Aztec Demonstrates Real Price Discovery Through Uniswap's CCA Protocol

Aztec Demonstrates Real Price Discovery Through Uniswap's CCA Protocol

🎯 Real price discovery

Uniswap published a detailed case study on how Aztec successfully used Continuous Clearing Auctions (CCA) to conduct a community-driven token distribution.

Key outcomes from Aztec's auction:

- Over 17,000 community members participated

- 99% of participants contributed under $100K

- Raised $60M total through transparent, onchain process

CCA is now live on both Base and Arbitrum, allowing any project to run permissionless token auctions with automatic liquidity bootstrapping on Uniswap v4. Teams like Huddle01 and Arrakis Finance are already building on top of the protocol.

The protocol enables projects to discover credible market prices while maintaining full transparency and onchain execution. All auctions are accessible through the Uniswap Web App, where users can discover, bid, and claim tokens in one place.

For teams interested in using CCA, we created a set of guidelines to help with configuration docs.uniswap.org/contracts/liqu…

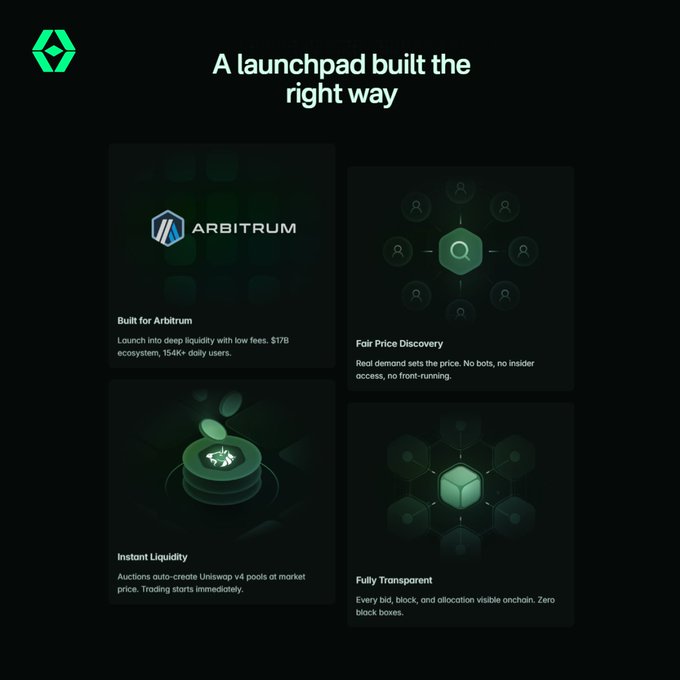

Continuous Clearing Auctions are now live on @arbitrum With this deployment, Arbitrum builders can now: → Run onchain token auctions → Discover a credible market price → Automatically seed liquidity on v4 In a way that's transparent and open to everyone

Auctions are coming to the Uniswap Web App Fully onchain. Powered by CCA. Discover, bid, and claim starting February 2nd

Starting February 2nd, CCAs will automatically be displayed in the Uniswap Web App All live auctions, upcoming auctions, and information on progress for a given auction will appear together in one place

The auction officially runs from February 3rd to February 5th Users can submit pre-bids now and participate at any time until the auction ends Pre-bidding improves the chances of a bid clearing in earlier blocks, which can result in lower average prices app.uniswap.org/explore/auctio…

CCA brings token distributions onchain, allowing anyone to participate For Aztec, that meant 17K+ community members, 99% contributing under $100K, raising $60M together Permissionless protocols → better markets

CCA is permissionless and free to use 🦄 cca.uniswap.org

We created CCA as a permissionless protocol to help teams distribute tokens, find a credible market price, and bootstrap liquidity Now, we’re bringing CCA to the Uniswap Web App Users can easily discover auctions, place bids, and claim tokens directly from the interface

Continuous Clearing Auctions have officially been deployed on @base, that means any Based builder can: → Run fully onchain token auctions → Discover a credible market price → Bootstrap liquidity on Uniswap v4

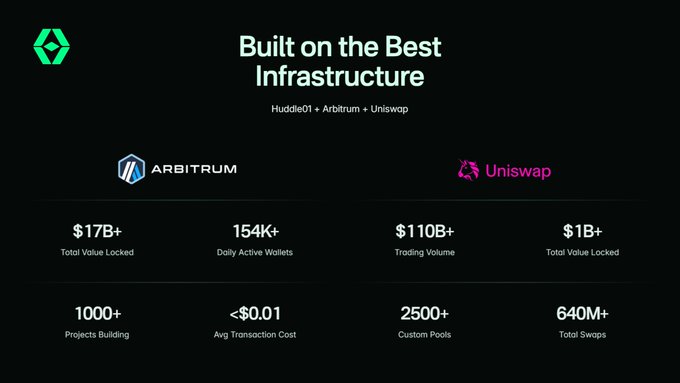

CCA is permissionless and customizable Teams like @huddle01com are building on top of it, bringing more transparent and onchain token distributions to Arbitrum

Guess who got a new look? 👀 Huddlepad just had a glow-up! The mission remains the same: fair, community-first token launches on @arbitrum. That's exactly why Huddlepad's mechanism is powered by @uniswap's CCA. 👉 Check it out: huddlepad.xyz

Participate in the next generation of token distributions Permissionless. Transparent. Fully onchain. app.uniswap.org/explore/auctio…

More on how Aztec used CCA to run a community-driven auction with real price discovery ↓ blog.uniswap.org/aztec-cca

Auctions are now live on the Uniswap Web App Discover, bid, and claim tokens from one place Powered by Continuous Clearing Auctions

Auctions are coming to the Uniswap Web App Fully onchain. Powered by CCA. Discover, bid, and claim starting February 2nd

The auction officially runs from February 7th to February 11th Users can submit pre-bids now and participate at any time until the auction ends Pre-bidding improves the chances of a bid clearing in earlier blocks, which can result in lower average prices app.uniswap.org/explore/auctio…

Any team can start building on top of CCA @ArrakisFinance is doing just that, bringing automated liquidity management to projects post-auction

Uniswap CCA is one of the best ways to distribute a token. Fair price discovery, broad distribution, automatic liquidity seeding into Uniswap v4. CCA is phase one. How that liquidity is managed afterward determines long-term market quality. We're supporting @Uniswap CCA auctions

Read the full announcement ↓ blog.uniswap.org/token-auctions…

Uniswap Unlocks DeFi Liquidity for BUIDL Token

Uniswap has announced a new integration that unlocks DeFi liquidity specifically for the BUIDL token. This development expands the platform's capabilities and provides new opportunities for BUIDL holders to participate in decentralized finance activities. **Key Points:** - BUIDL token gains access to Uniswap's liquidity infrastructure - Integration enables seamless trading and liquidity provision - Builds on recent platform enhancements, including token auctions This move continues Uniswap's expansion of supported assets and DeFi functionality. The integration allows BUIDL token holders to leverage Uniswap's established trading infrastructure and deep liquidity pools. For complete details, read the [full announcement](https://blog.uniswap.org/unlocking-defi-liquidity-for-buidl) on the Uniswap blog.

BlackRock's BUIDL Fund Now Trading 24/7 on UniswapX via Securitize Integration

BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) is now available for trading on UniswapX through a strategic integration with Securitize. **Key Features:** - Whitelisted investors can swap BUIDL bilaterally 24/7, 365 days a year - Access to market quotes across the platform - Direct bridge between traditional finance infrastructure and DeFi protocols The integration allows institutional investors to trade tokenized money market fund shares through decentralized exchange infrastructure, marking a practical step in connecting regulated financial products with on-chain trading venues.

BlackRock's BUIDL Fund Now Tradeable on UniswapX via Securitize Partnership

Uniswap has partnered with Securitize to enable trading of BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) through UniswapX. **Key Details:** - BUIDL, BlackRock's $2.5 billion tokenized treasury fund, will be accessible to UniswapX traders - The integration is facilitated through Securitize's infrastructure - This follows BUIDL's previous expansion to Binance and BNB Chain in November 2025 **What This Means:** The partnership brings institutional-grade tokenized assets to decentralized exchange infrastructure. Traders can now access BlackRock's treasury product through Uniswap's trading protocol, bridging traditional finance products with DeFi platforms. The move represents continued expansion of tokenized real-world assets into decentralized trading venues.

Uniswap V4 Deploys on MegaETH Network

Uniswap has officially deployed its V2, V3, and V4 protocols on MegaETH network (chain ID 4326). **Key Details:** - All three Uniswap versions now available on MegaETH - Official deployment addresses documented at [Uniswap docs](https://docs.uniswap.org/contracts/v4/deployments#megaeth-4326) - Expands Uniswap's multi-chain presence This deployment brings Uniswap's full suite of decentralized exchange protocols to the MegaETH ecosystem, allowing users to access V2's simple swaps, V3's concentrated liquidity, and V4's customizable hooks on this network.