Bitcoin Market Dynamics: Long-Term Holders Begin Distribution Phase

Bitcoin Market Dynamics: Long-Term Holders Begin Distribution Phase

🔄 Old Whales Are Jumping Ship

Bitcoin recently achieved a new all-time high of $123,120, marking a 65.3% surge from April's lows. A significant shift is occurring in holder behavior:

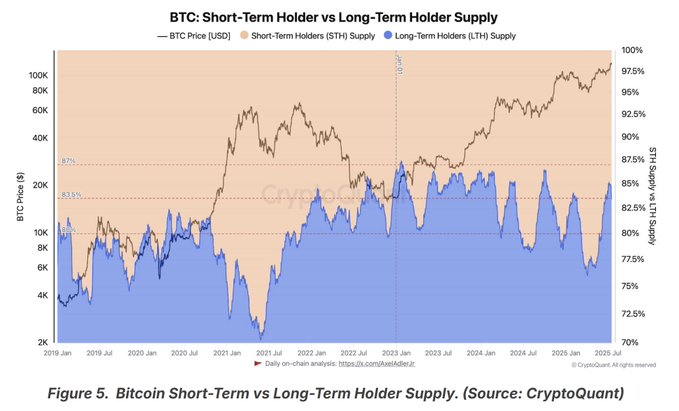

- Long-Term Holders (LTH) have become net sellers, increasing their exchange deposits

- Short-Term Holders (STH) have turned net positive, absorbing supply near ATH levels

- 95% of Bitcoin supply remains in profit despite recent cooling

- Altcoins showing strength as BTC dominance decreases

This rotation pattern suggests typical mid-cycle market behavior. Bitcoin continues to demonstrate characteristics of a high-beta safe haven asset, outperforming both gold and equities during periods of macro uncertainty.

Bitcoin reached a new ATH of $123,120 last week - a 65.3% rally from April’s lows. Now it’s cooling off… and altcoins are heating up. ETH, XRP & others are taking the lead as BTC dominance drops - classic mid-cycle vibes? Insights in Bitfinex Alpha: blog.bitfinex.com/bitfinex-alpha…

Tweet not found

The embedded tweet could not be found…

#Bitcoin breaks to new ATH: $123,120! Powered by a strong short-term holder bid, BTC is proving its status as a macro-resilient, high-beta safe haven — outpacing both gold & equities in terms of its recovery. Macro chaos? Bitcoin thrives. blog.bitfinex.com/bitfinex-alpha…

Bitcoin’s cooling off - but 95% of supply is still in profit. Long-term holders are finally distributing, while ETFs & retail soak it up. Is this healthy rotation… or the start of something bigger? 🎥 Watch the full breakdown! blog.bitfinex.com/bitfinex-alpha…

‘Bitcoin is a safe haven, just with higher Beta’ - Bitfinex Alpha @btctn news.bitcoin.com/bitcoins-high-…

Long-Term Holders are now net sellers of Bitcoin - sending more to exchanges than they’re stacking. Meanwhile, Short-Term Holders just flipped net positive, absorbing supply near ATHs. Will this rotation fuel a new rally? blog.bitfinex.com/bitfinex-alpha…

Bitcoin rebounded from a sharp 5% drop last week, defending short-term lows at $114,800. Over $1.1B in longs were liquidated - revealing just how overheated the market had become. Speculation cooled… but is leverage already back on the rise? blog.bitfinex.com/bitfinex-alpha…

Bitcoin goes over $120K – a new all-time high! 🚨 The original Bitcoin exchange, Bitfinex, celebrates this historic milestone with the community that’s been here since the beginning. 💚

Bitfinex Alpha Newsletter Signup Campaign

Bitfinex is promoting their Alpha newsletter, a weekly market intelligence service for crypto traders. The newsletter provides: - Advanced market data analysis - Macro trend insights - On-chain metrics - Institutional-grade research - Actionable trading insights Recent coverage has focused on Bitcoin's consolidation in the $100K-$110K range, with analysis of whale movements and retail buying patterns. The service aims to help traders make more informed decisions through professional-grade market analysis. [Sign up for Bitfinex Alpha](https://go.bitfinex.com/AlphaSignUpPage)

KaiaChain Integrates DeFi into LINE and KakaoTalk Platforms

KaiaChain is working to make DeFi more accessible by integrating it directly into established messaging platforms LINE and KakaoTalk, which together serve over 200M users. Key points: - Native integration provides familiar interface for mainstream users - Focuses on real user adoption rather than grant funding - Targets existing user bases on trusted platforms John Cho recently appeared on Bitfinex Talks to explain the technical architecture and vision behind this integration. The approach represents a practical path toward widespread consumer adoption of Web3 technologies. [Watch the full interview](https://youtu.be/FyrzUVrdJcU)

BitVMX Proposes Trust-Minimized Watchtowers for Lightning Network

BitVMX has published a paper proposing a significant improvement to Lightning Network's security model through enhanced watchtower functionality. Key points: - Current watchtowers rely heavily on trust, creating potential security vulnerabilities - BitVMX's solution introduces enforceable and verifiable watchtower logic - Implementation could reduce trust requirements and enhance network resilience The proposal builds on existing security recommendations for Lightning Network, including channel state verification and established payment channel prioritization. Learn more: [BitVMX Watchtower Paper](https://blog.bitfinex.com/education/how-can-bitvmx-watchtowers-help-improve-the-lightning-network/)

Bombie Becomes Highest-Grossing MiniDApp on KaiaChain

**Bombie** has emerged as the most successful MiniDApp on KaiaChain, achieving remarkable player engagement with an average spend of $350 per user. John Cho, VP of Partnerships, discusses the key factors behind this success: - Strategic product structure driving sustained growth - Strong player retention metrics - Innovative gameplay mechanics Learn more about Bombie's success story in the full interview: [Watch Here](https://youtu.be/FyrzUVrdJcU)

MicroStrategy Surpasses 600,000 BTC Holdings Milestone

MicroStrategy has achieved a significant milestone in institutional Bitcoin adoption, now holding over 600,000 BTC valued at more than $73 billion. This represents a substantial increase from their February position of 478,740 BTC. The company continues to execute its accumulation strategy through equity and preferred stock offerings, maintaining its position as the largest corporate Bitcoin holder. Key points: - 600,000+ BTC current holdings - $73+ billion total value - Funded through equity & preferred stock - 25% increase in holdings since February 2025 This development signals growing institutional confidence in Bitcoin as a treasury asset.