealised Profit just broke above its +2σ band, a level that’s historically marked local tops and triggered sharp intraday moves. Is the market overheating? More in Bitfinex Alpha: blog.bitfinex.com/bitfinex-alpha…

“This is not a melt-up - it’s a structurally supported move. As long as ETF + institutional flows persist and macro stays stable, dips are likely to be brief and bought aggressively. The path of least resistance remains higher.” Bitfinex Alpha @BTCTN news.bitcoin.com/bitcoins-lates…

Bitcoin closed April with a strong 14.08% gain, beating its historical average and reversing early-month losses. The strong April close sets up Bitcoin for summer, as the 32% rally from $74.5K to nearly $98K signals resilience amid macro uncertainty👇 blog.bitfinex.com/bitfinex-alpha…

"Bitcoin enters transition zone." - Bitfinex Alpha @benzinga benzinga.com/crypto/cryptoc…

“From here, the next zones to watch are $114K–$118K (minor liquidity walls) and then $123K–$125K, where large options open interest is building" - Bitfinex Analysts @BTCTN news.bitcoin.com/bitcoin-price-…

"Current market conditions “also resemble prior capitulation-driven setups which usually result in Bitcoin reversing course shortly after aggressive selling.” - Bitfinex Alpha via @cointelegraph cointelegraph.com/news/bitcoin-p…

Bitfinex Alpha analysts suggest BTC is at a crossroads, pinned between structural support and waning bullish momentum. Following almost $2bn in liquidations last week, BTC needs a major macro cue to advance. blog.bitfinex.com/bitfinex-alpha…

Unlock the Edge. Stay ahead of the markets with Bitfinex Alpha - your weekly source for institutional-grade insights, macro trends, on-chain data, and liquidity flows. 📈 Trade smarter with Bitfinex Alpha: go.bitfinex.com/AlphaSignUpPage

"The market is coiled, not broken, and the coming months could bring significant upside if catalysts align." Bitfinex Alpha @ForbesCrypto @BillyBambrough forbes.com/sites/digital-…

Bitcoin holders just witnessed the fastest profit restoration in 2025. Chart shows 25% of the supply was in unrealised loss last month, dropping to 2.9% after the recovery in price. What does this shift mean for your next trade? blog.bitfinex.com/bitfinex-bytes…

Bitcoin’s correction comes as derivative positioning hit new highs, with options open interest rising to $50B, on-chain metrics flashing ‘euphoria’, and macro headwinds building. ⚠️ Volatility ahead? 🎥 Watch our latest video for the full analysis! blog.bitfinex.com/bitfinex-alpha…

Why is BTC so stable? “This is a repositioned market—long-term holders are accumulating while shorter-term participants have exited. The market front-ran macro stress back in February & March”. Now we wait for more clarity - Bitfinex Alpha @BenzingaIndia in.benzinga.com/25/04/44763111…

“At these levels, the risk emerges that profit-taking outpaces new demand inflows" - Bitfinex Alpha @CoinDesk coindesk.com/markets/2025/0…

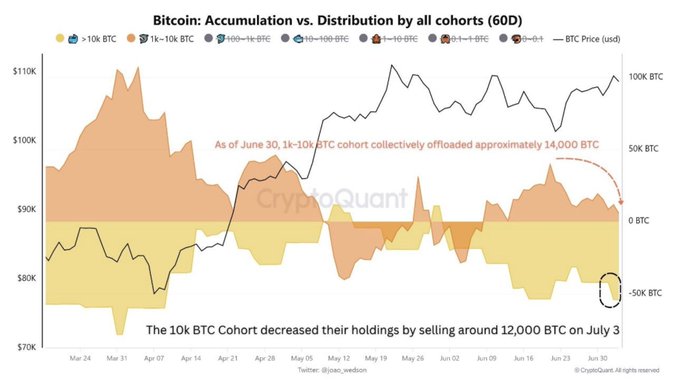

Mid-sized whales have been trimming ~14K BTC since June 30, while retail & short-term holders snapped up ~382K BTC in early July. This shift may stabilise prices short-term, but watch how new holders and institutions react to volatility.. ⚠️ blog.bitfinex.com/bitfinex-alpha…

Bitfinex analysts said BTC is on steadier footing after last week's leverage flush, but is at a critical juncture awaiting macroeconomic catalysts. x.com/CoinDesk/statu…

Bitcoin is showing resilience in the face of rising macro uncertainty - driven by strong ETF inflows, institutional conviction, and structural market demand. As consolidation sets in, is this a pause before a bigger move? Get the full breakdown 👇 blog.bitfinex.com/bitfinex-alpha…

For serious traders seeking an edge: Bitfinex Alpha provides in-depth weekly analysis on crypto markets, macro trends, on-chain metrics, and liquidity flows - all tailored to help you make informed decisions. Sign up now: go.bitfinex.com/AlphaSignUpPage

“Spot volume has cooled, taker buy pressure has weakened, and profit-taking has intensified — especially among short-term holders who rode the move from sub-$80,000 levels” - Bitfinex Alpha @cointelegraph cointelegraph.com/news/bitcoin-p…

📣 Weekly Bitfinex Alpha Community Summary is live! • BTC consolidates in $100K-$110K range after 50% rally • US economy shows mixed signals; Fed policy uncertain • Tokenised assets expand; crypto fraud risk persists 📊 Read in English: telegra.ph/Bitfinex-Alpha…

Stay Ahead in the Crypto Market with Bitfinex Alpha! 🧐 Want to enhance your investment strategies? 📊 Our in-depth analysis keeps you informed and ahead of the curve every week. Don’t miss out - sign up now! go.bitfinex.com/AlphaSignUpPage

Bitcoin consolidates between $100K–$110K, with dip buyers defending $98.7K and leverage low. History suggests what’s coming next: Q3 is typically BTC’s weakest quarter, with low volatility and slower moving markets. Will this time be different? blog.bitfinex.com/bitfinex-alpha…

Bitcoin is gaining serious traction again. With macro support, fresh ETF inflows, and strong on-chain signals, momentum is building fast. What’s fuelling the move? Watch our latest Bitfinex Alpha market summary for a full breakdown of the key drivers! 🎥

"This dramatic shift highlights just how quickly investor sentiment and behavior can pivot when momentum returns." - Bitfinex Alpha @Crypto_Potato cryptopotato.com/bitcoin-at-ris…

Macro pressure has arrived. 📉 Last week, BTC held up impressively - closing just -0.65%, far outperforming traditional risk assets. But this week’s sell-off shows it was only a delayed reaction. Still, we’re optimistic on Q2 👀 blog.bitfinex.com/bitfinex-alpha…

Short-term Bitcoin holders just realised $11.4B in profits last month. This is a 950% spike from $1.2B the month before. Only 8% of trading days in Bitcoin's history have seen higher profit-taking levels. What does this mean? 🧵 @BitcoinMagazine

Markets shook, but Bitcoin stood tall. Liquidations hit hard, yet spot ETF flows kept BTC steady. Is institutional conviction the new floor? Tuck into your weekend reads with Bitfinex Bytes, we have all the news in one place 👇 blog.bitfinex.com/join-the-commu…

Whales are trimming positions, but steady inflows from new buyers suggest underlying strength. The market waits… Don’t miss the details in our summary video, and the full Bitfinex Alpha! blog.bitfinex.com/bitfinex-alpha…

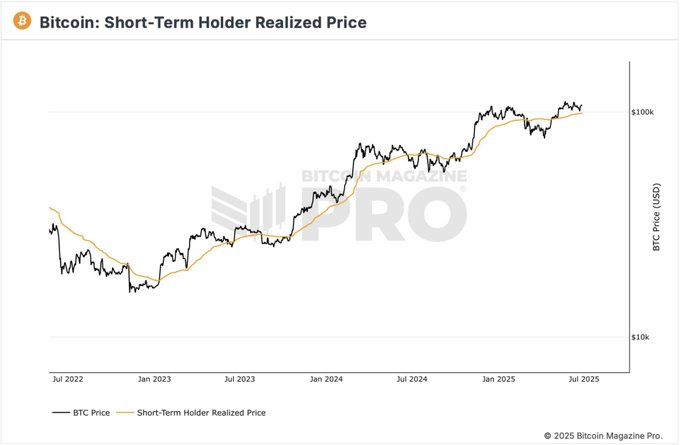

Bitcoin tested key support last week amid rising geopolitical tensions, sparking a sharp but short-lived sell-off. Buyers quickly defended the Short-Term Holder Realised Price, but BTC remains range-bound between $100K–$110K. 📊 Chart @BitcoinMagPro blog.bitfinex.com/bitfinex-alpha…

Historically, Q3 has been Bitcoin’s weakest quarter - averaging just +6% returns. Low volatility, muted momentum, and range-bound action tend to dominate. Will 2025 break the trend? 🎥 Watch our review video & read the latest Bitfinex Alpha here: blog.bitfinex.com/bitfinex-alpha…

After Bitcoin’s ATH, momentum shifts: BTC cools after a 50% run, leverage spikes, and macro pressure builds. 🔍 Meanwhile, privacy coins surge, @solana eyes real-world assets, and BTC devs clash over transaction filtering. More in Bitfinex Bytes ⬇️ blog.bitfinex.com/join-the-commu…

Sharpen your edge in the markets. 💡 Get expert insights, market trends, and deep analysis — all in Bitfinex Alpha. Stay informed. Stay ahead. go.bitfinex.com/AlphaSignUpPage

“The coming weeks will likely determine whether Bitcoinʼs latest breakout was a local high or the prelude to a more aggressive leg higher in Q3” - Bitfinex Alpha @cointelegraph cointelegraph.com/news/bitcoin-p…

We’re seeing Bitcoin long-term holders accumulating again, but the real test is how the market handles the next dip. Get the full breakdown of the current markets in our Bitfinex Alpha video! 🎥

Bitcoin jumped back above $85K last week after the US paused new tariffs. Spot buyers stepped in with conviction, and sentiment turned cautiously optimistic. Is this the start of a bigger move or just a relief bounce? Read the full breakdown: blog.bitfinex.com/bitfinex-alpha…

Markets are on edge. The dollar is falling, yields are spiking, and inflation expectations just hit 1980s levels. With consumer confidence sinking and rate cuts likely off the table, the US economy may be entering its toughest phase since 2020. blog.bitfinex.com/bitfinex-alpha…

"On‑chain metrics and order flow suggest a period of consolidation between $100k and $110k, rather than another vertical leg up." — Bitfinex Alpha x.com/CryptoEconomyE…

📉 Bitfinex warns BTC may consolidate 💥 @Bitfinex notes Bitcoin is stalling between $100K–$110K after a 50% rally, as spot volume and derivatives activity cool. crypto-economy.com/bitfinex-warns…

Bitcoin has shown notable structural resilience since reclaiming the $92K range in late April. The rally has been led by spot markets, with clean impulse moves following brief consolidations, indicative of real demand, not speculation. Read more 🧵 blog.bitfinex.com/bitfinex-alpha…

BTC holds steady in the $100K–$110K range as whales ease holdings and new buyers step in. The rising Short-Term Holder Realised Price keeps rising, but hesitation at the top of the range hints at caution... When will upward momentum return? blog.bitfinex.com/bitfinex-alpha…

What we are seeing is a ‘healthy reset’ following a historic rally rather than a breakdown. @BTCTN Bitfinex Alpha blog.bitfinex.com/bitfinex-alpha… news.bitcoin.com/analysts-warn-…

MicroStrategy Surpasses 600,000 BTC Holdings Milestone

MicroStrategy has achieved a significant milestone in institutional Bitcoin adoption, now holding over 600,000 BTC valued at more than $73 billion. This represents a substantial increase from their February 2025 position of 478,740 BTC. The company funded this expansion through equity and preferred stock offerings, demonstrating a committed long-term Bitcoin accumulation strategy. Key points: - 600,000+ BTC current holdings - $73+ billion total value - Funded via equity & preferred stock - 25% increase in holdings since February 2025 This move reinforces MicroStrategy's position as a leading institutional Bitcoin holder and signals growing corporate confidence in cryptocurrency assets.

Kaia Chain Connects Web3 Builders to 200M+ LINE and KakaoTalk Users

John Cho, VP of Partnerships at Kaia Chain, discusses how the platform is revolutionizing Web3 adoption by integrating with established messaging giants LINE and KakaoTalk. Key points: - Direct access to 200M+ active users across Asia - Focus on real user acquisition rather than grant funding - Integration with existing popular platforms for seamless adoption The initiative represents one of Asia's most significant moves toward mainstream Web3 adoption, providing builders with immediate access to an established user base. [Watch the full interview on Bitfinex Talks](https://youtu.be/FyrzUVrdJcU)

Bitcoin Market Dynamics: Long-Term Holders Begin Distribution Phase

Bitcoin recently achieved a new all-time high of $123,120, marking a 65.3% surge from April's lows. A significant shift is occurring in holder behavior: - Long-Term Holders (LTH) have become net sellers, increasing their exchange deposits - Short-Term Holders (STH) have turned net positive, absorbing supply near ATH levels - 95% of Bitcoin supply remains in profit despite recent cooling - Altcoins showing strength as BTC dominance decreases This rotation pattern suggests typical mid-cycle market behavior. Bitcoin continues to demonstrate characteristics of a high-beta safe haven asset, outperforming both gold and equities during periods of macro uncertainty. [Read full analysis](https://blog.bitfinex.com/bitfinex-alpha/bitfinex-alpha-alts-rally-follows-btc-ath/)

Bitfinex Opens Remote Social Media Manager Position

Bitfinex, the Original Bitcoin Exchange, is seeking a Social Media Manager to join their global team. This fully remote position offers an opportunity to: - Shape the platform's digital voice and presence - Create engaging content across social channels - Drive community growth and engagement - Work with a distributed crypto-native team **Key Role Details:** - 100% remote work environment - Global location flexibility - Focus on creative content creation - Community management responsibilities Apply here: [Social Media Manager Position](https://bitfinex.recruitee.com/o/social-media-manager-100-remote-all-locations)